Random articles

1. The left is beginning to understand that NIMBYs are the biggest enemy of the working class:

When there is not enough housing supply to go around, richer people will bid up the price of the housing units that exist, and poorer people will be forced to crowd into the shittier, less desirable housing units at the bottom. The only winners in this situation are the landlords (and existing homeowners) who own the existing housing supply, who are free to continue raising their prices, because the housing shortage means that people don’t have other choices. That includes major investment firms like Blackstone, who are happy to explain to their investors that the shortage of housing supply is what makes housing such a good investment. Right there in the Blackstone pitch deck, it says: “Chronic housing shortage exacerbated by recent supply declines support the pricing power of BREIT’s existing rental housing assets.” Everyone who inveighs against new housing construction because it might help out greedy developers is, in fact, playing into the hands of landlords and investment funds, who are happy to see the population suffer under a housing shortage because that shortage protects their pricing power. Congrats.

2. I frequently complain about the way America increasingly bullies the rest of the world (both enemies and allies.). Thus I was glad to see Tyler Cowen link to a new book by Henry Farrell and Abraham Newman entitled Underground Empire: How America Weaponized the World Economy. Amazon describes it as follows:

A deeply researched investigation that reveals how the United States is like a spider at the heart of an international web of surveillance and control, which it weaves in the form of globe-spanning networks such as fiber optic cables and obscure payment systems

America’s security state first started to weaponize these channels after 9/11, when they seemed like necessities to combat terrorism—but now they’re a matter of course. Multinational companies like AT&T and Citicorp build hubs, which they use to make money, but which the government can also deploy as choke points. Today’s headlines about trade wars, sanctions, and technology disputes are merely tremors hinting at far greater seismic shifts beneath the surface.

Slowly but surely, Washington has turned the most vital pathways of the world economy into tools of domination over foreign businesses and countries, whether they are rivals or allies, allowing the U.S. to maintain global supremacy. In the process, we have sleepwalked into a new struggle for empire. Using true stories, field-defining findings, and original reporting, Henry Farrell and Abraham Newman show how the most ordinary aspects of the post–Cold War economy have become realms of subterfuge and coercion, and what we must do to ensure that this new arms race doesn’t spiral out of control.

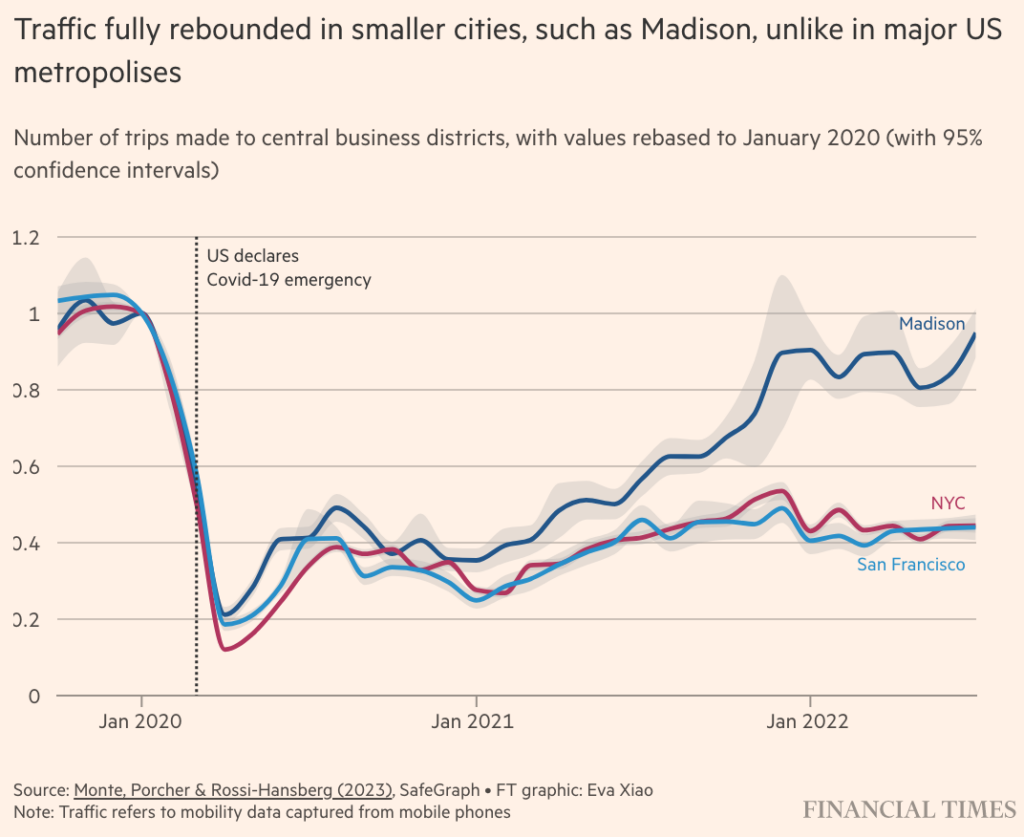

3. The Financial Times has an article explaining how smaller cities are outpacing large cities in the post-Covid period. They focus on my hometown. When I visited Madison during June of this year, I saw a flurry of new apartment construction.

4. This is the issue on which lab leakers should focus.

5. A study by Dhaval M. Dave, Yang Lian, Caterina Muratori, & Joseph J. Sabia found no evidence that pot legalization negatively impacts labor force participation:

Our study is the first to comprehensively explore the impact of recreational marijuana legalization on labor market outcomes of working‐age individuals (aged 16–64). First, using data from the 2002–2020 National Survey on Drug Use and Health, we documented that RML adoption is associated with a 2–4 percentage point increase in adult marijuana use. We also found that the largest increase in marijuana consumption occurs a year after RML adoption.

Next, using monthly data from the Current Population Survey outgoing rotation groups, we found little evidence that RML adoption has an impact on the probability of employment or on wages of all working‐age individuals. We also examined the effects of RMLs where recreational sales were allowed (i.e., at dispensaries) and for various working‐age populations by age, gender, race/ethnicity, and education and found little evidence of adverse labor market effects.

6. How do people become drug addicts? Here’s a typical case:

Joseph was a bright kid and four-season athlete who dreamed of a professional sports career.

He was studying physics and playing soccer at the University of South Florida when he sustained an injury on the field and was given opioid painkillers. Once his prescription ran out, he began buying pain pills on the street. That turned into buying heroin.

He came to Los Angeles for a rehab program about a decade ago and was in and out of treatment for most of his early 20s. Now at 32, he has been homeless for six years and has been addicted to fentanyl for the last four, he says.

Update: To be clear, I’m not blaming the addiction to fentanyl on Oxycontin, I’m blaming it on a lack of Oxycontin.

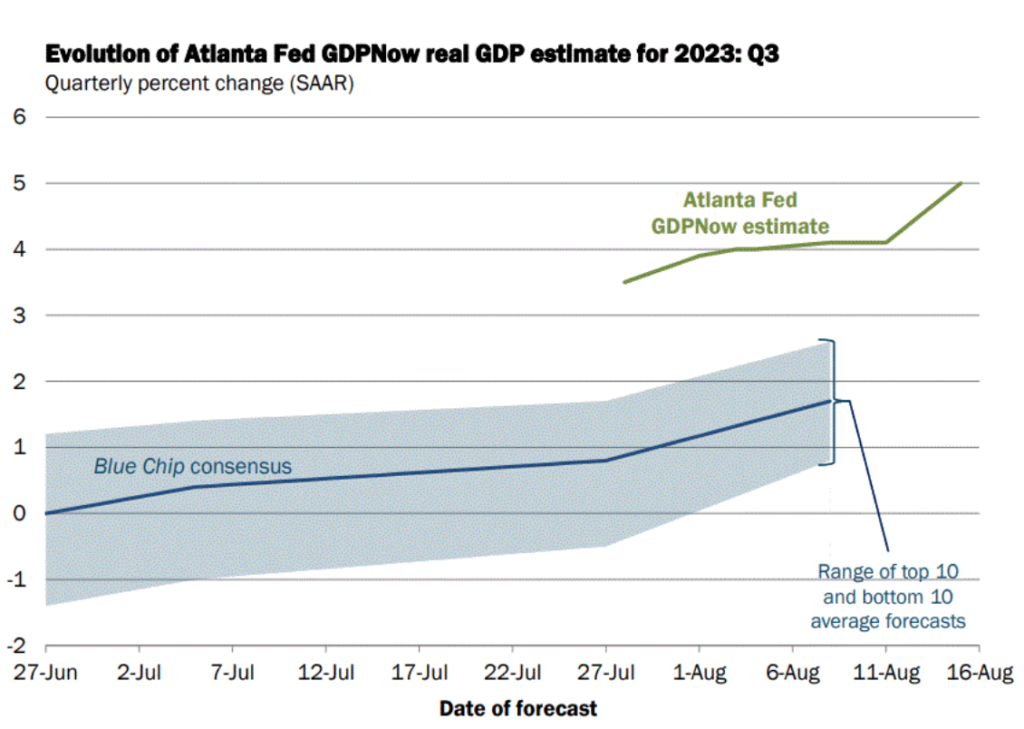

7. It looks like AI could already be leading to double digit GDP growth . . .

. . . in Anguilla:

A tiny island in the Caribbean is now sitting on a digital treasure.

Anguilla, a tropical British territory, is known for its coral reefs and white sand beaches. Since the 1990s, however, it’s also been in charge of assigning internet addresses that end in .ai to residents and businesses looking to register websites. . . .

The total number of registrations of sites ending with these two letters has effectively doubled in the past year to 287,432, according to Vince Cate, who for decades has managed the .ai domain for Anguilla. Cate estimates Anguilla will bring in as much as $30 million in domain-registration fees for 2023.

That’s roughly 10% of Anguilla’s GDP.