With NGDP, everything becomes much clearer

On the internet, I see endless debate about the so-called soft landing. Many people seem to believe that some sort of law of economics has been violated. Inflation has come down substantially, and yet the labor market remains strong.

I see all sorts of problems with this debate. One problem is that we are assuming that a soft landing has occurred, which is premature. The second problem is that we are using a “Phillips Curve” approach that is based on fluctuations in inflation, when we should be focussing on NGDP growth.

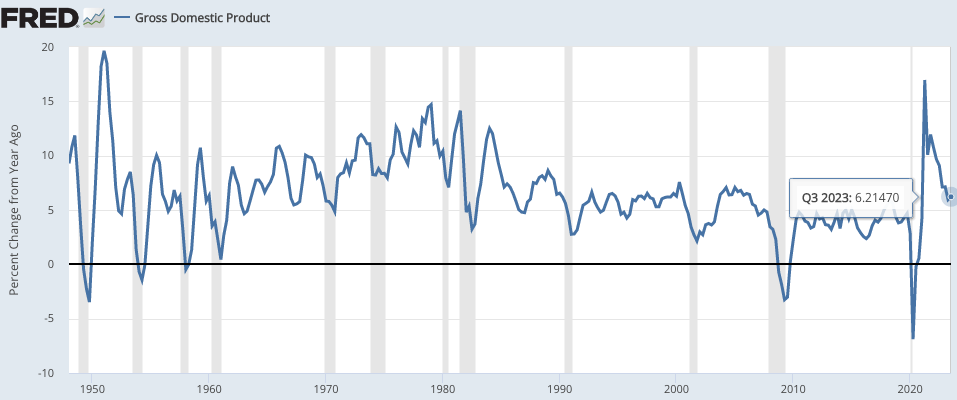

If you focus on NGDP growth, then things become much clearer:

In the past, recessions tend to occur when NGDP growth falls sharply. But not always. There was no recession in 1952, 1967 or 1986. And even better indicator of recession is a fall in NGDP growth to a level well below the average of the previous decade. That doesn’t explain the 1974 recession (when the economy was distorted by the removal of wage/price controls), but it basically explains all the others.

The most recent data shows a 12-month NGDP growth rate of 6.2%, which is well above the average of the previous decade. Yes, that’s much lower than two years ago, but as we saw in 1951-52, a big drop in NGDP growth doesn’t necessarily cause a recession if it’s a return to normal growth after an abnormal spike. Instead, recessions tend to occur in years like 1953, 1957 and 1960, when NGDP growth falls to well below normal. But that hasn’t happened . . . yet.

If NGDP growth were to stay at 6.2%, then inflation would level off at about 4.4%. But I don’t believe NGDP growth will level off—I expect further declines. People talk about how surprising it is that NGDP growth could fall to levels consistent with 2% inflation without triggering a recession, but maybe we should wait for that to actually happen before patting ourselves on the back.

And it might happen! There’s never been any logical reason why a soft landing is impossible—you need to disinflate at a gradual rate. So far the Fed has done that. (Keynesians are wrong in thinking that recessions cause the disinflation, they are a side effect of overly rapid disinflation. Tighter money causes the disinflation.)

Some might argue that the 6.2% NGDP growth rate for the past 12 months is overstated, as NGDI growth has only been about 3.0%. But the GDP figure seem much more plausible. For instance, reported RGDP is up 2.9% while RGDI is actually down more than 0.1% over the past year. Given that job growth has been far above trend, and trend RGDP rises at 1.8% even when job growth is normal, which figure seems more plausible?

So far, the economy’s performance is far less surprising if you focus on NGDP rather than inflation. NGDP growth has not fallen to a rate that would typically trigger a recession, it’s still well above trend. Yes, inflation has done a bit better than one might have expected given NGDP growth, just as inflation did worse than expected up until mid-2022. Both can be explained by temporary supply factors, which artificially boosted inflation in 2021-22 and have artificially depressed it over the past year. Those are head fakes. Don’t let misleading inflation figures screw up your understanding of the economy—ignore inflation and focus on what really matters—NGDP growth.

To achieve its 2% inflation target, the Fed must get trend NGDP down to about 3.8%. Perhaps it will do so without triggering a recession. Maybe it’ll over tighten into a recession. Forecasting is a game for fools. Right now, markets see a soft landing as the median outcome, but either an undershooting or an overshooting is certainly possible.

K.I.S.S.—Focus on NGDP and ignore inflation.

Happy New Year, and may all your landings be soft.

Tags:

1. January 2024 at 01:12

Good stuff. So many of your posts could just be summed up with the maxim “focus on NGDP”, and yet even after all these years economics commentary relies on older models that have proven to be flawed.

I wanted to mention that I usually read articles on my phone and have noticed that the current theme of the blog (which is from 2007!) is very challenging to navigate and read on smaller screens. An update to a more mobile-friendly WordPress theme might enhance readability and accessibility for users like myself who frequently use mobile devices. A modern, responsive theme could significantly improve the reader experience.

I don’t know all the details of your software setup or what specifically you are looking for, but one suggestion for a super-minimalist theme that you might find suitable is “Bibliophile”

https://wordpress.com/theme/bibliophile

1. January 2024 at 01:55

Happy New Year Scott!

1. January 2024 at 05:58

Too many people argue watching N-gDp is like looking in the rear-view mirror. But N-gDp is composed of two separate and relatively long distributed lags. And the FED’s mistakes tend to be reinforcing or cumulative.

Recessions are avoided by eliminating dis-intermediation of the nonbanks. The nonbanks cannot outbid the commercial banking system for loan funds, but the banks can outbid the nonbanks for loan funds.

1. January 2024 at 06:03

“Both can be explained by temporary supply factors, which artificially boosted inflation in 2021-22 and have artificially depressed it over the past year.”

I think I have asked before, probably poorly, if supply issues could cause or affect inflation. I thought you said no, but I am going to assume i misunderstood or asked poorly and your quote here is the correct take.

Happy New Year and hope your Bucks learn to play defense.

Steve

1. January 2024 at 06:18

On a macro level, savers never transfer their savings outside the banks, unless they are hoarding currency or convert to another national currency, e.g., FDI.

If the $1.15TN uptake in MMMF volumes in 2023 represented funds transferred through these intermediaries, from bank-held savings, then this resulted in an increase in the supply of loan funds (but not the supply of money).

I.e., interest rates would have averaged much higher had this flow not existed. And that doesn’t count the draining of the O/N RRP facility. I.e., the deficits must be reduced.

1. January 2024 at 06:42

The financial markets were buffeted in 2023 by halting the draining of bank reserves.

https://fred.stlouisfed.org/series/TOTRESNS

Contrary to Dr. John Cochrane: “If the Fed buys Treasury bonds to create reserves, banks hold more in reserves and less in Treasurys. Money available for lending is the same.”

This ignores that interest rates are now lower, that funding is less expensive, that borrowing is more likely, that “the revaluation of real and financial assets” takes place.

https://economics.princeton.edu/wp-content/uploads/2021/09/wealth-effects-risk.pdf

1. January 2024 at 10:13

William, Thanks for the suggestion. I like wide columns due to the need to present graphs. Unfortunately, my blog is basically set up for computers, not phones. I almost never use my phone for the internet.

Junio, Thanks, the same to you.

Steve, I always say that supply shocks don’t affect the long run average of inflation, but can affect headline inflation for brief periods. The problem recently is that inflation has been too high both during negative and positive supply changes. It should be say 3% then 1%, not 7% then 3%. It should average 2%. That was the point I was trying to make.

1. January 2024 at 10:26

Scott, what makes you think NGDP growth will continue to decline? It seems to me like the Fed has already pivoted to looser policy.

1. January 2024 at 10:34

Bobster, The financial markets seem to be predicting slower NGDP growth ahead, and that’s what I go by. But there’s a lot of uncertainty, so I’m far from confident.

1. January 2024 at 11:25

The financial markets are likely to be wrong again as the roc in short-term money flows increases in the first half of 2024. TBD.

1. January 2024 at 12:40

Happy New Year Scott and thanks for continuing to produce content. I only look at this on a computer so don’t pander to smartphone users—that’s what Twitter is for.

Per your instructions, I’m waiting for March 2025 before I make any bets on soft landings. Since I have nothing to lose, I’ll offer some useless predictions for this year:

-People in the regular financial media will continue to make claims that sector-specific weaknesses are a clear sign of impending recession. Commercial Real Estate is the current target for this commentary. They are wrong.

-If gas prices continue to fall it will improve Biden’s election prospects and outweigh nearly all other factors.

-Less than five new movies will be worth watching this year. I’m mostly looking forward to Dune.

1. January 2024 at 16:46

Here’s a fun one I just read: https://www.reuters.com/breakingviews/deflation-will-help-big-grocers-gobble-up-minnows-2023-12-29/

Apparently some people are now expecting deflation. That’s right, not disinflation, but inflation. Oy.

1. January 2024 at 16:47

Uh, typo, let me try that again…

Here’s a fun one I just read: https://www.reuters.com/breakingviews/deflation-will-help-big-grocers-gobble-up-minnows-2023-12-29/

Apparently some people are now expecting deflation. That’s right, not disinflation, but deflation. Oy.

1. January 2024 at 17:19

Scott, you said in response to bobster’s question about why you expect NGDP growth to slow that, “The financial markets seem to be predicting slower NGDP growth ahead.” How do you infer that? US 10 year bond yields are down, but only back at levels of mid-2023 and late 2022 when inflation was probably expected to take longer to fall than has happened. Meanwhile, US equities are at the record highs of late 2021. It all seems like markets expect recent strong firm revenue and profit growth will continue while NGDP falls by enough to require successive cuts in the Fed funds rate.

1. January 2024 at 17:54

David, I thought the first Dune was good but not great.

Will, It would take a pretty severe shock to deliver deflation. I’m skeptical.

Rajat, I’m focusing on those multiple rate cuts expected in 2024. I see no way we get anywhere near that number of cuts if NGDP growth in 2024 is close to 6%. That NGDP rate would imply inflation stays stubbornly above target, unless you expect a sudden AI productivity miracle.

I’d guess something like 4.5%. But stranger things have happened.

1. January 2024 at 18:28

Scott,

So far, this soft landing seems like a success for rational expectations. The Fed has gone into it with considerable credibility from the Second Great Moderation. I think that’s comparable to 1952, 1967, and 1986, when people generally weren’t worried about a big inflation. That was incorrect in 1967, but still a sensible expectation, since e.g. people didn’t know that the Bretton Woods System was about to fail as an effective constraint on inflation.

2. January 2024 at 10:35

William, “So far”, but we have a long way to go.

2. January 2024 at 12:30

I like the concept that a recession is associated with a drop in NGDP something below normal. I feel like when I have suggested that here in the past, I have been told that a recession is a drop in RGDP. Anyway, no point in digging up history.

NGDP is still a little bit too high, but inflation has moved out of the ugly zone. While still above target, the Fed has a little time to wait before evaluating if more tightening is still needed or if NDGP will fall a little further without further manipulations.

2. January 2024 at 14:10

Doug, You said:

“I like the concept that a recession is associated with a drop in NGDP something below normal. I feel like when I have suggested that here in the past, I have been told that a recession is a drop in RGDP.”

Both are true. Don’t confuse “is” with “is associated with”. Winter is associated with cold, but it’s not correct to say winter is cold weather. There are warm winders and cold springs.

2. January 2024 at 18:48

‘Forecasting is a game for fools.’

You say that, but I made some decent pocket change from the NGDP forecasting contests!

Happy New Year, to all those who area real people and not trolls/bots!

2. January 2024 at 19:45

Tacitus, I have two responses:

1. It could have been luck.

2. More likely, you were smarter than the average. But it was a small and inefficient market.

3. January 2024 at 00:33

A commenter said: “On a macro level, savers never transfer their savings outside the banks, unless they are hoarding currency or convert to another national currency, e.g., FDI.”

I fail to see how buying gold, bitcoin and other assets that hedge against inflation is the equivalent to “hoarding”. This is the same argument the Roosevelt tyrants used, while going door to door, pillaging communities, under the brand name of “hoarding.”

And yes, more people are sending their money abroad to places like Thailand, South Korea, Singapore and Vietnam; places with low debt and high growth. Everyone investor knows the thai baht and korean won have a brighter future than the dismal dollar.

3. January 2024 at 00:46

“Happy New Year, to all those who area real people and not trolls/bots!”

Yep, everyone who disagrees with you is a troll and a bot. You have oustanding logic, sir.

I mena, don’t you dare wish those terrible individualists a happy new year, because people who don’t conform are a threat to democracy, right? We have to stop them, right? We have to keep them off the ballot, right? We have to put them in their place, right?

Hmmm…

Sounds real democratic.

3. January 2024 at 00:49

Wonder where the third one is.

3. January 2024 at 04:42

It’s just recognition that the NBFIs are the DFI’s customers.

3. January 2024 at 22:16

Why do people trust government data? If you look at Chick-Fil-A pricing, for example, there has been a 22% increase in the last two years. The government keeps telling us that CPI is 3.1%, but how do we know that’s true? Who audits the work of the Bureau, and who audits the auditers?

In the real world, it doesn’t feel like we’re approaching a ‘soft landing’. It feels like we are approaching armageddon.

4. January 2024 at 05:58

N-gDp is an amalgamation of short- and long-term money flows. While it is true that a tight money policy can have an immediate impact, it is also true that an easy money policy will exert a delayed impact commensurate with its distributed lag(s).

While targeting N-gDp seems like a no-brainer, without fiscal restraints, targeting N-gDp is a pipe dream.

4. January 2024 at 13:31

How come we are looking at year-ago percentage growth rate than compounded quarter-to-quarter? Is it just so that the axis is a little less broken by the +40% growth of Q3 2020?

I’m just used to thinking of real GDP growth in terms of the compound rate.

4. January 2024 at 16:25

Scott: I would say that I am lucky that I was smarter than the average player in an inefficient market! But, then, I also say that about the stock and bond markets, too…

Ricardo: Where did I say anything about people who disagree with me? Bit of a giant leap of you, there. And you talk about my logic, hah!

Junio: My question, too. Only two of the three stooges!

10. January 2024 at 05:18

@ssumner:

Flagging this one because you might like to see an investment house following your lead:

“The 10-year Treasury rate is a good proxy for nominal GDP growth and at the current 4%, the bond market is merely factoring in a return to trend real growth of 1.8-2%. The year-over-year change in NGDP after Q3 2023 was 6.2% and if inflation is going to continue to moderate that has to come down. NGDP is inflation + real growth but we never know what the split is going to be. Over the last year though, NGDP fell entirely due to a fall in inflation. In Q3 2022 NGDP was up 9.1% yoy and that fell to 6.2% in Q3 2023 while RGDP growth rose from 1.7% to 2.9% yoy. The market seems to be betting that will be repeated and it could happen. Right now the best estimates we have for real growth and inflation for Q4 2023 come from the Atlanta Fed’s GDPNow and the Cleveland Fed’s Inflation Nowcasting. Using those two estimates puts Q4 NGDP at 4.3% with 2.5% real growth and 1.8% inflation.”

— https://alhambrapartners.com/2024/01/07/perspective-on-a-new-year/

(There’s some more that’s relevant in the article, I quoted the most salient.)

12. January 2024 at 18:33

Scott, why do you write that they need to disinflate gradually?

If the Fed announced that they were doing whatever it takes to eg keep the 1 year TIPS spread at exactly 2%, wouldn’t that immediately bring down inflation? Presumably without causing a recession. (Similarly and even better, if they targeted ngdp in the same way. Inflation wouldn’t go to exactly 2%, but it would come down if it was previously very high.)

Or are you making a comment specifically only about the current policy regime?

The Reichsbank in Weimar Republic Germany managed to bring hyperinflation down overnight when they introduced the Rentenmark, too. Though that might be too extreme an example, because the inflation itself made the economy suffer a lot.

I guess you can generate more examples of rapid disinflation by looking at instances of countries adopting a fixed exchange rate to a more stable currency?

12. January 2024 at 20:10

Matthias, Prices are far more flexible when you are ending a hyperinflation.