Should we target total wages or average hourly wages?

This post was inspired by a recent Nick Rowe post, which uses an AS/AD diagram to compare inflation and NGDP targeting under various sorts of shocks. I learned some things from reading the post, and George Selgin’s comments following the post. I recommend people take a look. But in the end I find sticky price models too confusing. Or maybe I just don’t have the energy to try to get over my confusion, because price stickiness doesn’t seem to me to be the key issue. For me, business cycles are all about employment fluctuations and wage stickiness.

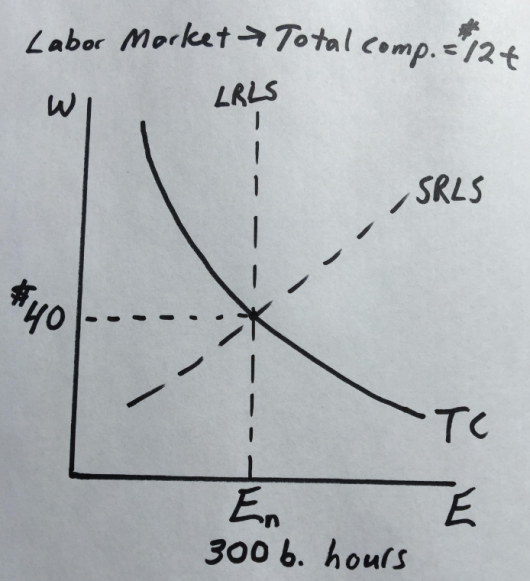

Let’s start with a graph where (for simplicity) we assume a vertical long run labor supply curve (LRLS), and an upward sloping short run labor supply curve (SRLS). Total compensation (TC) is a rectangular hyperbola, representing $12 trillion in labor compensation. I assume wages of $40 per hour (including benefits), and 300 billion total hours (2000 hours a year times 150 million workers.) These are ballpark numbers for the USA. The LRLS determines the natural rate of employment—which is optimal in the context of monetary policy decisions.

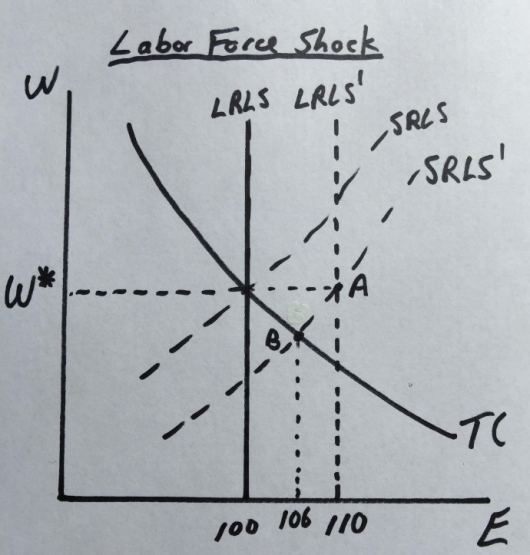

Now let’s consider two types of shocks. In the first case, there’s a sudden 10% boost in the labor force, perhaps due to a flood of immigrants:

Now let’s consider two types of shocks. In the first case, there’s a sudden 10% boost in the labor force, perhaps due to a flood of immigrants:

Notice that the optimal solution is a 10% rise in employment, with no change in nominal wages. That’s what happens with nominal wage targeting. Under total compensation targeting the employment level rises by only 6%, which is suboptimal. NGDP targeting would be the same. This example might help people to better understand George Selgin’s version of NGDP targeting, which adjusts for labor force changes. (Nothing changes if we assume a positive trend rate for wages that is fully expected.)

Notice that the optimal solution is a 10% rise in employment, with no change in nominal wages. That’s what happens with nominal wage targeting. Under total compensation targeting the employment level rises by only 6%, which is suboptimal. NGDP targeting would be the same. This example might help people to better understand George Selgin’s version of NGDP targeting, which adjusts for labor force changes. (Nothing changes if we assume a positive trend rate for wages that is fully expected.)

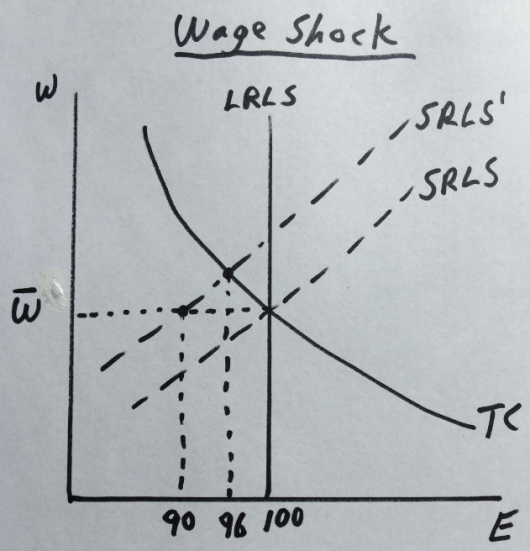

Now let’s consider a nominal wage shock. Say that workers get greedy and demand higher wages, because Bernie Sanders is elected President. But the LRLS doesn’t shift, which means the workers will eventually scale back their wage demands, at least in real terms:

This case is just the opposite. Now a monetary policy aimed at stabilizing total compensation gives you a better result. With nominal wage targeting, employment falls by 10%, relative to an unchanged LRLS curve. With total compensation targeting (and perhaps NGDP targeting as well) the fall in employment is smaller (only 4%).

This case is just the opposite. Now a monetary policy aimed at stabilizing total compensation gives you a better result. With nominal wage targeting, employment falls by 10%, relative to an unchanged LRLS curve. With total compensation targeting (and perhaps NGDP targeting as well) the fall in employment is smaller (only 4%).

In my view, the most pragmatic option is to try to target total compensation (or NGDP), adjusted for changes in the labor force, which is sort of in the spirit of George Selgin’s proposal. As I recall, he wanted a productivity norm that adjusted NGDP for both labor force and capital shock changes, but I don’t recall the exact details. Because I see the labor market as key, I’ve left out the capital stock issue, which seems secondary to me. But his basic intuition seems exactly right.

PS. It’s likely that this is nothing new, or maybe it’s wrong. It’s a framing that occurred to me after reading Nick’s post. I welcome any comments you might have.

PPS. I had the honor of writing a forward for the brand new addition to George’s Less Than Zero.

PPPS. Don’t be discouraged if all this theoretical analysis makes NGDP targeting seem “wrong”. It’s less far less wrong than anything else on offer from the major schools of thought in macroeconomics—close enough to optimal for the USA.

PPPPS. I didn’t look at productivity shocks, because they affect the optimal price level, not the optimal wage rate.