What’s fueling the rise in anti-Chinese hysteria?

How do Americans form their views of China? I see two possibilities:

1. They look at Chinese behavior, and form their views on that basis.

2. They take their cue from American politicians and pundits, who try to whip up anti-Chinese hysteria.

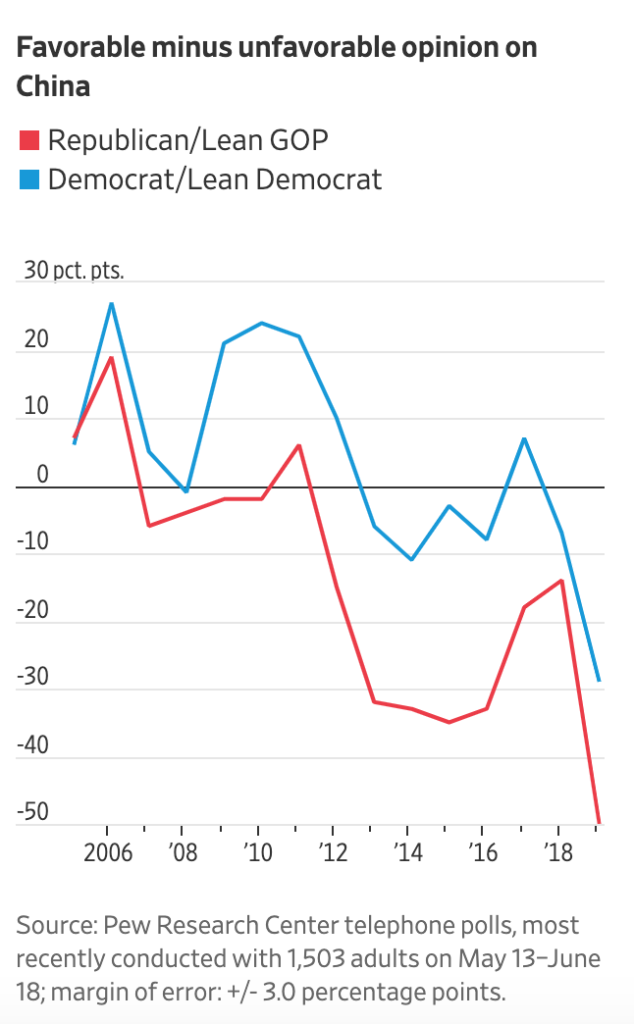

There’s actually an easy way to distinguish between these views. Chinese behavior has not changed significantly in the last year or two, but anti-Chinese propaganda has increased dramatically. So if we look at the attitudes of Americans toward China over time, we should be able to figure out how those views are formed. The following graph is from an excellent Greg Ip article in the WSJ:

The graph speaks for itself.

Ip’s article is still a tad too Ameri-centric for my taste, but it’s probably the best one could expect from a reporter who didn’t want to get drawn and quartered by the thought police. Well worth reading.

This is a key paragraph:

There’s good reason for the hawkish turn. Advocates of engagement have been dismayed by China’s mistreatment of foreign companies—such as forced transfer of their technology—its more bellicose behavior toward its neighbors and President Xi Jinping ’s tightening grip over domestic dissent.

The authoritarianism in China is a completely valid issue. We should speak out. Ironically, I’m far more opposed to authoritarianism in China than is the anti-Chinese Trump administration, which actually prefers authoritarian governments around the world (Saudi Arabia, Russia, Philippines, etc.) to our democratic allies like Germany and Canada. Trump often lavishes effusive praise on Xi Jinping.

Technology transfer is none of our business. China shouldn’t force technology transfer, but that’s an internal policy decision of the Chinese government. Nobody’s forcing our companies to invest in China.

As far as “bellicose behavior”, the US government routinely invades nearby countries, overthrows their government, and replaces them with governments more to our liking. China does not.

China’s not perfect, and indeed their bases on tiny uninhabited islands in the South China Sea are a needless source of friction in Southeast Asia. But for the US to criticize Chinese aggression borders on the absurd. Those islands are a trivial issue.

The Democrats are particularly disappointing in this area. What credibility do they have in criticizing Trump’s nationalism if they are going to engage in the same mindless fear-mongering?

Why aren’t the economic policies of other countries our business? After all, bad policies reduce our exports. OK, in 2018 we exported less than $26 billion to India and almost $130 billion to China. Both countries have a bit under 1.4 billion people. The difference is explained by the fact that China has economic policies that are more favorable to our exporters. You say it’s because India is much poorer? Well, why the heck do you think India is much poorer? So why aren’t you demanding a trade war with India? Why shouldn’t we demand that India adopt Canada’s economic model? After all, we export $282 billion to Canada, which has only about 36 million people. Should we demand that India “shape up”, so that our multinationals can get even richer? This whole trade war is ridiculous.

PS. There are a lot of predictions of a Brexit disaster and a US recession. This plays into the hands of Johnson and Trump, both of whom are likely to be elected (or re-elected) when the more dire predictions don’t come true. Remember Y2K? Actually, a Johnson win doesn’t bother me, given the main alternative. (Maybe UK voters should consider the Liberal Democrats.) Look for the Dems to play into Trump’s hands by selecting someone like Warren. Given the choice between a real nationalist and a fake nationalist, Americans will choose the real nationalist every time.

PPS. I have a new piece at The Hill.