GOP banking policy bleg

For millennials, the 2008 financial crisis was the defining economic shock of their lifetime. I believe I know how the Democrats think about his issue. But what about the GOP? For some bizarre reason, I have no idea what policy stance the GOP favors as a way of avoiding a repeat of 2008. If a student asked me to describe the GOP position, I’d wouldn’t know what to say. That’s not true of any other major public policy issue. I may not always agree, but at least I know where the GOP stands on abortion, tax cuts, coal burning, etc. I know they are split on trade. But I know nothing of their views on banking reform.

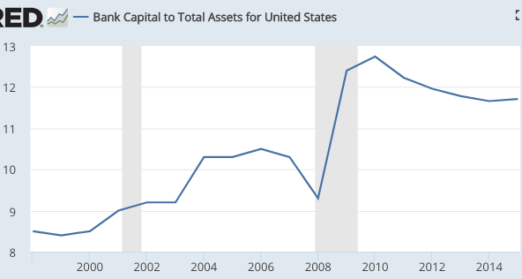

The Dems seem to favor something like Dodd-Frank. I don’t like that approach, as it’s overly complex and avoids most of the key problems (subprime loans, FDIC, the GSEs etc.) But what about the GOP? It would be nice if they favored a more sensible approach, which might include higher capital requirements for banks (or convertible debt), abolishing the GSEs, reforming or abolishing FDIC, more expansionary monetary policy during periods such as the Great Recession. Another option is to adopt the Canadian (big bank) system, which doesn’t have crises every few decades. But I never see any evidence for GOP support of any of those options. They favored tighter money during the Great Recession. (Oddly many Republicans are now calling for easier money, even as inflation is much higher than in 2009.) I see no evidence that the GOP has any interest in abolishing the GSEs or reforming FDIC. They seem to favor small banks, which are the biggest flaw in our financial system. The FT says the GOP is opposed to higher capital requirements, an option that seems greatly preferable to Dodd-Frank.

So what does the GOP actually favor? The 2008 financial crisis happened during a Republican administration. What lessons has the GOP learned?

I’m not being sarcastic, I’d actually like to know the GOP position on banking crises.

PS. The Mexico trade deal is good news, despite being a very slight net negative. There is a tiny bit more protection for industries, as well as tighter IP rules. I see those as small negatives. There will be freer trade in digital goods. The stock market hates protectionism and is rallying on the (good) news that Trump only cares about symbolic “wins”, not content (something I’ve been arguing for quite some time.) Let’s hope there is a similar agreement with Canada and China.

As far as the “downtrodden workers” in the Rust Belt—this agreement says the administration doesn’t care about you. The steel and aluminum tariffs will hurt manufacturing by more than the rules of origin changes will help.

PPS. Hopefully the Dems will take the House and refuse to ratify the agreement. But I suspect they’ll cave.