The next 12 weeks

I believe that the next 12 weeks will be critical for the Fed’s anti-inflation program. During that period, we’ll get three more jobs reports and the 3rd quarter NGDP report. Hopefully, we’ll see a bit further progress on wage inflation, which is the only sort of inflation that actually matters for macroeconomic stability. And I hope that NGDP growth continues its recent downward trend (to 4.7% in Q2).

But that’s not what I expect to happen. I expect that NGDP will accelerate in Q3, perhaps to 7% or 8%. That would be bad! And I expect 12-month nominal wage growth (average hourly earnings) to accelerate above the current 4.4% figure. I hope I’m wrong, but I fear that the Fed still hasn’t actually achieved a contractionary monetary policy stance.

When will the tight money end? Perhaps the real question is, “When will the tight money begin?”

Come back in November, and you guys can all laugh at me if I’m wrong. Maybe we’ll be in recession. Heck, Bloomberg says there’s a 100% chance of recession by then.

PS. I see the media talking about how CPI inflation has fallen from 9% to 3.2%. I hope my readers are smart enough to ignore those sorts of meaningless data points.

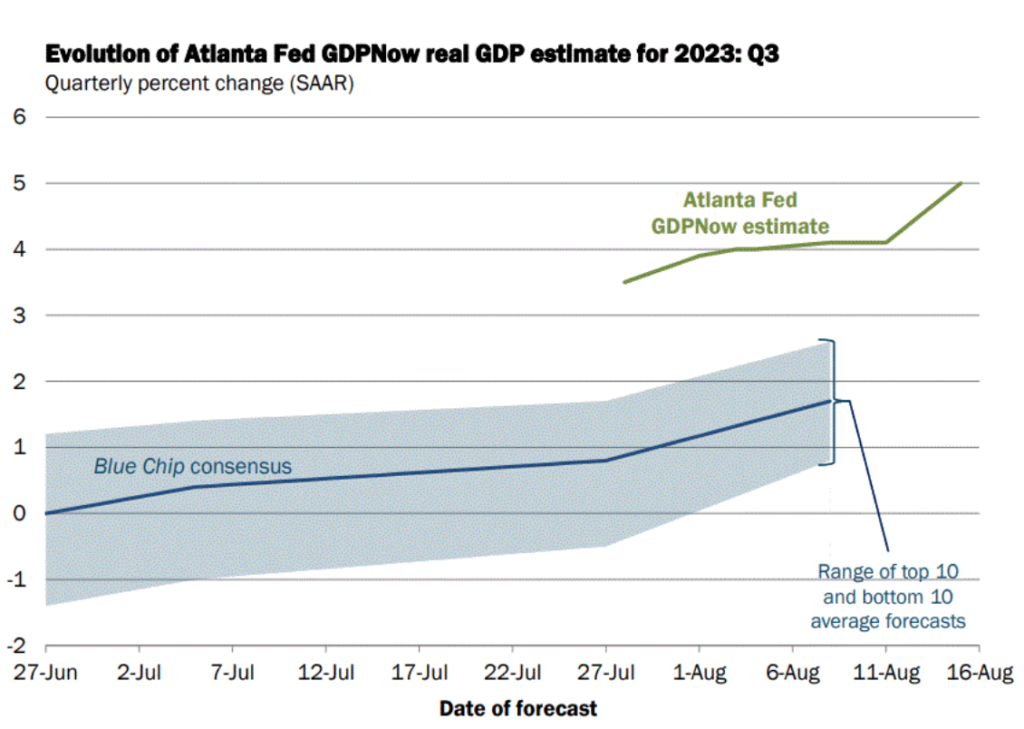

PPS. Here’s the Atlanta Fed’s current forecast for Q3 real GDP. Currently, they predict 5% RGDP growth. To get nominal GDP growth (which is what the Fed should care about), you need to add inflation.

Tags:

15. August 2023 at 15:30

Curious as to why do you think NGDP will accelerate from here? GDP growth (both nominal and real), inflation, job growth have all been slowing over the past year. Yield curve is still significantly inverted. Monetary policy is now expansionary? What should the Fed do from here?

15. August 2023 at 16:00

Atlanta GDPNow is well above where private forecasters are at the moment. To get that number would require the monthly numbers to continue to come out strongly, which I suppose the private forecasters are implicitly assuming won’t happen. Will be interesting nonetheless.

15. August 2023 at 16:00

I am not laughing at anybody.

But inflation at 3% or 2%—-perhaps not that important.

The Reserve Bank of Australia has a 2% to 3% inflation target.

My take is that tight job markets are very salubrious for social fabric.

Also, the US, Canada and Australia need aggressive housebuilding programs. Singapore style?

15. August 2023 at 16:36

John, Interestingly, in Q2 the private forecasters were too low and the Atlanta Fed was exactly correct.

16. August 2023 at 01:59

The radical left gangster known as Scott Sumner was wrong again.

Remember when he told us that SFO crime was a republican conspiracy theory?

Here is a heartbreaking, open letter, from one of the oldest stores in the city:

https://twitter.com/greenbergnation/status/1690784075320287232

16. August 2023 at 06:26

Banks don’t lend deposits. Money demand changes with a change in the composition of the money stock. This reverses the cause of secular stagnation, a deceleration in the transactions’ velocity of funds.

As Shadowstats puts it:

“The Federal Reserve Overhauled Its Money Supply Reporting, Redefining Traditional M1 from 34.8% to 93.4% of a Not-Redefined Total M2 • This Masked Accelerating Flight-to-Liquidity in Traditional M1 from Non-M1 Components of M2 • ShadowStats Defined “Basic M1″ — Combined Currency and Demand Deposits — Still Reflects the Extraordinary Liquidity Flight to, and Surge in the Narrower Money Supply”

The “narrower Money Supply” is our means-of-payment money.

16. August 2023 at 06:38

Scott,

If CPI goes to 2.5 (private forecasts and TIPS suggesting this), with NGDP around 6 is money still too tight?

16. August 2023 at 07:10

The activation of bank-held savings, the movement of money from the banks and channeled THROUGH the nonbanks, increases money velocity.

This is reflected in the surge in money market funds:

https://fred.stlouisfed.org/series/MMMFFAQ027S

16. August 2023 at 07:44

I had been hoping you would post something like this, and I agree with you on the timing. I think there’s a 30% chance that NGDP will rise in Q4. In general, I stand by a prediction I made a few months ago on this illustrious blog that we would end the year with NGDP growth at less than 6%. I’m probably lying about that prediction and I’m too lazy to track it down.

Since the general public perceives inflation almost entirely through the price of gas the recent uptick in that area will be a source of hysteria, no matter what happens with the official statistics. I’m not sure higher gas prices will dampen other discretionary spending. Energy prices are really low, and probably heading lower what with all these red states ruining the landscape with solar and wind projects.

More significantly, if more multifamily housing comes on the market we’ll have a brake on shelter inflation. Not here in Boston, though, our policies and regulations still suck. I bet your old house in Newton has doubled in price since you left for sunny California.

16. August 2023 at 08:02

I thought after the initial GDPNow number for 3rdQ, that it would steadily track down, but it just rose to 5.8%. That’s very high

16. August 2023 at 09:42

[QUOTE=sumner]I see the media talking about how CPI inflation has fallen from 9% to 3.2%. I hope my readers are smart enough to ignore those sorts of meaningless data points.[/QUOTE]

I guess I’m not. I know Scott focuses on NGDP, but what does he mean here?

16. August 2023 at 11:06

The transfer of funds to MMMFs reminds me of the “time bomb” in the 1st qtr. of 1981.

16. August 2023 at 17:13

Edward, You said:

“Remember when he told us that SFO crime was a republican conspiracy theory?”

When a group of commenters repeatedly lies about what I said, it doesn’t give independent observers much confidence in their ideology, does it? That’s why I don’t ban you and Sara and Ricardo—I want others to see what sort of person you are.

https://www.themoneyillusion.com/poop-phobic-conservatives/

TF, NGDP growth needs to get down to about 4%, unless there’s a productivity miracle that I do not anticipate. Otherwise money’s too easy.

David, Our Orange County house was actually cheaper than our Newton house, but is now worth much more.

18. August 2023 at 15:58

Chris, I have many posts arguing that inflation is not an important macroeconomic variable, at least in terms of public policy. We are forced to pay attention to it because the Fed targets PCE inflation. But the CPI over the past year is not a good indicator of where inflation will be going forward. Wage inflation is a far better indicator.

8. December 2023 at 14:03

Would love to see a follow-up to this, maybe when there’s Q4 data to assess.