Why is growth deflationary? And why do we all think it’s inflationary? (#2)

In the previous post I sketched out the basic correlation between M and P, when M is changing really fast. Here we’ll take a deeper look, and begin to explain why the correlation between M and P is not perfect. Let’s start with an identity:

P = M/(M/P)

That’s a sort of stupid identity, because if you simplify you get P = P. But it turns out to be pretty useful. If you take rates of change you get:

inflation = (money supply growth rate) – (percent change in real money demand)

(Technically, all these equations should actually be expressed as first difference in logs.) Where did I get the terms ‘supply’ and ‘demand’? It turns out that the central bank controls the nominal supply of base money, and the public controls how much real cash balances they want to hold. So you can model inflation by modeling those two variables.

Now let’s return to the table in the previous post. Notice that over 40 year periods the growth rates of M and P almost never differ by more than 10% (Libya’s the only exception.) So one way of thinking about the correlations we see is to assume that there is some factor or factors causing the real demand for money to change, but their impact is rather modest, and doesn’t get bigger when the money growth rate gets really high. So if real money demand is always changing by single digit annual rates over 40 year periods, then long run inflation will closely correlate with long run money supply growth, when the latter variable is growing really fast. That’s why the QTM tends to do best in the high inflation cases, money demand changes pale by comparison.

Next let’s see if we can go a bit further, and explain the various discrepancies between money supply growth and inflation. We know that in an accounting sense it’s explained by changes in real money demand, i.e. real cash balances, but why would the public choose to hold more or less real cash balances? What explains shifts in the real demand for money?

After Libya, two of the larger gaps are in East Asia, South Korea and Singapore. In both cases money growth was much higher than inflation. In an accounting sense that meant that the public in South Korea and Singapore were holding larger and larger cash balances. Not just in nominal terms (as in Argentina) but even in real terms. Their total holding of purchasing power rose by 9.3% per year in South Korea and 7.2% per year in Singapore, for many decades. (The Singapore data is only for 1963-89.) Why is that, why hold more purchasing power? The answer is obvious—these economies grew very rapidly in real terms, and hence the real demand for money rose over time. As the public became much richer and did much more shopping, they chose to hold larger real cash balances.

The sum of inflation and real GDP growth is NGDP growth. If people hold larger real cash balances when real GDP grows, then perhaps the best way to think about the QTM is not to look at the correlation between money growth and inflation, but rather between money growth and NGDP growth. In both Singapore and South Korea the money growth rate is much more closely correlated with NGDP growth than inflation. But if we insist on modeling inflation, then here’s what we have so far:

inflation = (Ms growth) – (real money demand growth)

Ms growth = f(Fed policy)

M/P growth = f(real GDP growth, other stuff)

Let’s try this conjecture. When real GDP grows by X%, people choose to carry X% more real balances, to use for shopping, etc. In that case, you’d expect the inflation rate to be equal to:

Inflation = Ms growth rate – real GDP growth rate + error term due to effects of other stuff

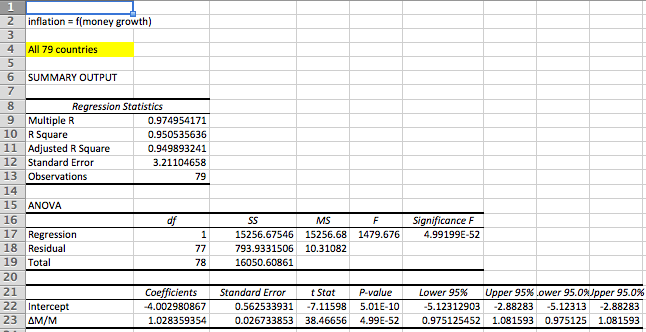

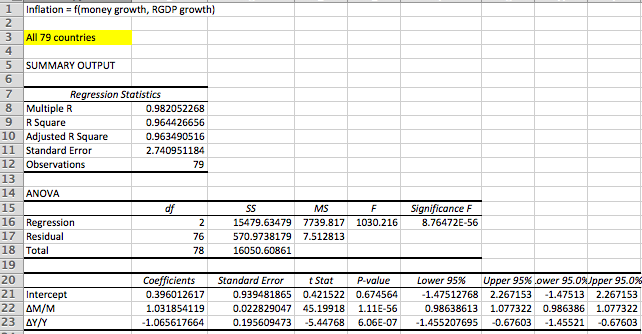

And that’s (almost) exactly what we found in the regression in the previous post. Here I’ll first show a regression w/o real GDP growth, and then repeat the regression from the last post, with RGDP growth:

The coefficient on money growth is roughly one in both cases, and the coefficient on real GDP growth is roughly negative one in the second. Growth is deflationary. And the adjusted R2, which was already 95% in the simple regression of M and P, improves to over 96% when real GDP is added.

There is (or should be) nothing surprising about the finding that growth is deflationary, it’s the prediction of this very simple money demand model. It’s also the prediction of the AS/AD model—as the LRAS curve shifts to the right, the price level declines. The only thing surprising is that so many people find this surprising.

By the way, suppose we label the “other stuff” with the letter V. Then we have:

delta P = delta M – delta Y + delta V.

Look familiar? It’s really just an identity; we need to explain the other stuff (V) to turn the Equation of Exchange into a model.

Let’s look for more hints in the data set. Of the 79 cases, it seems like the vast majority show a money growth rate that is larger than the inflation rate. That’s really not surprising, as almost every single country averaged positive RGDP growth over that period (except Guyana), and we’ve seen that positive economic growth holds down inflation, as the public desires to hold larger real cash balances.

Indeed the only surprise is that there were 12 cases where prices grew faster than the money supply, despite positive RGDP growth. There were 12 cases where the inflationary impact of the “other stuff” was more than the deflationary impact of the real GDP growth. We’ll model the other stuff in the next post, but first let’s briefly return to the issue of real GDP growth. Here are two questions:

1. Can we assume that growth in M has no causal effect on Y in the long run?

2. And if so, why are M and P positively correlated in the short run?

In the data set it looks like rapid money growth does not cause faster real GDP growth, at least in the long run. The 10 highest inflation countries averaged 4.0% real GDP growth, and the 10 lowest inflation countries averaged 4.5% RGDP growth in the long run. Money seems roughly long run superneutral, or perhaps hyperinflation is actually slightly negative for growth (as Mr. Ray Lopez has hypothesized.)

Then what’s going on in the short run? Why does everyone think recessions reduce inflation and booms raise inflation? Here’s a hypothesis. Suppose NGDP growth varies over time, due to monetary policy shocks. And let’s assume that while money is long run superneutral, in the short run it has real effects–perhaps due to sticky wages and prices. Thus in the short run, an increase in NGDP growth leads to both faster real GDP growth, and higher inflation. In that case it would look like growth is inflationary, even though growth would actually be deflationary. Thus if NGDP growth rose by 4%, and both RGDP growth and inflation rose by 2%, it would look like growth was inflationary. But in fact the NGDP growth (i.e. monetary policy) was causing 4% higher inflation, ceteris paribus, and the extra 2% RGDP growth was holding down the inflation rate, limiting the increase in inflation to 2%.

If this is the way the world works then one might expect many cognitive illusions to form. People would think growth was inflationary, whereas in fact it would be deflationary, as the regression in the previous post showed, and as our theoretical model predicts. Procyclical inflation would reflect bad monetary policy (unstable NGDP growth) and inflation would be strongly countercyclical under a sound monetary policy regime (stable NGDP growth.) If the central bank predicts that inflation will pick up during a boom period, they are predicting their own incompetence.

To summarize, it seems like the less restrictive version of the QTM is supported by the evidence. If the money supply is increased by X%, this will lead in the long run to both prices and NGDP being X% higher than otherwise. RGDP will be mostly unaffected. But we’d still like to explain more of the discrepancies, the “other stuff.” In the next post I’ll focus on those countries where inflation was higher than money growth, despite a growing real economy. If you prefer to use the Equation of Exchange, then these are the rare cases where V rose by more than Y, over long periods of time. We’ll also explain liquidity traps.

And in the post after that we’ll look at what happens when money supply growth rates are endogenous. How does that affect the QTM? It’s all there in the data set, if we look closely enough. BTW, don’t think that this analysis has no implications for the low inflation world we live in today. Monetary policy always and everywhere affects inflation and NGDP; we just need to figure out how to interpret what’s going on.

PS. Some commenters pointed out that the data really should be first differences of logs. That’s right, and I’m embarrassed to say that I don’t know if it is, or if it’s ordinary percentages (which is what I assumed when I had Patrick Horan calculate the NGDP growth rates.) I’ll try to get an answer in a few days.

Tags:

12. August 2015 at 04:21

You are right to do this series of posts Scott. Sometimes, reading around the blogosphere, it feels like a Dark Age. It seems like every generation or two, people keep forgetting this stuff, until someone like you reminds us of it.

12. August 2015 at 04:24

Again I’m not sure why anyone would be surprised that P%c negatively correlates with (NGDP/P)%c. Something weird would have to be going on for that not to occur as a simple matter of algebra.

But yes, you’ve given some good actual reasons why “growth is deflationary” that we should believe even if we’re not blown away by the “empirical result”.

12. August 2015 at 04:29

On the small long-run non-superneutrality, there are two hypotheses:

1. High money growth causes hyperinflation and causes low real growth.

2. Basket case governance causes both high money growth and low real growth.

Both hypotheses are plausible. It’s hard to distinguish between them. It’s probably a bit of both.

12. August 2015 at 04:39

The last two posts have been very informative.

What do you make of all these moves in China the last two days? Is this in any way reminiscent of FDR’s devaluation? Here is an analyst on CNBC

“However, sources told the Journal that following further precipitous declines in the yuan on Wednesday, the Peoples Bank of China then told state-owned banks to sell dollars on its behalf in the last 15 minutes of Wednesday’s trading, causing the yuan to jump about 1 percent against the greenback.”

“China is probably going to need to be on both sides of the currency market for a while, former Pimco chief economist Paul McCulley told CNBC’s “Squawk Box” in an interview, reacting to the news.”

“This is not a just one-off 2 percent devaluation, it is part of a mosaic of trying to have the currency be a more global-orientated currency,” he said. “They want to move to a more market-determined exchange rate.”

“Markets can’t figure it out immediately,” McCulley added. “There is no text book you can pull off the shelf,” calling this a real-time learning experience.

http://www.cnbc.com/2015/08/12/china-intervenes-to-support-yuan-wsj.html

12. August 2015 at 05:40

Excellent stuff, Scott.

To me, it doesn’t make sense to talk about growth being inflationary or deflationary in a world where inflation is a monetary phenomenon.

So let’s imagine a fixed money supply (not a gold standard- people can dig up gold.)

It seems to me that increasing standards of living due to growth are largely expressed as deflation in a world with a fixed money supply.

Is this consistent with what you are saying?

12. August 2015 at 05:42

One aspect people/economist forget is moderate deflation was the goal of nations and central banks until The Great Depression. (For all the complaints about Taft-Harwley that is exactly what Republicans did with downturns in years past.) So in downturns they did not mind 1 – 2% deflation to force supply side changes (growth, wage cuts and bankruptcy) into the system to force an upturn. With the Great Depression at 5% deflation forced so much wage cuts and bankruptcies created such debt deflation it crashed the economy.

So why does long run NGDP growth seem so much less important than short run NGDP growth?

1) In the long run, Hume is correct but economic decisions are short run.

2) Of course the money supply is higher than growth in 1950 – 1990 as the global population was increasing at accelerated pace during the period. I don’t know this hold as much in modern times. Money & GDP per person (or working age person) might play a role here.

3) Again, the political strife and wars play a huge role here. If the seven highest NGDP all come from Civil War strife South America then leads me to believe there outside influences here.

12. August 2015 at 05:43

Interesting post. I always say, “Bring on the Full Tilt Boogie Boom Times in Fat City”–I didn’t know I was actually fighting inflation!

Though my experience in manufacturing is that unit costs go down, when production goes up.

Is money super-neutral in the long run? Well in a 100,000 years it probably won’t matter what the money supply was. But the last 20 years in Japan suggest the long run is long enough to have a deleterious effect on any particular generation…or two.

Other note: the world economy and especially the US economy has been globalized in the last 25 years. Could this data-set be out of date?

12. August 2015 at 07:41

Note readers that Sumner says “perhaps” when discussing supposed sticky wages and prices; he’s agreeing that ‘perhaps’ I’m right (no sticky wages/prices). Note further that Nick Rowe says hyperinflation is exception to the rule that money is (long-term) super-neutral. Exactly as I have said: money is neutral (long term and short) except during hyperinflation. I hope you believe it when you hear it from professional economists rather than me.

As for Sumner’s ‘deflationary’ reasoning, without going through the data it could well be that he is simply defining any economy where real GDP grew faster than inflation as ‘deflationary’. This is not conventional, but Sumner is free to coin his own neologisms I suppose.

12. August 2015 at 08:51

@scott

“As the public … did much more shopping, they chose to hold larger real cash balances.”

This goes back to the argument that “Bill Gates doesn’t buy a Ferrari because he holds more cash.” The causality is opposite. “He acquires more cash in order to buy the Ferrari.” I think you understand this and get it right in your post.

Monetary policy works because it encourages the public (BTW – I would say the non-banking sector instead of “the public”) to do more shopping (i.e. buy more real goods and services) through higher financial asset prices and through expectations of higher NGDP. That in turn raises the demand for money.

Because the tool used by the Fed to accomplish this is generally asset purchases, this also results in an accompanying increase in the money supply so that the higher RGDP is non-deflationary.

Inflation is determined by expectations of the future balance of supply and demand for goods and services so that rate of change in Y (and the derivative of the rate of change of Y) are the primary determinants.

Obvious stuff but nice post nevertheless. I think you could have made it shorter though.

12. August 2015 at 09:09

One of the favorite thought-experiments of monetarists, suppose the amount of money doubled overnight. Let’s change it.

Suppose productivity suddenly doubled.

Output doubles. Real GDP doubles. The same amount of money chases twice the supply of goods. Goods prices fall. It wouldn’t be neutral, i.e. all prices do not fall by 1/2. But then, I don’t believe money is neutral, either. Nonetheless, the net effect would be lower prices.

If M growth is > productivity growth, prices should rise. If productivity growth > M, we should have deflation with rising RGDP.

Central banks–

MV = PY.

V has some noise to it. It is encompasses everything in the economy that is not M,P or Y. V may be volatile in the short-term. The Fed creates changes in M with the goal of managing a small and positive change in P. If V is volatile, and the Fed sees and unexpected increase in Y with no change in P, it would be reasonable to conclude that perhaps MV is growing faster than they would like. Even though a change in Y is deflationary, an increase in output is an indicator of inflationary pressure.

12. August 2015 at 10:00

[…] Source […]

12. August 2015 at 10:26

Thanks Nick, It’s very basic, but as you say a lot of people have forgotten this stuff.

And I completely agree with your second comment.

Andrew, From one perspective it seems obvious, but not from others.

Mike, I have a couple recent posts on that at Econlog.

Brian, Yes.

Collin, You said:

“Of course the money supply is higher than growth in 1950 – 1990 as the global population was increasing at accelerated pace during the period.”

I have no idea what that means.

Ray, You never fail to disappoint:

“As for Sumner’s ‘deflationary’ reasoning, without going through the data it could well be that he is simply defining any economy where real GDP grew faster than inflation as ‘deflationary’. This is not conventional, but Sumner is free to coin his own neologisms I suppose.”

Just moronic.

dtoh, People do more nominal shopping because the money supply (or V) increased, they do more real shopping because wages and prices are sticky.

Doug, You said:

Output doubles. Real GDP doubles. The same amount of money chases twice the supply of goods. Goods prices fall. It wouldn’t be neutral, i.e. all prices do not fall by 1/2.”

That’s not at all what money neutrality means. it does not imply that relative prices can’t change, only that they don’t change as a result of money supply increases.

12. August 2015 at 10:29

Ray Lopez (and perhaps others): terminology.

“Neutral” means the *level* of M has no real effects.

“Super-neutral* means the *growth rate* of M has no real effects.

My beliefs (and Scott’s, and most macroeconomists):

Short Run: money is neither neutral nor super-neutral. That’s why monetary policy matters a lot.

Long Run: money is neutral, but only approximately super-neutral. The non-super-neutralities are small, so you can usually only see them in hyperinflations, when the money growth rate is very large.

12. August 2015 at 11:02

Nick, That’s right.

12. August 2015 at 11:15

Perhaps an easy way to think of growth being deflationary is to consider the effect of productivity improvements — they lower real prices.

12. August 2015 at 11:18

@Scott,

Oh good. Thanks for indulging me. So, what do we think of this fixed money supply / deflationary economy?

One thing that seems obvious to me is that holders of financial assets enjoy increasing wealth over time just by stuffing their money in a mattress.

This doesn’t seem like a good idea to me. It promotes hoarding of money and is a classic “the rich get richer” scenario without breaking a sweat. Debtors suffer from an appreciating currency, even at 0% interest rates.

So… price stability, which means increasing the money supply along with the size of the economy. This seems to be the result gold bugs are after, but to me, an increase in the supply of gold would only coincidentally track the increase in the size of the economy, and intermittent gold strikes would add senseless noise.

Besides, money illusion suggests a modicum of positive inflation (say 2% per year, enough to make Ray Lopez shit a brick) can alleviate the stickiness issues and make owners of financial assets sweat a bit to maintain or increase the purchasing power of their assets.

Whether to overcome deflation or get to a modicum of inflation, the mechanism is simple: keep printing money until inflation hits your target.

I’m trying to boil this down to “monetary economics that I can explain to my mom”. How close am I?

12. August 2015 at 11:24

@Tall Dave, I remember in Sinclair’s The Jungle a worker who was paid on a piece-rate basis.

As productivity improved, so that it took less time per piece, the worker’s wage (per piece) was cut.

I suspect this was pretty common in hard money days.

Another example that I can’t find support for is the old English currency units of half-penny and farthing. Surely these denominations came after the penny, and almost as surely, they were developed in response to deflation.

12. August 2015 at 11:29

@Nick Rowe – thanks, I knew that, but in common conversation it’s rarely spoken that money is super-neutral, just neutral. Friedman’s second derivative of Hume and all that is of only professional concern.

I fully agree with you on monetarism in the long run but not on the short run. Re the short run, I don’t see how a 3.2% effect of money non-neutrality in the short run, as Bernanke et al (2003) found in their FAVOR econometrics study, is of any consequence. Remember, this is 3.2% of the increase. In the US for a $16T economy growing at 2%/yr that’s 16*.02*.032 = 10.2$B. That’s trivial. Even if you take Bernanke’s upper limit of 13.2% you get a mere $42B effect from central bank machinations. I think the medical marihuana business is two times bigger than $42B. Do you think if this industry shut down by 50% the US would fall into depression or otherwise be adversely affected? Only if you believe flapping butterfly wings can trigger hurricanes. Most stable $16T economies don’t respond to a mere $10-42 B = 0.3% change, unless you believe this small change is so important it’s like taking out the World Trade Center. Though monetarists like to think they’re vital, it’s doubtful if they’re that vital. As evidence that central banks don’t matter, consider the states that don’t even use their own currency, like Costa Rica, Greece, Zimbabwe, others. Life goes on, because money is largely neutral and even super-neutral long and short run. (now watch the readers confuse my point about not printing your own money with the state of the economy of Greece, Zim, and Costa Rica, lol, gotta love the level of ‘debate’ in these fanboy blogs)

In short, you have to be smoking something to believe in monetarism. What’s you smoking Sumner?

12. August 2015 at 11:37

Brian — Indeed, in deflationary times as the worker’s employer you would have to cut his wages in order to stay in business, since your prices would be falling, and he shouldn’t mind since his purchasing power isn’t affected. But wages are sticky downward…

I read Scott for a long time before I really understood where he was coming from on sticky wages.

12. August 2015 at 12:00

Does anybody that that “growth” — pure TFP fairy wand waved growth — is inflationary? When people think of growth as inflationary they are probably thinking of a situation like today where if the Fed wanted to increase real GDP they wold have to violate their self-imposed constraint of allowing the inflation rate to exceed 2%. Of course it is not that growth is inflationary; it’s that in certain circumstances inflation is growthish.

12. August 2015 at 12:13

Nick Rowe,

I’ve sometimes seen ‘neutrality’ defined as a CHANGE in the level. Which makes me wonder if we can’t distinguish four different hypotheses-

(1) A change in the level of M has no real effects.

(2) The level of M has no real effects.

(3) The rate of growth of M has no real effects.

(4) A change in the rate of growth of M has no effects.

For example, if I understand it correctly, the hysteresis hypothesis is consistent with all of those except (4).

12. August 2015 at 14:01

@TallDave-And once again we have “wages are sticky downward” as if it were an eternal law of nature and not a feature of modern inflationist economies.

I notice how commenters on this post persist in their apoplithorismosphobia, in spite of just having been taught that growth is deflationary.

“Sticky downward wages” and other such complaints about “deflation” have no relevance whatsoever to growth induced deflation.

@Brian Donohue-Sorry to break it to you, but the half penny was introduced to replace coin cutting, not because of deflation!

https://en.wikipedia.org/wiki/History_of_the_halfpenny

Incidentally, you can find a retail price index for Britain going back to 1209, though the early years have gaps, at measuringworth: as it turns out, the 13th century-during which the half penny was introduced (not withstanding earlier attempts) was one of long term inflation!

12. August 2015 at 14:59

@Andrew_FL, but why were people cutting coins in the first place? Presumably, when the penny was introduced, no one thought that they would later need a smaller unit of currency (or two- remember the farthing), and I don’t see how a smaller unit of currency would later become necessary on account of inflation, but under deflation, it would be the natural course of events.

I will look at measuringworth though. Thanks.

12. August 2015 at 15:08

@Brian Donohue-Because the English crown never had very good understanding of, or incentive to deal with, the “Big Problem of Small Change.”

12. August 2015 at 15:12

Selling twice the goods for half the price on the basis of real, and not dollar based, physical improvements in productivity, allows the same nominal investment and the same spending on output, to purchase more and more goods at lower and lower prices.

The reason why popular opinion has come to associate growth and “overheating” economies with rising prices, is because of the historical correlation between price inflation and aggregate productivity (rising) on the up cycle, and price deflation and aggregate productivity (falling) on the down cycle.

Economists have failed to properly educate the public because economists have adopted the positivist methods of physicists and chemists, which has all but eliminated rationalism, introspection and deduction, all of which are vital to understanding how productivity increases lowers prices without depression, even if we live in a world with rising prices!

12. August 2015 at 15:52

@ThomasH: “It is not that growth is inflationary; it’s that in certain circumstances inflation is growthish.”

+1

12. August 2015 at 16:05

@Andrew_FL: “we have “wages are sticky downward” as if it were an eternal law of nature and not a feature of modern inflationist economies.”

It’s clearly a feature of all modern economies. Can you show us evidence that there are large classes of economies where it is (or was) not a feature? I don’t just mean your theoretical guess. I mean actual historical economic evidence.

“apoplithorismosphobia … “Sticky downward wages” and other such complaints about “deflation” have no relevance whatsoever to growth induced deflation.”

That’s clearly false, since sticky wages is a nominal effect, and hence it isn’t relevant what caused the deflation. apoplithorismosphobia is a useless and misleading term, since it completely confuses nominal and real quantities. Deflation doesn’t increase the general public’s purchasing power, if their wages decline at an even faster rate. (Similarly, inflation doesn’t erode purchasing power, if wages rise faster than inflation.)

To have anything intelligent to say about inflation or deflation, you need to distinguish nominal from real, and you need to consider how the path of wages relates to the path of prices (in order to conclude anything about a change in real purchasing power).

12. August 2015 at 16:08

Don, I’m not going to engage a troll who doesn’t know what he’s talking about. Have a nice day.

12. August 2015 at 16:19

Brian: Try 3% inflation instead of 2%. See 1982 through 2008, USA. Real growth was just north of 3% and inflation was just south of 3%.

Good enough for me.

12. August 2015 at 16:34

Brian Donohue,

“Whether to overcome deflation or get to a modicum of inflation, the mechanism is simple: keep printing money until inflation hits your target.”

My understanding of market monetarism is that when you hit the lower bound on interest rates, printing money in itself achieves nothing or very little. The only thing that really matters is expectations.

12. August 2015 at 16:44

I say that because from what I’ve read the market monetarist position is that at only permanent increases in the monetary base have an effect. But that’s equivalent to saying that the only thing that matters is expectations – about future NGDP, future policy, etc.

12. August 2015 at 17:01

@Scott

You said,

“As the public became much richer and did much more shopping, they chose to hold larger real cash balances.”

AND, you said,

“People do more nominal shopping because the money supply (or V) increased.”

So which is it?

12. August 2015 at 17:10

@dtoh-The first statement is the public doing more “real shopping” the second pertains to more “nominal shopping.”

12. August 2015 at 17:33

Brian, I’d encourage you to pay no attention to inflation, and focus on NGDP growth, or even better, NGDP per capita growth. I’m not sure the optimal rate of growth, and to be honest it’s the stability of growth that matters, not the rate.

Thomas, You said:

“When people think of growth as inflationary they are probably thinking of a situation like today where if the Fed wanted to increase real GDP they wold have to violate their self-imposed constraint of allowing the inflation rate to exceed 2%. Of course it is not that growth is inflationary; it’s that in certain circumstances inflation is growthish.”

That may be it, but as a side note just getting up to 2% would boost growth substantially.

Philippe, Expectations are key regardless of whether you are at the zero bound or not.

dtoh, Both, the first was about real money demand and the second was about nominal money supply.

12. August 2015 at 20:35

Andrew_FL — @TallDave-And once again we have “wages are sticky downward” as if it were an eternal law of nature and not a feature of modern inflationist economies.

Laws of economics cannot be laws of nature, except in the narrow sense that humans and human behavior are natural phenomenae, but we observe some common behaviors like nominal rigidity. It’s well-established people disproportionately disfavor loss relative to gain; evolution doesn’t select for intelligence, it heads blindly for local optima.

And if wages are sticky, fear of deflation is rational. Mises was a brilliant writer in his time but Friedman clearly gets the better of that argument; deflationary spirals create suboptimal outcomes. My favorite part of Amity Shlaes’ book on TGD is when local concerns started issuing their own scrip because they cannot find any cash.

12. August 2015 at 20:47

@TallDave-Again it’s not worth engaging people who don’t make any effort whatsoever to understand the point under dispute.

You deny that sticky wages are an eternal law of nature, and then claim they’re some millions of years old, originating from human evolution. Yeah, no, that’s the same damn thing. And it’s an article of faith for you, that an observed historical phenomenon of recent history, originated in fact on savannah of Africa. Slow. Clap.

In substituting history, and recent history at that, for theory, Friedman was completely wrong. You have no idea what you’re talking about.

12. August 2015 at 21:57

@Andrew_FL: So why don’t you bother educating us? You obviously have a strong belief that sticky wages are only a recent “feature of modern inflationist economies“. We’re open to changing our mind. Why not present the non-sticky-wage evidence that led you to your strong conclusion? How do you expect anyone to be convinced, if you only state conclusions but never justify them?

12. August 2015 at 22:36

@scott

What is “nominal money supply”? I’m not familiar with that term.

13. August 2015 at 04:19

dtoh,

It’s the money supply when it’s NOT divided by the price level.

13. August 2015 at 05:16

dtoh, The actual money supply, in current dollars. The real money supply is M/P.

13. August 2015 at 05:41

It is easy to convert percent changes to log changes. Just use ln(1+pc) where pc is the percent change.

13. August 2015 at 05:55

@scott

So you are saying that the public will spend more money simply because of an increase in the money supply.

If so could you explain what causes a firm or individual to do this. Do they a) simply decide to hold less cash, or b) do they somehow get more cash to spend?

If it the latter, where does the cash come from? Do they get more income? Maybe they sell stocks? Borrow? Get a gift? Find the money growing on an apple tree? Could you explain how this works?

13. August 2015 at 06:08

@TallDave-Again it’s not worth engaging people who don’t make any effort whatsoever to understand the point under dispute.

Indeed, but we replied to you anyway.

I cited several studies and a well-established psychological principle in support of sticky wages, you’ve adduced no evidence at all against them, not a single iota. You may prefer to wallow in ignorance, but we are not required to join you in the muck. Let us know if you have any substantive arguments to make, else you’ve already conceded you lack them.

13. August 2015 at 06:11

Don — I think my favorite response from Andrew was I’m not going to engage a troll who doesn’t know what he’s talking about. The lack of self-awareness there is wonderfully self-refuting.

13. August 2015 at 06:12

@Scott, Thanks and yes. I understand I’m being concrete-steppish and trying to boil this down to a simple story, but a simple story that is largely true is communicable to Main Street and might reduce the mystery that is the Fed (although you may think this is a futile and wrongheaded course.)

There’s something elegant and easy about the QTM where you don’t even mention interest rates or expectations though, just purchasing power.

The first order effect* of every new dollar printed as a tiny dilution to every financial asset in existence. Bad for creditors, good for debtors. I think this is trivially true and easy to understand. William Jennings Bryan.

Yet the common view today from liberals and populist conservatives is that QE is some kind of subsidy to Wall Street.

The idea of deflationary growth means printing more money doesn’t debase the currency, the Austrian bugbear.

* I understand that second-order effects are where things get interesting, but also where you leave 90% of the public behind. So again, maybe this isn’t about low-level political understanding.

13. August 2015 at 06:19

BTW Andrew your education can start here — the modern human form (and by extension modern human psychology) is only about 200,000 years old.

https://en.wikipedia.org/wiki/Anatomically_modern_human

13. August 2015 at 08:36

Didn’t have the time do read all the comments (perhaps some other reader already commented on this), but notice that the first regression, w/o adjusting for real GDP, has a statistically significant intercept different from zero (not explained by the model), a negative one. But, adding real GDP growth, that goes away, and the intercept is not significantly different from zero anymore. And real GDP shows up as deflationary. Just a technical point that was not commented before.

13. August 2015 at 09:05

TallDave-You’ve gone from ignorant troll to belligerent jerk, congratulations. I’m not going to educate you because I don’t believe in dissuading people from their religious beliefs, especially not those who engage in verbal abuse when their faith is questioned.

So the both of you, again, may have a nice day.

13. August 2015 at 09:57

OK thanks Andrew, you’ve answered my question, conceding you have no coherent argument. An easy add to the “do not read” list, and sorry to everyone else for FTT.

13. August 2015 at 14:19

Thank you for adding me to your do not read list, it will save me the trouble of having to deal with you in the future. And thank you for conceding that you’re a close minded troll who doesn’t know what he’s talking about.

13. August 2015 at 15:14

[…] Sumner has a few posts on whether or not growth is inflationary. He […]

13. August 2015 at 16:15

On the other hand for those of you who aren’t wedded to religious beliefs about all lesser mortals being less rational than your superior brains, here’s a nice bit of information:

Number of years from 1246 to 1945 when Average Nominal Earnings in the UK declined relative to the previous year:

278 (out of 700, or ~40% of years)

Number after? Two. Of 69. Or ~3% of years. Gosh, what changed? Oh yeah, persistent inflation after the nationalization of the Bank of England.

What about the United States? Number of years the money wage index of unskilled labor declined from 1775 to 1913, relative to the previous year: 53, out of 139, or about 38% of years. From 1914 onward? 7, our of 103, or about 6.7% of years. Number of times since 1933? Once. 1.2%. What changed? In 1913, we got the Federal Reserve. In 1935 we got Unemployment “Insurance.” In 1938 we got the Minimum Wage. So that’s three things that didn’t exist in the past, that contribute to the fact that nominal wages don’t tend to fall. And gosh, before those things existed, nominal wages did sometimes fall. Who’da thunk it?

Not anyone who attributes sticky wages to “evolution” or some other expression that implies they are a law of nature.

13. August 2015 at 16:24

are you trying to put forward the argument that things were better for workers in the UK prior to 1945? Because if you are, you argument fails as soon as it leaves your lips.

13. August 2015 at 16:43

@Andrew_FL: See, that wasn’t so hard! Now, why couldn’t you have just given that data when I first asked you for it?

In any case: do you have a cite or a link for your historical wage data?

13. August 2015 at 18:05

Don: All the data can be found at:

http://measuringworth.com/

With cites there in.

And what was so hard was that I don’t like you.

@Phillipe-Are you arguing that workers are better off having wages that are sticky downwards than not? If not then your statement has no relevance to the question.

If you are, however, I can’t actually disagree, since I believe that refusing to accept nominal wage cuts is a rational response to eternal inflation by central banks. But thanks for missing the point.

13. August 2015 at 20:15

Andrew, we’re all proud of you! Keep up the good work, I might even read some of your less vitriolic words.

Sadly, you still haven’t made any coherent arguments. The existence of falling wages doesn’t prove wages aren’t sticky downwards any more than the existence of rockets disproves gravity. Of course fiat regimes resist deflation. Your denial of the existence of the entire field of evolutionary psychology is at least amusing, though.

I’ll let you carry on frothing now.

13. August 2015 at 20:28

@TallDave-If “wages are sticky downward” isn’t a denial that wages can ever fall, then we’ve literally been arguing about nothing. This is the very thing I was arguing against!

But I’d prefer that you don’t read any of my words if you’re going to continue to be jerk even when you’re not disagreeing with me.

13. August 2015 at 20:35

I will note however that you based your apoplithorismosphobia on the belief that wages don’t fall period, so it’s back to the drawing board for you on why even though growth is deflationary, growth must never be permitted to lead to deflation. Ever.

13. August 2015 at 20:39

Excellent work again Andrew, many of those words were not namecalling and several conveyed discernible meaning.

Few if any theories of nominal rigidity holds that any prices are immutably unlowerable under any circumstance. That’s not what “sticky” means. Did you read the wiki? https://en.wikipedia.org/wiki/Nominal_rigidity

I’ll explain again: fiat regimes resist deflation. Wage deflation is one kind of deflation. Since fiat regimes can and do resist deflation by increasing the money supply, it would be very strange if they had exactly the same levels of deflation as non-fiat regimes.

13. August 2015 at 20:52

@TallDave-And you’re back to condescending again.

Again: your position is that growth induced deflation is bad because wages are “sticky”-if deflation occurs, even purely growth induced deflation, eventually nominal wages will have to be cut if labor markets are to still clear. Your argument above was that during growth induced deflation this wouldn’t happen because “wages are sticky”-people, in your mind, just don’t get it. They can’t, it’s programmed into their lizard brains. That’s your theory of nominal rigidity. They can’t tell the difference between a nominal wage cut when the economy is growing and prices are falling, and a nominal wage cut when the economy is shrinking and prices are rising. If this is not your position, you have no grounds for your apoplithorismosphobia.

You know what your theory, appealing to innate inferiorities of the human brain to your…what, supercomputer angel brain?-is lacking? A theory of how wages do fall when necessary, when doing so makes sense and when people have the information necessary to see that. If it’s lizard brains, they can’t see that. They’re biologically incapable of seeing that. Sticky downward wages becomes a law of nature, and the only solution is perpetual inflation, and we’re justified in always fearing deflation, no matter the kind, or origin thereof.

14. August 2015 at 05:21

Well, I already congratulated you for working your way up to being worthy of condescension rather than mere shunning, but again, good work.

But if you’re not going to read the wiki it’s hard to help you reach the rarefied heights of actually making sense. Prices are not perfectly flexible and humans are not perfectly rational.

14. August 2015 at 05:45

dtoh, It doesn’t matter how people end up with more money, if they have excess cash balances they will end up spending them.

Thanks Brian. But it’s actually pretty hard to simplify this for average people.

Jose, Very good observations. I missed that, but it fits the theory.

Andrew, Falling nominal wages is NOT evidence that wages are not sticky—wages fell from 1929-33, but were very sticky, causing mass unemployment.

14. August 2015 at 05:50

TallDave-I do not believe prices are “perfectly flexible” by which you mean they instantly jump to where they “should be” as if human beings were omniscient. Human beings do however behave perfectly rationally, and not being omniscient and instantly knowing what prices should be when things change is not a strike against that.

Scott, my position is that wages became much “stickier” after 1913 and especially after 1935 than they had been before. It’s not that wages are or ever have been “perfectly flexible.

14. August 2015 at 06:22

@scott

“It doesn’t matter how people end up with more money, if they have excess cash balances they will end up spending them.”

Not necessarily, rather than spending they can exchange the cash balances for (invest in) financial assets. This is what happens when (and why) there is a drop in NGDP due to a financial shock (drop in asset prices). Asset prices fall relative to real goods and services and people exchange cash for assets rather than goods and services.

And yes it does matter because it speaks to causality and how the transmission mechanism works.

14. August 2015 at 06:27

Re: sticky wages and prices. To be precise, it doesn’t matter if wages and prices are sticky. It only matters if they are more sticky than financial asset prices. If they weren’t, monetary policy would be both unnecessary and ineffective.

14. August 2015 at 08:17

@Scott, I agree. It’s really, really hard. Friedman could do it, which is an important part of his enduring influence.

15. August 2015 at 05:54

Andrew, I’d say they got stickier after the election of 1928.

dtoh, They’ll spend more on everything, both financial assets and commodities. They have an incentive to buy goods today because the extra money creates expectations of higher prices in the future.

Brian, I agree.

15. August 2015 at 14:14

@scott

You said; “They’ll spend more on everything, both financial assets and commodities. They have an incentive to buy goods today because the extra money creates expectations of higher prices in the future.”

You’re getting very close. It’s the relative amounts of each which causes changes in NGDP growth rates. If people marginally increase their spending (exchange) of cash for assets… NGDP growth drops. If they increase their exchange of cash for goods and services…. NGDP growth goes up.

Because wages and prices are sticky and assets prices are not, shocks and OMO cause changes in the price of assets relative to the price of goods and services, which in terms causes changes in the relative “spending” on assets versus goods and services. This the key to everything. If you understand this, everything else is simple.

16. August 2015 at 05:14

dtoh, There are many causal factors, but swapping money for goods is the essential one, the sine qua non. It would still be true even if there were no financial sector, as in ancient times.

17. August 2015 at 00:22

Scott,

Yes, if people swap more money for goods, NGDP will rise. That’s tautological, but it doesn’t address why they swap more money for goods or why or how they acquire more money.

Why don’t you do a post postulating as to whether or not sticky wages and prices impacted real output in barter economies and/or economies with money but with no financial sector.

17. August 2015 at 04:59

dtoh, They can acquire the money in many different ways, it doesn’t matter. And they buy goods because prices are expected to increase.

17. August 2015 at 08:17

Scott,

It does matter if you want to understand how monetary policy works.

18. August 2015 at 10:44

@scott

Also – people will presumably not increase their purchases of goods unless they expect an increase in the rate of inflation. Sure V is higher at higher rates of inflation, but do you actually think expected changes in the rate in low inflation economies causes people to buy more. If so, they presumably also expect their nominal income to rise in which case the choice they are making comes back to the price of financial assets (e.g interest rates on bank accounts) relative to the price of goods and services and whether they will hold more financial assets or whether they will buy goods and services.

29. August 2015 at 10:23

Hi Scott,

I’m way late to this party, but this model is an information equilibrium model:

http://informationtransfereconomics.blogspot.com/2015/08/scott-sumners-information-equilibrium.html