I don’t have strong views on who’s going to win the election. Clinton seems more likely to win, but by how much? Earlier today I defended 538, which gives Trump a (fairly good) 35% chance. That’s more than the betting markets. Now I’ll present the opposite argument, and then try to tie it in to monetary policy, which is what this stupid blog is supposed be about—right?

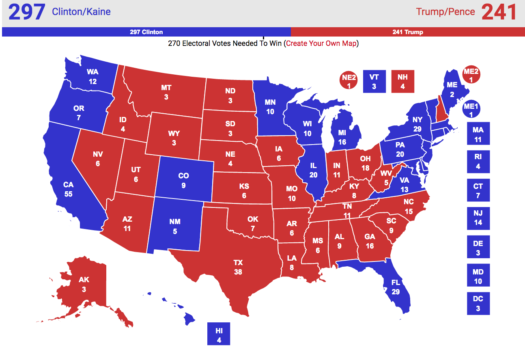

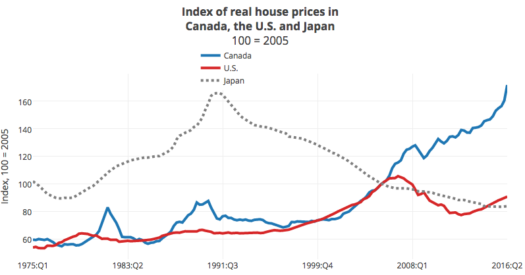

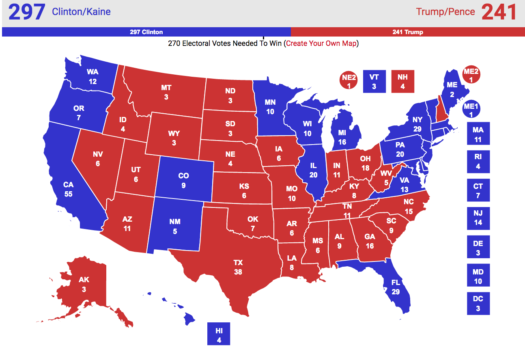

To see the argument for Trump having a good chance, check out this map, from RealClearPolitics. It shows all states colored, based on poll averages, no matter how narrow the margin:

That seems like a pretty decent margin for Hillary–so why do I say it’s good news for Trump. Because (blue) Florida is really close, has 29 electoral votes, and would put Trump up to 270 if it flipped. That brings back memories of 2000, when a very close Florida put Bush up to 271. And just as in that case, if Trump narrowly wins with 270 electoral votes, he’ll likely lose the popular vote—too many wasted Hillary votes in California and New York. My hypothetical is identical to 2000, except Iowa, Virginia and Colorado flip.

That seems like a pretty decent margin for Hillary–so why do I say it’s good news for Trump. Because (blue) Florida is really close, has 29 electoral votes, and would put Trump up to 270 if it flipped. That brings back memories of 2000, when a very close Florida put Bush up to 271. And just as in that case, if Trump narrowly wins with 270 electoral votes, he’ll likely lose the popular vote—too many wasted Hillary votes in California and New York. My hypothetical is identical to 2000, except Iowa, Virginia and Colorado flip.

I think this path to victory is semi-plausible, which is why Nate Silver’s 538 gives Trump a 35% chance. But if he loses any of these states, no matter how small, then he falls short unless he can pick up another state. And that’s where things get tougher. He’d need Pennsylvania, Colorado, Michigan or some place like that. Those are tougher than Florida. (I’m from Wisconsin, and have confidence in my fellow cheeseheads.)

To me, the most interesting event in the past 24 hours is the sharp fall in Trump contracts in the betting markets, to 22%. AFAIK, that’s 10 points down from a couple days ago. What’s going on? The polls have not changed dramatically. I’m not sure, but I suspect Nevada:

And now that Nevada early voting has come to a close, Ralston isn’t mincing words about how he sees Trump’s prospects. “Trump is dead,” Ralston tweeted Saturday. He elaborated on his blog that from the early voting numbers so far, the GOP nominee would need a “miracle” to win Nevada at this point.

The polls have tended to put Nevada as a pure toss-up state, and a few recent ones have even shown Trump ahead there. Accordingly, it hasn’t generally been considered part of Clinton’s swing state “firewall.”

But Nevada is a famously difficult state for national pollsters to get right. Its population is transient and many work at night. Furthermore, its population is over one-quarter Hispanic, and it’s often challenging for English-language polls to sample Hispanic voters accurately.

Does anyone know where Nevada was two days ago in the betting markets?

In the past, polls in Nevada have been less accurate than in other states:

So in previous years, analysts like Ralston have found success in reading tea leaves from Nevada’s early voting numbers instead. And all week, Ralston has been warning of danger signs for Trump. The partisan and geographic breakdown of early voting turnout has looked similar to 2012, when Barack Obama won the state by 6 and a half points. But the final day of early voting Friday was, Ralston writes, “cataclysmic” for Republicans.

. . .

Though the statewide early voting numbers aren’t yet finalized, Ralston estimates that registered Democrats will have a 6 point lead on registered Republicans among early voters. Since registered partisans tend to overwhelmingly vote for their own party, Trump probably either needs to dominate among early voters associated with neither party or else make up the gap on election day.

But how important is the early turnout? This important:

But ballots equivalent to well over two-thirds of the total 2012 turnout in Nevada have already been cast. So if Trump has indeed fallen significantly behind in the early vote, it will be very challenging for him to catch up.

Experts warn that early vote totals can be misleading. But they are not meaningless. At a minimum, we actually have some HARD DATA. We know that Dems in Nevada are turning out in large numbers. That doesn’t mean Hillary will win the state; I could image Trump doing well among working class Dems. But it tells us something–maybe that GOTV is working. It’s no longer just polls. My hunch is that 538 is ignoring this data, because early voting isn’t always reliable, but the betting markets are concluding that Hillary is very likely to win Nevada. Indeed while RCP (i.e. polls) give Nevada narrowly to Trump, the betting markets show a very strong 77% for Hillary. I know of no other state with such a huge gap.

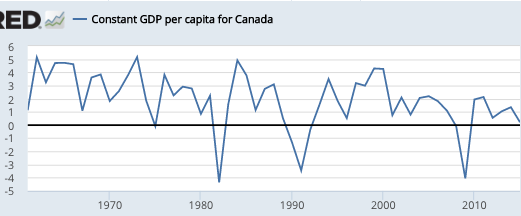

Rational expectations say that investors look at everything when making a forecast, including decisions on asset valuation. Thus while experts might have said (in the weeks after Brexit) that “it’s too soon to say how it will impact the UK economy” the markets sniffed out that the UK was holding up better than expected, and UK stocks rallied quite a while ago. Economists wait for data like GDP and employment, which comes out with a lag. As another example, I think the markets sniffed out that slow RGDP growth and “lower for longer” interest rates were the new normal long before the Fed figured that out. The Fed relies on models where 3% trend RGDP growth and 5% T-bill yields are “normal”, and it took them a long time before they downgraded those forecasts.

So while 538 is a great site, and I love their thoughtful statistical analysis, you could argue that it’s more driven by “models” than a pure rational expectations forecast would imply. That is, it might not put enough weight on tea leaves like the Nevada early vote, because of its unreliability in other contexts.

I don’t want to make too much of this difference, as 22% isn’t that different from 35%. Even after the election we won’t know for sure which approach was “right”, especially if Hillary wins. I suppose if Trump wins then 538 will look good, as its numbers for Trump have been higher than elsewhere. But even then it won’t be a crowning victory, after all, 538 is predicting a Hillary victory. Michael Moore won’t be impressed. You’d need lots of repeated tests to establish whether rational expectations beats really good models.

I believe it does, which is why I prefer NGDP futures markets to Lars Svensson’s suggestion that the Fed target its own internal forecast, based on structural models. So there, a Trump Derangement Post that actually had implications for monetary policy!

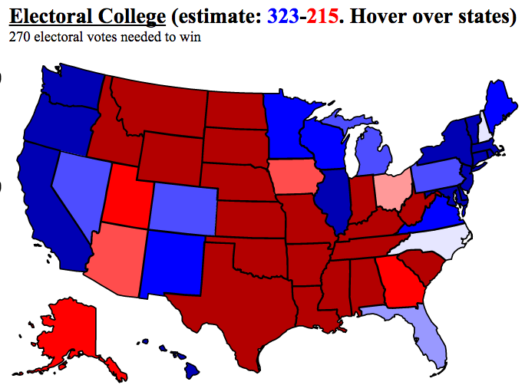

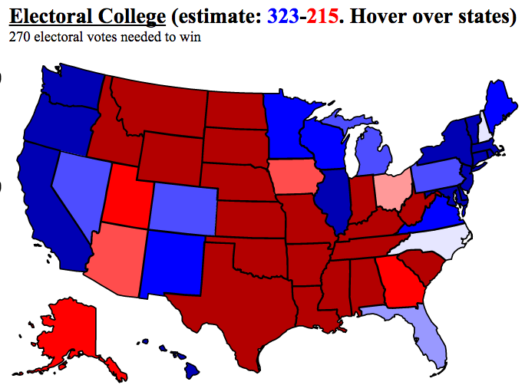

PS. Here is the betting market map:

Notice that they have Hillary winning New Hampshire and North Carolina too.

PPS. Not enough derangement in this post? I love this Matt Yglesias post on that disgusting illegal immigrant Melania:

So there’s really nothing so surprising about the Melania story. Trump doesn’t like immigrants who change the American cultural and ethnic mix in a way he finds threatening and neither do his fans. Europeans like Melania (or before her, Ivana) are fine. I get it, David Duke gets it, the frog meme people get it, everyone gets it.

But it does raise the question of why mainstream press coverage has spent so much time pretending not to get it. Why have we been treated to so many lectures about the “populist appeal” of a man running on regressive tax cuts and financial deregulation and the “economic anxiety” of his fans?

Slovenian models include anorexics, prima donnas, former porn stars, and some, I assume, are good people.