This is your economy on fentanyl

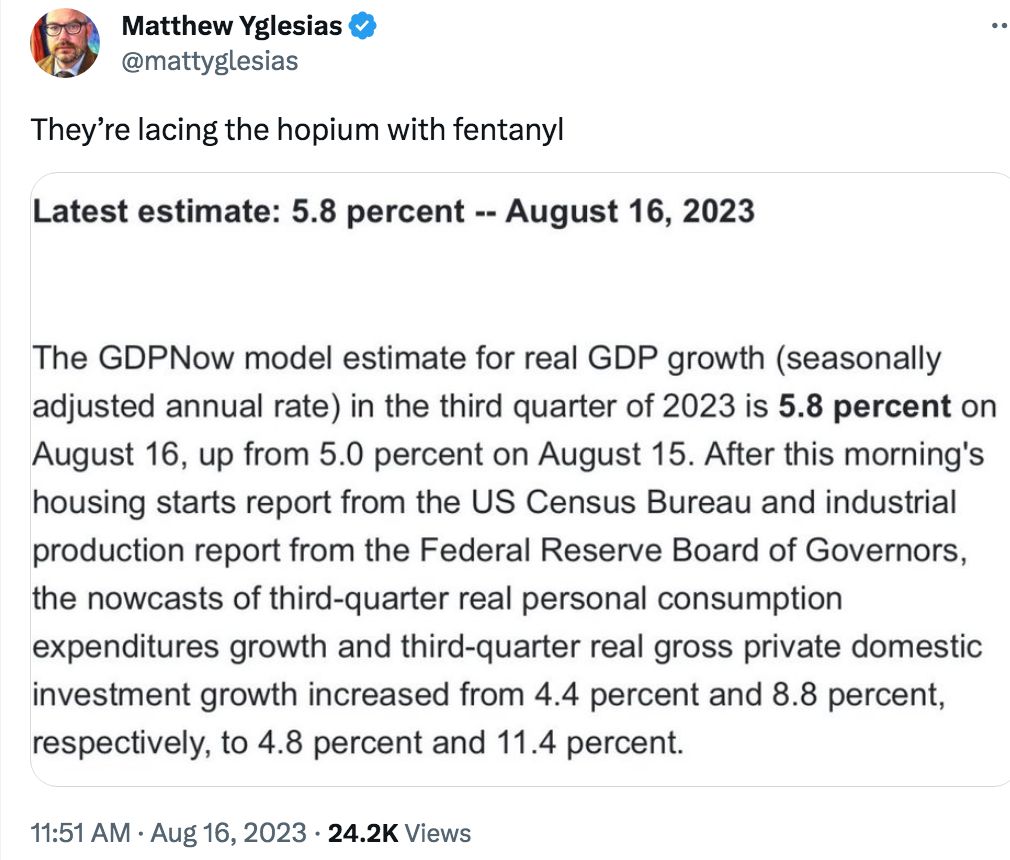

Another day, another upward revision over at the Atlanta Fed’s GDPNow:

Matt Yglesias is correct, this is good for the US economy in much the same way that fentanyl is good for one’s well-being. I’ve never taken that particular drug, but I imagine that it makes one feel good—for a while.

[Yeah, I know, Yglesias meant something else. 😉 ]

So what’s wrong with 5.8% RGDP growth? Nothing, as long as NGDP growth is below 5%. But let’s be real; if RGDP comes in at 5.8%, then NGDP growth (which is what matters) will be 8% or 9%. And that would increase the risk of recession in 2024.

On the other hand, Bloomberg says there’s a 100% chance of recession by October, so perhaps the Atlanta Fed is wrong.

When RGDP came in negative during the first two quarters of 2022, I recall Keynesians suggesting it was the lagged effect of the Fed signaling tighter money in late 2021. Hawkish forward guidance. So this growth (if it happens) would be the lagged effect of exactly what?

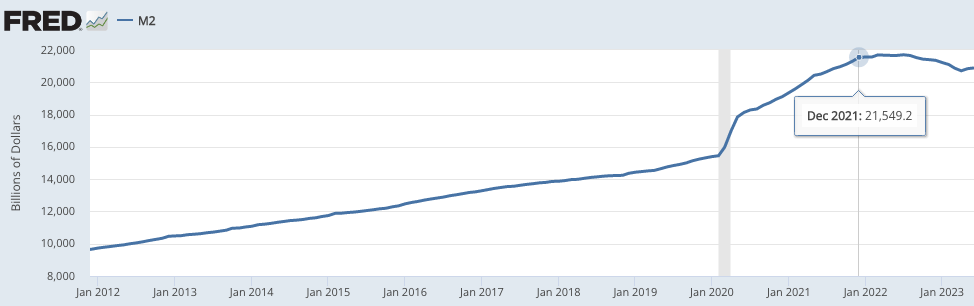

M2 leveled off after December 2021 and began falling after July 2022. Real M2 fell even earlier. So I’m not letting monetarists off the hook.

Even the markets have fallen a bit short.

As I keep saying, there’s not much evidence that the Fed adopted a contractionary policy in 2022.

All good arguments for level targeting.

PS. The case for optimism. And this.

Tags:

16. August 2023 at 11:58

Scott,

Is it possible for there to have been a Covid productivity boom that we are just beginning to see? There was lots of job switching and technology adoption. Tips imply inflation is not an issue. I’m optimistic and am viewing higher real growth as positive not negative.

16. August 2023 at 13:21

Its actually possible to look at what forecast values the atlanta fed is using for services and retail good.

For Q3 they average out to 2.7% for services and -0.2% for goods

16. August 2023 at 15:30

Inflation is coming down. And the economy is growing.

If this is fentanyl, then let’s dope it up to the moon.

16. August 2023 at 15:47

Regarding the “Case for Optimism” links, I’m curious as to what sort of lags we should expect to see in wage series. Union contracts extend for years, some other mechanisms are annual.

16. August 2023 at 17:49

TF, Yes, but it would be merely a few tenths of one percent. These sorts of NGDP numbers would likely represent overheating.

A better argument for why TIPS are well behaved is that it would be just a one quarter blip for NGDP, and that subsequent quarters would resume the downward trend.

17. August 2023 at 04:43

Yeah, N-gDp is too high.

“There is considerable uncertainty in the outlook, but we estimate that these excess savings are likely to be depleted during the third quarter of 2023.”

– Update by the San Francisco Federal Reserve Bank

The transfer of funds from bank CDs to MMMFs increases the supply of loan funds, but not the supply of money – a velocity relationship. It acts like the “time bomb” in the 1st qtr. of 1981 (with the widespread introduction of NOW accounts).

17. August 2023 at 04:49

That’s what the 1966 Interest Rate Adjustment Act is all about:

“A number of participants noted that balance-sheet runoff need not end when the committee eventually begins to reduce the target range for the federal funds rate,” according to minutes of the US central bank’s July 25-26 policy meeting published Wednesday in Washington.

The approach — which some policymakers including Chair Jerome Powell have mentioned — could present communication challenges for the US central bank. That’s because reducing bond holdings — a process known as quantitative tightening, or QT — is usually interpreted as strategy for tightening monetary policy. Interest-rate cuts, however, work in the opposite direction, easing policy by lowering borrowing costs.”

Interest is the price of credit. The price of money is the reciprocal of the price level. Lowering the award rate on O/N RRPs will help fund the tsunami of Treasury issuance.

17. August 2023 at 06:53

Scott, any reactions to a libertarian winning the Argentine primaries?

https://www.economist.com/the-americas/2023/08/14/argentina-could-get-its-first-libertarian-president

17. August 2023 at 08:52

I did a post at Econlog

17. August 2023 at 23:02

SS: “So what’s wrong with 5.8% RGDP growth? Nothing, as long as NGDP growth is below 5% [??? WHY-RL]. But let’s be real; if RGDP comes in at 5.8%, then NGDP growth (which is what matters) will be 8% or 9%. And that would increase the risk of recession in 2024.[??? WHY-RL]”

What? Nothing in the above post makes sense. NGDP = RGDP + inflation, an accounting identity. But inflation is more or less unrelated to RGDP, unless you believe in the discredited Phillips Curve, which has been discredited since the 1970s. Yet, strangely, our host somehow believes in some version of reality where high inflation causes recession?? Scott, do yourself a favor and look at real GDP vs inflation in Brazil post WWII. Hint: they are largely uncorrelated. You can have high RGDP and high inflation.

18. August 2023 at 06:02

re: “Hint: they are largely uncorrelated.”

That’s wrong. They are highly correlated. That’s exactly why N-gDp targeting works in the longer term. That’s why you maintain the N-gDp path.

Money flowing through the nonbanks never leaves the payment’s system. There’s just an increase in the supply of loan funds but no increase in the supply of money, a velocity relationship.

That’s what has happened, a demand shock, an anomaly. Link:

https://www.zerohedge.com/markets/banks-usage-emergency-fed-funds-hits-new-record-high

Source: Bloomberg

“The decoupling between money-market fund inflows and bank deposits continues…”

That’s a shock that N-gDp targeting will dampen.

18. August 2023 at 06:42

Any injection of new money can be robust, neutral, or harmful. It all depends upon the distributed lag effect of monetary flows, volume times transaction’s velocity. And the distributed lag effect(s) of money flows have been mathematical constants for > 100 years.

https://www.bankofengland.co.uk/-/media/boe/files/external-mpc-discussion-paper/2001/the-lag-from-monetary-policy-actions-to-inflation-friedman-revisited.pdf?la=en&hash=FB372D3F424040044E65C1516CB4AC56B93E246E

The “time bomb” of the 1st qtr. in 1981 is a good example. The widespread introduction of NOW accounts vastly accelerated the transaction’s velocity of money (something Divisia Aggregates missed). The G.6 Debit and Deposit Turnover release reflected this.

N-gDp hit 1981-01-01 19.9% The gDp deflator hit 1981-01-01 11.0%

19. August 2023 at 04:54

Inflation and R-gDp are inextricably linked. Short-term money flows are a subset of long-term money flows. N-gDp targeting reduces the degree of oscillation.

19. August 2023 at 11:31

@spencer – I see you drank the Kool-Aid. Explain Brazil then: high inflation, high growth after WWII (hint: demographics). Thanks for the reply though. And for any math purists: NGDP = RGDP (1 + inflation rate), expand this, the second term I called “inflation”

19. August 2023 at 14:41

The numbers are not accurate.

Look at the inner cities. Look at the hallowed out middle class in rural areas like Appalachia.

It reminds me of the Soviet Union. The homeless can’t find jobs, but somehow there is 5% growth. It doesn’t add up.

19. August 2023 at 18:11

If the gap between NGDP growth and the S&P 500 earnings yield means anything, economic growth is too high, assuming Q2 earnings estimates are close enough to imputed values.

20. August 2023 at 05:51

@Ray Lopez

R-gDp is a construct of inflation. In fact, it is 42% of it.

20. August 2023 at 07:45

A bit off-topic, but The Boston Globe ran a piece on the Jones Act today. The author indulged in a bit more “both-sideism” than I would have liked, but it’s encouraging that this crappy law is getting a bit more exposure.

I’m sure that a principled Republican candidate can run against the idiotic protectionism of the Jones Act and sweep into office.

20. August 2023 at 08:08

David, I just want them to stop claiming they plan to invade Mexico. It reminds me of that comedy routine where the two Nazi soldiers ask each other if it’s possible that they are the bad guys.

21. August 2023 at 01:49

OT, but SS knows a lot about China and monetary policy—

The PBOC just marginally cut rates, in a nation with a flagging property sector, and low inflation (some deflation).

What gives? Has the PBOC gone Western? Has central banker-itis?

I don’t know. I’m asking.

21. August 2023 at 06:01

Isn’t a lot of this just bidenomics? It seems like fiscal policy which has been running 2-3% higher has been the big boost.

It just seems to me rates or fed actions aren’t as powerful with so much fiscal policy. And doing monetary offset is really hard right now.

Also with the Fed being a huge net debtor (and mortgages being slow to reset) means that rates are translating to higher income.

21. August 2023 at 16:06

Sean, You said:

“And doing monetary offset is really hard right now.”

What makes you say that? I see zero evidence that monetary policy is ineffective. What would the evidence look like?

Wall Street is obsessed with every tiny indication the Fed might move this way or that.

Don’t forget, INTEREST RATES ARE NOT MONETARY POLICY. Rates are high because NGDP growth is high.

22. August 2023 at 08:46

re: “Rates are high because NGDP growth is high”

That’s right. But then you have to ask why N-gDp is high? The 39-year-old bull market in bonds occurred because the composition of the money stock changed. Velocity fell. Since C-19, it has partially reversed. Velocity has risen.

22. August 2023 at 21:37

Tyler Cowen just dropped this bombshell. What macro delusion is our host under? – RL

Macro illusions — which ones are you suffering under? by Tyler Cowen August 23, 2023 Monetarist ideas start fading as early as 1982, when money supply control techniques did not work out so wonderfully. Litterman and Weiss (1983) raised doubts about whether money matters at all.

23. August 2023 at 04:51

Tyler’s ignorant. So are nearly all economists.

The “time bomb” of the 1st qtr. in 1981 is a good example. The widespread introduction of NOW accounts vastly accelerated the transaction’s velocity of money (something Divisia Aggregates missed). The G.6 Debit and Deposit Turnover release reflected this.

N-gDp hit 1981-01-01 19.9% The gDp deflator hit 1981-01-01 11.0%

AAA Corporates hit 15.49% in 1981. My prediction for AAA corporate yields for 1981 was 15.48%. You can verify that with Jim Sinclair, whose dad founded the OTC stock market.

In regulating the money supply the monetary authorities using monetarist guidelines will be cognizant of the volume and rate of change of monetary flows, i.e., the volume of money times its (transactions) rate of turnover, (MVt).

It should be quite obvious that the extent of money’s impact on prices and the economy is measured by monetary flows, not the stock of money. If the transactions velocity of money were a constant it would not matter, but money turnover has varied from an annual rate of 13 in 1945 to over an all-time annual high of 525 in Oct. 1996.

Link: The G.6 Debit and Demand Deposit Turnover Release

https://fraser.stlouisfed.org/files/docs/releases/g6comm/g6_19961023.pdf

23. August 2023 at 05:17

“Over recent decades, however, the relationships between various measures of the money supply and variables such as GDP growth and inflation in the United States have been quite unstable. As a result, the importance of the money supply as a guide for the conduct of monetary policy in the United States has diminished over time.”

https://www.federalreserve.gov/faqs/money_12845.htm

Dr. Richard G. Anderson: “Although the evidence is mixed, the MSI (monetary services index), overall suggest that monetary policy *WAS ACCOMMODATIVE* before the financial crisis when judged in terms of liquidity”

The transaction’s velocity of money seized up in the 4th qtr. of 2008.

The transactions’ velocity of money can move in exactly the opposite direction as income velocity. Vi is a “residual calculation – not a real physical observable and measurable statistic.” Income velocity may be a “fudge factor,” but the transactions velocity of circulation is a tangible figure.

I.e., income velocity, Vi, is endogenously derived and therefore contrived (N-gDp divided by M) whereas Vt, the transactions’ velocity of circulation, is an “independent” exogenous force acting on prices.

23. August 2023 at 05:38

Contrary to Dr. George Selgin, all monetary savings originate within the payment’s system. There is just a shift between transaction’s deposits and gated deposits.

There is a one-for-one correspondence between demand and time deposits (as loans = deposits). As time deposits are grow, transaction’s deposits are depleted (currency notwithstanding).

See the shift:

https://fred.stlouisfed.org/series/LTDACBM027NBOG

As Dr. Philip George puts it: “Changes in velocity have nothing to do with the speed at which money moves from hand to hand but are entirely the result of movements between demand deposits and other kinds of deposits”.

23. August 2023 at 07:44

Money numbers fell into contraction in May. The only thing floating the economy is the increase in the transaction’s velocity of funds.

24. August 2023 at 13:41

The FED can lower its administered rates, but it must hold the money stock constant for another 8 months (continue with QT).

Velocity, as Dr. Philip George defines it (debits to deposit accounts), is accelerating:

https://fred.stlouisfed.org/series/WRMFNS

25. August 2023 at 06:37

Bernanke held the “means-of-payment” money supply constant for 4 years. Powell just needs to hold DDs constant for 2 years.

The FED can lower the O/N RRP award rate at the same time it continues with QT.

https://research.stlouisfed.org/publications/economic-synopses/2023/08/23/the-mechanics-of-fed-balance-sheet-normalization

28. August 2023 at 03:40

re: “raised doubts about whether money matters at all”

Monies impact on the economy will be quite evident in 2024 when the 2-year rate-of-change in the distributed lag effect of money flows takes effect.

To quote economist John Gurley, “Money is a veil, but when the veil flutters, real-output sputters.”

28. August 2023 at 16:59

Wasn’t claiming monetary policy was ineffective but the amount of tightening needing to offsetting fiscal policy seems like a lot right now. Yes ngdp is high right now but I never imagined we could be this high after last decade. I think tightening fiscal policy would get rid of the excess growth easier.

30. August 2023 at 10:57

Sean, Sure by the Fed doesn’t control fiscal. They have to adapt monetary policy to the reality of the fiscal stance.

30. August 2023 at 16:33

Scott,

Knowing absolutely nothing, the most likely explanation imo seems to be that the GDPNow model is just entirely wrong. We’ll get some more information tomorrow with the PCE release, and I’m betting (not literally) neither core nor headline will be > 2.5%. If I’m right, the chances of NGDP coming in at 8-9% seems incredibly low, and with it the odds of RGDP growth of 5.8%.