Arnold Kling on monetary and fiscal policy

Arnold Kling has a new article on monetary and fiscal policy. Because he slightly mischaracterizes my views, I should probably respond:

Scott’s argument for monetary dominance is that the Fed, which sets monetary policy, is way more agile than Congress, which sets fiscal policy. It’s like a game of rock, paper, scissors in which if Congress shows rock, the Fed shows paper. Or if Congress shows scissors, the Fed shows rock. The Fed can always win.

I do think the Fed is more agile, but the decisive factor is that the Fed is much stronger. If you want a metaphor that is better than rock, paper, scissors, imagine I’m driving my car and my 6-year old daughter pushes the steering wheel to try to change direction. I’d simply push back more strongly.

I believe in fiscal dominance. That is because I do not think that Peter cares all that much whether he hangs on to his T-bill or exchanges it for money. Scott thinks that Peter will spend more in the latter case. I am skeptical.

This isn’t the right thought experiment. I don’t doubt that if you give the average person a briefcase with a million in cash they’ll go on a shopping spree, and that’s equally true if you give then a million dollars in T-bills. That’s not the issue. Money is special not because it is regarded by individuals as wealth, rather because it is the medium of account exchange.

If you add more cash to the economy than people want to hold, they can get rid of the excess cash balances only by pushing up the price level. In contrast, if you add more T-bills than people want to hold, they can drive down the price of T-bills, with no change in the price level. You merely need to assume that they aren’t perfect substitutes. (At least when nominal interest rates are positive, and Arnold seems to be arguing for fiscal dominance even during periods where interest rates are positive.)

Scott, like almost all mainstream economists, sees inflation as having a continuous dose-response pattern. Give the economy a higher dose of money and it will respond with higher inflation. Other economists measure the “dose” as the employment rate.

I think of inflation as an autocatalytic process. Inflation is naturally low and stable. But it can be jarred loose from that regime and become high and variable. Then it takes a lot of force to bring it back to the low and stable regime.

Nominal variables don’t have natural rates. It’s a policy choice. Inflation was not low and stable for most of American history, but became low and stable after 1990, when the Fed decided to target inflation at roughly 2%. These things don’t happen automatically. That’s why most central banks have set inflation targets, to prevent this:

Here’s Arnold:

Once inflation gets going, the only way to stop it is to slam on the economic brakes. Usually, this means drastically cutting government spending. But in the U.S. in the early 1980s, we slowed the economy without cutting government spending. Instead, the foreign exchange market put on the brakes by raising the value of the dollar, stimulating imports and making our exports non-competitive. And the bond market put on the brakes by raising interest rates, so that nobody could afford the monthly payment on an amortizing mortgage. After a few years of high unemployment, inflation receded.

Most economists attribute these developments to Fed policy under the sainted Paul Volcker. Scott could say that this was exhibit A for monetary dominance. The economic consensus may be right, but I would raise the possibility that the financial markets were the main drivers.

The price of goods (CPI) the price of foreign currency (E) are two ways of measuring the value of money (actually its inverse.) Here Arnold is saying that monetary policy did not make the dollar strong, a stronger dollar (exchange rate) made the dollar stronger (purchasing power). OK, but the two most plausible theories for the strong dollar were tight money and fiscal deficits. Obviously, Arnold is not saying that big fiscal deficits brought inflation down in the 1980s.

Exhibit A? Volcker was perhaps Exhibit J for monetary dominance; there are so many other examples that one hardly knows where to begin. Remember LBJ raising taxes and pushing the budget into surplus in 1968 in order to bring down inflation? How’d that work out? Budget deficits were pretty low in the 1970s, as a share of GDP. What happened to inflation? Then inflation fell as Reagan pushed the deficit much higher. A big reduction in the budget deficit from $1061 billion in calendar 2012 to $561 in calendar 2013 should have slowed the economy according to the fiscal dominance theory. Instead NGDP growth sped up in 2013. Then the deficit ballooned to a trillion dollars in 2019, and yet inflation stayed below 2%.

Overseas you find the same thing. Japan runs some of the biggest fiscal deficits ever seen in peacetime from the mid-1990s to 2013 and both the price level and NGDP actually fell. Then a new government switched to fiscal austerity and monetary stimulus, and NGDP begins rising (albeit still too slowly.)

Sorry, but fiscal dominance is not remotely plausible, at least with positive interest rates and an independent central bank.

Almost every major school of thought—monetarist, Keynesian, and Austrian, etc.—believe that monetary policy has a major impact on nominal variables. The financial markets respond to monetary policy announcements as if they are extremely important, often adding or destroying hundreds of billions of dollars in wealth within seconds. The history of economics is full of examples of monetary dominance over fiscal policy. Basic theory predicts that a $100 bill is not identical to a T-bill yielding 2% interest; otherwise they’d have the same yield. If Arnold Kling and the MMTers want to convince the me, the rest of the profession, and the financial markets that open market operations don’t matter when interest rates are positive, they are going to need something better than dubious thought experiments about the substitutability of cash and T-bills.

Tags:

1. March 2021 at 11:18

I’m not questioning Sumner, but there were three significant shifts in the past 40 years: the shift in the production function to China, the shift in the US economy to services, and the shift in income and wealth upstream. Deficits and the “strong” dollar to fund them didn’t change much, but the three shifts I listed had a profound effect on wages and prices and policies adopted in both Congress and at the Fed.

1. March 2021 at 12:09

If attempting to control the supply of food kills one hundred million people, then why do economists think controlling the supply of money will yield a better result?

One doesn’t need to be an economist to see that 75% of US businesses are zombie corporations that are only alive because banks continue to let them borrow loans that they will NEVER be able to repay. The bankers of course know this, but they have no choice but to keep lending and hope the business survives.

The Federal Reserves narcissism, and desire to plan our supply of money, is going to be the very cause of the greatest economic collapse since Rome.

1. March 2021 at 12:42

Sumner sees his name in print and like a little boy wants to respond, how predictable. And guess what? He is misunderstood (no surprise).

Let’s deconstruct Sumner’s post. Sumner (SS): “I do think the Fed is more agile, but the decisive factor is that the Fed is much stronger.” – how much is much? How long is a string? Without a yardstick, how do we know Kling is disagreeing with Sumner?

Kling thinks fiscal > monetary policy (the commonsense view): Sumner: “This isn’t the right thought experiment” What? It’s not a thought experiment, it’s a historical fact. See more here Youtube: 2021 – MacroVoices #260 Lyn Alden: Shifting from Monetary to Fiscal Dominance. In short, after WWII and now, the fact we’re printing and deficit spending more than 25% of GDP via fiscal policy is huugee, to quote the Orange Man.

SS: “If you add more cash to the economy than people want to hold, they can get rid of the excess cash balances only by pushing up the price level. In contrast, if you add more T-bills than people want to hold, they can drive down the price of T-bills, with no change in the price level” – no. Sumner apparently has never heard of a brokerage house, where you can give them cash and get T-bills in exchange. People are not that sticky.

SS: “Nominal variables don’t have natural rates.” – no. Nominal = F(Nominal, natural rate). The nominal variable is path dependent. Easy to model, it’s called “anchoring”. If somebody says: “pick a number between 1, 10 and 1M, you are likely to pick something well over ten since your mind is anchored to the higher number.

SS: “Exhibit A? Volcker was perhaps Exhibit J for monetary dominance; there are so many other examples that one hardly knows where to begin” – begin with that at times Volcker raised rates and inflation ROSE and he lowered rates and inflation FELL, the opposite of conventional monetary theory.

SS: “almost every major school of thought—monetarist, Keynesian, and Austrian, etc.—believe that monetary policy has a major impact on nominal variables.” – wrong. The Ray Lopez / Nobelist Fisher Black school says money is largely short-term and long-term neutral. Only hyperinflation is non-neutral. Money is like the Van der Waals forces in nature: very weak, inverse r2 forces. Statistically true as Bernanke said in his 2003 FAVAR econometrics paper, but weak (Bernanke found monetarism is about 3.3% to 13.3%–out of 100%–to a range of economic variables including nominal GDP, and unemployment. Weak, like our host’s arguments.

1. March 2021 at 16:14

rayward, the monetary policy shifts over the past 60 years are what had a profound impact on wages and prices…

https://marcusnunes.substack.com/p/inflation-mongering-is-back

1. March 2021 at 16:48

Rayward, None of those affect inflation, which is targeted by the Fed at 2%. For instance, trade with China merely affects the relative price of tradeables vs,. non-tradeables, with no impact on the absolute price level.

Lin, That’s worth a post.

Ray, Sorry, but it didn’t work. I wrote the post yesterday afternoon, as someone else sent it to me in the morning. By the time you emailed me last night recommending that I respond to Kling, I had already written the post.

1. March 2021 at 20:11

Nevermind the administrations of LBJ through Reagan. Volker putting the brakes on the economy is exhibit A because Arnold Kling is concerned about inflation getting too high. Failure to grow the level of Fed assets held (series WALCL) in 2015 and 2016 (and a late 2015 Fed funds rate increase) may be another example of putting on the brakes. It might be seen as having been effective because the market’s breakeven inflation rate was below 2% for much of the 2015 and 2016 period. Yellen, Comey, and Jill Stein were from the unwitting committee to elect Trump.

The posted statistics on inflationary episodes (for example Brazil) can be saved for when people are worried about the Fed doing too little. And yet these kinds of statistics don’t edify on the U.S. situation since 2008 because the USD interest rate environment is too low. Still they are amazing statistics.

Speaking of Yellen…

Yellen on CBDC…“I gather that people at the Federal Reserve Bank of Boston are working with researchers at MIT to study the properties of it. We do have a problem with financial inclusion. Too many Americans really don’t have access to easy payment systems and bank accounts. This is something that a digital dollar, a central bank digital currency, could help with. I think it could result in faster, safer and cheaper payments.”

Jerome Powell… “a high priority project for us.” “We are committed to solving the technology problems, and consulting very broadly with the public and very transparently with all interested constituencies whether we should do this.”

Is this in preparation for a helicopter drop capability? How will this affect “demand” deposits at banks?

1. March 2021 at 21:26

Isn’t non-targeted fiscal stimulus actually long-term deflationary at present DM debt levels?

2. March 2021 at 04:42

[…] Scott Sumner writes, […]

2. March 2021 at 04:53

Scott says “If you add more cash to the economy than people want to hold, they can get rid of the excess cash balances only by pushing up the price level.” Not necessarily true.

If the economy has plenty of spare capacity, i.e. if unemployment is much higher than it need be, then the attempt by everyone to spend away their excess stock of cash will result extra GDP and less unemployment rather than price rises.

2. March 2021 at 05:30

The basic argument against monetary policy (at least in the form of artificial interest rate adjustments) is that the GDP maximising rate of interest is presumably the FREE MARKET rate. Ergo in a recession, more base money should be created and spent into the economy rather than have the economy brought up to capacity via artificial interest rate cuts.

Of course there is the point that Congress is particularly “un-agile”. But that problem can in principle be solved. E.g. the central bank could say to govt when appropriate “Here’s $Xbn to spend. Get a move on and spend it, or cut taxes, and if you don’t do anything within two months, we’ll hand the money to govt departments, city authorities etc.”. Ben Bernanke gave the thumbs up to the latter sort of system.

2. March 2021 at 08:58

PG, I don’t think it affects inflation either way in the long run.

Ralph, Yes, it pushes up NGDP. In the long run the effect is inflation, but (as you say) output may rise in the short run.

You said:

“Ergo in a recession, more base money should be created and spent into the economy rather than have the economy brought up to capacity via artificial interest rate cuts.”

I completely agree. Just target NGDP and let the market set interest rates.

2. March 2021 at 09:09

re: ” but became low and stable after 1990, when the Fed decided to target inflation at roughly 2%”

Scott should have responded. He was mischaracterized.

But inflation fell because Congress turned 38,000 financial intermediaries into 38,000 commercial banks. It was called the DIDMCA of March 31st 1980. The result, as predicted, was the peak in velocity, the Savings and Loan Association credit crunch and the 1990-1991 recession. The result, as predicted, was the dominance of FNMA and GNMA, the GSEs.

Banks don’t loan out deposits. So velocity fell because of the complete deregulation of interest rates.

2. March 2021 at 09:09

Scott, you said that money is special because it is a medium of exchange. In the past, you have said that money is special because it is a medium of account. In today’s world, they are the same. Do you still hold the view that medium of account is the more important function?

https://www.themoneyillusion.com/when-we-have-internecine-battles-you-know-that-market-monetarism-has-arrived/

2. March 2021 at 09:43

I enjoy reading Arnold Kling and Scott Sumner so much and now a direct exchange between the two, it’s like Easter and Christmas together. I don’t understand all the details due to my limited language and economic skills, but as far as I understand it, Scott “won” this round, though of course it’s not about winning, it’s about the fruitful exchange of opinions, which was (and is) really lovely.

I think both sides made their points, although Scott sounds more convinced of his views, and thus more convincing to others, at least to non-experts like myself.

2. March 2021 at 10:10

Scott,

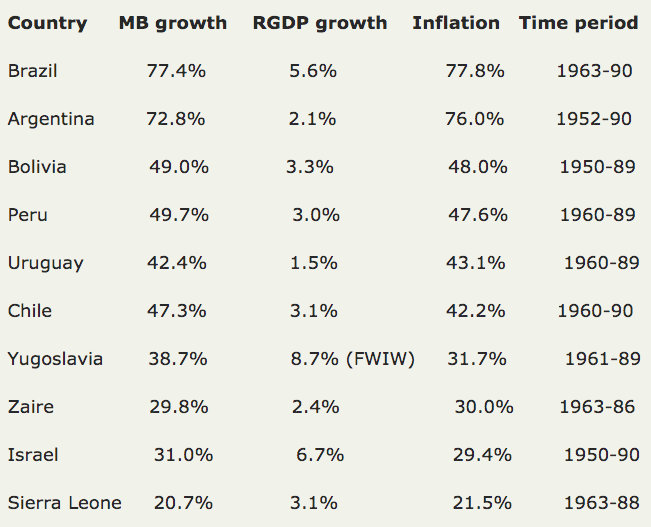

Are the MB/GDP/inflation numbers you posted for Brazil, Argentina, etc cumulative for the time period listed, or are they annual figures?

What do you expect the long run impacts on GDP growth (and potentially inequality, if you have an opinion) of the Biden administration’s spend plans — stimulus bill and potentially infrastructure?

Thanks!

2. March 2021 at 14:57

SS: “Ray, Sorry, but it didn’t work. I wrote the post yesterday afternoon, as someone else sent it to me in the morning. By the time you emailed me last night recommending that I respond to Kling, I had already written the post.” – well, doxxing noted (leaking to the public my private emails to the Great Man) and also no sense of humor by our host, otherwise, point taken.

3. March 2021 at 11:45

Travis, No, I think I’ve always argued that the medium of account was key.

Christian, “Sounds more convinced” is not exactly a persuasive argument. There are madmen in lunatic asylums that sound very convinced.

Trying, Annual averages. I doubt Biden’s stimulus will have much effect. And why not call it Trump stimulus? Most of the stimulus was done under Trump.

Ray, Wait, are you saying you didn’t encourage me to respond to Kling? And lighten up, I was just joking.

3. March 2021 at 12:13

“Pioneer Of Inflation Targeting Adds Asset Prices To Its Framework, While The Fed Adds More Fuel”

Guess what we will have to fall back on to hit targets? One of Sumner’s longest-standing favorite metrics.

6. March 2021 at 07:23

I complained too early. As long as FRED still publishes demand deposits and or currency, there won’t be a forecasting problem.

Currency follows the trend in demand deposits. It exhibits the same distributed lag effects.

But people are stupid. This is déjà Vu. Don’t you recognize the recurring pattern? As interest rates rise, savings flow into time deposits thereby destroying money velocity. In a twinkling, the economy sufffers.