How are those China crash predictions working out for you?

Back in 2010, I did a blog post expressing skepticism about theories that China was in a bubble. I quoted this statement:

Faber joins hedge fund manager Jim Chanos and Harvard University’s Kenneth Rogoff in warning of a crash in China.

China is “on a treadmill to hell” because it’s hooked on property development for driving growth, Chanos said in an interview last month. As much as 60 percent of the country’s gross domestic product relies on construction, he said. Rogoff said in February a debt-fueled bubble in China may trigger a regional recession within a decade.

So how does that prediction look 11 years later? The Economist has a new article on China property. In the print edition, it is titled:

The Great Escape

Long seen as a bubble, China’s housing market now looks stable. Can that hold?

The online addition has a scarier sounding title:

Can China’s long property boom hold?

The country is building five times as many houses as America and Europe combined

(I prefer their print editor.)

Both editions point to past predictions that have not panned out:

As far back as 2009 Jim Chanos, a hedge-fund manager, said China was “Dubai on steroids”, predicting that its property sector would implode spectacularly. Since then prices have doubled, and enough homes have been built for 250m people. The longevity of the boom suggests that the market is more complex than its depictions as a bubble suggest.

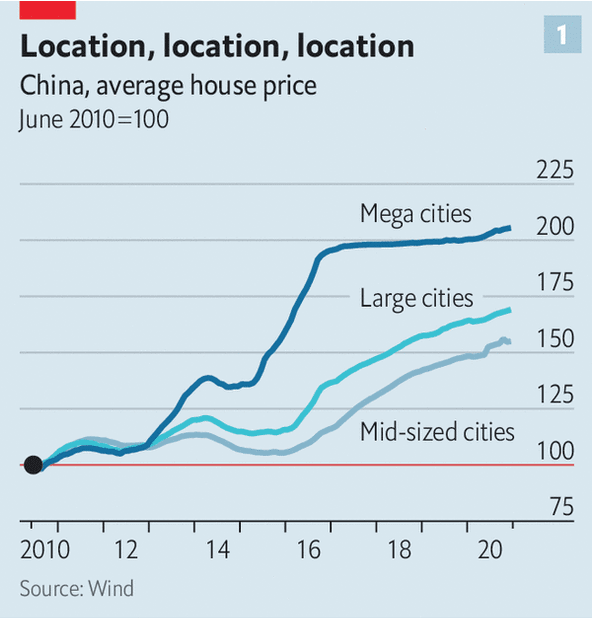

And they provide this useful this graph:

Are you people getting tired of me pointing out, over and over again, how bubble theories are useless? How past bubble predictions for everything from China to Bitcoin to NASDAQ to US real estate are not helpful to investors?

Then stop talking about bubbles.

The beatings will continue until the bubble talk stops.

PS. In a 2016 post I made the following prediction:

If I’d had to guess, I’d estimate that China will have one Korea-1998 type disaster in the next 30 years, but I have no idea when. It will be impossible to predict. That’s because if it could be predicted three years ahead, then the date of the crash would immediately move up by three years!

So don’t hold your breath for a China crash. It will probably happen at some point, but no one will be able to predict it. Nonetheless, you can be sure that Jim Chanos and other China bears will take credit for predicting it, even though they were wrong many times before being right.

P.S. In a 30 year window, I think the second most likely number of 1998-type disasters for China is zero. Two is third most likely.

PPS. In the same issue of The Economist, I saw this claim:

If low real rates are the main prop for share prices, then any attempt to time the stockmarket is in essence a bet on the bond market—and, in turn, on how inflation evolves, and how central banks react to it. Good luck with getting those calls right.

OK, I’ll take the dare. I’ll predict 2% inflation during the 2020s. Wish me luck. If I’m right I’ll remind you all in 2030.

(If I’m still alive. I’m more confident about inflation averaging 1.6% to 2.4% during the 2020s than I am about living to 75.)

Tags:

6. February 2021 at 17:52

How about GameStop and related stocks? I think most bubble stories are nonsense, but I jumped on that one, and I’ve had quite the rate of return. I bought some puts, going out a few months(too pessimistic about my perspective, but wanted to be safe). GameStop and the related stocks are way, way down, and it happened quickly.

I acknowledge this is a different sort of situation than the bubble examples you usually cite, and you can say those of us who bet on this bubble collapsing quickly were lucky, but can you say we were wrong?

6. February 2021 at 22:13

I used to believe in bubbles before I read Refet Gurkaynak: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=658244.

If we can’t measure it, what’s the point?

6. February 2021 at 22:29

Michael, Anyone who makes money was “right” about the direction of price change. Whether bubbles exist is a different question.

David, Exactly.

6. February 2021 at 22:36

“ If I’d had to guess, I’d estimate that China will have one Korea-1998 type disaster in the next 30 years, but I have no idea when. It will be impossible to predict. That’s because if it could be predicted three years ahead, then the date of the crash would immediately move up by three years!”

How is that not a bubble? This seems like a no true Scotsmen type of argument. What are the price to rent ratios for various cities in China? What type of changes to the residential registration system will take place over the coming decades? As China’s population shrinks, will cities still require people to buy property to have access to public hospitals and schools?

I would agree that these types of changes are impossible to predict, but it seems likely that over a period of a few decades these things will change, and with these changes, there will be big changes in the relationship between housing supply and housing demand, which will cause large adjustments in prices and big changes in the industries tied to real estate, like construction, steel, concrete, and finance/insurance.

Calling something a bubble just indicates a trend that seems unlikely to continue, and that when the trend reverses, it has lots of consequences that people are not prepared for.

7. February 2021 at 01:52

Scott,

I’m going to call the recent phenomena exemplified by GameStop a bubble, defining “bubble”, too mean a large, very short-term run-up in the price of a stock that is not based on future fundamentals of the underlying business. Might want to add the term “predictable” as well, concerning the outcome.

Predictions for the end of this bubble were pretty precise. This certainly wasn’t saying “x stock or market is in a bubble that will pop eventually.” and then allowing years for the outcome, in cyclical markets.

7. February 2021 at 03:49

I agree with Michael that the recent surge and decline of the GameStop stock seems like a rare case of an actual bubble, in the sense that the decline really was predictable to many people. I was wondering why more people didn’t short it when it was at its height (if they had, it wouldn’t even have gotten there).

Maybe lots of brokers refused to offer shorts on GME right then? Or maybe all the big hedge funds were too busy cutting their losses, while ordinary investors weren’t used to conducting shorts? I checked with my bank to see if they would let me short American stocks, but apparently I would have to send them some boring documents by snail-mail first, so I immediately lost all interest…

7. February 2021 at 05:23

“If I’m right I’ll remind you all in 2030.”

Assuming industrial civilization has not ‘collapsed’?

“ . . . our best estimate is that the net energy

33:33 per barrel available for the global

33:36 economy was about eight percent

33:38 and that in over the next few years it

33:42 will go down to zero percent

33:44 uh best estimate at the moment is that

33:46 actually the

33:47 per average barrel of sweet crude

33:51 uh we had the zero percent around 2022

33:56 but there are ways and means of

33:58 extending that so to be on the safe side

34:00 here on our diagram

34:02 we say that zero percent is definitely

34:05 around 2030 . . .

we

34:43 need net energy from oil and [if] it goes

34:46 down to zero

34:48 uh well we have collapsed not just

34:50 collapse of the oil industry

34:52 we have collapsed globally of the global

34:54 industrial civilization this is what we

34:56 are looking at at the moment . . . “

https://www.youtube.com/watch?v=BxinAu8ORxM&feature=emb_logo

7. February 2021 at 06:56

Ben Bernanke in a speech:“First, the Fed cannot reliably identify bubbles in asset prices. Second, even if it could identify bubbles, monetary policy is far too blunt a tool for effective use against them.”

“How do you know it’s a bubble?”

Alan S. Blinder gives a convincing explanation:

(1) The historical data should be long enough to give us an historical perspective.

(2) The data should be deflated (using real prices)

(3) The data should be compared to the relative prices of other things.

“Using 120 years of historical home prices, the relative prices of houses in America barely changed over more than a century! The average annual relative price increase from 1890 to 1997 was just 0.09 of 1 percent. Then things changed dramatically. According to the Case-Shiller index, real house prices soared by an astounding 85 percent between 1997 and 2000—and then came crashing down to earth from 2006 to 2012. This represented a large, long-lasting, and a sharp deviation from fundamental value.” Pg. 32 “After the Music Stopped”

7. February 2021 at 07:01

The economy fell off a cliff beginning in July 2008. Bernanke said he couldn’t see that happening. In Ben Bernanke’s book, pg. # 56: “The Courage to Act” he opined: “Unfortunately, beyond a quarter or two the course of the economy is extremely hard to forecast”.

That wasn’t true. See also author, Dr. Richard G. Anderson: “fomer St. Louis Fed’s technical staff: “Although the evidence is mixed, the MSI (monetary services index), overall suggest that monetary policy WAS ACCOMMODATIVE before the financial crisis when judged in terms of liquidity.”

Some people prefer the “devil theory” of inflation: “It’s all Peak Oil’s fault”, ”Peak Debt’s fault”, or the result of the “Stockpiling of Strategic Raw Materials/Industrial Metals” & Soaring Agriculture Produce. These approaches ignore the fact that the evidence of inflation is represented by “actual” prices in the marketplace;

The “administered” prices would not be the “asked” prices, were they not “validated” by (M*Vt), i.e., “validated” by the world’s Central Banks;

7. February 2021 at 08:39

Re: Friedman

I never comment on your excellent monetary policies essays as I have nothing meaningful to add—-but I really liked your linking Friedman to modern MM more explicitly than ever—-at least that I have noticed. One thing I had not resolved before (still have not—but I at least know about it now) is the relationship between real rates, nominal rates, inflation and NGDP (I assume that is funny)—-and for what to me is a very unintuitive and difficult set of concepts.At least I have learned enough to get the fact that “money supply” per se is not the issue—-at least I think,so,:-).

I did teach “finance” at Columbia for 5 years as adjunct professor (yes ‘Professor”—-was ‘promoted” twice—-that too is funny). I was in Investment Banking during the early OTC Derivatives markets. I was a “mini shot”— But a shot.

That subject is mechanical and super micro. Economics, which I enjoyed, had so many disagreements I defaulted to Smith, Ricardo and Bastiat—then later I created a concept of economics derived from Friedman;s “pencil”——which is really Hayek on knowledge and the mystery of man. (I joke on “created” as I never heard of Hayek)-because they basically said the same thing—-one might call that Uber macro.

Everything else was black hole. Money, which seems like it should be easy——is very counterintuitive——like Ricardo’s comparative advantage—except there are 20 or more of those in Monetary policy.

————————————————

Re: Bubbles

Re “bubbles”

I am tired of you talking about bubbles. Who cares? I think bubbles can exist and do exist——but as you have said —-it’s not useful——and my EMH “theory” is weaker than the weakest form—-as it is the most useful (although it implicitly is virtually the same in a “practical” sense) —if there are bubbles one can feel free to trade them.

So yes, you will never get a bubble guy and an outperformance guy to accept what you say—-so please stop.

You know what I want you to write about—-but it’s clear as I have said, your heart is not in it. It is what it is. They really are boring. But still……

7. February 2021 at 09:19

The NYSE roughly doubled in the year before the Great Crash. But no bubble of course. The NASDAQ roughly doubled in the year before the Tech crash. But no bubble of course. The commercial real estate index (MIT/CRE TBI) roughly doubled in the year before the crash of 2008. But no bubble of course.

Bubbles never happen. Tulip prices were entirely justified at the peak. Obviously.

By the way, I agree about China. “Reports of my death have been gravely exaggerated”. China will probably crash at least once between now and 2050. When and why is entirely unknown (in my opinion) at this point.

7. February 2021 at 09:31

Lizard, If asset prices are unforecastable then there are no bubbles. The existence of business cycles does not imply the existence of bubbles.

Peter, Thanks for making it clear that you don’t know the difference between a bubble and a volatile asset price. I’ll be sure to ignore your future comments on the issue.

7. February 2021 at 10:23

There is a policy target, a “sweet spot” (area or range that is most effective or beneficial), where the rate-of-change in money flows is either robust or net-neutral. This contrasts with where the rate-of-change in money flows is harmful.

It is the gap, not the level, between short-term and long-term money flows that must be minimized. The rate-of-change in long-term money flows should not exceed the rate-of-change in short-term money flows by more than 2-3 percentage points.

7. February 2021 at 10:38

The NASDAQ traded at 1288.54 on 12/20/1996 and 1287.86 on 10/18/2002. In between it peaked at 5,132.52.

But no bubble of course. Write on the board 100 times.

“I will not use the ‘B’ word”

Strangely enough Investopedia has separate definition for “bubble” and “volatility”. So foolish of them. Wikipedia has separate definitions as well. More foolishness.

7. February 2021 at 12:43

“The beatings will continue until the bubble talk stops.”

A better analogy is that Sumner will continue firing into the barrel until the last fish stops flapping.

7. February 2021 at 13:14

Peter Schaeffer,

Scott has done a very good job explaining the rationality of the high P/E’s of the late 90s-2000. Many new companies didn’t survive long, but then there was Amazon, Ebay, Google, which make up for lots of losers. It was an era for a technological revolution, and it’s very difficult to pick winners and losers at times like that. Everyone knows most companies will fail, but the successes make investments in such times worthwhile.

Compare it to the auto industry in the early 20th century US. Almost every automaker eventurally failed and/or was acquired, and only 3 major companies survived, AMC aside, which was acquired circa 1980. At the same time, two alernative propulsion technologies failed in the industry, steam and electric, in favor of internal combustion engine cars.

Scott has also argued very persuasively, along with other market monetarists, that the Fed crashed the stock market in 2001 with a tight money shock. It wasn’t a problem with market efficiency. With high P/E ratios, stocks are more sensitive to changes in the expected path of NGDP growth.

7. February 2021 at 18:59

Glorifying the rise of the CCP is akin to advertising the rise of Nazi Germany.

We should all be actively trying to stop the rise and power of China, not endorsing it.

7. February 2021 at 19:09

Do you really think that people are going to stop predicting bubbles? Are you suggesting that we’re in a bubble of bubble predictions?

8. February 2021 at 02:58

And then there’s this:

The Chinese ‘Debt Trap’ Is a Myth

https://www.theatlantic.com/international/archive/2021/02/china-debt-trap-diplomacy/617953/

8. February 2021 at 04:48

Scott

You may be interested in this: Labor rep and economist gives the RBA bigwigs a difficult time about the RBA’s performance.

https://www.livewiremarkets.com/wires/rare-occasion-the-rba-snookered-in-public-debate?utm_campaign=8493&utm_medium=wire-page-share&utm_source=twitter&utm_content=rare-occasion-the-rba-snookered-in-public-debate

8. February 2021 at 06:15

re: “the Fed crashed the stock market in 2001 with a tight money shock”

The FED’s been responsible for every economic recession since WWII with the exception of Covid-19.

And the American Bankers Association is responsible for subpar economic growth (with the elimination of Depression Era Reg. Q ceilings). Since 1981, the expansion of interest-bearing accounts (or bank-held savings), is no longer offset by an increase in the residual transaction deposits, or an increase in bank debits.

The operations of any individual bank is diametrically opposed to the operation viewed from the standpoint of the payment’s system. It is incontrovertible. Banks create credit, they don’t transmit credit. Liquidity risk and maturity transformation in the banks is an optical illusion.

8. February 2021 at 06:27

Banks are “black holes”. From a system’s perspective, bank-held savings are lost to both consumption and investment. That’s why the velocity of circulation has fallen since 1981.

And the source of interest-bearing deposits is other bank deposits shifted into time deposits, either directly or indirectly via the currency route (never more than a short-term situation), of through an increase in the DFI’s capital accounts through the retention of profits. An increase in time deposits depletes demand deposits dollar for dollar.

The economics of stock vs. flow is startling. The expansion of the nonbanks does not reduce the size of the payment’s system. Saved bank deposits that are transferred to the nonbanks are not transferred out of the banks; only their ownership is transferred.

The reverse process, which is called “disintermediation”, has the opposite effect: the intermediaries shrink in size, but the size of the payment’s system remains the same (like the Sept. 18, 2008 draw down in money market accounts).

The solution to subpar economic growth is to drive the banks out of the savings business, to activate savings (which would make them more profitable and not reduce their size).

8. February 2021 at 07:50

Why aren’t business cycles considered bubbles? Is this something that is true by definition? If so, who is determining the definition? The way that the word “bubble” is frequently used in the press indicates that there is a large community of journalists who do view business cycles and bubbles as being overlapping concepts. Is that analytically confusing? If so, what better vocabulary is there to talk about the business cycle that reflects the reasons why so many journalists use the word “bubble” in connection to business cycles?

8. February 2021 at 08:26

Peter, You are just making a fool of yourself. Try to catch up to the discussion in this blog, before posting further comments.

ankh, The real Nazis are the people who want China to go back to Mao-era poverty, when tens of millions of Chinese starved to death. You guys are the evil ones. I want their 1.4 billion people to be prosperous.

Mark, Bubble talk was quite rare during the last half of the 20th century (until 1999). Soon after I started blogging, I predicted that the 21st century would be full of false claims of bubbles, because people would not understand that low interest rates lead to higher P/E ratios. Seemingly overpriced assets would be the new normal.

So far I’ve been right.

Thanks JC1.

Lizard, See my reply to Mark. The two concepts were not linked in the 20th century. A bubble is an asset market that is clearly overpriced, and likely to fall in the future. A business cycle is a fluctuation in real GDP and employment. They are unrelated. For instance, the 1987 stock market crash was not in any way linked to any business cycle. And lots of business cycles do not involve so-called asset price “bubbles”.

8. February 2021 at 08:28

Tpeach, Thanks, I’ll do a post on that.

8. February 2021 at 09:15

Link: “Repo Turmoil and Lessons for Liquidity Policy”

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3749618&download=yes

re: “But during the mid-September episode, MMFs failed to provide repo liquidity—again, despite favorable returns in a market in which they typically trade—suggesting constraints on MMF participation.”

That’s called in interest rate inversion, where the banks, via the remuneration rate, outbid the nonbanks for loan funds.

8. February 2021 at 09:19

Business cycles, like bubbles, represent a misallocation and maldistribution of available credit.

8. February 2021 at 09:24

“I’ll predict 2% inflation during the 2020s.”

How do you factor crypto currencies into your prediction? Do you consider them a non-factor as a medium of exchange in this decade or do you think that even if they gain in popularity as a medium of exchange, they will not change the inflationary dynamics of the decade?

8. February 2021 at 10:22

Scott,

“I’ll be sure to ignore your future comments on the issue”

and them

“Peter, You are just making a fool of yourself. Try to catch up to the discussion in this blog, before posting further comments.”

That didn’t take long.

Michael Sandifer

Let me use eBay as a case in point. Ebay traded (briefly) at $12.82 a share. Within a year it crashed as low as $3.22 a share. Was eBay “efficiently” priced at $12.82 or $3.22?

Keynes (the quote may be allegorical) said

“The Markets Can Remain Irrational Longer Than You Can Remain Solvent”

Folks, I have some Tulip bulbs to sell you. Don’t worry, they are cheap. Only 300X last year’s price. How can you possible lose money?

8. February 2021 at 11:42

Peter Schaeffer,

Yes eBay was likely efficiently priced in that case. You’re referring to the so-called tech crash, which was caused by a tight money shock. NGDP growth expectations fell, which reduced the value of the S&P 500, for example, by about 46%, so it wasn’t just tech.

Most movements in stock prices are caused by changes in expected macroeconomic growth rates. If this was a tech bubble, why did not tech stocks also crash? This was an economy-wide phenomenon, and we did have a mild recession.

8. February 2021 at 11:44

I meant to say that if this was really a tech bubble, why did non-tech stocks also crash?

8. February 2021 at 11:46

Also, you keep bringing up the supposed tulip bubble, but there are historians who don’t believe such a thing ever actually occurred. For example:

https://www.smithsonianmag.com/history/there-never-was-real-tulip-fever-180964915/

8. February 2021 at 12:08

Peter, If you are going to ignore my points, I’ll ignore yours.

8. February 2021 at 13:50

MS, On 3/5/2000 the NASDAQ peaked at 5,132.32. By 4/1/2001 it was down to 1,720.36. By contrast, the NYSE was at 6,337.26 on 3/5/2000 and 6,164.80 on 4/1/2001.

But no bubble in the NASDAQ. Obviously not.

As for Tulipmania. Never happened. Obviously.

Should we move on to the South Sea Bubble? Sir Isaac Newton, allegedly said that he “could calculate the motions of the heavenly stars, but not the madness of people”.

8. February 2021 at 13:54

MS, I followed your link. Let me quote from your link.

“That’s not to say that everything about the story is wrong; merchants really did engage in a frantic tulip trade, and they paid incredibly high prices for some bulbs. And when a number of buyers announced they couldn’t pay the high price previously agreed upon, the market did fall apart and cause a small crisis—but only because it undermined social expectations.”

As for Tulipmania. Never happened. Obviously.

8. February 2021 at 18:46

Peter Schaeffer,

All you’re pointing out is that Nasdaq stocks didn’t recover at the rate that S&P 500 stocks did. That shouldn’t be surprising, given that newer companies are less solvent on average, as well as the fact that a big washout was coming anyway, and was simply more punctuated, due to the recession.

With regard to tulipmania, do you have an empirical case to make for a bubble here, or just opinions you’ve read?

If you can’t produce a useful, operational definition of the word “bubble” that fits empirical data, then you have nothing of value to offer here. Can you do that?

I think Scott is right to say that if you think you have a good theory about bubbles, then you should at least be able to profit from it.

Give me an example of a bubble that exists now, and tell me how you’ve invested to profit from the bursting of that bubble.

9. February 2021 at 03:24

re: “Most movements in stock prices are caused by changes in expected macroeconomic growth rates”

True enough, most moves within 3 months, are correlated. And all movements in N-gDp are caused by the rate of change in monetary flows, volume times transaction’s velocity.

9. February 2021 at 08:45

MS, You need to do some homework before you post. You have all of your facts wrong.

“All you’re pointing out is that Nasdaq stocks didn’t recover at the rate that S&P 500 stocks did”

On 3/5/2000 the S&P 500 was at 1,395.07. On 4/1/2001 the S&P 500 was at 1,128.43. The S&P didn’t ‘recover’ in the period in question. It fell (not as much as the NASDAQ). Actually, the S&P continued to fall for several more years (somewhat less than two years).

“With regard to tulipmania, do you have an empirical case to make for a bubble here, or just opinions you’ve read?”

Quote from Wikipedia

“Viceroy Tulip was worth upwards of five times the cost of an average house at the time”

But no bubble, obviously.

Quote from Wikipedia

“Tulip mania (Dutch: tulpenmanie) was a period during the Dutch Golden Age when contract prices for some bulbs of the recently introduced and fashionable tulip reached extraordinarily high levels, and then dramatically collapsed in February 1637”

So the fundamentals ‘dramatically collapsed’ in February 1637? Sure they did. Obviously.

“If you can’t produce a useful, operational definition of the word “bubble” that fits empirical data, then you have nothing of value to offer here. Can you do that?”

Trivial.

From Investopedia

“What Is a Bubble?

A bubble is an economic cycle that is characterized by the rapid escalation of market value, particularly in the price of assets. This fast inflation is followed by a quick decrease in value, or a contraction, that is sometimes referred to as a “crash” or a “bubble burst.””

“Give me an example of a bubble that exists now, and tell me how you’ve invested to profit from the bursting of that bubble.”

You are confusing the strong form of the EMH (Scott’s version) with the weak form of the EMH (there is no magic formula for making a profit in the stock market, which is what I believe).

I should also say that I have taken advantage marketplace mispricing in the past and done rather well. It actually wasn’t that hard.

9. February 2021 at 09:50

Peter, I’ve addressed all your points 100 times over in previous posts. A big rise and fall in an asset price is not a bubble, unless you want to define “bubble” in an utterly meaningless way.

9. February 2021 at 09:57

MS, Tulip prices declined by 95% from 2/3/1637 to 5/1/1637.

But no bubble of course. Write on the board 100 times.

“I will not use the ‘B’ word”

9. February 2021 at 10:04

Scott,

Shares in the South Sea company went from somewhat over 100 pounds (and generally flat) to almost 1000 pounds (briefly) to under 100 pounds (and generally flat).

But no bubble of course.

“A big rise and fall in an asset price is not a bubble, unless you want to define “bubble” in an utterly meaningless way.”

vs.

He (Sir Isaac Newton) “could calculate the motions of the heavenly stars, but not the madness of people”.

9. February 2021 at 10:18

Peter Schaeffer.

You are obviously not here to discuss, but to try to force your view, which I see as silly. It’s pointless discussing anything with you. You don’t seem familiar with the scientific method.

You still didn’t address my question as to why the entire stock market crashed if there was a tech bubble in 2000. That’s because you apparently don’t have an answer to the question and aren’t concerned about the inconsistency in your story. It is, however, consistent with the story Scott tells in which tight money caused the recession, which reflected a drop in the expected NGDP growth path, which crashed the entire stock market.

I may have had the dates wrong in my memory, but I know the S&P 500 recovered much more quickly than the Nasdaq after that recession. Your point, well, has no point. The same is true of your entire perspective. It’s all meaningless, and I doubt you’ve convinced anyone here.

9. February 2021 at 10:47

You might want to add “bubble” to your list of Categories for the blog to save you time referencing the definition. And, at the risk of being referred to that reference myself, I’m curious how the EMH explains what happens to information in a transaction where Warren Buffett bought 1 share of XYZ stock at $10 and sold it to Donald Duck for $100. Does the EMH posit that there is no loss of information about the value of XYZ stock in that transaction? Does it posit that there is no such thing as dumb money or does it just assume that the dumb money is evenly distributed throughout the market?

9. February 2021 at 13:38

MS, You have memories (self-serving one’s). I have facts.

“On 3/5/2000 the NASDAQ peaked at 5,132.32. By 4/1/2001 it was down to 1,720.36. By contrast, the NYSE was at 6,337.26 on 3/5/2000 and 6,164.80 on 4/1/2001.”

That’s a 66.5% decline in the NASDAQ versus 2.7% decline in the NYSE.

“You still didn’t address my question as to why the entire stock market crashed if there was a tech bubble in 2000.”

I have addressed this issue. The general market did not crash as the NASDAQ fell. You do know the difference between 66.5% and 2.7%? Don’t you?

“It is, however, consistent with the story Scott tells in which tight money caused the recession, which reflected a drop in the expected NGDP growth path, which crashed the entire stock market.”

Take a look at FRED series FEDFUNDS. On 3/5/2000 the Fed Funds rate was 5.85%. On 4/1/2001 the rate was 4.8%. M2 provides another measure. M2 was 4.6783 on 3/6/2000 and 5.0942 on 4/2/2001.

“I may have had the dates wrong in my memory, but I know the S&P 500 recovered much more quickly than the Nasdaq after that recession.”

What you know and the actual facts are not all that well related. The S&P bottomed out at 800.58 on 9/30/2002. It then rose to 1156.86 on 3/1/2004. By contrast, the NASDAQ went from 1139.9 to 2047.63 in the same period.

Let me apologize for my writing style. I prefer facts and numbers to emotions. Shame on me.

I will write on the board 100 times.

“I will not use the ‘B’ word”

9. February 2021 at 13:43

MS, I accept that I am not going to persuade you of anything. However, this blog is (hopefully) visited by folks with more open minds who will consider that numbers before reaching any conclusions.

“Don’t confuse me with the facts”

Used by a Congressman in 1974, although the phrase was not new even then (it may even go back to Plato).

9. February 2021 at 13:50

Peter Schaeffer,

Over the same period as the Nasdaq losses, between 2000 and 2002, the S&P 500 lost about 46% of its value:

https://www.google.com/finance/quote/.INX:INDEXSP?sa=X&ved=2ahUKEwjTwc_M493uAhUYTTABHR0ABIEQ3ecFMAB6BAgBEBE

And the S&P 500 recovered much more quickly.

I’ve been right, and you’re dead wrong. Why should anyone pay attention to anything you say at this point?

9. February 2021 at 16:17

MS, Cherry-picked dates aren’t going to improve your case. Let’s see what really happened.

The NASDAQ was at 2547 on 8/1/1999, 5132 on 3/5/2000, 1720 on 4/1/2001. So the NASDAQ doubled and then lost 2/3rds of its value in 20 months. But no bubble. Tulip bulbs lost 95% of their value in 3 months. But no bubble.

Just efficient markets. Sure. Obviously.

Shall we try South Sea Shares?

9. February 2021 at 18:06

Peter Schaeffer,

LOL Cherry-picking? Just take the highs versus the lows of that economic cycle. If you’re going to troll, at least be intelligent about it.

9. February 2021 at 22:07

MS, In your worldview all prices are ‘efficient’ prices, so ‘highs’ and ‘lows’ don’t really exist.

Or have you changed your mind and now agree that not all prices represent ‘efficient’ markets. “Enquiring minds want to know”.

However, since the NASDAQ is sort of (very) embarrassing for you, let’s switch to just the S&P 500 (a much broader market). On 10/5/98 the S&P 500 trades at 984.39, on 4/3/2000 the S&P 500 trades at 1516.35, and on 9/30/2002 the S&P 500 trades at 800.58.

So the market rises by 54% in less than 18 months and then crashes 47% in around 2.5 years. Doesn’t look or sound very ‘efficient’. Did the PDV of the future earnings stream of the S&P 500 really rise by 54% in 18 months? Did the PDV really crash by 47%? “Enquiring minds want to know”.

10. February 2021 at 08:05

people predicting a crash really do not understand the secondary housing market or how the hukou system functions

lol China is still pouring more concrete than the rest of the world combined, where do they suppose all that is going?

there will never be enough Tier 1 housing

by design

Tips and Risks

The process of buying a house in China is neither easy nor cheap hence you need to take extreme and thoroughly caution on the seller and target property before you sign any contracts. You also need to know some few tips about buying properties in China like, the government has complete ownership over the land upon which all the properties are built. This means that when you buy a house, the residential area is leased to you for a 70 year term. Also buying older properties is risky as the government can make a compulsory purchase of your property for the purpose of new construction. If this happens, you may be forced to sell the property and you may also lose money from it. This means, that the newer your property is, the less likely the government will want to purchase it. You need to make sure that the mortgage the seller took out on your target property is paid off before you make the purchase. You can do this by checking the original deeds on the property, in case the seller’s mortgage is not settled, the deeds will state what loans have been taken out under this property. If the seller’s mortgage is in foreign currency, the seller is not allowed to convert your down payment into foreign currency so as to pay off his mortgage.

10. February 2021 at 08:25

to put that in perspective, in larger US cities most housing stock is 50+ years old and transfer taxes are usually less than 1%

in Tier 1/2 cities, where transfer taxes are often >10%, CCP is tearing down structures as little as 25 years old and financing new construction via LGFVs

lol gee wonder why

11. February 2021 at 09:32

DJP, I have seen (and used) the numbers for concrete production/consumption in China. They are amazing. In my opinion, China will eventually be over-built. However, that may be many years in the future.

A good guess is that China will eventually (by 2050) reach around 70% of US per-capita GDP in PPP terms. At that point, GDP growth will slow to the US/Japan/Taiwan rate. This will impact housing demand when it happens. It is possible that China will never have a property crash. However, the history of the US/Japan/others suggests that it will. When is a very different question.

15. February 2021 at 02:06

” . . . China will eventually (by 2050) reach around 70% of US per-capita GDP in PPP terms.”

It will never happen?

‘We’ have ten years?

“ . . . our best estimate is that the net energy

33:33 per barrel available for the global

33:36 economy was about eight percent

33:38 and that in over the next few years it

33:42 will go down to zero percent

33:44 uh best estimate at the moment is that

33:46 actually the

33:47 per average barrel of sweet crude

33:51 uh we had the zero percent around 2022

33:56 but there are ways and means of

33:58 extending that so to be on the safe side

34:00 here on our diagram

34:02 we say that zero percent is definitely

34:05 around 2030 . . .

we

34:43 need net energy from oil and [if] it goes

34:46 down to zero

34:48 uh well we have collapsed not just

34:50 collapse of the oil industry

34:52 we have collapsed globally of the global

34:54 industrial civilization this is what we

34:56 are looking at at the moment . . . “

https://www.youtube.com/watch?v=BxinAu8ORxM&feature=emb_logo