The increasing populism of the new right

India’s Modi shares some similarities with other populists in places like Turkey, Italy and the US. Here’s a recent FT story:

Tensions between the RBI and Mr Modi have been mounting for months over the central bank’s hawkish monetary policy, use of its mounting reserves and the tough measures taken to clean up bad loans at India’s state-run banks.

Mr Modi has been accused of demanding that the RBI ease back on its crackdown out of fear it will hit economic growth during his drive for re-election, particularly as liquidity in non-bank lenders has dried up after a series of defaults at IL&FS, a high-profile finance and infrastructure group.

At a 10-hour board meeting last month, Mr Patel made a number of concessions under heavy pressure from government nominees, including promising to review restrictions on fresh lending by banks that already have high levels of bad debt. Pressure on the RBI was expected to continue at Friday’s meeting.

Fresh lending from banks that already have high levels of bad debt? What could go wrong?

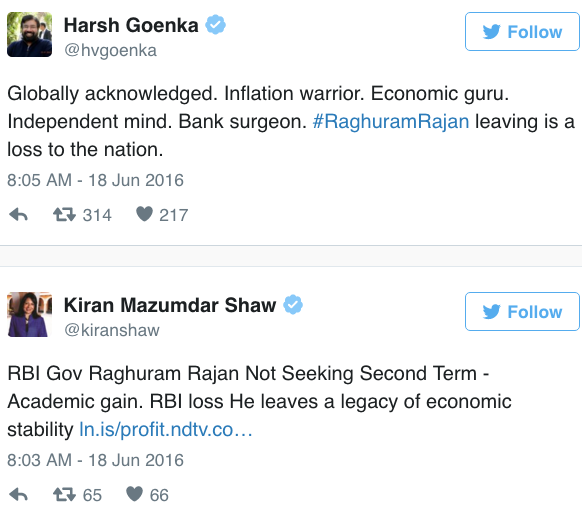

As a result of the pressure, Patel announced his resignation today. (Recall that Raghuram Rajan was let go two years ago, for similar reasons):

“By forcing Mr Patel’s hand, the government has now made it clear who runs the show,” said Eswar Prasad, a professor at Cornell University, adding that the move marks “the culmination of the government’s taking the hammer to a cherished and widely respected institution”.

The Indian rupee fell more than 1.8 per cent against the dollar in the immediate aftermath of Mr Patel’s resignation.

If you look around the world, there is more and more evidence that the left and right are switching position on a wide range of issues:

1. The populist right is increasingly supportive of monetary stimulus and opposed to central bank independence. (Easy money)

2. The right is increasingly supportive of protectionist trade policies. (Mercantilism)

3. The right is increasingly supportive of ramping up “moral hazard” in the financial system. (Easy credit)

4. The right is increasingly supportive of deficit spending, including entitlements.

Those used to be left-wing positions. Of course there are plenty of Republican politicians and pundits in the US that still oppose this populism, but this is the way that politics are evolving, all over the world.

I predict this process will continue, with local variations. Many other left wing ideas will flip to the right. The right will advocate a higher minimum wage and more government spending on infrastructure. Right wing populists will increasingly oppose Silicon Valley type companies. But this switch on tech firms will be less noticeable in the US, as it conflicts with the desire of nationalists to extract rents from the rest of the world. In contrast, populists in the other English speaking nations will be less protectionist than in the US, as the costs of protection are more obvious in those smaller trading nations (Canada, the UK, Australia, New Zealand, Ireland, etc.)

Nonetheless, at a deep psychological level, the forces reshaping politics are obviously global. The Economist has a fascinating article on the recent dramatic changes in Australia’s (conservative) Liberal Party, in which a Trumpian wing is suddenly becoming far more powerful. Interestingly, the factors that supposedly led to the rise of Trump in America (opposition to imports, the Great Recession, low-skilled immigration, etc.) are largely absent in Australia. This suggests that the psychological cause of this phenomenon is far deeper that the shallow explanations offered by media pundits. I have no idea what those causes are, but imagine they will become clearer over time. Why is misogyny usually a part of the package, for instance?

The Conservative Party in the UK is going through turmoil very similar to what’s reshaping Australia’s Liberal Party. Unlike in Australia, however, it stays afloat because its opposition is even more loony. The Australian Liberal Party doesn’t benefit from such a weak opposition, and thus faces a disaster at the next election.

The good news is that all of this turmoil may eventually lead to a US political party that is socially liberal and economically liberal. I fear, however, that in the short run we’ll have two economically illiberal parties.