Why does a measly quarter point matter?

I was recently discussing my new book with someone, and he asked why a small difference in the Fed’s target interest rates could have vast effects on the economy, such as the Great Recession. Most people don’t even pay any attention to the fed funds rate, so how could a small misalignment have much impact on aggregate demand?

I’d break this down into two parts. First, what is the actual transmission mechanism between Fed interest rate policy and the economy? And second, how does a change in Fed policy become known to the broader public? I’ll start with the first question.

There are three ways to think about the transmission mechanism between the fed funds target and aggregate demand:

1. Interest rates as an epiphenomenon

2. Interest rates as a signaling mechanism

3. The cumulative process

I will use the example of December 2007 (the beginning of the Great Recession) as an example to illustrate these three concepts. You need to keep in mind that these aren’t really three different transmission mechanisms; they are three ways of visualizing what’s going on.

In December 2007, the Fed cuts rates 1/4%, at a time when markets were hoping for a 1/2% cut. The stock market crashed on the news, ending up almost 5% lower than where it would have ended up with a half point cut (over 2% lower in absolute terms.)

I often argue that interest rates are an epiphenomenon, something that happens as a side effect when monetary policy changes, but not the core of the policy. The core policy is changes in the supply and demand for base money. One way to institute a tight money policy is slowing the growth rate of the monetary base, which is exactly what the Fed did in late 2007. Interest rates may rise or fall in response; it depends on the relative importance of the liquidity, income and Fisher effects. In late 2007, tight money reduced interest rates. The reason the smaller than expected rate cut of December 2007 hurt markets is that the economy needed a bigger monetary base, and if the Fed had given it a bigger monetary base then rates would have fallen a bit faster. The base was the actual problem; interest rates a side effect.

Monetary policy affects all sorts of asset prices. In many cases, such as December 2007, the effect on other assets is much greater than the effect on short-term interest rates. Interest rates aren’t a good indicator of changes in the stance of monetary policy.

That’s a sort of monetarist explanation of how a measly quarter point can matter so much. Now for a Keynesian explanation:

The December 2007 Fed decision was viewed as a policy signal. Even a quarter point rate cut can have a big effect if the markets see the rate cut as signaling important changes in the future path of monetary policy. By itself, overnight interest rates have almost no impact on the economy—what matters is longer-term interest rates and other asset prices. But the way the Fed adjusts a short-term rate can send a powerful signal about the likely future path of monetary policy.

Now for a Wicksellian explanation:

Suppose the policy rate equals the natural rate of interest. Now assume the policy rate is suddenly raised 1/4%. Or if you prefer, assume the natural interest rate falls 1/2% and the Fed only cuts the policy rate by 1/4%. In either case, the policy rate is 1/4% above the natural rate. So what’s the big problem?

The big problem is that this small disequilibrium sets in motion a cumulative process. It slows the economy slightly, which reduces the natural interest rate slightly. Now the policy rate is 1/2% above the natural rate. The economy slows further, and now the policy rate is 3/4% above the natural rate. Eventually the Fed will begin cutting the policy rate, but by this time the natural rate is falling rapidly.

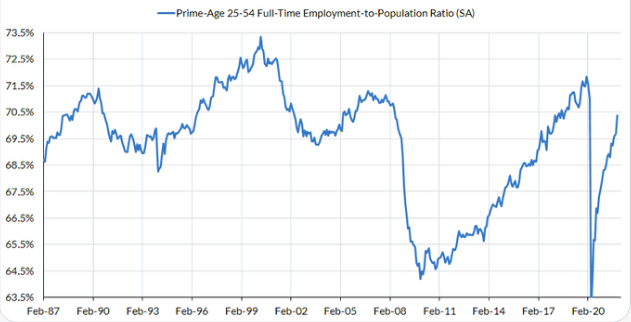

That’s the story of late 2007 and 2008. For instance, the Fed set the policy rate at 2% from late April to early October 2008. But during that period, the natural interest rate was falling sharply. How do we know this? Because NGDP growth was plunging dramatically lower. The Fed was behind the curve.

To most economists, the 2% policy rate did not seem like a big deal. But the financial markets became increasingly alarmed as it became apparent that this rate was too high to maintain adequate NGDP growth.

Again, all three of explanations are describing the same underlying transmission mechanism in different languages: monetarist, Keynesian and Wicksellian.

Now for the second part of the question. How does the broader public become aware of the policy change?

The public doesn’t direct observe monetary policy, but does observe the effect it has on informed observers in the financial markets. Upper middle class people spend less because their stocks go down. Working class people spend less because they lose a job building a commercial development when the high yield bond market tanks. Etc., etc. There are a million transmission mechanisms to the broader public.

So in one sense interest rates matter hardly at all, they are an epiphenomenon. In another sense interest rates can have an impact far beyond what even a Keynesian economist would expect, if the Fed sets its target at the wrong level and sets in motion a cumulative process of depression or high inflation.