The yield curve inverted

The Financial Times reports that the yield curve inverted, albeit by just 1 basis point:

Does this mean a recession is more likely than before?

Yes.

Does this mean that a recession is likely in the next 12 months?

Probably not.

Does this mean that monetary policy is too tight?

Hard to say.

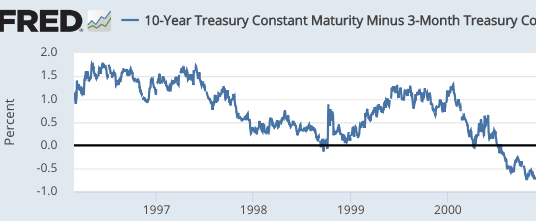

In my view, the current situation reminds me most closely of 1998, when the US economy was pretty strong at a time when the global economy was weakening. That year also saw a mild inversion, which turned out to be an incorrect recession forecast:

In its entire history, the US has never experienced a soft landing, in the sense of having a recovery extend for many years after unemployment had fallen close to the natural rate. Since unemployment has fallen close to the natural rate, that fact alone should make us worried. On the other hand:

1.Australia and the UK have experienced soft landings in recent decades.

2. In previous US expansions, you didn’t have MMs beating the drum for stable NGDP growth, level targeting. (Yes, I’m joking.)

When unemployment falls to the natural rate, problems are almost always just around the corner. In 1966, the yield curve inverted when unemployment fell below 4%, and again there was no recession. But there was a problem just around the corner—high inflation.

So low unemployment is a very dangerous time for the US. We are a clumsy country, which fails to achieve soft landings. That’s the real story here, which is even deeper that the “inverted yield curve means recession” story. Low unemployment and inverted yield curves are a warning of choppy waters ahead, of monetary policy in danger of drifting off course, one way or another.

In my view, the stock market decline at the end of 2018 was partly due to a perception that rates should not be increased, while the Fed was planning another set of rate increases in 2019. (Other worries such as trade, global growth, etc., also played a role).

When the Fed backed off, stocks rallied. Despite today’s sell-off, stocks are at very lofty levels and hence stock market investors likely don’t foresee a recession during the next 12 months. Neither do I. But it would be foolish to deny that the recent yield curve inversion makes a recession more likely than before, say a 25% risk rather than a 15% risk.

Update: This recent post had more to say on the yield curve issue.

Tags:

22. March 2019 at 12:37

I agree Scott. I was also just looking at 1998. The Fed cut three times in quick succession in the wake of the 10-year yield’s plunge in Aug/Sept.

Today, gold is rising and EM is rising. I think the gold signal is telling us the Fed is already on the case — and EM is following gold. This time the Fed “gets it” whereas in three of the last four inversions they were almost proud of their having inverted.

22. March 2019 at 14:40

Scott, you may want to point to a post you made a couple of weeks ago when you raised the question of what is “normal” for the yield curve in case people missed it. It may be a good companion post for this one.

22. March 2019 at 22:33

Why only look at US equities for nominal growth forecasts? Why not most recent levels of nominal GDP plus a range of market indicators? Include copper, oil, bond yields (esp collapsing 10 year yields). There’s at least one bunch who do just this…

http://ngdp-advisers.com/2019/03/19/ngdp-outlook-update-outlook-moves-lower/

23. March 2019 at 11:55

James, I do not rely on US equities for NGDP forecasts. I agree that they are not a reliable guide. Look at 1987.

Notice that fed funds futures are also not predicting a recession.

23. March 2019 at 15:40

Quarterly ngdp growth is way down from last year. Long term yields, indicative of ngdp growth, are down. Inflation persistently below target. Seems easy to argue that money is still too tight and that the Fed had better be ready to cut short term rates again. In fact, they probably should have already.

23. March 2019 at 16:06

Randomize, You said:

“Seems easy to argue that money is still too tight and that the Fed had better be ready to cut short term rates again.”

The second part of that statement is clearly true. I’m not at all sure about the first part.

23. March 2019 at 22:24

Fed Fund futures, what is their track record on predicting a recession? Or are they just a coincident indicator?

We agree that by the time the Fed is “forced to cut rates” it’s probably too late. And this time we’ll be back at the ZLB in 0 secs. And then … more QE … but again netutralized via IOER … and then …

[note that German 10yr bunds have plunged below 0% again]

24. March 2019 at 08:11

James, Low unemployment predicts recessions. So the policy implication is?

24. March 2019 at 22:11

Pretty easy to work out. Keep cool when unemployment is low; look at other measures like LFPR, industrial production, NGDP levels, core PCE; and don’t tighten policy until the market ”forces” you to. Do not try to be a hero and do not think about those bl00dy punchbowls.

25. March 2019 at 06:22

James, So if you are happy with low unemployment, despite the fact that low unemployment predicts recessions, why do you worry that inverted yield curves predict recessions?

25. March 2019 at 11:54

Low unemployment doesn’t cause recessions but it does cause the Fed to cause recessions. I like low unemployment, the Fed has it as objective, but once achieved, tightens. That’s why the US doesn’t get soft landings. The inverted yield curve reveals what the Fed is up to, causing recessions.

26. March 2019 at 21:02

James: You said:

“The inverted yield curve reveals what the Fed is up to, causing recessions.”

As in 1966? As in 1998?

It is certainly a warning sign, as is low unemployment. And I certainly agree that the Fed needs to be careful here. We’ll know more in a year.