This post is not about China

China reports its RGDP growth rates in several ways. There is quarterly data, which is reported in “year-over-year” terms. In contrast, the US reports quarterly growth rates over the previous quarter, which are then annualized by multiplying by roughly 4.

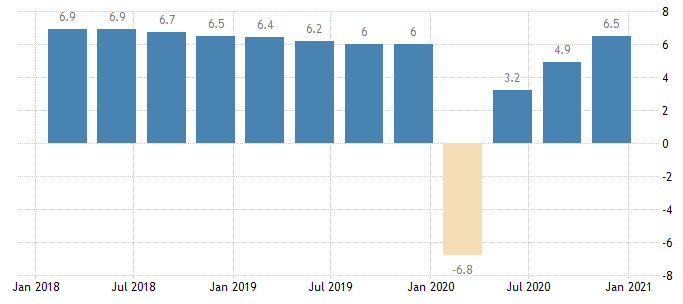

China also reports growth for the entire year, as compared to the previous year. In 2020, RGDP grew by 2.3% over 2019, whereas in 2020:Q4, the growth rate was 6.5% over 2019:Q4:

In the past, commenters always tell me the Chinese data is fake. I provide detailed explanations as to why the data should be taken seriously. Commenters then ignore my detailed explanations, and keep repeating the same claims. So I’m going to treat the Chinese data as being roughly accurate.

But this post is not about China. It’s about the US and Europe. Most experts seem to expect our RGDP to remain well below trend for years. But why? The vaccine is being distributed and the pandemic may be mostly over by mid-2021. So why won’t things go back to normal at that point?

I’ve been asking myself this question for the past 12 months. Am I crazy to think that an economy might be able to bounce back quickly from this sort of shock? Given that almost all the experts think I’m wrong, that seems likely.

But the Chinese figures give me a bit of hope for the US and Europe. China is not a small country like Iceland, where GDP figures bounce around randomly due to industry specific factors. It’s one of the three great economies of the world (along with the US and the eurozone.) Changes in China’s GDP reflect the decisions of more than a billion people, and hence are “statistically significant”. China didn’t just luck back to the previous trend line (actually about 0.5% above trend.) Maybe there is some reason that China can quickly bounce back and the US and Europe cannot. I may be missing something. I just don’t know what it is.

PS. Hong Kong stocks rose sharply on that “fake” Chinese GDP data.

Tags:

18. January 2021 at 11:51

When it comes to chinese statistics, there’s space between “completely made up” and “as good as western stats. What’s wrong with “heavily polished to make the CCP look good”?

18. January 2021 at 12:28

Scott,

You ask, “Am I crazy to think that an economy might be able to bounce back quickly from this sort of shock?”

I don’t think so. I think you’re right.

Here’s what I see as the problem: Biden and a Democratic Congress will implement many of the same kinds of anti-growth spending, tax, and regulatory programs that Obama did. Think of the points Casey Mulligan make in his book The Redistribution Recession.

18. January 2021 at 12:34

I assume that China didn’t hold back, out of fear of inflation, as the economy returned to “normal”. Democrats will hold the White House at least four years. I would expect the Republican inflationistas will be out in force, threatening not only the economy but the members of the Fed. This after Republicans passed tax and budget policies (before the pandemic) that produced budget deficits of a trillion dollars a year. During an expansion. Some things never change. We are doomed.

18. January 2021 at 12:37

I think those predicting a slow recovery are not appreciating that this is a supply-driven recession, unlike all previous recessions in the past 40 years. As soon as the hospitality sector can safely operate again, I predict demand will be booming.

Also, the market seems to be forecasting a rapid recovery. Isn’t the Hypermind NGDP market forecasting 2021 growth?

18. January 2021 at 13:29

I think one of the main differences between the US and China is that the US will have had to endure the pandemic for a year and a half, whereas China was locked down for a relatively short while.

We will have a snap back in economic activity (we already have, in fact, relative to 2020Q2), but probably not a full return to trend as we saw in China.

Where I live (a city small enough not to make it into the top 50 in the country), dozens of restaurants are permanently out of business. Generally speaking, I’ve heard news reports of large numbers of small businesses that have either failed or which were only barely hanging on months ago.

If I had to guess, if the virus disappeared today, by 2021Q2 GDP would at best return to 2019Q4 levels, and probably a little below that, with unemployment in the 5.5%-6.0% context. That would be a significant improvement vs. today as our 6.7% unemployment rate includes a pandemic-driven decline in the labor force of 4 million.

5.5%-6.0% is not terrible. Certainly not something which calls for $2 trillion in additional stimulus. But it will take several years of new business formation and expansion to get unemployment back below 4% again. Then again, with a proposed minimum wage of $15, it may be challenging for unemployment to fall below 5%.

18. January 2021 at 13:51

I think Tom is saying what Scott had been saying since the beginning of the Covid Virus. I was talked out of an implosion left tail possibility by Scott that Tyler Cowen had been hypothesizing at the time.

Historically, the political party in power has not been highly correlated with economic or market performance. I think that is because, for example, Nixon was very different than Reagan, and Clinton was very different than Obama.

But David makes the point that I worry about. It is about redistribution—and not merely from the better off to the worse off—but in both directions.

We still do not know how this will play out. In the 1990’s Hillary healthcare fiasco created the unexpected outcome of “new Democrat” Clinton teaming up with “Contract with America” Gingrich. They may have been the best “Speaker/ President” Combo in the last 50 years—even as each party hated with venom both of them.

Pelosi could have done that–she chose not to. Clinton chose to take credit for Gingrich’s best ideas—that ended up working well.

Trump and Pelosi could have still hated each other–but she went too far–so be it–it could have worked even with external hate and impeachment.

But Trump lost—Clinton was a better politician—and Gingrich imploded. I don’t know what this current crew is about—but it does not sound good.

18. January 2021 at 14:55

I could see the loss or impairment of a family member that provided child care for a working parent impeding the return of many to full time employment. There are plenty of people who will be dealing with long term health effects from COVID. It’s not just chronic fatigue and brain fog. People have had heart failure, strokes, vision loss, and limbs amputated. And we’re not talking about the elderly. This happened to plenty of prime working age adults.

And I know early in the pandemic you were negative about any sort of financial aid for airlines as they could always declare bankruptcy. But some of the pilots and mechanics whose employment was affected weren’t going to twiddle their thumbs until things returned to normal. So it wouldn’t surprise me if the airlines have a shortage in skilled staff when things return to normal. And I suspect the same will happen to other employers which were most heavily impacted by the pandemic and who employed some sort of highly skilled labor.

18. January 2021 at 15:57

Why did HK stocks rise in China GDP news? What info content is there that isn’t in things like PMI etc? I ask because it seems like US stocks aren’t very reactive to GDP announcements because of higher frequency data

18. January 2021 at 16:52

We must have different experts. The economists I follow expect a very quick rebound once the virus is under control. The emphasis has been “this is not 2008”. Or even “this is the opposite of 2008”.

18. January 2021 at 17:33

Of course it COULD. Just like it could have bounced back from the 2008 panic, but the Fed would have actually follow its mandate and markets to believe that it will continued to follow its mandate for that to happen. Right now the Fed is not even following the price stability mandate (TIPS 10 breakeven rate is only 2.1% CPI instead of 2.3%), much less the maximum employment mandate. A reduction in the full employment deficit, higher immigration (Hong Kong refugees?) and fewer trade restrictions would help.

18. January 2021 at 19:13

A few subjective evidence that might contribute to the strong rebound:

Personal:

1. Living in the city of Shenzhen, discretionary consumption is pretty strong since Summer 2020. Restaurants are packed with young people dining and shopping malls are so crowded that sometimes I worry about social distancing when someone is breathing to my neck.

2. Housing market is also red hot, money is once again flowing into the markets. The sales prices in major cities like Shenzhen, Guangzhou and Shanghai reached ATH.

Street talkings:

1. Some of the labor heavy industries saw lost orders coming back from India/Bangladesh as China was the only major economy with fully recovered supply chains. Thanks to the governments that are handing out coupons here in China and relief checks in the US/EU/JP, even the deserted factories are now seeing three shuffles a day to maximize the production.

So yes I think a strong rebound in the US/EU is almost inevitable, although I suspect that some of the jobs might be lost given the pandemic has reshaped the global supply chain in the short term.

18. January 2021 at 19:13

A few subjective evidence that might contribute to the strong rebound:

Personal:

1. Living in the city of Shenzhen, discretionary consumption is pretty strong since Summer 2020. Restaurants are packed with young people dining and shopping malls are so crowded that sometimes I worry about social distancing when someone is breathing to my neck.

2. Housing market is also red hot, money is once again flowing into the markets. The sales prices in major cities like Shenzhen, Guangzhou and Shanghai reached ATH.

Street talkings:

1. Some of the labor heavy industries saw lost orders coming back from India/Bangladesh as China was the only major economy with fully recovered supply chains. Thanks to the governments that are handing out coupons here in China and relief checks in the US/EU/JP, even the deserted factories are now seeing three shuffles a day to maximize the production.

So yes I think a strong rebound in the US/EU is almost inevitable, though I suspect that some of the jobs might be lost given the pandemic has reshaped the global supply chain in the short term.

18. January 2021 at 20:23

Cassander, I’ve already done many long posts on that topic. I’d be glad to respond to people that find flaws in my arguments.

David, I’m not persuaded by Mulligan’s claims. I think it was mostly tight money.

Tom, Yes, but Hypermind still is predicting a lower than normal level of NGDP at the end of 2022.

Justin, If people want to eat out, then restaurants will provide the service.

Michael, You said:

“Trump and Pelosi could have still hated each other–but she went too far”

Yeah, Trump didn’t go “too far”, it was Pelosi. LOL.

Gordon, Yes, to some extent. But I doubt that will have much effect in aggregate. Another factor is the lower rate of immigration.

Garrett, I’m not sure, but it seems like the Chinese GDP reports are accompanied by reports on industrial production, investment, retail sales, etc.

rwperu, That’s good to hear.

Thanks Yang, Very good comment.

18. January 2021 at 22:31

I am going to second Gordon’s comment. Lower immigration, lots of people with employment gaps on their resumes, many more people who are now disabled or quasi disabled, and lots of boomers who retired earlier than they were planning means that the pandemic will depress labor supply even once everyone is vaccinated. Lower labor supply means slower growth and a smaller economy relative to previous trends.

18. January 2021 at 22:36

Where/how does https://twitter.com/michaelxpettis/status/1351058993398091778 fit with the China GDP.

19. January 2021 at 05:03

Scott,

I’m surprised by your comment about Mulligan’s claims. I agree that it wasn’t most of the problem during the recovery after the Great Recession, but I’d think it was a significant factor depressing real GDP growth, along with relatively high commodity prices that continued for 4-5 years into the recovery.

Clearly, money was tight, as there was no return to trend NGDP growth and inflation was very consistently undershot, but I think Mulligan makes a persuasive, if overstated case concerning high effective marginal tax rates for those returning to work. The minimum wage increases hurt a bit too.

19. January 2021 at 05:14

And just so you know, I think I do recall you commenting on Mulligan’s claims at the time. And you have mentioned more than once how the unemployment benefit extension was slowing employment growth and that the minimum wage increases were counter-producrive. I know you’re not entirely dismissive, but your comments surprise me nonetheless.

I wonder what your best estimate is of the various factors that slowed real growth during the last decade. How much was tight my money, verus counter-productive incentives for labor, versus the continuation of the commodity price shocks that lasted until roughly 2014.

Obviously, commodity prices weren’t a significant factor in the second half of the decade, but we should have expected a much higher rate of average real and nominal GDP growth in the first half, due to the post-recession rebound. Hence, I don’t think it’s necessarily instructive that real growth remained low in the latter half of the decade.

19. January 2021 at 08:23

Have you tried the “Faking growth rate data is folly, because the faking has to keep compounding forever?” It’d not take all that many quarters of utter lies in growth before the compounding error is so ludicrous anyone with eyes can tell they are fake.

It’s just like we could doctor unemployment figures to make 2% of the population appear employed when they are not, but we couldn’t just keep saying that we created 5% more jobs than we really did on every report. Eventually we’d have to pretend completely ludicrous things.

19. January 2021 at 09:07

anon, I think he’s right about the fastest growth this year being in investment, and that there’s lots of malinvestment.

Michael, I do think supply side problems played a role, but I disagree with Mulligan’s claim that it was the main problem.

Bob, Yup, that was one of my arguments. I’ve been to China many times, and the country seems every bit as rich (or more precisely poor) as the government claims. Per capita GDP is reported at about $10,000 in dollars terms. That seems very plausible, even accounting for low incomes in the 40% of the country that is rural.

19. January 2021 at 09:14

Debt hangover in the US?

19. January 2021 at 09:35

Sumner refuses to mention anything about genocide, or the fact that the CCP is exterminating Uighurs as we speak.

Instead, he wants you to believe that their “superior” form of totalitarianism and currency control (i.e, deflating currency) is responsible for their large growth rates, and thus America should follow in her footsteps.

That is the whole point of this post.

CCP is Nazi Germany 2.0, and should NEVER be emulated.

19. January 2021 at 10:24

re: emulated

As monetary policy is a blunt instrument, in a command economy such as China’s, its targeted real investment is superior.

19. January 2021 at 14:28

Europe is not a “great economy”. And neither is the US.

If you really believe that, then you are utterly unfit to hold any office – even a lowly academic one.

Europe is in turmoil, and is bankrupt, by socialist policies. Germany is the only country that has wealth, and that wealth is generated by manufacturers who still make things. In other words, the Germans are not “paper pushers”.

The USA is in so much debt, that it’s future is written in stone. The collapse of the dollar is imminent.

The Chinese have a great economy, because they place tariffs on incoming goods & artificially deflate their currency to remain an attractive investment zone to unscrupulous politicians and big businessmen looking for outsized profit margins at the expense of the American worker. They use that money to prop up their totalitarianism globally – and commit genocide against those that don’t look “han”.

19. January 2021 at 15:18

Xu, You said:

“CCP is Nazi Germany 2.0, and should NEVER be emulated.”

Yes, the CCP of 1949-76 was as bad as the Nazis, and should never be emulated.

And Trump should not have encouraged Xi to put the Uighurs into concentration camps.

19. January 2021 at 17:09

–“Justin, If people want to eat out, then restaurants will provide the service.”–

My point is that a large number of bars and restaurants are now gone and (those particular restaurants) will never be coming back. It will take time for new restaurants to come online.

If your favorite restaurant is gone or if restaurants are crowded with long wait times due to reduced supply, people will be more likely to eat at home (at least I will). Some people will be extremely excited to eat out and will do so constantly, but others might have decided they can live eating at home more and appreciate how much lighter it is on the budget. I think the surviving businesses will do well as there is less competition, but they won’t fully offset the loss of the failed businesses in terms of production & employment.

It’s not just restaurants either, other small businesses have struggled but that’s just an obvious example. That everyone knows a $15 minimum wage is coming probably doesn’t help in terms of either businesses staying open or new business formation. The summer riots also were a problem for restaurants/small businesses in cities. Housing prices in the suburbs near me are very strong, whereas rents in the downtown area have collapsed.

It will be a solid year and a half before life can go back to normal. Despite COVID being a supply shock, because it was prolonged a lot of businesses surely focused harder on expenses in 2020 than they would have otherwise. I’m sure fewer Garrett Jones organizational capital workers are employed now than they would have been had there been no pandemic, even though they can usually work remotely.

We’ll see though. I’d be happy to be surprised.

19. January 2021 at 18:32

Scott,

In case you didn’t see this yet, here’s a new NBER working paper which models supply-side effects of monetary policy.

https://www.nber.org/system/files/working_papers/w28345/w28345.pdf

Here’s an interesting quote from the abstract:

“We study an economy with heterogeneous firms, sticky prices, and endogenous markups. We show that if, as is consistent with the empirical evidence, bigger firms have higher markups and lower passthroughs than smaller firms, then a monetary easing endogenously increases aggregate TFP and improves allocative efficiency. This endogenous positive “supply shock” amplifies the effects of the positive “demand shock” on output and employment. The result is a flattening of the Phillips curve.”

19. January 2021 at 19:13

Justin, You said:

“It will take time for new restaurants to come online.”

I doubt it will take very long. Many will occupy the same spot as the restaurants that closed. The equipment will still be there this summer—it’s not like the landlords have any other options.

20. January 2021 at 00:34

re: “supply-side effects of monetary policy”

We necessarily have regulated capitalism. That’s why we have the Sherman and Clayton Acts. “Section 7 of the Clayton Act prohibits mergers and acquisitions when the effect “may be substantially to lessen competition, or to tend to create a monopoly.”

Antitrust actions should be conducted on the basis of the most economical size of plant. That is, limit corporations to a size that would achieve minimum unit costs at optimum rates of output. Outlaw the conglomerate and holding companies beyond the first degree, and severely restrict vertical as well as horizontal corporate aggregations. That is to say, prohibit corporations from conducting unrelated activities under a single corporate roof, from expanding in order to broaden their share of the market or from controlling their suppliers through ownership or legal devices.

20. January 2021 at 03:11

Scott, any thoughts on this twitter thread? Implies it’s not quite as sustainable as it seems

https://threadreaderapp.com/thread/1351058958925111296.html

20. January 2021 at 06:21

Scott—-you ignored my main point—-.. By “too far” I meant Pelosi’s relationship with Trump. Period. I think impeaching him hurt them working together. Gingrich was already gone by the time they got around to Impeaching Clinton—-they already accomplished things.

20. January 2021 at 22:19

Fairwinds, I responded to that above.

Michael, Have you still not figured Trump out? Trump never intended to work with Pelosi. His only goal in life is to humiliate people.

22. January 2021 at 05:32

Scott. I will be presumptuous and say we have comparable observation skills. Yet our individual premises of what we are observing are complete opposites on Trump and Pelosi. This is a general truth in the US today about these two pols. I have noticed as time goes by, and I review what I believed in the past, I often wonder why I did. Reagan has held steady. Some Dems have improved and some GOPs have declined.

In particular we exaggerate those we dislike.