Clubhouse event tomorrow

I will be doing a Clubhouse discussing inflation with David Beckworth and Christopher Russo tomorrow (Friday) at noon EST.

Here is the link:

clubhouse.com/event/mWVaQzr6

A slightly off-center perspective on monetary problems.

I will be doing a Clubhouse discussing inflation with David Beckworth and Christopher Russo tomorrow (Friday) at noon EST.

Here is the link:

clubhouse.com/event/mWVaQzr6

Politico has an interesting piece discussing the Fed’s current QE program. Some pundits correctly point out that the economy probably doesn’t need any more demand stimulus at the moment. Robert Perli responds that the Fed might want to continue QE in order to insure that its policy announcements continue to be credible:

The effect of the Fed’s purchases is also misunderstood, argued Roberto Perli, founding partner of research firm Cornerstone Macro and a former Fed economist.

Perli said the benefit to the Fed’s asset purchases — or “quantitative easing,” as it is known — is entirely front-loaded: Markets react to the central bank’s initial announcement that it will conduct massive amounts of buys over an unspecified period of time, and rates adjust accordingly. The rest of the process is just the Fed following through on those purchases, which have already been factored in by investors.

“If there was no QE today, and the Fed was considering, ‘OK, do we need to do it?’ Probably the answer is no,” Perli said. “But QE was necessary a while ago, like a year ago, and nobody ever thought that QE was going to end after a month or two months or six months, so the market built expectations of how much QE there would be.”

“In fact, those expectations were all that mattered,” he added. “And at the time that was why QE was so effective, because people expected QE to be large.”

I wouldn’t say that the expectations are all that matters, but like Nick Rowe I think they are 99% of monetary policy.

Just to be clear, I’m not a fan of the Fed promising to do X amount of QE. I’d rather they commit to do just as much QE as necessary to maintain adequate market expectations for inflation or better yet NGDP growth. But given that they have decided to engage in instrument-based forward guidance, there’s something to be said for carrying through with promises that were effective only because at the time they were made they were believed by the markets.

This also caught my eye:

But George Pearkes, macro strategist at Bespoke Investment Group, said it’s a misconception that the Fed’s mortgage-backed security purchases have a targeted effect on mortgages. Because those types of securities are already backed by the government, he said, the calculus for a lender on whether to sell a mortgage to housing giants Fannie Mae and Freddie Mac isn’t going to be much different.

“I absolutely detest this argument,” he said. “I think it’s nonsense.”

I don’t know if the view he criticizes is “nonsense”, but I also have trouble seeing how the Fed buying MBSs that have been guaranteed by the Treasury is much different than buying actual Treasuries. Obviously the two bonds are not perfect substitutes, but I doubt whether any differences are large enough for Fed purchases to have a major distortionary effect on the economy.

Nonetheless, it probably makes sense to mostly focus on buying Treasuries, and only shift over to MBSs if there is an actual need to go beyond Treasury purchases.

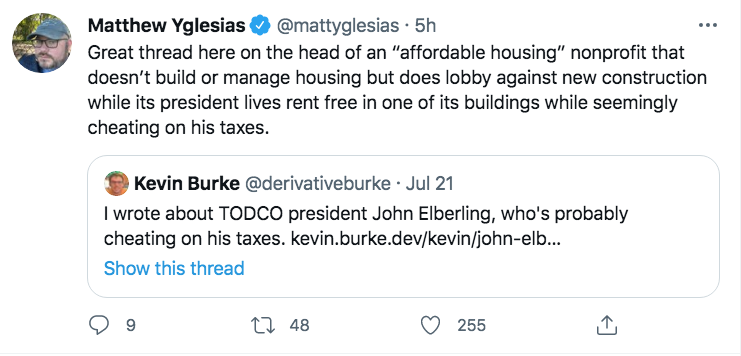

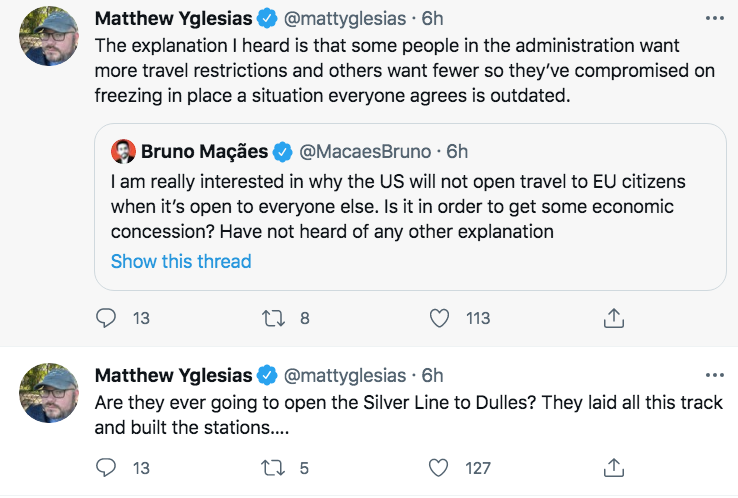

Matt Yglesias didn’t use the term “great stagnation”. Nor did he draw any parallels between the following four tweets. But it’s hard not to notice when within 60 minutes a well known progressive points to four areas of stagnation, at least three of which can be blamed on progressives:

The “status quo” bias that Yglesias cites in the third tweet reminds me of how cities won’t allow developers to tear down buildings that provide housing to the homeless, but also won’t allow developers to build (SRO) buildings that provide housing for the homeless.

No matter how cynical I get, I can’t keep up with the real world.

When will America get its “infrastructure? I vote for “never”. It’s over. We are done with the material world. Our future is living in isolation from each other, connected by iPhones and iGlasses, being closely surveilled by governments and corporations. Comfortably numb.

PS. Progressives aren’t just stopping solar. They are closing down California’s last carbon free nuclear power plant. They are tearing down carbon free hydroelectric dams in California. They are opposing wind power. It’s an all out war on carbon free energy.

Check out my recent podcast with David Beckworth, where I discuss one of the most underrated economists of the 20th century.

Most readers will want to skip this wallow in boomer nostalgia, but since my favorite sports team won the title last night I’ll indulge in dredging up some old memories. (Which is fitting, since I’m currently reading In Search of Lost Time.)

First a comment on the post title. I believe the Bucks were a bit lucky in winning the NBA championship this year. But I also think they are a mostly unlucky franchise. They’ve been good enough to win about four titles during their 53 year history, but have only two. (With average luck, they’d have had two in the 70s, one in the 1980s, and one in 2019-21.) If you want to bet on this team, you can do so on sites like 카지노 먹튀.

Because of this bad luck, they’ve been on the fringes of the consciousness on most NBA fans, in the shadow of more glamorous franchises. But even a bland midwestern franchise like the Bucks is more interesting than you think.

Two years ago, if Kawhi’s 4 bouncer doesn’t drop in against Philly, the Bucks probably win the title. Even if it does drop in, the Bucks probably win the title if the Bucks go 23/33 at the free line in game three against Toronto, instead of 22/33. The difference between winning and losing is often really close. Think of Ray Allen’s shot that beat the Spurs, or the injuries to Detroit in 1988 that cost them a title and indeed changed the whole narrative of “the 80s”. Or the injury to Chris Paul than kept him out of game 7 of Houston/Golden State.

Entire career reputations rest partly on luck. Kawhi’s a great player, but if that shot didn’t bounce in then his reputation today would be much lower. Giannis is even greater than Kawhi, but if Kevin Durant doesn’t wear oversize sneakers in game 7 against Milwaukee, then Giannis’s reputation is lower today, and Brooklyn or Phoenix would have a title. (Durant wears one size too big, and Brooklyn failed to win game seven as his foot was 1/4 inch over the three point line on the last shot of regulation.)

The Bucks and Phoenix came into the league in 1968, and I’ve followed the Bucks from the beginning. The two teams tied for the worst record, and the Bucks won the famous coin flip for the first pick in the 1969 draft. The Bucks picked Lew Alcindor (now Kareem), who had the most impressive career of any player ever. I’m not saying he was better than Michael or LeBron, as the game is getting more competitive over time. But Kareem had 6 championships and 6 MVPs. Oh, and he scored more points than anyone ever, while also being an excellent rebounder, passer and shot blocker. And he scored the most points despite staying in college for 4 years, where he won 3 national championships. (Freshman did not qualify for varsity teams in those days.) His signature shot would be just as unstoppable today as it was then. He’s also one of the brightest intellectuals ever to play in the NBA, the author of many books. He’s my favorite athlete in any sport.

Lots of NBA fans know about Kareem, but how many know that in the same draft the Bucks picked Hall of Famer Bobby Dandridge in the 4th round! Kareem plus Dandridge was the best single draft in NBA history, even better than Jordan and whoever else they got. Lots of NBA fans know that Kareem and Oscar Robertson won a title in 1971, the third year of the Bucks existence, but how many know that even the 1969-70 Bucks were really, really good, and didn’t even have Oscar? In one year, rookies Kareem and Dandridge took the worst team in the NBA up into the elite.

With average luck, the Bucks would have won another 1970s championship. No luck was involved in 1971 when they rolled over all the opposition, winning the finals in four straight, none of which were close. The next year they faced what was once regarded as the greatest team in NBA history–the 69-win Lakers, which had the famous 33 game winning streak in the regular season. (A streak ended by the Bucks, just as they ended several other famous winning streaks.) But as great as the 1972 Lakers were, the Bucks were just as good—but not as lucky. The Bucks crushed the Lakers by more than 20 points in game one (in LA). The Lakers barely won game two in LA by one point (on a bad call from the referee.) The Lakers barely won game three, and then the Bucks crushed them by more than 25 points in game 4. The Lakers won the series, but the Bucks outscored them by 14 points overall. Bad luck. In 1974, the Bucks lost to the Celtics in 7 games. More bad luck. With average luck they’d have had titles in 1971 and either 1972 or 1974. (Bucks injuries also played a role, especially in 1974.) The Bucks were the first NBA team ever to have three straight 60 win seasons.

Kareem forced a trade to LA, and the Bucks rebuilt under the innovative coach Don Nelson (and later Del Harris) in the 1980s. The 1980s team epitomizes the history of the Bucks, always falling a bit short, always in the shadow of other teams. No “superstars”. They had 7 straight 50 win teams. By 1991, the Bucks were the third winningest team in NBA history (if my memory is correct.)

The year they came closest was 1981, when after the mid-year trade for Bob Lanier they were probably the best team in the NBA. But they lost by one point in game seven to Philly, which had the home court advantage. Philly then lost by one point in game seven to the Celtics, which had the home court advantage. To this day, I think the Bucks were the best of the three on a neutral court. All through the 1980s, things never broke their way. They swept the Celtics 4 straight in 1983, but that was the year when Philly was a juggernaut.

When people think of famous 1980s rivalries, they think Lakers/Celtics or Celtics/Philly. But by far the biggest rivalry was Bucks/Philly:

The Sixers and Bucks met six times in the span of seven postseasons between 1981 and 1987 for a total of 34 games. Philadelphia won four of those series, Milwaukee two. There was even a coda playoff match in 1991 for good measure.

Those other rivalries by comparison:

Sixers versus Celtics had 24 games over four series.

Celtics versus Lakers had 19 games over three series.

Pistons versus Celtics had 22 games over four series.

Sixers versus Lakers had 16 games over three series.

Again, Sixers versus Bucks had 34 games over six series with three of them going to a do-or-die contest.

With average luck, the Bucks might have won one title in the 1980s (probably 1981, but another year if their rivals all had a down years at the same time.) And not only was the team underrated, always in the shadow of other teams, players like Sidney Moncrief were also underrated, in the shadow of players who were flashier (like the Julius Erving of the 1980s) but not any more talented.

There were actually two Bucks 1980s teams. In mid-decade, they traded some older players for younger players like Cummings, Pierce and Hodges, and kept playing at a high level until 1991. That trade was what impressed upon me the importance of age, and it’s why I knew the Nets trade a decade ago would be a disaster.

The 1990s were a down decade. Some younger fans recall the 2001 playoff series with Philly and feel the refs screwed us by suspending a key Bucks player for the final game. But I doubt they would have beaten the Lakers that year, even though the Bucks were 8-0 against the top four Western conference teams during the regular season. So I’d give them at most a 10% chance at the title that year.

I sometimes read commentary on the Bucks in internet forums or at No Tech Ben, and am surprised that all the fans seem so young. I don’t recall a single other fan who followed the team in its first year (before Kareem). (I tried to, but few games were on TV back then, and there were many years (such as 1973-81) when I didn’t even own a TV set.) Still, it’s nice to feel part of a community with shared interests.

Seeing them win the title last night, and then thinking about the person I was back in 1971 when I first saw them win, makes me think about the passage of time. I was 15, now I’m 65. I don’t even feel like I’m the same person. It’s certainly not the same NBA.

The two Bucks championships are like bookends to my life as a sports fan. Fifty years of misery has ended.

PS. Charles Barkley called it.

PPS. Bucks in 6!

PPPS. If only the final score had been 120-104. 🙁

PPPPS. Fifty points and five blocks in a closeout finals game? Don’t think I’ll live to see that one broken. (But we can’t vote for Giannis for MVP because he’s just a regular season player.)

PPPPPS. Winning a title is nice for fans, and even nicer when the key players on the team are likable individuals.

I don’t expect a recession to occur in the next few years, but recessions are almost impossible to predict. It’s more interesting to think about the sort of policy mistakes (were they to occur) that might lead to a recession within a few years.

One mistake would be an excessively tight money policy, which could trigger a recession in 2022 or 2023. That’s possible, but seems quite unlikely at the moment.

A slightly more likely scenario would involve excessively expansionary monetary policy, which drove wage growth to levels inconsistent with 2% inflation over the long run. To get the inflation rate back on target the Fed would then need a tight money policy, which might trigger a recession.

When people suggest that current inflation is transitory, they mean it’s likely to go away without the Fed having to drive the economy into recession. (It’s transitory alright, but why?)

Some pundits want the Fed to do enough monetary stimulus to “give workers a raise”. That’s an extremely misguided view, which would not even help workers. In the long run, real wages are determined by real factors like productivity (and perhaps monopoly power among workers.) Monetary policy is a nominal factor, and cannot artificially create persistently higher real wages. (In the short run, monetary stimulus may push up prices faster than wages, reducing real wages.)

But unstable monetary policy can hurt workers by creating an unstable business cycle. The best policy mix is a monetary policy that produces stable nominal wage gains, combined with good supply side policies to boost real wages, that is, to improve the real wage/inflation mix for a given nominal wage increase.

Almost no one wants a recession in 2024. If we get one, it will be due to the misguided policies of people trying to help workers. They would overstimulate, and by 2023 the Fed would be forced to tighten to restore inflation credibility. I don’t think that’s the most likely case; rather it’s the most likely cause of a near-term recession should a recession occur.

PS. I say “almost” no one wants a recession in 2024 because . . . well . . .

PPS. Opposing coaches need to think about the fact that Bill Belichick wants them to punt when it’s 4th and one at midfield. Giannis needs to think about the fact that Phoenix wants him to take three pointers. Progressives need to think about the fact that Trump wants the economy to overheat in 2023.