Bad intentions are not enough

Do we judge a president on what they try to do, or the results? In 2019, Trumpistas sidestepped the bad intentions with claims that “results are all that matters”. Today it’s just the opposite. We are told that results don’t matter at all; they are beyond the control of the president. America’s massive job loss, skyrocketing crime, falling life expectancy and loss of global prestige under Trump’s watch don’t matter—we judge Trump on what he was trying to do. In this post, I’ll judge him both ways.

Successes:

Tax simplification and reduced corporate tax rates. I’m not an expert on deregulation, but my sense is that there was beneficial deregulation in areas such as education and labor markets.

Operation Warp Speed

Got a few small countries to recognize Israel.

Neutral:

In other areas such as the environment and banking, the utility of deregulation is less clear. It may have helped in some cases for the usual reason that free market policies are generally best, and it may have made things worse in some cases due to externalities and moral hazard.

I view the Supreme Court picks as being no better or worse than Merrick Garland.

Illegal immigration increased during 2017-19, but that might be viewed as a success if you think illegal immigration is good.

Like Clinton and Obama, no major wars but bombed some countries now and then.

Replaced Yellen with Powell.

Failures:

Murder rate soared.

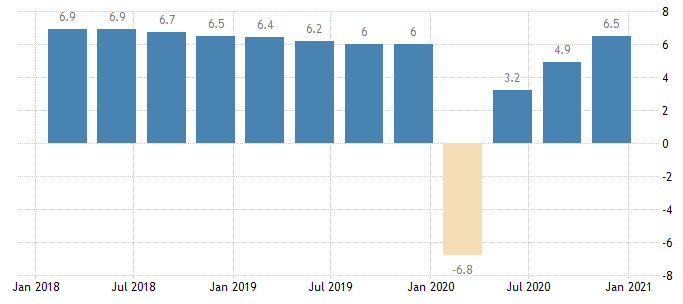

Millions of jobs lost.

Falling life expectancy.

Trade deficit got larger.

Border wall project botched.

Obamacare still intact.

Reckless fiscal policy even prior to Covid.

No leadership on Covid, frequently mocked those who worse masks and discouraged testing. Vaccine rollout botched.

Promoted “cancel culture”, encouraging NFL to fire protesting players. Advocated expanding the ability of politicians to launch libel suits again the media. Opposed Section 230 protections.

Praised despots who engaged in human rights violation, Most notably, encouraged Xi Jinping to put Uighurs into concentration camps.

Advocated torture. (Policy was not carried out, which gets at the intentions/results issue. How do we judge?)

Tried to abolish American democracy by having a mob pressure Congress to overturn 2020 election.

Repealed Cadillac tax on health insurance, an underrated policy failure. By itself, this one act more than offset the gains from all his deregulation combined. Perhaps Trump’s worst decision from a purely “utilitarian” perspective.

Turned to NIMBYism in final year in office.

Massive election year boost in wasteful farm subsidies.

Restricted H1-b visas. Fewer refugees accepted.

Semi-racist Muslim travel ban.

Told brown-skinned Congresswomen born in America to go back to their own country.

Ended Iran deal, causing Iran to restart nuclear program.

Tightened sanctions on Cuba, a policy that has failed for 60 years in a row.

Launched trade war with China that failed on all counts (economic and political.)

Replaced NAFTA with a worse NAFTA.

Engaged in lots of white nationalist rhetoric.

Transformed the Republican Party into a personality cult.

Demanded that government officials be personally loyal to him, even if it meant breaking the law.

Frequently had his officials direct government business to his properties.

Pressured Ukraine to damage his political opponent.

Frequently praised (and pardoned) US war criminals, excusing their behavior.

Engaged in scorched-earth policy after losing election, having his aides enact a raft of last minute policy changes solely aimed at sabotaging the next administration.

Engaged in almost non-stop lying, far beyond the norm in American politics.

Pardoned many criminals to avoid having them testify against him.

Ended his term with the lowest average approval rating in modern polling history. First president to be impeached twice. First president to have someone in his own party vote to convict him (and likely multiple people in the second trial.)

These are just off the top of my head. Who can remember everything that happened over 4 years?

I’m trying to be impartial here, so I won’t tip my hand as to any sort of overall appraisal. I’ll leave that decision to my readers.

What do you think?