The answers to these questions seem obvious to me, but I can tell from the recent comments that most people don’t agree. Saturos and Bill Woolsey have argued (in the comments) that money is the medium of exchange. I argue that money is the medium of account. What makes this issue so tricky is that money is almost always both, and the textbooks define it as having both characteristics. But which criterion is the “essence” of money?

Money is also that thing we put in monetary models of the price level and the business cycle. That begs raises the question of whether the price level is determined by shocks to the medium of exchange, or shocks to the medium of account. Once we answer that question, the business cycle problem will also be solved, as we all agree that unanticipated price level shocks can trigger business cycles.

So now we have to figure out what we mean by the term ‘inflation’. I’d like to propose 5 criteria:

1. Inflation is a general rise in the sticker price of goods.

2. Unanticipated inflation helps borrowers and hurts lenders.

3. When wages are sticky, deflation causes unemployment.

4. Inflation reduces the value of the medium of account.

5. Inflation reduces the value of the medium of exchange.

When the medium of exchange and the medium of account are identical, then all five of these statements are true. If they are split, statement 5 is true for the medium of exchange, and statements 1 through 4 are true for the medium of account. Let’s take an example to illustrate this confusing issue:

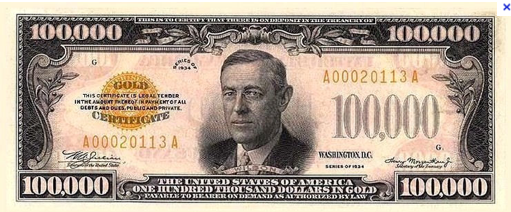

Imagine Zimbabwe uses gold as the medium of account. Then they have budget problems because their economy crashes when the government tries to take too much wealth from the top 1%. So they decide to print money. But the president (who is a madman) tells his treasury minister that he wants to stay on the gold standard, and will not tolerate any inflation. If the treasury minister violates this demand, he and his family will be executed. What’s a treasury minister to do?

Easy. Tell the public that they must continue to set all wages and prices and debt contracts in terms of grams of gold. At the cash register there will be a sheet of paper listing today’s exchange rate between paper Zimbabwe dollars and grams of gold. People will pay their bills with Zimbabwe dollars. (I’ve seen something similar in Canadian border towns, with US dollars as the MOE.)

In this example, gold is the medium off account and Zimbabwe dollar is the medium of exchange. What is the “true” rate of inflation? In terms of the definitions above, the criteria 1 through 4 apply to inflation in gold terms, and criterion 5 applies to inflation in terms of Zimbabwe dollars. I would add that the average person would view inflation in gold terms. Imagine you are a Zimbabwe diamond miner who works on a wage contract promising you 10 grams of gold per month. You could care less what the prices are in Zimbabwe dollars, you have a fixed wage in gold terms, and when you go shopping you will see price stickers on the goods in gold terms, not Z$. That’s your “cost of living.” When prices in terms of gold rise then you are worse off. Zimbabwe dollars are just a medium of exchange.

In any model of the price level you are essentially modeling the real value of the medium of account, and not (necessarily) the medium of exchange. And I’d add that the same is true of business cycles. Saturos and Bill Woolsey (and I think Nick Rowe) believe that recessions occur when there is a shortage of the medium of exchange. I disagree. I never have any problem getting cash, even during recession years. A lack of cash never causes me to spend less. A recession is caused by a decrease in supply or an increase in demand for the medium of account. Thus suppose that Zimbabwe was on the gold standard at the same time that soaring gold demand in Asia was pushing its value up, relative to other goods and services. Zimbabwe would experience deflation. If the wages of Zimbabwe gold miners were sticky in gold terms, then the diamond mine would have to lay some of them off. They would be unemployed, and would start buying fewer goods and services. Indeed in some cases market signals (such as higher interest rates) will encourage people to buy less even before the workers are laid off (the effect before the cause). But the fundamental problem is that there is too little NGDP, given the current (sticky) level of nominal hourly wages. The medium of account is becoming too valuable.

In the comments section I get the impression that people believe recessions occur because there is less media of exchange to spend. That’s not a useful way of thinking about the problem, for several reasons. Start with a gold standard, and think about the effect of worldwide deflation on a small economy like Canada. If Canada wants to maintain a fixed peg between gold and the Can$, they might have to reduce their currency stock. Is the lower currency stock “causing” the drop in spending? Obviously not. The global increase in gold demand that caused the global deflation in gold terms is the fundamental problem, and Canada’s declining currency stock is a symptom, just as the decline in lots of other nominal variables in Canada are symptoms.

In many cases the stock of currency does not decline during deflation. For instance, it actually rose in the US during the early 1930s. That’s because the negative effects of lower prices are more than offset by the increased demand for currency caused by the lower nominal interest rates (which are the opportunity cost of holding currency.) When this occurs it is especially easy to see why a lack of media of exchange is not a problem. During 1932 Americans held much more currency than in 1929. The lack of spending wasn’t because they had less currency in their wallets and piggy banks; they had plenty. Rather they had a higher demand for money, and simply chose not to spend it as often.

What makes this confusing is that today currency is the medium of account. Thus an increase in the demand for currency that causes deflation and depression would be the fundamental problem, not merely a symptom of a deeper problem in the ultimate medium of account (as in the early 1930s). And because these two roles (medium of account and medium of exchange) are now unified, both sides can look at the same set of facts and reach similar conclusions. It’s only when we separate out the roles of medium of account and medium of exchange that we can clearly see the real essence of “money.”

What’s the role of the financial system in all this? Financial systems are recent inventions; money and monetary policy and inflation have been around for millenia. Yes, financial shocks can impact currency demand, but at a fundamental level the financial system is nothing special, just one more factor (like drug dealing) that impacts the demand for currency. I don’t care if currency is only 1% of all financial assets. Give me control of the stock of currency, and can drive the nominal economy and also impact the business cycle. Cut the value of currency by 90% via OMOs, and you will raise the nominal GDP 10-fold, and prices 10-fold, and wages 10-fold, and the nominal stock of all assets by 10 fold.

PS. The equation of exchange (MV=PY) applies to the medium of account, but of course one could substitute any dollar-denominated asset for M, and it would still be an identity. After all, the definition of V is NGDP/M.

PPS. It’s true that the broader aggregates fell in the early 1930s, but you can find plenty of recessions where they didn’t, due to higher demand for liquidity.

PPPS. Totally off topic, but Matt Yglesias’s critique of the electoral college is a rare note on sanity in an otherwise horribly confused debate.