Milton Friedman as a market monetarist

Marcus Nunes directed me to a very interesting 1971 paper in the JPE by Milton Friedman. Here is the abstract:

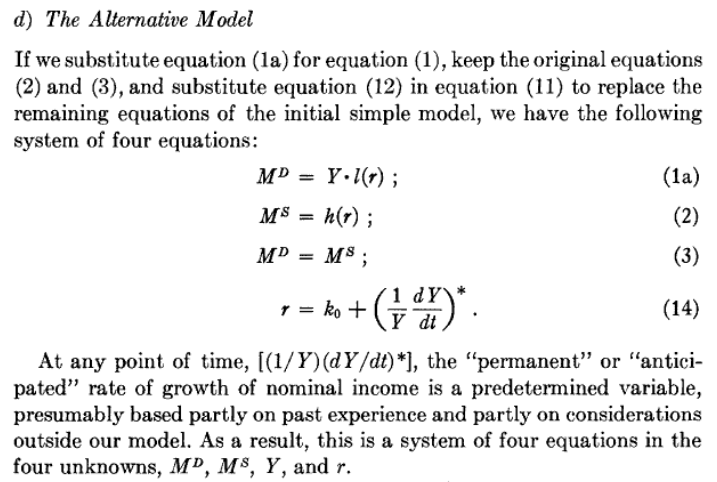

Market monetarists also prefer to skip over inflation and RGDP growth, and focus directly on NGDP growth. Once you start ignoring inflation, you have to rethink concepts such as the Fisher equation, which states that the nominal interest rate is the real rate plus inflation. I’ve advocated replacing inflation with NGDP growth, and Friedman does the same in equation 14:

The variable “ko” in equation 14 is the difference between the real interest rate and the real GDP growth rate, and “r” is the nominal interest rate.

The following is my favorite sentence, which discusses how NGDP shocks are divided up between prices and output:

The two alternative approaches he refers to are the simple quantity theory (which assumes RGDP is fixed) and the simple Keynesian income/expenditure model, (which assumes P is fixed.) An NGDP model makes no assumptions about how NGDP shocks are partitioned between prices and output.

The whole paper is worth reading. Great stuff!

PS. I have a related post at Econlog.

Tags:

5. February 2021 at 12:55

This is very practical, for purposes like NGDP level targeting, which is the most important thing from a policy perspective. But, theoretically, how would one actually break down these variables?

The strength of your position against mine, is that you need only rely on traditional macro models and don’t need as many theoretical distinctions. The burden of proof, if we’re to believe there are relationships the between interest rates, rates of return on capital, and NGDP growth expectations that I claim, is entirely on me.

Either perspective agrees NGDP level targeting or some kind of nominal wage targeting would be near optimal for monetary policy.

5. February 2021 at 13:17

This post gives me an opening to pose a question that’s been bothering me for a few weeks—what is “overheating” in an economy? Does it refer to a Weimar style inflation orgy? Does it refer to China’s growth run from late 80’s to present? To U.S. growth runs in the 19th century and 20th century?

Is “overheating” a term that is as worthless as “bubble” when it comes to assessing the relative health of a nation or a basket of assets?

Did the Volcker Fed respond to “overheating” in the early 80’s?

Maybe I’m conflating too many things here but I want to know what situations are real problems and what are manufactured by policy makers and media.

5. February 2021 at 13:52

Although much better than inflation rate ceiling approach 2008-19, NGDP targeting suffers two problems, 1) Without a futures market, the data for feeding back to policy instruments come out very infrequently. 2) It is one very specific interpretation of the best tradeoff between inflation and maximum unemployment (ideally of all factors of production) where Congress presumably wanted to allow for judgement.

With a large liquid market in real GDP futures and another in PCE futures we would at last be able to judge Fed performance against it’s Congressional mandate in real time.

5. February 2021 at 14:20

David, Overheating is hard to define, but a rise in wage growth that threatens to push inflation well above target is one indication.

Another would be if NGDP shoots up to well above the trend line. David Beckworth has a website that tries to estimate an NGDP gap.

5. February 2021 at 14:22

Thomas, You said:

“where Congress presumably wanted to allow for judgement.”

Whose judgment?

5. February 2021 at 20:27

My undergrad intro macro course assumed V was constant and that an increase in M would lead to a shift in Y and P, but left the split presumably for the econ majors in later classes or for future research. With the notion of ‘overheating’ in mind, it seemed that Y would probably move before P got out of hand. Then with the evidence from the last two recessions that V ain’t no constant, I quickly came around to the Sumnerian view (not to be confused with the Sumerian view!) that recent concerns about the Fed kicking off runaway inflation are pretty overblown.

5. February 2021 at 23:16

David S,

I think I can give you a more explicit answer.

Overheating, as I understand it, refers to a situation in which increased money supply growth expectations relative to money demand push output, and hence employment beyond sustainable levels. This is because the resulting expected increase in inflation temporarily lowers real wages, because wages adjust more slowly than output and employment. Think average nominal wage/(Real GDP + inflation) = average real wage.

So, as consumer demand, for example increases, some purchases are moved forward temporally to avoid higher expected prices later. This incents suppliers of goods and services to expand production, requiring hiring more employees, to meet the increased demand.

But, as wages gradually rise more quickly to adjust to the new expanded NGDP growth, layoffs become inevitable and a recession occurs, unless there’s another positive monetary shock.

There’s a nice graph illustrating the concepts here:

https://opentextbc.ca/principlesofeconomics/chapter/24-3-shifts-in-aggregate-supply/

There is a hypothetical maximum ustainable RGDP growth rate and employment rate, though it may be forever in flux and difficult to estimate.

This overheating/recession cycle was witnessed multiple times from the late 60s to the early 80s in the US, complicated by negative oil price shocks which temporarily lowered potential RGDP.

Here’s historical US NGDP growth since 1948:

https://fred.stlouisfed.org/graph/?g=AujY

And here’s NGDP versus average wages, revealing wage stickiness, which is what gives inflation real effects:

https://fred.stlouisfed.org/graph/?g=AOhB

6. February 2021 at 00:42

“Then with the evidence from the last two recessions that V ain’t no constant . . . ”

It depends upon which ‘V’ is being measured?

“This paper has suggested a simple model that can account for the key anomalies of the traditional monetary approach. It disaggregates the quantity of credit into a ‘real’ and a financial circulation. In time periods, when the ratio of credit in the financial circulation to credit in the real circulation rises, the simple quantity theory must be expected to disappoint, as it is a special case of the more general quantity theorem of disaggregated credit. In such time periods, a financial boom is likely, as asset prices are driven up by speculative borrowing on the back of collateralised assets. This explains why the traditional monetary quantity theory was not popular in the 1920s and 1930s, and again in the late 1980s and early 1990s. Then the traditionally defined velocity of money declines and excess credit creation can ‘spill over’ as foreign investment. However, during time periods such as the 1950s, when in many countries credit was mainly channeled into the real economy, asset prices remained stable and the traditional quantity theory could be expected to hold. The fact that the model can account for the major anomalies observed in many countries over many time periods demonstrates generality and robustness.

The empirical results for the Japanese case have been unambiguously supportive. The Japanese asset bubble of the 1980s was due to excess credit creation by banks for speculative purposes, largely in the real estate market. The apparent velocity decline is shown to be due to a rise in credit money employed for financial transactions, while the correctly defined velocity of the real circulation is found to be very stable“

https://eprints.soton.ac.uk/36569/1/KK_97_Disaggregated_Credit.pdf

6. February 2021 at 03:02

Scott and Michael,

Thanks for the answers to my question. If I was reading the graphs correctly Beckworth seems to be noting a deeper NGDP drop than the Fed—but that may just be a data lag, and the events of the past year have been unusual to say the least.

I wonder if Q3 of this year will see a snap back of wages in leisure & hospitality that moves the NGDP into “hot” territory. Maybe the sector isn’t big enough to register that impact. If the Fed “reaches for the punch bowl” in mid 2022 they might be reacting too soon given the output gap trend. I can imagine a scenario where wages stay flat even as labor force participation recovers to 2019 levels.

6. February 2021 at 03:23

” . . . and you’d have to be spectacularly ignorant or innocent not to know this. Milton Friedman may have been either or both. After

all, one of his series of films (collectively titled Free to Choose) which the BBC showed in 1980, used Japan – an outstanding example of state-managed capitalism – as an exemplar of the free market.”

https://www.lobster-magazine.co.uk/free/lobster81/lob81-view-from-the-bridge.pdf

6. February 2021 at 07:10

The spurious assumptions are laughable. Milton Friedman was only good at math.

Our concern is the relationship of money (not interest rates), to the level and movement of prices. It is a well know fact that a rise in prices, not too rapid and extreme, has a stimulating effect on business profit expectations. Acting under the impulse that wider profit margins are in the offing, businesses will go into debt, hire workers, buy additional inventory, expand their rate of operations, and if their optimistic anticipations cover a long enough period, decide to expand their plant capacity, and develop new outlets for their products.

6. February 2021 at 07:21

re: “The model combines one element from Irving Fisher (the difference between the nominal and the real interest rate)…”

As the world’s leading authority on bank reserves, Dr. Richard G. Anderson, posited:

“The Fed’s staff are all very sensitive to the Fisher equation and its implied spread between nominal market rates and “real” rates. Every economics class has taught about the Fisher equation for decades. But, of course, there are open issues — which maturity of nominal rate to use? And which price deflator? Some folks would use an overnight rate, some a 90 day rate, some a government rate, some a private sector rate, some would use the 10-year bond rate, etc……

6. February 2021 at 09:01

Spencer:

You wrote

. A whole lot of macroeconomics fits into that clause, “not too rapid and extreme.”.

6. February 2021 at 09:50

Daniel, You said:

“My undergrad intro macro course assumed V was constant”

You should ask for a refund in your tuition. Even monetarists don’t believe that.

6. February 2021 at 13:07

Scott, I don´t remember if when I brought your attention to Friedman´s paper I sent my accompanying post. In that paper Friedman came “this close” to be the proponent of what became Market Monetarism. I was frustrated to see that in later manifestations he went back to “rising money per unit of output” view of inflation.

https://thefaintofheart.wordpress.com/2021/01/26/does-the-monetary-theory-of-nominal-income-stand-scrutiny/

6. February 2021 at 13:32

Without asking permission I´ll use Scott´s blog to “advertise” that “to compete with Krugman”, I´ve also moved to Substak. This was my first post there. Please sign up for free access and shere with your friends.

Thanks

Marcus

https://marcusnunes.substack.com/p/from-the-title-the-fed-could-have

6. February 2021 at 14:03

@Carl re: “not too rapid and extreme”

Before the next stimulus, breakevens will likely top around when the CPI is reported on Feb. 10 2021. I.e., long-term monetary flows, volume times transactions’ velocity, are set to plateau.

https://fred.stlouisfed.org/series/T10YIE

6. February 2021 at 22:34

Marcus, Good luck with your Substack.

7. February 2021 at 11:25

““where Congress presumably wanted to allow for judgement.”

Whose judgment?”

The Fed board of governors’ judgement. Congress could have defined the inflation-employment tradeoff if it had wanted to.

8. February 2021 at 07:57

“one very specific interpretation of the best tradeoff between inflation and maximum unemployment”

Is there actually a trade off?

Japan has had minimal inflation for decades, and the average unemployment rate has been quite low.