Random thoughts

1. For Christmas, we have a truly heartwarming story of entrepreneurial success from the WSJ:

TikTok really was everywhere this year.

The app, known for its silly dancing videos, was the world’s most visited site on the internet in 2021, surpassing last year’s leader, Alphabet Inc. GOOG 0.13% ’s Google, according to Cloudflare Inc., NET 0.34% a cloud-infrastructure company that tracks internet traffic.

The app, owned by Beijing-based ByteDance Ltd., has had a rapid rise, hooking people with its secretive algorithm, which delivers video clips that it thinks you would like. It has turned dancing influencers Addison Rae and Charli D’Amelio into household names, getting cast in TV shows, commercials and movies.

I seem to recall that about 18 months ago the media was full of stories that Tiktok and WeChat were a threat to American national security. (As you may recall I was skeptical of those claims.) Trump promised to protect us with a ban, or at least force a sale. And yet here they are 18 months later, bigger than ever. So why don’t we see more news stories about how Tiktok is hurting American national security? Where are the exposés?

The only “dark side” mentioned by the WSJ has nothing to do with national security:

Like other social-media sites, TikTok has its dark side. The video-sharing app’s algorithms can drive minors to videos about sex, drugs and eating disorders, investigations by The Wall Street Journal have found.

2. Because our medical ethicists opposed challenge studies, it took far longer than necessary to test the Covid vaccine. Thousands died. Because a bunch of medical experts discouraged Pfizer from filing with the FDA as soon as it was apparent that the vaccine was highly effective, the filing was delayed. Thousands died. Because the FDA took weeks to consider the application, despite the fact that the evidence was overwhelming, another delay took place. Thousands died. Because a bunch of demagogues peddled phony conspiracy theories that the vaccine was risky or less than highly effective, vaccination rates remained disappointingly low. Thousands died.

3. The Washington Post has a story headlined:

While omicron explodes around the world, covid cases in Japan keep plummeting and no one knows exactly why

Right under the headline is a photo of a crowded street in Tokyo, where everyone is wearing a mask. Further down in the story is a photo of London, where almost no one is wearing a mask. Hmmm.

The WaPo story actually discusses two issues. One issue is why Japan has a low rate of Covid transmission at the moment, a fact that is largely unrelated to masks. But the article also discusses the issue of why East Asian countries like Japan and South Korea have had low rates of Covid throughout the pandemic, an issue which clearly does relate to mask wearing. (Although In South Korea testing is also a factor.)

4. It’s even worse than we thought:

In Cape Girardeau County, the coroner hasn’t pronounced a single person dead of COVID-19 in 2021.

Wavis Jordan, a Republican who was elected last year to serve as coroner of the 80,000-person county, says his office “doesn’t do COVID deaths.” He does not investigate deaths himself, and requires families to provide proof of a positive COVID-19 test before including it on a death certificate.

Meanwhile, deaths at home attributed to conditions with symptoms that look a lot like COVID-19 — heart attacks, Alzheimer’s and chronic obstructive pulmonary disease — increased.

“When it comes to COVID, we don’t do a test,” Jordan said, “so we don’t know if someone has COVID or not.”

Nationwide, nearly 1 million more Americans have died in 2020 and 2021 than in normal, pre-pandemic years, but about 800,000 deaths have been officially attributed to COVID-19, according to Centers for Disease Control and Prevention data.

A majority of those additional 195,000 deaths are unidentified COVID-19 cases, public health experts have long suggested, pointing to the unusual increase in deaths from natural causes.

And where are most of these unreported deaths? Do you even have to ask?

These trends are clear in small cities and rural areas with less access to healthcare and fewer physicians. They’re especially pronounced in rural areas of the South and Western United States, areas that heavily voted for former President Donald Trump in the 2020 presidential election.

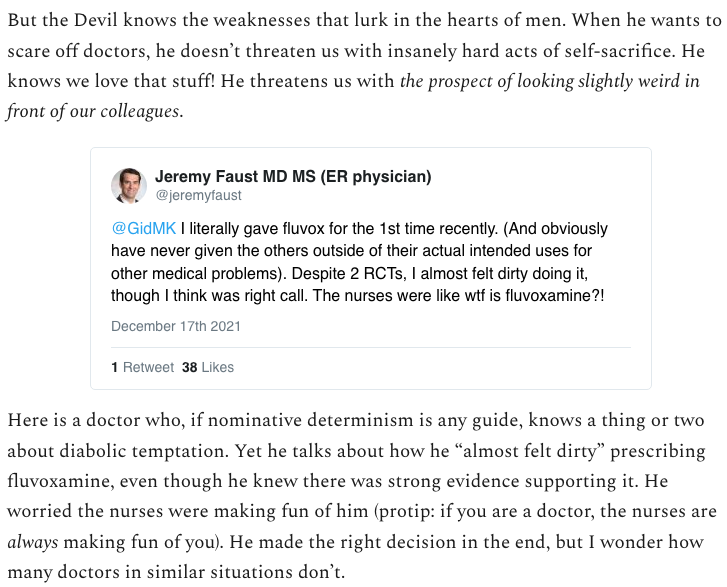

5. People sometimes tell me they don’t get why Scott Alexander is regarded as such an impressive blogger. Here he discusses why some doctors might be reluctant to prescribe fluvoxamine:

I could blog for 20 years and never write a paragraph that amusing.

6. I frequently use the term “Puritan” to describe recent cultural trends in the West, but Ed West suggests that a better analogy is the transition from the Regency era to the Victorian:

Ironically, just as those pushing for empire were the forebears of today’s sanctimonious decolonialists, Victorian moral campaigns against homosexuals were led by moralising Nonconformists, forerunners to today’s progressive campaigners. Acts such as the Criminal Law Amendment Act outlawing ‘any act of gross indecency with another male person’ were put forward by radical MPs, not by Tories. Quaker families who were involved in those early campaigns against sexual impropriety today often bankroll the moral campaigns against racism. The same urge to improve the world drives them, the same sanctimony. . . .

By 1842, Flashman laments that ‘respectability was the thing: breeches were out and trousers came in; bosoms were being covered and eyes modestly lowered; politics was becoming sober… the odour of sanctity was replacing the happy reek of brandy, the age of the dandy was giving way to that of the prig, the preacher to the bore’.

Those Regency men raised in the 20th century must feel the same way about this new age, even if it is a better world in most ways. The new Victorians may preach about different sins, but the sanctimony is the same.

Read the whole thing.

And Merry Christmas everyone!

(But then if you were the sort of person who celebrated Christmas, you wouldn’t be reading my bad blog today.)