Keynesians, NeoFisherians, and Market Monetarists

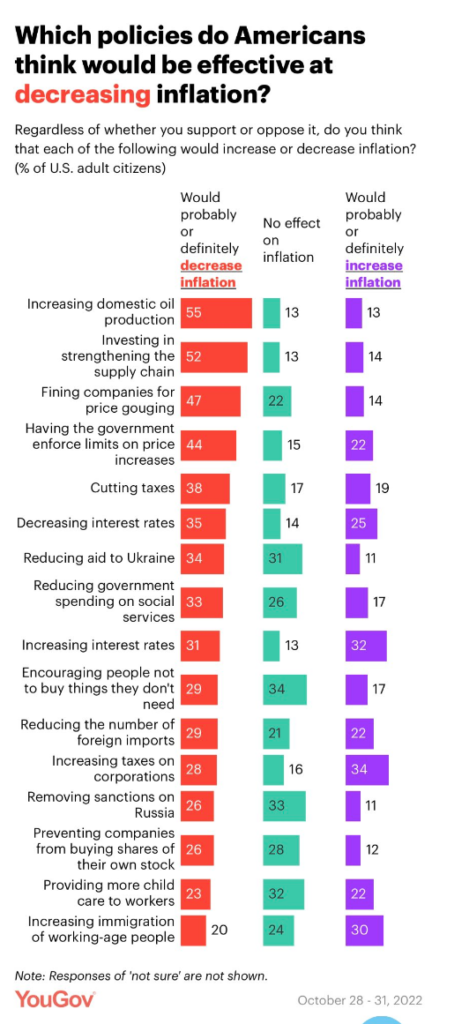

Matt Yglesias directed me to this survey:

Oddly (but not surprising to me), the questions asking about the effects of increasing and decreasing interest rates do not produce symmetrical answers.

Based on these responses, it seems as though roughly 3 in 10 Americans hold Keynesian views on monetary policy, a slightly larger number hold NeoFisherian views, and about one in 7 hold market monetarist views (interest rates don’t have any consistent impact on inflation.)

I wonder how economists would answer this survey question?

PS. Bonus election forecast: I predict a bad outcome when the votes are finally counted next month. My reasoning process is as follows. The US has become a banana republic (as even Trump now admits, and I’ve been saying for almost 7 years). Banana republics do not have good political outcomes. Hence the US will have a bad outcome.

PPS. Bonus global forecast: Authoritarian nationalism is on the rise almost everywhere. Thus (as in 1914-45), the world faces a bleak future.

Tags:

8. November 2022 at 10:34

Depressing survey.

8. November 2022 at 11:41

“I predict a bad outcome when the votes are finally counted next month.”

I agree because both parties have adopted bad platforms. No matter who wins, they will try to make those bad platforms into bad laws. But, I guess this what Americans want – if they didn’t, then the political parties wouldn’t have the platforms they do. It’s sad that the public doesn’t hold views that would allow a modern version of the 19th Century British Liberal Party doesn’t exist. Oh well.

“Authoritarian nationalism is on the rise almost everywhere. Thus (as in 1914-45), the world faces a bleak future.”

Yes, though perhaps not as bleak of a future as it faced in 1914. The ultimate disaster that could happen to the world would be a another great power war similar to WWI and WWII. But I think the chance of such a war is lower than the early 20th Century.

It’s true that there are major powers that are willing to overturn the status quo by force (Russia being the obvious example). And yes, the war in the Ukraine has elevated the chance of war between Russia and NATO

However, the United States is still, and likely to remain for the foreseeable future, the global military hegemon. No rational leader of any other major nation could hope to fight a war against the United States and not be destroyed in the process. No combination of major powers appears likely to combine against the US. Moreover, the US has a large number of other great powers allied to it. With no hope for victory, I can’t see any major power deciding to start a war that would bring direct US intervention. So, I agree with you Scott that authoritarian nationalism is on the rise, but I think the chances that we avoid global war is much higher than the first half of the 20th Century and therefore our future is not as bleak as it was to those living then.

8. November 2022 at 11:42

I’ll use my 2nd comment to correct the first. I meant to write:

“It’s sad that the public doesn’t hold views that would allow a modern version of the 19th Century British Liberal Party to exist.”

8. November 2022 at 13:00

“Bonus global forecast: Authoritarian nationalism is on the rise almost everywhere. Thus (as in 1914-45), the world faces a bleak future.”

This is like the King of England telling the colonists they were “authoritarian nationalists” because they rejected the King’s centralized policies.

Most people don’t like your world view Sumner. And rejecting your policies doesn’t make them “authoritarian.” Your policies are just BAD policies. People have been telling you this since the 90’s; you just don’t listen.

And if you keep calling people Nazi’s, and you keep creating uncessary division because you cannot stand the fact that some people oppose your centralized policies, or because they gravitate towards Trump or Desantis or Cruz’s policies over yours, then it may lead to something really bad: like a civil war, because if you cannot accept the will of the people at the ballot box, like in 2016 when you ranted and raved on your blog, and blamed Russia and Trump collusion and Nazi’s and corruption, and yelled and screamed at those damn conservatives because they are horrible people, and other fictious actors, then this country might be better off separating; because if you cannot accept the core tenants of classical liberalism, then we have a problem.

When Bolsonaro gets voted into office because the people of Brazil are tired of American MNC’s and their thuggish economic zones which ripup and destroy their downtowns and farms; and when these people reject other subsidies which enrich politicians and their favored industries at the expense of mom and pops, all under the banner of “neo-liberalism” which is really just old-fashioned fuedalism, then people will fight it, because it doesn’t make their lives better; it makes their lives worse!

And I, for one, stand with the people.

8. November 2022 at 15:36

Very depressing survey. I’d guess many of the policies labeled as decreasing inflation are policies people think would decrease their immediate personal costs, without any regard for effect on the macro economy or any secondary effects. For example, decreasing interest rates decreases your costs if you’re a borrower and decreasing taxes decreases your costs if you’re a taxpayer. How can limiting imports possibly decrease inflation?

8. November 2022 at 18:06

I have a very bad feeling in the pit of my stomach. Hopefully, history will rhyme more than it repeats with this global rise in fascism. It’s very disturbing how much better the fascists market their lies and poor results than their opponents do the truth and their superior, though often vastly suboptimal results.

8. November 2022 at 23:57

You essentially have the inner city nobles, who take orders from the supranational philosopher kings and queens, then you have the suburban people which are your busybodies who fill a menial but somewhat needed rol – at least for now – and out in the rural area are the regressive, horrible, no-good-rotten conservative supremacists, and religious loving peasants that need to OBEY OR ELSE.

That is the democrat’s feudalist platform over the last three decades. =/

9. November 2022 at 05:34

Example. Bernanke contends: “a flawed and over-simplified monetarist doctrine that posits a direct relationship between the money supply and prices”.

See the Nattering Naybobs’ “Elephant Tracks”.

Some people think Feb 27, 2007 started across the ocean. “On Feb. 28, Bernanke told the House Budget Committee he could see no single factor that caused the market’s pullback a day earlier”.

In fact, it was home grown. It was the seventh biggest one-day point drop ever for the Dow. On a percentage basis, the Dow lost about 3.3 percent – its biggest one-day percentage loss since March 2003.

It reflected an historical drop in legal reserves.

ME -flow5 (2/26/07; 14:34:35MT – usagold.com msg#: 152672)

Suckers Rally. If gold doesn’t fall, then there’s a new paradigm

And we know that Bernanke dismissed monetarism’s connection. As Dr. Richard G. Anderson (the world’s leading guru on bank reserves) wrote me:

“Spencer, this is an interesting idea. Since no one in the Fed tracks reserves…”

Bernanke contracted legal reserves for 29 contiguous months which directly caused the GFC.

9. November 2022 at 06:03

While not all results are in yet, I’m rather relieved to see that it appears Republicans have greatly underperformed by midterm standards. There are more data points here that suggest that support for Trump and Trumpism is slowly waning. Trump is not one who adds to his base. His craziness only slowly subtracts.

That said, we shouldn’t celebrate too much, as the “candidate quality” for Republicans this year was also unusually low, even for them.

9. November 2022 at 07:58

“the world faces a bleak future”

Tyler Cowen would ask, and I ask sincerely, not trolling: Are you short the market?

9. November 2022 at 09:25

Todd, No, and shorting the market is not a rational way for me to respond to my political views—I believe in the EMH.

11. November 2022 at 09:21

Hi, can someone explain his view that interest rates don’t affect inflation? Does he mean long term?

How is this logic wrong: Increasing interest rates will cause borrowing from the future to be more expensive. This leads to less present spending which reduces prices.

Thanks in advance (maybe links to other posts where he explains?)

11. November 2022 at 10:08

Alvaro, That’s “reasoning from a price change”. Perhaps this post will help:

https://www.themoneyillusion.com/monetary-policy-isnt-what-you-think-it-is/

12. November 2022 at 07:03

Hi Scott, thanks for the link. Your argument is that if the equilibrium interest rate increses by 2% and the FED increases rates by 1%, this is expansive monetary policy although rates are being increased?

Thanks

12. November 2022 at 08:25

Alvaro, Yeah, and it’s not just my view, it’s what the textbooks say. Where I differ from other economists is that I think the mainstream underestimates the extent to which monetary policy moves the natural rate of interest.

12. November 2022 at 08:44

Thanks for the answers, very interesting!