Random thoughts

1. For Christmas, we have a truly heartwarming story of entrepreneurial success from the WSJ:

TikTok really was everywhere this year.

The app, known for its silly dancing videos, was the world’s most visited site on the internet in 2021, surpassing last year’s leader, Alphabet Inc. GOOG 0.13% ’s Google, according to Cloudflare Inc., NET 0.34% a cloud-infrastructure company that tracks internet traffic.

The app, owned by Beijing-based ByteDance Ltd., has had a rapid rise, hooking people with its secretive algorithm, which delivers video clips that it thinks you would like. It has turned dancing influencers Addison Rae and Charli D’Amelio into household names, getting cast in TV shows, commercials and movies.

I seem to recall that about 18 months ago the media was full of stories that Tiktok and WeChat were a threat to American national security. (As you may recall I was skeptical of those claims.) Trump promised to protect us with a ban, or at least force a sale. And yet here they are 18 months later, bigger than ever. So why don’t we see more news stories about how Tiktok is hurting American national security? Where are the exposés?

The only “dark side” mentioned by the WSJ has nothing to do with national security:

Like other social-media sites, TikTok has its dark side. The video-sharing app’s algorithms can drive minors to videos about sex, drugs and eating disorders, investigations by The Wall Street Journal have found.

2. Because our medical ethicists opposed challenge studies, it took far longer than necessary to test the Covid vaccine. Thousands died. Because a bunch of medical experts discouraged Pfizer from filing with the FDA as soon as it was apparent that the vaccine was highly effective, the filing was delayed. Thousands died. Because the FDA took weeks to consider the application, despite the fact that the evidence was overwhelming, another delay took place. Thousands died. Because a bunch of demagogues peddled phony conspiracy theories that the vaccine was risky or less than highly effective, vaccination rates remained disappointingly low. Thousands died.

3. The Washington Post has a story headlined:

While omicron explodes around the world, covid cases in Japan keep plummeting and no one knows exactly why

Right under the headline is a photo of a crowded street in Tokyo, where everyone is wearing a mask. Further down in the story is a photo of London, where almost no one is wearing a mask. Hmmm.

The WaPo story actually discusses two issues. One issue is why Japan has a low rate of Covid transmission at the moment, a fact that is largely unrelated to masks. But the article also discusses the issue of why East Asian countries like Japan and South Korea have had low rates of Covid throughout the pandemic, an issue which clearly does relate to mask wearing. (Although In South Korea testing is also a factor.)

4. It’s even worse than we thought:

In Cape Girardeau County, the coroner hasn’t pronounced a single person dead of COVID-19 in 2021.

Wavis Jordan, a Republican who was elected last year to serve as coroner of the 80,000-person county, says his office “doesn’t do COVID deaths.” He does not investigate deaths himself, and requires families to provide proof of a positive COVID-19 test before including it on a death certificate.

Meanwhile, deaths at home attributed to conditions with symptoms that look a lot like COVID-19 — heart attacks, Alzheimer’s and chronic obstructive pulmonary disease — increased.

“When it comes to COVID, we don’t do a test,” Jordan said, “so we don’t know if someone has COVID or not.”

Nationwide, nearly 1 million more Americans have died in 2020 and 2021 than in normal, pre-pandemic years, but about 800,000 deaths have been officially attributed to COVID-19, according to Centers for Disease Control and Prevention data.

A majority of those additional 195,000 deaths are unidentified COVID-19 cases, public health experts have long suggested, pointing to the unusual increase in deaths from natural causes.

And where are most of these unreported deaths? Do you even have to ask?

These trends are clear in small cities and rural areas with less access to healthcare and fewer physicians. They’re especially pronounced in rural areas of the South and Western United States, areas that heavily voted for former President Donald Trump in the 2020 presidential election.

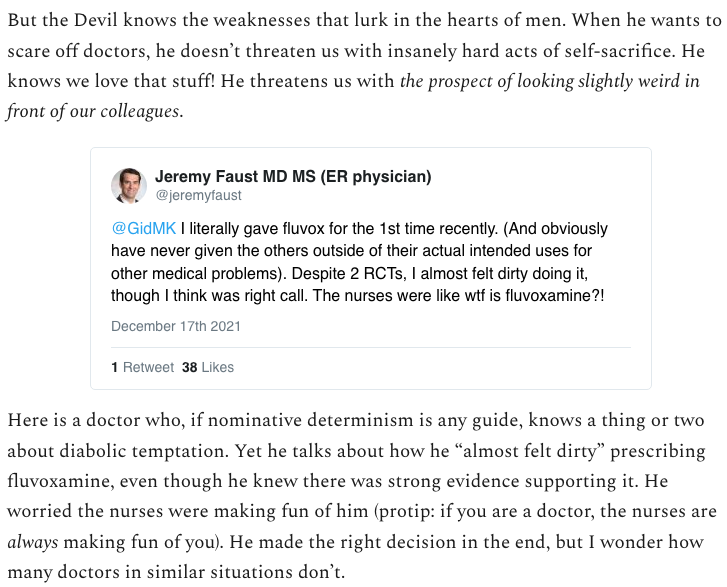

5. People sometimes tell me they don’t get why Scott Alexander is regarded as such an impressive blogger. Here he discusses why some doctors might be reluctant to prescribe fluvoxamine:

I could blog for 20 years and never write a paragraph that amusing.

6. I frequently use the term “Puritan” to describe recent cultural trends in the West, but Ed West suggests that a better analogy is the transition from the Regency era to the Victorian:

Ironically, just as those pushing for empire were the forebears of today’s sanctimonious decolonialists, Victorian moral campaigns against homosexuals were led by moralising Nonconformists, forerunners to today’s progressive campaigners. Acts such as the Criminal Law Amendment Act outlawing ‘any act of gross indecency with another male person’ were put forward by radical MPs, not by Tories. Quaker families who were involved in those early campaigns against sexual impropriety today often bankroll the moral campaigns against racism. The same urge to improve the world drives them, the same sanctimony. . . .

By 1842, Flashman laments that ‘respectability was the thing: breeches were out and trousers came in; bosoms were being covered and eyes modestly lowered; politics was becoming sober… the odour of sanctity was replacing the happy reek of brandy, the age of the dandy was giving way to that of the prig, the preacher to the bore’.

Those Regency men raised in the 20th century must feel the same way about this new age, even if it is a better world in most ways. The new Victorians may preach about different sins, but the sanctimony is the same.

Read the whole thing.

And Merry Christmas everyone!

(But then if you were the sort of person who celebrated Christmas, you wouldn’t be reading my bad blog today.)

Tags:

24. December 2021 at 20:56

Merry Christmas!

Reading your blog only takes a few minutes at a time. Christmas isn’t that busy to exclude all else!

24. December 2021 at 21:25

That WaPo headline is wrong. Cases in Japan bottomed out a couple of weeks ago and have started to rebound; by the time the article ran, there was a clear upward trend. The first confirmed omicron case was just a couple of days ago, so it’s too early to see the impact.

Masks may be helping, but they’re not the whole story. Case and death rates have been low relative to the US and Europe all along, but cases didn’t really get under control until very recently, when vaccination rates hit 70%.

24. December 2021 at 21:33

I missed the part where you said masks aren’t the reason cases are low now, so disregard that.

I’ve been following Tokyo numbers much more closely than national numbers. What I’ve seen is that cases can grow quickly in Tokyo, but this is cut short by the government stepping in to impose containment measures. Every wave has peaked about a weak after a state of emergency is declared. The measures aren’t that strong (restaurants close at 8, serving alcohol is prohibited), but voluntary compliance with social distancing is pretty high.

25. December 2021 at 01:27

> East Asian countries like Japan and South Korea have had low rates of Covid throughout the pandemic, an issue which clearly does relate to mask wearing.

Why is this clear? I believe that if you had spent 2020-2021 in Spain, where outdoor mask wearing was mandatory until June 2021 (and yes, it was actually enforced), you would feel more ambivalent about the effectiveness of masks.

25. December 2021 at 05:57

1) It was “hurting” us because it was making money that was not going to US companies. Using govt to eliminate competition is an old and tested tactic.

2) Not sure I buy all of that. If you go through when all of the successful vaccines are first given they all start in December and January. Russia announced it had a vaccine in August but still didnt start vaccinating until December. Chian did its challenge trial with its military in the summer but didnt start vaccinating the public until the end of December. It takes time to build the infrastructure and acquire everything you need to mass produce stuff. It looks to me like everyone took about the same amount of time and reached it at the end of the year. Maybe you have some special knowledge about Pfizer that suggests they could have been done sooner than anyone else? I am pretty sure Russia, China, India, etc were not worried about FDA rules so why didnt they have vaccinations sooner?

Finally, after a slow start, we were supply constrained in our vaccination efforts early on. Building as fast as they could the vaccine companies couldn’t meet demand.

4) The excess death counts are doing yeoman’s work. In the counties that are not counting covid deaths they have a lot of essentially unaccounted for deaths. Heart failure just doesnt get it.

5) Alexander is a psychiatrist. He orders fluvoxamine frequently. The rest of us do not. I thought dirty was an odd word choice. Weird is how I would describe it. I would bet he would feel the same if we found that lasix is good for depression. That said he is a good writer. I sometimes cringe when he write about real medicine rather than psychiatry but he tries.

Merry Christmas!

Steve

25. December 2021 at 06:25

Easy to get a booster shot. Hard to shake off a covid-19 infection.

25. December 2021 at 06:48

What’s the turnover ratio for currency? Is it the same as DDs? Apply the function.

25. December 2021 at 06:53

Sumner will go to his grave advocating N-gDp targeting. That’s without regard for the composition of N-gDp. Sumner doesn’t know a credit from a debit, just like his brethren.

You simply can’t say, as for example Selgin and Thornton do, that banks are intermediary financial institutions. That would mean that banks don’t create money. That’s not an ipsedixitism.

25. December 2021 at 07:01

You increase real wages through productivity, by putting savings back to work, or through Net Domestic Investment/GDP (which has been in the decline over the last 40 years – peaking at 1.4 in 1950 and falling to .04 in 2021).

25. December 2021 at 07:47

“If I thought we could sustainably run the economy in a red-hot way, that would be a wonderful thing, but the consequence — and this is the excruciating lesson we learned in the 1970s — of an overheating economy is not merely elevated inflation, but constantly rising inflation,” Harvard’s Larry Summers said. “That’s why my fear is that we are already reaching a point where it will be challenging to reduce inflation without giving rise to recession.”

Summers is wrong. Secular stagnation is a deceleration in money velocity.

25. December 2021 at 07:50

William, I certainly don’t think it’s the only factor.

Steve, Good comment. We also should have put much more effort into building up vaccine supplies quickly. And then there’s the testing fiasco. And the mask shortage fiasco. And the stupid decision to pull J&J due to a phony health care. And the AstraZeneca hysteria.

We shot ourselves in the foot in so many different ways.

25. December 2021 at 09:40

Reading your blog is an important part of my celebration of Christmas (and many other days).

25. December 2021 at 09:47

Brandon B. wrote: “Every wave has peaked about a weak after a state of emergency is declared. The measures aren’t that strong (restaurants close at 8, serving alcohol is prohibited), but voluntary compliance with social distancing is pretty high.”

This isn’t correct. Covid cases in Japan were already falling by the time Japan made its non-lockdown state of emergency declaration in April 2020. The same thing happened again last winter.

There is a headline from July 30 about Japan: “Residents have largely returned to the streets of Tokyo amid a surge in infection as Olympics remain closely controlled.”

25. December 2021 at 09:52

Sumner: “But the article also discusses the issue of why East Asian countries like Japan and South Korea have had low rates of Covid throughout the pandemic, an issue which clearly does relate to mask wearing. (Although In South Korea testing is also a factor.)”

Scott forgot to explain why with that great South Korean testing and universal mask use it has seen Covid cases shoot up since summer and accelerate from November where the recent high is 6 times higher than the peak last year.

25. December 2021 at 10:08

Steve, everything you said in (5) supports what Alexander said. He’s not saying he’s better than you. He’s saying there’s a general pattern of thought/behavior that applies to most everyone. Half the piece is about how it applies to himself.

25. December 2021 at 10:55

Scott, thank you for this bad blog. It provides an important safe space for those of us who are intimidated by the brutality of the comments thread at Marginal Revolution. Your posts are also good.

I encourage you to watch Die Hard–to remember the genius of Alan Rickman.

Or Zardoz–for Sean Connery

And the pop-up ad for getting to these comments is for the National Review—a joke of sorts?

25. December 2021 at 15:04

Merry Christmas, Scott!

In the spirit of Christmas and random thoughts, I have been eagerly waiting for your opinion on The Green Knight. I think I understand the overall theme, but I’m not sure all the episodes actually hang together.

On a related note, are there any current film critics you respect? Outside of your quarterly posts, I don’t know where to find insightful thoughts on difficult films.

25. December 2021 at 17:08

Merry Christmas, Scott.

25. December 2021 at 17:15

Merry Christmas, Scott. (I didn’t mean to send this comment twice.) Your bad blog and book, which I’m still slowly working through, are helping me stay sane out here in the family gathering.

25. December 2021 at 20:57

Merry Christmas everyone.

Todd, You said:

“Scott forgot to explain . . . ”

Aren’t the newer variants more contagious?

David. I actually saw Zardoz when it came out, roughly 100 years ago.

My New Year’s resolution is to get rid of ads.

Tom, Never heard of that film. I used to like the Village Voice critic (Hoberman?), but I think he retired.

25. December 2021 at 23:54

So a photographer in Japan takes a photo of a few people, the photo is printed in a newspaper, and Sumner declares masks are effective?????

Almost every reputable study shows masks are ineffective.

Colombians don’t wear masks. Current case count in Colombia is about 2,000.

You also say “we did so many things wrong”. Who is “we”. I’m not a “we”. I’m and individual. And the last thing the world needs is more totalitarian apparatchiks determining what is best for “we”.

But please keep publishing moronic, illogical posts.

And if you are not celebrating Christmas, you should.

Christmas is about love & virtue, respect and morality. Something you clearly need help with!

26. December 2021 at 00:06

Ah yes, the Sumner with nothing to do on Christmas but rant and rave.

I was wondering where the bitter Mr. Scrooge had gone!

Your post is baffling, mostly because it fails to follow the data. First of all, almost every publication in lancet now shows that the vaccine has very little efficacy.

Secondly, Pfizer has a history of producing products that kill people. They had to SETTLE a billion dollar lawsuit recently. If any company needs more scrutiny, it’s pfizer. They certainly don’t need less. Nobody settles for 1B unless they are guilty.

Thirdly, many people have died from the vaccine. In fact, more people have died from this vaccine than all others combined. And finally, there is ongoing debate over whether mass vaccinations lead to variants. Most people who have gotten Omicron are vaccinated, not unvaccinated. This fits in line with several theories, one of which is being propogated by Peter McCulluogh, the most published cardiologist in America.

But after all of this evidence, you want the FDA to move faster? You do realize that vaccines typically take 10 years, right? So not only do you want them to move faster, which means we don’t know what the long term side effects may be, but you also want them to mandate it.

It sounds like you are trying to kill people.

Not smart. Unless of course, you are getting a kickback from Pfizer. Then, your post does makes sense.

26. December 2021 at 00:18

Your biggest mistake was banning zinc, hydroxocloriquine, and ivermectin. Ivermectin has been used in India, Thailand and Japan successfully, which is why there are very few deaths.

Of course, no pharmaceutical wants you to use a cheap drug like ivermectin, when they can make billions from their vaccine.

And why do you blindly trust the FDA and Pfizer. WTF is wrong with Americans and Europeans today? You used to fight against centralized actors, whether they were the old oil & steel barrons, or Mao and Stalin. Now you suddenly place all of this faith in government and big business. Historically, that is a terrible idea. Pfizer doesn’t care about you. They will pay millions to politicians to ban any other drug that is cheaper and effective.

A man in Virginia recently recovered after a judge forced the hospital to give him Ivermectin. Many have died while hospitals refused. One hospital in Wisconisn actually had the audictity to appeal after the judges ruling. The woman died, unecessarily, because of that appeal.

And btw, we also don’t wear Masks much in Thailand. We only have about 1500 to 3000 cases a day.

26. December 2021 at 00:23

I’m not taking the vaccine you totalitarian thug communist prick.

Someone shoot this communist before he tries to restrain and old woman on the road, and force inject her with shit particles.

FUCK YOU SCOTT COMMIE SUMNER! FUCK YOU!

INJECT YOURSELF WITH SHIT PARTICLES. STAY AWAY FROM MY KID COMMIE

26. December 2021 at 01:18

I’m just wondering if our dictator Scott Sumner will at least include the vaccine details so that we can read it. Can we also please get the trial data from the FDA, preferably faster than the 50 years they asked for?

Or has our dictator Sumner outlawed reading too.

https://www.newswars.com/pharmacist-shocked-to-discover-vaccine-inserts-are-blank-i-shouldnt-be-giving-these-out/

26. December 2021 at 01:29

Dr. Jessica Rose coauthored a paper with Peter McCullough showing a 19x risk of myocarditis. It also shows that the spike protein circulates throughout the blood and accumulates in varies organs, including the ovaries.

This is obviously detrimental to woman’s reproductive health. The full implications are unkown, but the more data we get from the FDA (slow release) and the more we study the effects of the spike protein, the more negative things we find.

Sumner is clearly “pro vaccine”. If the vaccine killed 500,000 people, he would still promote it. Either he’s being paid, or he cannot read the data, but either way I wouldn’t rush into it.

It’s better to wait for all the data to emerge, before you take the vaccine. And any government that attempts to coerce you ought to be viewed with a critical eye. The lockstep conformity to destroy economies and enforce mandates – all for a disease with a 1% fatality rate – indicates that there are “other motives”.

26. December 2021 at 02:46

‘Reputation’ ‘on the line’?

“The data shows no reduction in covid or death”

The last American vagabond video at 27:57.

28:00 These spike proteins cross the blood brain barrier. . . . They have prion disease effects. We are going to see this in about a year and a half.

39:50: the outcomes of these prion diseases. The data shows that it is a problem for both {the virus and particular the vaccine}

42:00: We don’t have any major data that shows Ivermectin or ????????? ‘works’. ?

https://www.flemingmethod.com/select-videos

26. December 2021 at 05:53

Don’t know why South Korea is having a surge (Omicron?) but if you look at it on a per capita basis their record highs now would be considered a very good day in the US.

Steve

26. December 2021 at 05:56

Flu immunization also has side effects.

26. December 2021 at 06:56

Steve wrote: “Don’t know why South Korea is having a surge (Omicron?) but if you look at it on a per capita basis their record highs now would be considered a very good day in the US.”

This has nothing to do with Omicron.

Obviously masks and/or test and trace started to lose some effectiveness in Korea from early July, only for some mix of that decline to reduce even further in the fall so that cases have maybe peaked at 7 times what they were last winter.

Covid deaths are 3 times as high as the peak this past early January.

Meanwhile in Sweden, Covid deaths are 25 times lower than they were last winter, which is why the media again ignores it.

26. December 2021 at 07:27

re: “We are going to see this in about a year and a half”

No, the evidence shows that the long-term effects show up immediately in the short-term. You already know what the long-term effects will be. You just read the bad data.

26. December 2021 at 08:08

I’ve been a reader of your posts for over a decade and still appreciate them. Even though I stopped commenting years ago. From a fellow former Madisonian, Merry Christmas Scott!

26. December 2021 at 08:56

Steve, Yeah, people like Todd focus on current trends, ignoring the vast difference in cumulative deaths.

Philip, Thanks. Merry Christmas.

26. December 2021 at 10:34

“Steve, Yeah, people like Todd focus on current trends, ignoring the vast difference in cumulative deaths.”

OK, I laughed.

I just compared what is going on now in South Korea with respect to a year ago. Looks like a long term view to me.

I also feel I’m one of the very few Americans who is interested in what has been happening between Japan and the U.S./U.K and Japan and South Korea whereas, Scott and MSM have said almost nothing on Japan for 18 months.

26. December 2021 at 13:00

Scott Alexander is an impressive blogger but speaking of impressive, can somebody please explain Ross Douthat? Is there a disconnect from how smart he sounds in a podcast and his writing? Does Douthat have fans among conservatives or are they pretending to notice him? How can people find it interesting that a conservative sees decadence when that is exactly what we already expect? I do not have the patience for his writing so may be somebody can help me appreciate him by directing me to some sort of dispassionate review or “dummies’ guide” or withering critique, please?

26. December 2021 at 13:08

Brian, Douthat is a great writer and an astute observer of society. I don’t agree with him on lots of issues, but I can see that he’s a very impressive intellectual.

Different intellectuals have different strengths and weaknesses. Douthat’s strength is his writing. Robin Hanson’s greatest strength, in contrast, is his (out of the box) ideas.

26. December 2021 at 14:12

“For a detailed technical description of this you can read through Seneff’s paper, but the take-home message is that COVID-19 shots are instruction sets for your body to make a toxic protein that will eventually wind up concentrated in your spleen, from where prion-like protein instructions will be sent out, radically increasing your risk of developing neurodegenerative diseases.” ?

https://articles.mercola.com/sites/articles/archive/2021/12/20/unintended-consequences-of-mrna-vaccines.aspx?ui=16be86d4b60cd177bee965d048abec76b7a1010e6e8d073904424fe5a5f7374c&sd=20211214&cid_source=dnl&cid_medium=email&cid_content=art1HL&cid=20211220&mid=DM1070516&rid=1355755587

26. December 2021 at 14:19

The non existent ‘long term evidence’ shows!!!

26. December 2021 at 19:48

Scott Sumner and his big pharma buddies just killed another kid.

https://www.newswars.com/the-new-normal-investigation-launched-after-three-year-old-girl-dies-from-cardiac-arrest-one-day-after-receiving-covid-19-injection/

26. December 2021 at 20:08

Postkey, Well that certainly looks like a reputable website!

26. December 2021 at 20:34

“A lie told often enough becomes the Truth” – Vladmir Lenin. Based on Sumner’s writings, I presume he subsribes to the same view.

https://www.cidrap.umn.edu/news-perspective/2020/04/commentary-masks-all-covid-19-not-based-sound-data

This of course is not the only study, there are a two from Oxford as well. And the type of mask you wear clearly matters. But this article is a good summary.

It’s a shame that leftward thugs threatened the scientists who wrote it: requesting they “take it down” because it didn’t subsribe to their narrative.

But at this point nobody is surprised. All I can say is that Texas is not going to go willingly. You can try your neo-marxist experiment on the failed states of NYC and CA. You’ll have to rip freedom from our cold dead fingers in Texas.

27. December 2021 at 00:42

This summarizes the lefts radical wokism.

https://twitter.com/tedcruz/status/1475356672122101763

Elizabeth Warren is so โง่. Translation: stupid!

Seems to be a common disability in America these days. I can’t remember the last time I met a smart American. Although, Ted Cruz seems like a real stud. I’d love to meet him. Not the hippes that come to my country. Please leave! lol.

27. December 2021 at 02:00

Play the wo/man, not the ball?

27. December 2021 at 05:20

re: “The non existent ‘long term evidence’ shows!!!”

The facts show that long-term effects show up immediately. It’s not like you study the literature. My “old man” is 98. He was Alpha Omega Alpha in Med School. He’s an endocrinologist. Was on the Board of the American College of Sports Medicine… He studies the literature.

27. December 2021 at 05:34

Larry Summers: “There are no examples of successful inflationary policy that has worked out to the benefit of workers,” he said, citing historical efforts in the U.K. and U.S. in the 1970s, along with similar campaigns in Latin America. “It backfired with respect to the very people it was trying to help.”

“But as it turns out, Summers’ predictions that inflation would run hotter than 5% by the end of 2021 were conservative.”

Not that Summers is “all that”.

“The ARRC interim report served to highlight just how dominant GSEs are in the Fed Funds market – over 90% of trades involve a GSE lending cash” — So much for the 2 trillion dollars in O/N RRPs

Peter Stella: “In the October 2016 survey, consumers reported using cash for 7.9 percent of their payments by value. Applying that percentage to 2016 US data on personal consumption expenditures yields about $1 trillion in cash payments made during that year (5.4 percent of US GDP)”

https://www.centralbankarchaeology.com/post/money-velocity-much-ado-about-nothing

There are only two deposit classifications that have much turnover.

27. December 2021 at 07:40

Hard to read your trolls Scott, but how much of this do you think is sheer innumeracy? I probably have some idiosyncrasies in how I look at data but do have some formal training and decades of experience, plus we raised a kid who became a math major so numbers are part of what I do and live with. But then I read people here, and all over the place really, who think that one or two case reports of something is actual proof positive of something. It’s so common I think it is way beyond trolling and they actually believe it. As Alexander pointed out in his follow up lots of people really believe that the quality of studies is unimportant. You just count up the number of studies for or against some outcome and the one with the most studies wins.

Steve

27. December 2021 at 08:00

Scott,

Happy holidays.

I’ll limit my comments to saying that TikTok is very cool. Got on the app initially just to see what my kids are seeing. I still spend about an hour a week on it, because there is a lot of interesting a creative content. And it doesn’t have the annoying social network aspect of the the other apps. Highly recommend.

On the other hand, I tried to get on snapchat and it is so confusing. I am terrified that if I push a button and send a picture of my dumb face to everyone in my daughter’s high school. But, I think the reasons that kids like it are a positive sign. No liking. No history. No long term accountability for you what you say. All good things in my view.

27. December 2021 at 08:14

I’m not sure what weight to give Ed West’s theory that the motivation for banning homosexuality 200 years ago and for woke anti-racism today are the same: sanctimony. I suspect that the quantity of sanctimoniousness was consistent but something changed to remove a constraint on its public expression in the two eras, the weakening of a powerful group believed to have practiced the “unclean” behavior.

27. December 2021 at 09:44

Steve: “…plus we raised a kid who became a math major so numbers are part of what I do and live with.”

I didn’t raise a kid who became a math major, but I *was* a math and and physics major.

27. December 2021 at 10:21

Todd K- So was my son actually, plus a computer science minor. I didnt think that many people dual majored in those two but maybe it is more than I thought. Maybe i can find a study on this we can argue about! I started as a physics major as an undergrad but quickly changed to biology since I was working 60 hours a week to support family. Easy to do with biology but not so much physics.

Trust you saw this? Math part is good but cant decide between the safety one or evil one actually being better.

https://twitter.com/benorlin/status/1435638786172637187?lang=en

Steve

27. December 2021 at 15:12

Steve,

I think physics and math along with computer science and math were pretty common double majors – or at least not uncommon – 30 years ago. I briefly (15 crazy minutes) thought of adding a comp sci minor.

28. December 2021 at 04:10

Which ‘facts’?

28. December 2021 at 04:10

re; “But then I read people here, and all over the place really, who think that one or two case reports of something is actual proof positive of something”

Some people “march to a different drummer”. Some people can see for “miles and miles”. If you need the validation of others, then you aren’t very smart.

Sumner rarely uses numbers. That makes him a Teflon man.

To begin with, the monetary base [sic] has never been a “base” (money multiplier), for the expansion of new money and credit. Flawed as the AMBLR figure is (Adjusted Member Bank Legal Reserves), it was superior to the Domestic Adjusted Monetary Base (DAMB) figure, which is generally cited.

The DAMB figure included AMBLR (interbank demand deposits held at one of the 12 District Reserve banks, owned by the member banks, as well as “applied” vault cash, traditionally -> ”prudential” or a part of a bank’s liquidity reserve balances before 1959), plus the volume of currency held by the private-sector’s non-bank public (Nobel Laureate Dr. Milton Friedman’s misnomer: “high powered money”).

Any expansion or contraction of DAMB is neither proof that the Market Group’s “trading desk” intends to follow an expansive, nor a contractive monetary policy (adding or draining interbank demand deposits, IBDDs). Furthermore, any expansion of the non-bank public’s holdings of currency, the “cash-drain” factor, merely changes the composition (but not the total volume) of the money stock. There is a shift out of demand deposits, NOW or ATS accounts, into currency. But this shifting does reduce member bank reserves by an equal, or approximately equal, amount.

In other words, we have a “managed” currency system, not a “fiat” one. In a fiat system the volume of currency issued is dictated by the deficit-financing requirements of the issuing government (like the Civil War Greenback). Whereas in a managed-currency system (ours), the volume of currency in circulation is impersonally determined by the public, and the amount which meets the needs of trade.

The basic process by which currency is put into and taken out of circulation is through the banking system. The volume of currency held by the public needs no formal or specific regulation since it is impossible for the public to acquire more of a given type of currency (or even less given current operating policies), without giving up other types of currency, or else bank deposits. In other words, under our managed system it is impossible for the public to add to the total money supply consequent to increasing its holdings of currency.

An expansion of the public’s holdings of currency will cause a multiple contraction of bank credit and “total checkable deposits” (relative to the increase in currency outflows from the banks) ceteris paribus. To avoid such a contraction the desk typically offsets currency withdrawals with open market operations of the buying type (e.g., purchases of government securities for the portfolios of the Reserve Banks, an increase in the Central Bank’s System Open Market Account, SOMA).

The reverse is true if there is a return flow of currency to the banks. Since the trend of the non-bank public’s holdings of currency is up (ever since 1930), return flows are purely seasonal & cannot therefore provide a permanent basis for bank credit and money expansion.

And all currency gets into circulation, directly or indirectly, through the liquidation of time deposits, by the cashing of demand deposits. There is one exception in demand deposit creation; those historical instances when the U.S. Treasury borrowed from the Federal Reserve Banks (its prior, and given sequestration, too-long since abandoned “overdraft privilege”). However, it cannot be said (as of time-savings deposits), that increases in the public’s holdings of currency reflect prior commercial bank credit creation.

It is more appropriate to say that expansions of currency are accompanied by concurrent expansions of Reserve Bank Credit (Manna from Heaven).

28. December 2021 at 04:15

Some ‘facts’?

“67:38 uh with the deaths of 95 of those mice

67:41 occurring

67:42 in two weeks which is a year and a half

67:43 for humans

67:45 and uh now the recent uh macaques

67:48 paper that shows the lewis bodies for

67:51 parkinsonian

67:52 and other types of neurologic

67:53 abnormalities showing up

67:56 from the transmission of these spike

67:57 proteins”

https://www.youtube.com/watch?v=ZJ0MYmKY8_U

28. December 2021 at 06:04

Steve, People believe what they want to believe.

bb, Thanks, but I’m too old to learn that stuff.

28. December 2021 at 19:00

“Right under the headline is a photo of a crowded street in Tokyo, where everyone is wearing a mask. Further down in the story is a photo of London, where almost no one is wearing a mask. Hmmm. ”

It’s called propaganda. It’s nuance conditioning. The whole point is to convince you that Londoners are horrible, terrifying brutes for not doing exactly what they are told, when they are told. They want to convince you that the west needs to change it’s concept of liberty. You could take 1000 random pictures in London, and in 900 of them you’d see the majority of people wearing masks.

CNN doesn’t spend 24 hours covering white people who die at the hands of police officers (happens more than blacks). They don’t cover young white children shot for branding a toy weapon (only black children). And they will never mention anyone who has ever died from the vaccine. To do so, would be to break with narrative. Btw, 2M have crossed the border illegally in 2021. CNN airtime: 0 minutes.

You are a bit obtuse sometimes, Scott.

28. December 2021 at 19:54

Craig, When a new commenter comes on here with this sort of silly post, I can only shake my head. CNN?? That’s all you got?

Enjoy your epistemic bubble.

29. December 2021 at 03:51

The FED has surreptitiously tightened monetary policy:

Increase over previous 4 months;

02/1/2021 ,,,,, 1140.1

03/1/2021 ,,,,, 1335.0

04/1/2021 ,,,,, 1096.5

05/1/2021 ,,,,, 681.5

06/1/2021 ,,,,, 928.9

07/1/2021 ,,,,, 901.9

08/1/2021 ,,,,, 738.6

09/1/2021 ,,,,, 672.6

10/1/2021 ,,,,, 614.3

11/1/2021 ,,,,, 410.5

12/1/2021 ,,,,,

29. December 2021 at 07:12

Little thug boy scott sumner is trying to kill us all, so corrupt Pfizer & the CCP will continue sending him checks.

https://www.newswars.com/rand-paul-thousands-dying-due-to-fauci-pushing-vaccines-wednesday-live/

29. December 2021 at 11:31

@Spencer:

It’s hardly surreptitious. They have been very vocal about how they are now tightening.

29. December 2021 at 14:11

Scott,

1. At the onset of the pandemic (when Japan initially had higher case rates), mask usage was around 40% so there were 15 million daily unmasked riders a day on Tokyo subways and trains (out of 25 million riders.) In NYC, there were 6 million daily riders. Covid transmission was 10 or 20x higher in NYC.

2. Bars and restaurants have been packed in Tokyo (except during the periods when emergency restrictions were in place.) No one wears masks in Japanese bars and restaurants.

3. Out of doors Covid transmission is very rare.

4. Transmission in Japan jumped when delta became prevalent and is now showing an upward trend with Omicron. Some variants are more transmissible than others, but in all cases, the transmissibility of each variant has been at least an order of magnitude lower in Japan than in the U.S.

5. Covid vaccinations in Japan were 6 months behind vaccinations in the U.S.

6. Masks have a very minor impact on transmission.

7. There is a very strong negative correlation between universal childhood BCG vaccination programs and Covid transmission rates.

29. December 2021 at 15:46

Japan has been both one of the most interesting countries with respect to the pandemic and by far the least reported on in the msm. Gee, wonder why. There was almost a religious view that South Korea Covid deaths were much lower than most countries in the West because of some great test and trace program despite that can’t work well once a rapidly transmitting respiratory virus is everywhere. There was no mention of why Japan’s Covid deaths were also very low compared to most of the West despite much lower test and trace there.

At the end of 2020, Japan had 1.5 times more Covid deaths per capita than South Korea and today has had 1.4 times more Covid deaths per capita than South Korea.

30. December 2021 at 01:45

Sumner’s fascists are on the move again.

https://www.scmp.com/news/hong-kong/law-and-crime/article/3161304/hong-kong-prosecutors-hit-tycoon-jimmy-lai-6-former

The last hope for freedom lovers is eastern europe, and the 1B democracy in India. The rest have either fallen, or on the verge of collapse.

30. December 2021 at 06:05

@msgkings

It seems like one big experiment. Money has a “sweet spot”, but velocity has an interminable one (i.e., non-neutrality).

30. December 2021 at 06:38

Real interest rates (nominal minus inflation) are determined by the savings-investment imbalance. It’s the division between money products and savings’ products. An increase in savings products will increase the real rate of interest, e.g., the reduction in FDIC insurance from unlimited to $250,000 in Dec. 2012 (which produced the “Taper Tantrum”).

30. December 2021 at 06:47

https://new-wayland.com/blog/interest-price-spiral/

Black-Scholes option pricing equation also contains the risk free rate… where the option price increases with an increase in the risk free rate… risk free rate is in the numerator…

Which should be enough for the economorons right there as if the right to buy a product INCREASES with an increase in the risk free rate that implies the price of the underlying went UP…. and your option to buy the product has increased in value from when you bought it at the previous lower risk free rate…

Yet how many of these monetarist morons probably rely on the Black-Scholes yet AT THE SAME TIME would say “hey! Fed has to increase rates to fight inflation!” ?

Probably all of them…

the cost of credit is incorporated into the cost of all goods and services

30. December 2021 at 06:52

The Myth

The standard line is this from the Bank of England

when we raise Bank Rate, banks will usually increase how much they charge on loans and the interest they offer on savings. This tends to discourage businesses from taking out loans to finance investment, and to encourage people to save rather than spend.

Like all propaganda The Myth sounds very reasonable at first glance. However even a cursory institutional analysis reveals a glaring problem. MMT shows us that The Myth is not compatible with how banks work. Loans create deposits. So if there are fewer loans then there will be fewer deposits. For you to save financially, there has to be a corresponding outstanding loan somewhere.

That’s not a matter of opinion. That’s a matter of accounting fact. Even the Bank of England Agrees.

Overall if loans go down, financial savings must go down by exactly the same amount.

If you want the stock of bank loans to come down, while the stock of bank deposits goes up, then, unfortunately, reality won’t let you do that.

The Myth expects people, faced with increasing prices and who haven’t the wage income to meet daily needs, to suddenly start spending less and saving more, solely because interest rates have changed. Yet, when you look at it from the MMT point of view, it is clear, both institutionally and systemically, that it is an extremely unlikely proposition.

30. December 2021 at 08:40

dtoh, I used to have some sympathy for the BCG idea, but when death rates in places like South America and Portugal started soaring I basically lost all interest in that theory. I just doesn’t hold up.

Kester, Still peddling the MMT snakeoil?

“Loans create deposits”

LOL. It’s a simultaneous system.

30. December 2021 at 09:48

Really bad joke. You still don’t know a credit from a debit.

Banks don’t lend deposits. Deposits are the result of lending.

Japan’s M2 velocity is .458. The US M2 velocity is 1.115.

We will be turning Japanese.

31. December 2021 at 02:48

Scott,

So how do you explain the fact that based on the most recent data (i.e. as of December 30), BCG countries have a per capita case rate that is 50% of and a fatality rate that is 56% of countries without BCG programs.

Also I don’t know why you are cherry picking Portugal when it has always been an outlier even in the initial studies (probably because it’s BCG vax program was nowhere near universal…only 32%.)

31. December 2021 at 05:12

https://www.newswars.com/germany-govt-reports-96-of-omicron-cases-are-among-fully-vaccinated-4-are-unvaccinated/

Very interesting that 96% of all Omicron cases are from the vaccinated. The establishment – and mainly pharmaceuticals – went into propaganda overdrive when Geert Vanden Bossche warned that mass vaccination may lead to these types of variants….

He appears to be right.

31. December 2021 at 11:25

Seen latest from Paul Krugman

https://twitter.com/paulkrugman/status/1476551183414312971

Price is how the market rations supply. The correct approach to price rises is always to increase supply. Where you can’t increase supply, then you ration supply directly on a quantity basis.

Controlling price encourages hoarding. It’s completely the wrong end.

The problem is that economists are obsessed with prices and can’t see past it to the root cause of the problem – insufficient stuff available.

It’s good to see Krugman getting half the answer. When he discovers anti-trust and increasing competition in markets that put prices up he’ll have truly opened his eyes.

31. December 2021 at 15:48

– Well, it took a long time but finally here is the first MAJOR sign of the deflation of the australian housing bubble. The 25 year bull run in the australian housing market is/seems to be over. And the australian economy is going to suffer under those falling real estate prices.

(One Scott Sumner doesn’t believe in bubbles, right ??)

31. December 2021 at 16:53

Scott:

Happy new year. I am going through your book and it’s taking me a while because I am trying to understand the concept, then reflect whether it’s true based on my experience and how it might differ from conventional wisdom. The concepts are opening new worlds even though I have followed the blog regularly. The idea that economic growth is deflationary hasn’t been mentioned elsewhere and is mind blowing. My biggest take away is to see monetary policy as part of tool kit that gets the economy to the desired state but often mis-used and mis-understood.

31. December 2021 at 17:43

Happy new year, Scott.

What I saw on TikTok was appalling. Its incredible triviality and irrelevance is hard to believe. It is the zenith of stupidity.

Not to mention that anything that could offend the big pink fragile panda is censored. And the big fragile panda is offended by everything.

Malaysian singer Namewee recently nailed it:

https://www.youtube.com/watch?v=-Rp7UPbhErE

31. December 2021 at 18:04

dtoh, When you first presented that idea in this comment section, you pointed to lots of Western countries with the BCG vaccine that had far lower Covid fatality rates than those without. Now those countries have very high fatality rates, and you tell me that they don’t count because they never used the BSG vaccine in large quantity? Then why did you cite them?

Sure, Asian countries have lower fatality rates, but it could be any number of factors.

Willy2. LOL. Once a year for at least a decade you’ve informed me that the Australian housing “bubble” has finally popped. Each time you’ve been wrong. Nice to see you making another prediction before the end of 2021. Keep up the good work!!

LC, Thanks for reading it. Of course economic growth is only deflationary holding M constant.

Christian, I’ve never seen TikTok, and I don’t favor banning “appalling” things.

1. January 2022 at 01:49

(I knew one S. Sumner would take the bait)

– Agree. I have been wrong many times. But this time I can back up this claim with data.

– Did one Scott Sumner never read the work of an american economist called Harry S. Dent ? This person lays out the relationship between demographic developments (think: Baby Boomers) and the economy.

– One can say that the australian real estate market peaked (already) in early 2018. In both 2018 & 2019 home prices went down. – But in 2020 & 2021 home prices started to go higher again. However, this was limited to the socalled “high end of the market(s)” and especially in the largest australian cities. Other parts of the australian housing market(s) didn’t recover or didn’t recover not nearly as much.

– Right now the REAL kicker is that now even those high end parts of the real estate markets have seen a big surge in the amount of houses up for sale, a sharp rise in listings. But following the (keynesian) law of demand and supply this has led to price reductions of up to 10% in (about) 6 months time. 10% down in 6 months time = Confirmation of a bubble !!!

1. January 2022 at 06:45

Willy2: You have to have a decline in money flows for housing to retreat, aka, the S&L crisis, GFC, etc. I.e., it has been driven by disintermediation of the nonbanks.

1. January 2022 at 06:49

RRPs drain reserves (and certain broad classifications of the money stock, as 90% of the counterparties are nonbanks, e.g., GSEs, MMMFs). This draining is not acknowledged by the FED’s statisticians. It is surreptitious. On the one hand reserves are reduced, but not the money stock figures, e.g., just like the reporting of large CDs over $100,000 are excluded.

But the O/N RRP administered rate, sets an effective floor on the fed funds rate (earning interest on excess cash). MMFs account for almost all ON RRP take-up.

https://www.federalreserve.gov/econresdata/feds/2015/files/2015010pap.pdf

Note that on March 17, 2021, the FOMC increased the counterparty limit to $80 billion. And 2 days later, interest rates peaked.

The draining of reserves reduced the growth of R-gDp in the 3rd qtr. of 2021 (from 6.7% to 2.3%). It supported the value of the US $. It capped oil prices.

During this same period (where the effective FFR stayed at 8%), SOFR stayed at 7%. OFR stayed at 5%, the IOR stayed at .15%. But the volume of O/N RRPs went to 2 trillion dollars.

As I said: “30 May 2021, 12:14 PM

“The “soak up” is self-reinforcing (self-regulating). Too much cash or too few securities (driving rates below zero at auctions), and financial institutions rush to the O/N RRP facility. The FED doesn’t have to do anything — and the excess liquidity is automatically drained by the private sector.”

1. January 2022 at 07:19

John Mason: “From September 1, 2021, to December 29, 2021, the Federal Reserve added $544.5 billion to the amount of securities it sold under an agreement to repurchase after a short period of time.

The amount of securities the Federal Reserve purchased outright during this same period of time: $464.0 billion.

That is, the Fed sold $80.5 billion more securities during this four-month period of time than it purchased!”

But that kept the effective FFR @ a steady 8%

1. January 2022 at 10:44

@ Spencer Brtadley Hall:

Quote:

“You have to have a decline in money flows for housing to retreat”

Correct. And that’s precsiely what’s happening in Australia. Those falling real estate prices are already signaling (good old fashioned keynesian Supply & Demand) that less money is flowing into the purchase of (in this case) australian real estate. This won’t lead to a crash tomorrow but this is sowing the seeds for a future crash (in 2022 ???).

Pile on top of that the ageging australian population (like here in the US) and it should be clear (think: retirements) that the real estate market is heading for trouble (both here in the US and in Australia).

1. January 2022 at 17:31

https://doctors4covidethics.org/publications/

This is a much more intelligent blog, without the pious self righteousness and gratituious ingratation towards Pharma, that is so common in Sumner’s posts.

2. January 2022 at 04:24

Sumner and Schwab, the two mega thugs behind the WEF’s “trusted news intitiative”, AKA the ministry of truth, just banned Dr. Malone from Twitter.

Take out the Sumtard, before he consolidates MNC tyranny against humanity.

2. January 2022 at 06:41

Willy2: Got it. In the US the policy makers have tried to shift the funding to bond-backed sources since the DIDMCA of March 31st 1980. That first caused the s&l crisis. Then the originate to distribute model. It’s reversed the savings-> investment process, financing to the GSEs, and not to the George Baileys of the world (a building and loan banker).

2. January 2022 at 07:30

“When the Desk conducts RRP open market operations, it sells securities held in the System Open Market Account (SOMA) to eligible RRP counterparties, with an agreement to buy the assets back on the RRP’s specified maturity date. This leaves the SOMA portfolio the same size, as securities sold temporarily under repurchase agreements continue to be shown as assets held by the SOMA in accordance with generally accepted accounting principles, but the transaction shifts some of the liabilities on the Federal Reserve’s balance sheet from deposits held by depository institutions (also known as bank reserves) to reverse repos while the transaction is outstanding.”

https://www.newyorkfed.org/markets/rrp_faq.html#:~:text=%20%20%20%20%20%20Overnight%20Reverse,%200.05%20percent%20%202%20more%20rows%20

IF they deduct for reserves, they should subtract for money.