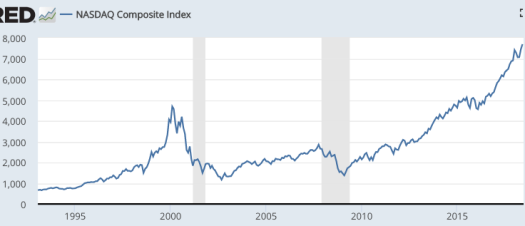

After my previous post, several commenters argued that I did not present persuasive evidence against the view that Nasdaq was in a bubble at the end of the 20th century. They often made the following argument:

While the current level of Nasdaq is well above the 2000 peak value (of roughly 5040), the rate of return on Nasdaq has been far below the rate of return on alternative investments that are much less risky, such as T-bonds.

This is certainly a reasonable argument, but I find it unpersuasive for several reasons. I’ll list them in order.

1. I don’t think it’s reasonable to compare current prices to the absolute peak of the tech boom, which only lasted for a few days. Whenever you look back on an asset price time series, the absolute peak level will usually look overpriced, in retrospect. Importantly, that would be true even if there were no such things as bubbles. As an analogy, bubble predictions of Bitcoin have proved spectacularly wrong. There were many people claiming that Bitcoin was a bubble at $30, then $300. Last time I looked it was near $6000. On the other hand, the absolute peak of Bitcoin was more like $19,000. And yet I don’t think you could argue that Bitcoin was a bubble just because it briefly hit $19,000. It’s pretty apparent that there is huge uncertainty as to what Bitcoin is worth. Perhaps if it falls far below $30 then those who called Bitcoin a bubble at $30 can claim vindication. But not at $6000.

2. So here’s what I’d say. There were widespread claims that Nasdaq was a bubble throughout the entire mid-1999 to mid-2000 period. Most of the time, the market was trading in the 3000 to 4000 range. Thus the current level of Nasdaq is roughly twice the level of the so-called bubble period.

3. Even this, however is not enough to rebut my critics. After all, T-bonds were yielding over 6% during the peak of the tech bubble, and they are a safer investment than tech stocks. Here I’d point to the fact that long term bonds benefited hugely from an unexpected plunge in interest rates. During most of the past 18 years, T-bills have yielded close to 1% (a bit above or below.) And T-bills are an even safer investment than T-bonds. For instance, I recall reading that long-term Treasury bonds lost 50% of their value during the Jimmy Carter years, even before inflation! Then in 1982 their total return was over 40%, in a year of about 4% to 6% inflation (depending whether measured calendar year or year over year.). That’s a pretty volatile asset. Suppose you’d bought a 30-year Treasury in 1981, yielding 15%. Then suppose a friend had bought a stock that (ex post) yielded 11%/year over 30 years. Would this suggest that the stock was overpriced in 1981? No, it simply shows that the T-bond did far better than expected, in a relative sense. After 1981, NGDP growth and inflation slowed sharply, which made T-bonds a great investment, ex post. That inflation slowdown obviously reduced the nominal return on many alternative assets, such as stocks.

4. Several commenters pointed to the fact that even (real) TIPS yields were pretty high in 2000, and Nasdaq has done poorly in real terms, relative to TIPS. But the preceding argument also applies here. Real interest rates also plunged sharply and unexpectedly during the 21st century. Indeed they’ve often been negative.

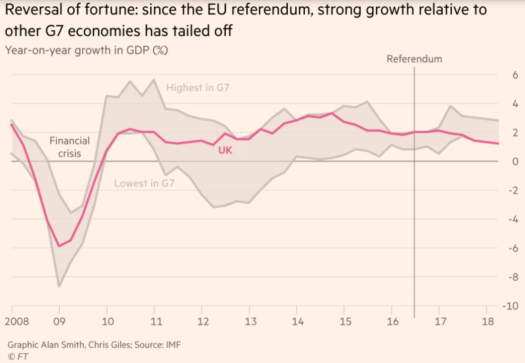

5. If you are having trouble with this argument questioning the relevance of bond yields, I can flip it around to make tech stocks look better. Think about why interest rates plunged unexpectedly. Much (not all) of the plunge was due to an equally unexpected plunge in trend NGDP growth, which has been far slower than expected during the 21st century. If NGDP growth had been as fast as expected, fast enough to justify those 6% T-bond yields back in 2000, then Nasdaq would have also grown far faster. In that case, Nasdaq would almost certainly be far higher today, say roughly 10,000. Also, don’t forget that back in 2000, capital gains taxes were far lower than taxes on bond interest. That made tech stocks especially attractive.

So here’s my argument. Let’s go back to when Nasdaq was 3500 during the tech boom, a level certainly considered bubble by people like Robert Shiller (recall his initial bubble call was in 1996, when Nasdaq was barely over 1000). I claim that this 3500 Nasdaq value was rational, if you assume NGDP would grow at the rate that bond market participants probably expected it to grow (say 5.5%/year). If that growth had occurred, then Nasdaq would now be closer to 10000, and the market would have roughly tripled (plus dividends.) Admittedly, even that sort of return would have been a bit lower than the historical average since 1926, but I believe markets have done well since the 1980s partly because of a growing realization that stocks were undervalued during most of the 20th century. Thus a part of the 1982 to 2000 stock price boom was a sort of “catch up” as investors realized Shiller’s model was wrong, and historical valuations were too low. (Or historical rates of return were too high, given the risk involved, if you prefer to think that way.) As an aside, I believe that’s why Shiller has done such a poor job of giving investment advice in the 21st century—not telling people to buy in 2009, and then saying stocks were overvalued a few years later, when in fact everyone should have been buying. He has the wrong model, which undervalues stocks.

6. Now let’s think about the justification for the bubble claims. In 2000, people argued that all of these companies couldn’t be successful. That’s true but not relevant; only some companies needed to hit the jackpot. People also argued that these valuations only made sense if internet oriented companies eventually grew to utterly dominate the US economy. Well, today the so-called FAANG stocks do dominate the stock market, with market valuations that dwarf the traditional corporate giants like GM, GE, etc. I recall people mocking companies like Amazon, which made no profits year after year and were focused on growth. So who’s the richest guy in the world right now?

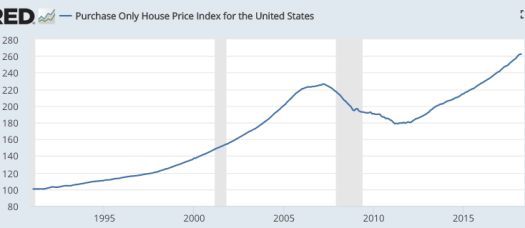

Almost every single argument used against my EMH position when I started blogging in 2009, now looks far weaker. Both Nasdaq and US housing have at least mostly recovered, even relative to trend. The above market returns of the Ivy League school endowments are mostly gone. Ditto for the above market returns for the hedge funds. Bitcoin didn’t crash when it hit $30. The people who told me the Canadian and Australian housing bubbles would crash “any day now” are still waiting, 9 years later. And what about the overbuilt Beijing and Shanghai property markets? Anyone willing to sell me property at 2009 prices in those two cities, widely regarded as a “bubble” even a decade ago?

I can’t prove the tech bubble was not a bubble, just as I can’t prove that people like Warren Buffett and Cliff Asness did not become rich by finding market inefficiencies. I’d be shocked if there wasn’t an occasional case of someone spotting a market inefficiency. Almost all social science theories are technically false, in the sense that they are not completely true. But the EMH is far less false than most of the very useful theories we teach in economics. It’s much easier for me to find industries that violate the laws of supply and demand (say due to market power) than it is for me to beat the stock market. I believe that 99.9% of investors should assume the EMH is true, and thus buy and hold index funds. I believe regulators should assume the EMH is true, and thus not try to spot and pop asset price bubbles. I believe that academic economists should assume the EMH is true, and thus replace 20th century macro with a new macro centered around real time market forecasts of expected NGDP growth, not VAR predictions of inflation and real growth.

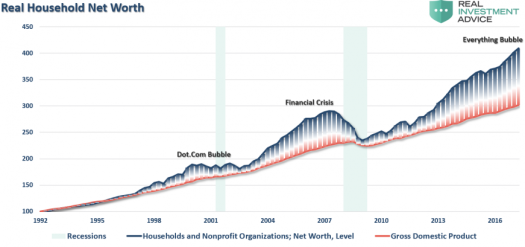

I like the term “everything bubble”. For a number of years I’ve been claiming that the 21st century would be full of “bubbles” that were not actually bubbles. In other words, asset valuations would be higher than expected based on traditional valuation methods, but nonetheless justified. This is from the spring of 2015:

I like the term “everything bubble”. For a number of years I’ve been claiming that the 21st century would be full of “bubbles” that were not actually bubbles. In other words, asset valuations would be higher than expected based on traditional valuation methods, but nonetheless justified. This is from the spring of 2015: