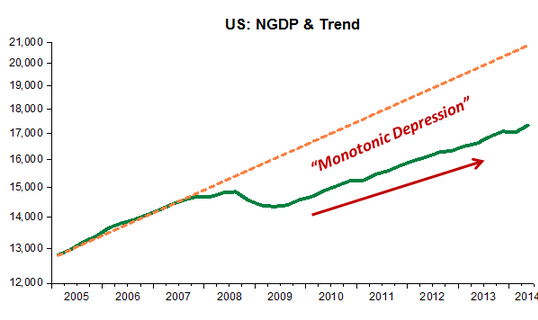

We’re getting there (not?)

Update: I’m told the CFTC did not allow US trading in NGDP futures markets, despite this press release. Can anyone find the actual regulation?

Update 2: Several commenters linked to a letter from the CFTC that makes it clear that Americans will not be able to trade in the NGDP futures. Although it is stated in a way that suggests the university made this request in their application, the way the process played out it was clear this was the most they could hope for. I’m really disappointed with this for two reasons. First, I don’t see any reason why Americans should not be free to set up this market, or any other prediction market. I don’t see any reason for government regulation. People can legally lose millions of dollars in Las Vegas, but the government is worried about prediction markets where no one would be allowed to wager more than $850. And these are markets that (unlike Vegas) have enormous potential benefits to social welfare. Even worse, this isn’t an American endeaver, it’s New Zealand university doing this project. Just imagine if Harvard was trying to set this up and the New Zealand government set a letter warning Harvard they could face legal troubles unless betting was restricted to Harvard students and staff. I’m an American, and I can tell you that Americans would be outraged. “Who gives the New Zealand government the right to tell Americans what we can or cannot do in our own university! How does this affect them?” It’s times like this that I feel first hand what foreigners must feel quite often–how the US often acts like a big bully. I have nothing personal against the individual who sent the letter–presumably he is just following US government policy. But Americans overall need to think about how they would feel if foreign governments made demands on us that were similar to the demands we are increasingly placing on foreigners. And of course this is just the tip of the iceberg—whole countries are being destroyed by a war on drugs that the US government insists they fight.

Commenter Cthorm pointed me to this new regulation from the CFTC:

RELEASE: PR7047-14

October 29, 2014

CFTC Staff Provides No-Action Relief for Victoria University of Wellington, New Zealand, to Operate a Not-For-Profit Market for Event Contracts and to Offer Event Contracts to U.S. Persons

Washington, DC “” The U.S. Commodity Futures Trading Commission’s (CFTC) Division of Market Oversight (DMO) today announced the issuance of a no-action letter for Victoria University of Wellington, New Zealand (University), to operate a not-for-profit market for event contracts, and to offer event contracts to U.S. persons, without registration as a designated contract market, foreign board of trade, or swap execution facility, and without registration of its operators.

The University’s proposed market for event contracts is similar to the Iowa Electronic Markets (IEM) operated by the University of Iowa. CFTC’s Division of Trading and Markets, which preceded DMO, previously granted no-action relief to the University of Iowa with respect to the operation of the IEM by letters dated February 5, 1992, and June 18, 1993. Like the IEM, Victoria University of Wellington’s proposed market for event contracts consists of submarkets for binary contracts concerning political elections and economic indicators, is operated for academic research purposes only, and its operators, who are faculty at the University, receive no separate compensation.

The University’s main objective for its event contracts market is to determine whether it can aggregate information and predict outcomes of certain events more accurately than through alternative means, such as public opinion polling. The University plans to use the results from its market as teaching tools in its courses on statistical analysis, market theory, and trader psychology, and as supporting data for research papers and analyses.

The University’s market would vary from the IEM model in certain respects, including a larger allowable number of traders in its market, as well as a higher, inflation adjusted cap on investment by any single market participant. DMO believes that each of these variances is intended to promote the educational public interest purpose of the project, while maintaining the market’s small-scale, not-for-profit nature.

I’ve frequently criticized government regulations restricting prediction markets. Although I don’t think there should be any regulatory barriers at all in this area, I applaud the CFTC for allowing this futures market to avoid regulatory sanctions from the US. It’s an important first step. If successful, it will offer valuable data on NGDP expectations.

Hopefully with this barrier overcome, Wellington University will be able to provide us with a tax advantaged way of donating money. I’ll let you know when I hear more.

Meanwhile Hypermind is already running, and will receive a $10,000 infusion of prize money within a few days.

PS. Cullen Roche has a new post entitled “Scott Sumner Says Silly Things,” where he compares me to a silly and amateurish monkey. I’ve been called worse, and if I have to be a monkey I guess I’d prefer not to be a sober and boring one. Roche says it’s obvious I was referring to new Keynesianism, whereas I thought it was obvious I was referring to the older variant, the one that took liquidity traps much more seriously.

Oh, and Milton Friedman (the guy who advocated QE for Japan back in 1997, and who pointed out that money in Japan was way too tight despite near-zero interest rates and that the euro would fail) has been “totally discredited.” Roche admits that much of new Keynesian economics is based on Friedman’s work, so I guess he thinks NK is also completely discredited. And he suggests that Robert Lucas’s work has also been completely discredited. I’d guess he also thinks RBC theory has been completely discredited. And Austrian economics? All that’s left is circa-1938 Keynesianism, the theory that QE doesn’t cause an exchange rate to depreciate. Is that Roche’s theory?

Driving to work today the BBC reporter was assuring NPR listeners that QE in Japan had been tried over and over again, and always failed. Really, when did it fail? The BOJ got the growth it wanted from 2002 to 2006, and then pulled much of the money out of circulation when it feared high inflation in 2006. Is that what the BBC reporter meant when he said it failed? Yet people like Roche get upset when you point out that Keynesians still believe in liquidity traps.

PPS. This has to be one of the most perplexing sentences I’ve ever read:

In somewhat related snippets, Noah Smith on people who can’t admit that they were wrong about QE

HT: Marcus Nunes