Random comments

1. Part two if my critique of MMT is finally available online here. Part one is here.

2. Commenter Lin asks:

If attempting to control the supply of food kills one hundred million people, then why do economists think controlling the supply of money will yield a better result?

I presume Lin is referring to the Fed controlling the supply of Fed money. This is how markets work. Ford controls the supply of Ford cars, Apple controls the supply of iPhones, and the Fed controls the supply of Fed money.

It’s a free country and alternatives such as travelers checks, Bitcoin, one ounce bars of silver, and other types of money are freely available if you don’t like using Federal Reserve Notes.

3. Until I read this four part series, I knew nothing about the guy who was recently fired by the NYT for supposedly being a “racist”. Now I know that his views are pretty much like mine. I’ve also learned that someone with my sense of humor and/or my political views is not welcome at the NYT. And that’s fine with me. Most of all, I’ve learned that a sizable fraction of the people who work at the NYT are totally insane. Especially the younger employees. And I’ve learned that some teenage girls have no sense of humor. The Great American Bourgeois Cultural Revolution rolls on.

And as Robin Hanson might say, anti-racism isn’t about anti-racism.

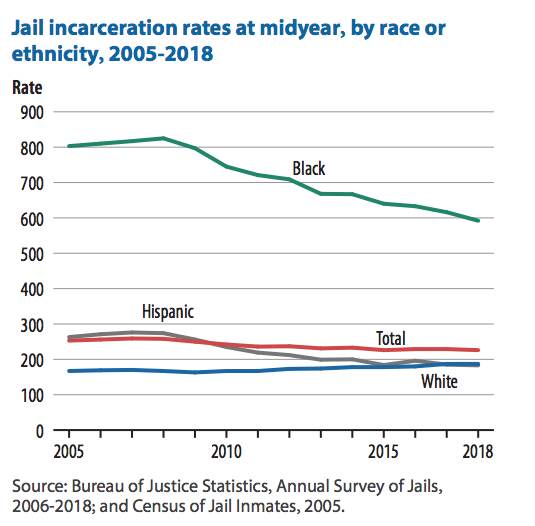

4. I also recently learned that Hispanics living in America are imprisoned at a lower rate than whites, but only since Trump took office in 2017. Before then, Hispanics were imprisoned at a higher rate than whites.

If you like Trump you’ll say this proves that he’s not bigoted against Hispanics. If you despise Trump (like me), you’ll say it shows he was wrong to characterize Hispanic immigrants as rapists and murderers.

And if you work for the NYT, you’ll insist it should be spelled “Hispanix”.

Tags:

2. March 2021 at 11:14

So, I ran into this guy I know–Rip Van Winkle–who I hadn’t seen in awhile. He explained that he’d fallen asleep at NYU in 1968 listening to Walter Heller tell Milton Friedman:

‘I really don’t understand how the scarcity of any commodity can be gauged without referring to its price— or, more specifically, how the scarcity of money can be gauged without referring to interest rates. It may, strictly speaking, be wrong to identify any market interest rate as the price of money. In the U. S., no interest is paid either on demand deposits or on currency. But this is quibbling. The point is that a change in the demand for money relative to the supply, or a change in the supply relative to demand, results generally in a change in interest rates. To insist that the behavior of the price of money ( interest rates) conveys no

information about its scarcity is, as Tobin has noted, an “odd heresy.”’

So, Van Winkle tells me he just woke up a couple of days ago in a classroom and some fresh faced grad students are arguing over something called a ‘blog post’ between a couple of guys named Sumner and Kling about the same issue. He says he’s glad he didn’t miss anything.

2. March 2021 at 12:01

I don’t like Trump and I think he was wrong to characterize Hispanics as rapists or murderers, but the chart does not indicate any change since 2017.

the

2. March 2021 at 12:27

On the New York Times, I don’t understand why anyone reads it much at all. It’s always seemed like crap to me, along with every other newspaper, with the possible exception of the FT, which I also don’t read. Sure, the Times will still occasionally do some investigative reporting, but even then I usually pick up what they write second-hand. I guess I just never liked newspapers. And I’m a liberal Democrat, so this is not ideological for me.

Especially, in this day and age, there are just many better ways to get news.

2. March 2021 at 12:50

And Hispanics and blacks are much younger than whites. I think they are a higher percent in the most likely to incarcerated ages.

https://www.pewresearch.org/fact-tank/2019/07/30/most-common-age-among-us-racial-ethnic-groups/

2. March 2021 at 12:59

MMT would work…until it stopped working. That’s why MMTers go about everything the wrong way—they want more people to have more dollars—so the way to do that is by finding excuses to print money while maintaining the veneer of orthodox Keynesianism. So America already has a sizable MMT operation going on and it’s called SS and Medicare and SNAP and EITC and Medicaid and unemployment insurance. So we know from 2009-2013 that the next government dollar spent goes to an able bodied adult that could be in the labor force. So step back—we should maximize throwing dollars at people that really shouldn’t be in the work force—so parents of babies are people I don’t want in the work force so that makes a parental leave program a good excuse for ongoing MMT.

Next MMTers should focus on one shot programs that get Americans dollars to Americans that will spend the dollars—in 2021 paying reparations to descendants of American slaves is a macroeconomic no brainer. We know it would be nothing more than a focused helicopter drop with the goal of increasing aggregate demand and helping productive Americans. So the fact it is limited means over the long term able bodied adults aren’t leaving the labor force because they have an ongoing source of income.

2. March 2021 at 13:14

It would be curious if Sumner would change his opinion on Trump if he was 30 years old and had to live in the world the NYT advocates and promotes.

Easy to retire and fall back on watching movies. Much differently when you need to participate in today’s society. And that’s why the middle class is flocking to him.

2. March 2021 at 13:30

Scott,

Your observation may be correct, but I can’t find your observation in the graph or in the linked PDF.

What I found is data on prisons, with 2018 appearing to be the most recent year with current data.

Here we have 1,501 black inmates per 100,000, 797 Hispanic inmates per 100,000 and 268 non-Hispanic whites per 100,000.

So I don’t really get what you are talking about. It’s not even close.

https://www.pewresearch.org/fact-tank/2020/05/06/share-of-black-white-hispanic-americans-in-prison-2018-vs-2006/

2. March 2021 at 13:31

From your MMT post: “MMTers tend to be skeptical of the usefulness of supply and demand models”.

As far as I’m concerned, if the MMTers are unable to refute that claim they are admitting not to being on one end of the economics spectrum but to being off the spectrum entirely.

And regarding the Aaron Sibarium anti-anti-racism post: the commenter who posted the Monty Python Life of Brian stoning scene summed the situation up perfectly.

2. March 2021 at 13:35

So MMTers should go underground and hold themselves out as Keynesians in the public sphere. But another rule that should limit their MMT discussions on their secret Google groups is that socialism fails because schemers displace productive members of society as the most respected members of a society…and then the society breaks down. So disposable income must always have some relationship to productivity otherwise the people with most productive potential will stop being productive. You also want to maximize able bodied adults in the labor force because you want those people working for dollars instead of being comfortable getting a check without working. So maximize the number of people you really don’t want working (like parents with babies) while maximizing able bodied adults in the labor force. So getting low skilled people hustling to get dollars from productive members of society makes the society stronger as long as the low skilled hustlers get to lead a safe and comfortable life. This last sentence is the one our society has trouble getting the balance right and creates an opening for MMTers.

2. March 2021 at 15:01

Never let a graph get in the way of a good story

2. March 2021 at 15:14

MMT types do get something right: fiscal policy >> monetary policy, and printing money to spend, as was done in the US Civil War, for a while isn’t all that bad.

Sumner: “It is monetary policy that determines the path of aggregate demand, not fiscal policy.” – hahaha! Cite please? MMT, Keynes, Friedman, Sumner and the Austrians are all wrong: any economy is shaped by shifts in AD caused by animal spirits and nothing the government does really matters. In fact, as Sumner himself points out in the book “Midas Paradox”, the Great Depression was largely over by 1934, when the bank runs ended (Sumner credits going off gold, I credit FDR’s fireside chats). The Great Depression was a depression along the lines of the 1837 Martin Van Buren panic. Routine. You didn’t need a Federal Reserve to get out of the 1837 panic and you didn’t need one for the Great Depression (in fact neither government spending nor what the Fed did in the 1930s mattered; in the end, the public simply got confidence again and WWII spurred demand).

A pox on every ‘house’ in the economics camps, they are all wrong.

2. March 2021 at 15:59

Re:Patrick Sullivan

Do you think that Scott believes the price of money is not relevant, or that it cannot be scarce, or that demand is not part of the equation regarding scarcity?

And are you really sure about “animal spirits”? We all are motivated by emotion and reason –emotion to succeed, fear of being fired——but its just a term that describes an element of humanity—-it is not in contradiction to rational expectations—which is another phrase that is often misunderstood. Or given too much literal meaning. When you are about to succeed at something—–do rational expectations get ignored? The desire to succeed and rational behavior are both part of who we are. Do we feel better when we are right? Yes. Do we ignore what is fron’t of our face because it is rational to do so (like that train coming down the tracks at us)?

Was buying Gamestop rational? Or just an expression of animal spirits? It was rational and an expression of animal spirits. It was a game, a contest, to try and win. I wouldn’t do it—-but that not my thing

2. March 2021 at 16:45

Thomas, Before 2017, Hispanics were incarcerated at a higher rate than whites, now it’s the reverse.

Floccina, Very good point.

Sean, LOL. No, the middle class is not flocking to him. Did you miss the last election?

And why would my opinion of Trump be affected by my opinion of cancel culture? That that excuse Trump’s fascism?

Christian, Perhaps the graph is wrong. Or perhaps they just included jails, not prisons. I’m not sure.

2. March 2021 at 18:22

Scott, on 2, your answer is unpersuasive. If the government opened it’s own (terribly run, low quality) restaurant chain, funded by tax dollars (but costing them $50 per hamburger), would you say, ‘it’s a free country, you can always eat at one of the private restaurants.’ The private restaurants may barely exist because of their disadvantage relative to the state-subsidized alternative (and due to being regulated by their biggest competitor).

A better answer: the cost of producing money is effectively 0, so the only area where currency producers would compete is in determining how much currency to produce. Inasmuch as a border-line monopoly on currency is inevitable (such as because the state only accepts taxes paid in its favorite currency, among other reasons), if we can reasonably identify when supply is meeting demand, then a central authority may approximate the currency production of a functioning free market.

Selgin and White argued, I believe, in ‘How Would the Invisible Handle Money,’ that a free market in currency would tend to stabilize nominal GDP.

2. March 2021 at 19:06

Thank you for your response.

When Piermont Morgan bailed out NYC in 1906, he famously said that he would rather give 1M to an honest man without any collateral, then give 1M to an unscrupulous man with collateral. Morgan actually needed to service his partners. He needed the cash on hand. He needed partners that were trustworthy. Above all, he needed to act with impeccable integrity!

As a layman (I prefer Physics to Economics), it seems to me that the banks are now using the Fed to hedge their risky loans with tax payer money. Unlike Morgan, these banks can loan 90%, hold 10%, and borrow from the Fed to cover their requirements.

Since their risk is now covered by the American Tax Payer, they can recklessly engage the markets (especially when that rate is very close to zero).

Is that not the very definition of a house of cards?

Would economists in the old soviet Union not respond similarly, by saying that their central planning of food was no different than Ford supplying automobiles?

Perhaps more importantly, why are taxpayers covering the risks of private bankers?

2. March 2021 at 20:27

Mark, You said:

“Selgin and White argued, I believe, in ‘How Would the Invisible Handle Money,’ that a free market in currency would tend to stabilize nominal GDP.”

There’s a difference between “arguing” and arguing persuasively. I’m not persuaded.

And the Fed is not subsidized; indeed it’s taxed at a very high rate, much higher than commercial banks.

Lin, You are right that government insurance is causing reckless lending, but the main problem is FDIC, not the Fed. Even so, I’m certainly no fan of what the Fed is doing on that front. And yes, the taxpayers will be left holding the bag.

3. March 2021 at 08:15

Scott – Middle class doesn’t have a college degree. College degree holders moved to the left. Roughly 35% of americans have a college degree over 25. The middle 30% do not have a college degree.

3. March 2021 at 11:39

Sean, That’s now how “middle class” is defined in America. In any case, people aren’t flocking to Trump, they are flocking away from him.

3. March 2021 at 13:52

The Fed has a state-sanctioned monopoly on the only currency accepted by the federal government (an institution with which we all must do business regularly), which also regulates other currencies, so the Fed has clear advantages over potential competitors.

3. March 2021 at 15:38

Thank you for Part 2 of your critique of MMT.

I would say that many of your observations seem accurate enough to me. (I resemble some of them myself).

But you have not managed to point out exactly where Modern Monetary Theory is mistaken about what it claims. For example- you state that MMT is very concerned with the process of banks and how bank loans actually happen. Did you find that MMT was misrepresenting that process? Or is it more a situation where you might think they were drawing unwarranted conclusions but based on accurate description?

Anyways, thanks Scott. I had inquired about your critique previously and appreciate the chance to read it. And I also appreciate that you took the time and effort to read the MMT textbook first and then evaluate what they say.

4. March 2021 at 10:27

Mark, I’d say that’s a very small advantage. I don’t choose to use dollars because I pay taxes in dollars; I choose to use dollars because they are more convenient that Bitcoin, pesos, bars of silver, etc. I’d still use dollars for most things even if the IRS suddenly said taxes must be paid in euros.

Jerry, You said:

“But you have not managed to point out exactly where Modern Monetary Theory is mistaken about what it claims.”

I pointed to many specific mistakes, such as the claim that open market operations don’t impact inflation.

4. March 2021 at 13:12

Always nice to see the power of the Fed, today, to move all markets. USD sharply up, 2-10 yield spread wider, stocks down. Means … ???? Please can we have NGDP Futures markets!

4. March 2021 at 16:40

James, Not sure what the markets were expecting. Yield curve control? What did they want Powell to say?

5. March 2021 at 13:15

Hard to interpret, for sure, he moved markets though.

I always think a steeper yield curve is a sign monetary tightening will come but won’t be a good idea, hence equities fell and the USD rose. To be judged a success by MM we need a parallel shift up in the yield curve, a sign that benign nominal growth is ahead. To do that he’d probably have to endorse NGDP Growth Targeting. The best of times for the US economy are when the yield curve is flat at 4-5%. Steep or flat at a low level are problematic.