The new Rubb/Sumner principles textbook

I’m very pleased to announce that my 5-year project to write a principles textbook is now complete. Macmillan/Worth has just released the new book I co-authored with Steve Rubb, which is aimed at the mainstream principles of economics market.

Like Hubbard and O’Brien’s principles textbook, it has a business flavor that should make the subject more interesting for many students. Our book tries to be shorter and more concise, however, as many of today’s students simply don’t have the time to read an 1176 page textbook like H&O. Ours came in just under 800 pages—with a word count that is probably pretty similar to Mankiw’s relatively concise principles text. (Ours is actually 100 pages shorter than Mankiw, but each page is a bit bigger.) This picture shows our new text (in blue) next to Hubbard and O’Brien (in white).

Don’t be fooled by the business flavor, we still cover all the basics of economics, including important public policy issues such as price controls, externalities, labor, inequality, health care, and fiscal and monetary policy.

This book should be of interest to both monetarist and Keynesian instructors. Obviously my own views lean more monetarist, but we’ve covered the material to reflect the views of the profession as a whole. Thus there is much more coverage of inflation than NGDP, reflecting the consensus of the profession. Keynesians will find an optional “aggregate expenditure” chapter containing the Keynesian cross, if they are so inclined. If I were still teaching I would not cover the Keynesian cross, but would cover the part of the AE chapter that discusses the intuition behind Keynesian economics. Although I’m not a fan of fiscal stimulus, I believe it’s important for students to understand why these policies are so popular.

We also have the normal mainstream macro chapters, including a three chapter sequence of AS/AD, fiscal policy and monetary policy, as well as a two chapter money sequence that looks first at the basics of how the Fed controls the supply of money, and then the classical theory of inflation (i.e. money and prices in the long run.) I especially like our money/inflation and economic growth chapters.

In my view, the book is most successful at adding a business flavor in the micro chapters, especially those covering market structure. I believe students will find those chapters to be especially interesting, with lots of good real world examples. But we’ve tried to add as many business examples as fit at various spots throughout the book. Many students take economics because they have an interest in business.

As far as my own views, we’ve sprinkled the “never reason from a price change” concept into several of those chapters, including both S&D and AS/AD. There’s a brief discussion of monetary offset of fiscal policy in the section that covers issues such as crowding out. And there is some coverage of the logic behind NGDP targeting toward the end of the macro section. In monetary policy, we point out that low interest rates can reflect either easy money or a weak economy/low inflation.

But again, I didn’t think it appropriate to use a principles text to try to indoctrinate students into my own views where I have not (yet) been successful in convincing my colleagues. Students need to begin with the well-established basics. As a result, readers will occasionally run across statements in the text that conflict with opinions offered in this blog. That doesn’t worry me at all, indeed it’s appropriate.

For instance, you won’t come across “inflation doesn’t matter, only NGDP matters” in this textbook. You won’t find “fiscal policy is useless” in this textbook. Both monetarists and Keynesians should be quite comfortable with the presentation. When I taught at Bentley, most students were not aware of my views on economics—indeed were just as likely to view me as liberal than as conservative. The book reflects that balance.

If you do like my views on economics, I’d argue that we do a better job of presenting many macro topics than what you see in the other textbooks. For instance, our transition from MV=PY to the AS/AD model (using Y = C + I + G) is far more understandable than in most other textbooks. Indeed students would be utterly confused by this transition in many other textbooks (although Cowen and Tabarrok are an excellent exception.) I also like the way we explain topics such as the quantity theory of money, or the challenges of doing monetary policy when interest rates are zero. The fiscal chapter includes both supply and demand-side perspectives. Like some other newer texts, the economic growth chapter emphasizes the importance of good institutions, not just a mechanical model with “labor”, “capital” and “natural resources”.

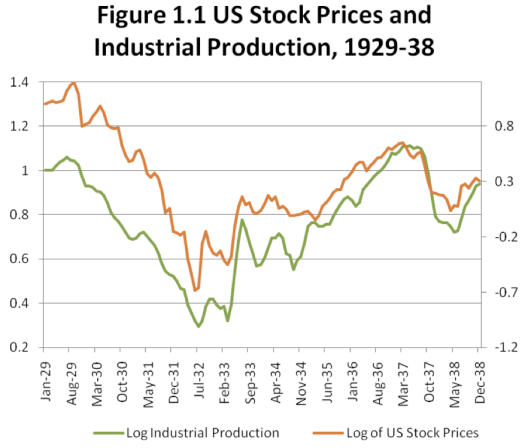

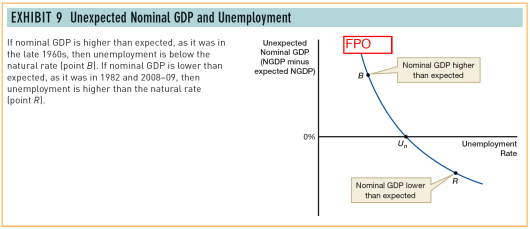

Toward the end we have an optional chapter on expectations, covering issues such as the Phillips Curve and rational expectations. I believe we do a particularly good job of explaining the concept of expectations. At the end of this chapter is a brief section on how the Phillips Curve approach could be applied to NGDP growth instead of inflation (Ignore “FPO”, an editorial note not contained in the final version):

In terms of level, I suppose it’s in the eye of the beholder. In my view our book is aimed at the middle of the market—not too difficult, but not dumbed down so much as to be misleading. Note that the preceding graph comes in a chapter that has already covered the pros and cons of the basic Phillips Curve, with inflation on the vertical axis.

In terms of level, I suppose it’s in the eye of the beholder. In my view our book is aimed at the middle of the market—not too difficult, but not dumbed down so much as to be misleading. Note that the preceding graph comes in a chapter that has already covered the pros and cons of the basic Phillips Curve, with inflation on the vertical axis.

BTW, if I could do a book with no constraints, I’d make it even shorter. However, textbooks are expensive projects for publishers and you need to address the preferences of the instructors. They each have topics that they view as essential.