The wage paradox

Falling wages are a problem, a sign of a labor market that is out of equilibrium. Falling wages are a solution, they help restore equilibrium in the labor market.

Both statements are defensible, and I think the best way to visualize business cycles is to try to hold both ideas in your mind at the same time. This is from a recent article in The Economist:

In fact, they say, Mr Abe’s campaign may be primarily political. Having nominated a team of tough-talking money-printers as governor and deputy governors of the Bank of Japan, he is determined that the central bank should hit its new 2% inflation target. The problem is, if prices rise but wages don’t, workers will feel the pinch. That would not bode well for an upper-house election in July in which Mr Abe hopes his ruling Liberal Democratic Party will secure a majority in both chambers of parliament.

Hence the pressure applied by Mr Abe and his finance minister, Taro Aso, on big businesses to increase worker compensation. Amid signs of rising consumer sentiment and household spending in January, some have responded positively. Lawson, another convenience-store operator, said higher bonuses this year would boost the annual average pay of a worker with three school-age children by ¥150,000 ($1,600). Other firms, especially exporters benefiting from the falling yen, are likely to agree to union demands for higher bonus payments in annual pay talks this spring.

But Keidanren, the main big-business lobby, has remained cool, saying it wants to see more sustainable profit growth before its members agree to basic-pay increases, which are harder to reverse than bonus payments. Masamichi Adachi of J.P. Morgan says overtime and bonus payments are likely to rise before core salaries do. He says that, rather than higher inflation expectations, the country needs higher growth expectations before companies commit to permanent wage increases. As it is, a planned rise in the consumption tax next year is likely to offset some of the effect of a big fiscal stimulus this year, which means growth may flatten in late 2014.

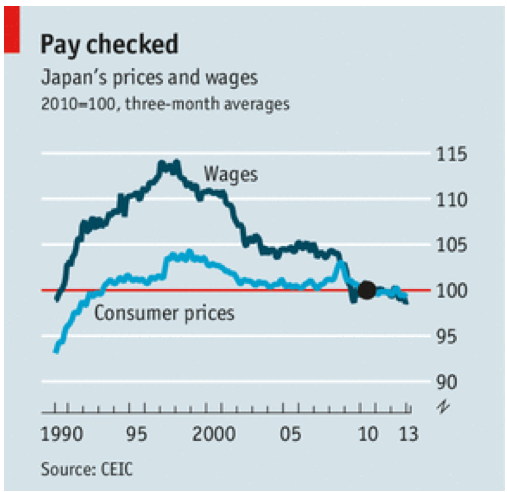

That’s quite an interesting graph. I see three downshifts in nominal wage rates; the after-effects of the 1997 East Asia crisis, the 2001 tech recession, and the global 2008-09 recession. Because nominal wages are sticky, and only some adjust each month, a falling nominal wage rate means (surprisingly) that some other wages are too high. Thus falling nominal wages are often associated with rising unemployment. And I believe that’s true in Japan.

But once wages have fully adjusted, unemployment can go back to the natural rate. On the other hand absolute wage cuts are difficult to make, so the Japanese unemployment rate is probably still a bit above the natural rate. (Note that Japan traditionally has very low unemployment, and some argue that the actual unemployment rate is higher than measured unemployment.)

If Abe’s policy is successful then wages may rise a bit, but it would be a mistake to put the cart before the horse. You’d like wages to rise because of a stronger economy, higher NGDP growth, not because of political pressure. Indeed if wages are forced up artificially that might raise unemployment in Japan.

Also note that Japanese real wages have fallen by about 10% since the 1990s. Japan isn’t doing well, but then neither are the other developed countries (with a few exceptions like Australia and Canada.) Ultimately the key is growth. If monetary stimulus raises RGDP growth, real wages might actually do better than under a tighter monetary policy with lower inflation. Notice that real wages leveled off during the 2002-06 QE program, which temporarily halted the deflation. Once again, it’s not a zero sum game. A bigger pie could mean higher real incomes, at least in the long run—even if inflation rises.

PS. I know that some models predict monetary contraction will raise real wages, but what if it forces young people into the informal economy, where productivity is much lower?

Tags:

15. March 2013 at 07:22

[…] See full story on themoneyillusion.com […]

15. March 2013 at 07:25

Scott, you’ve said a couple of times,

“and some argue that the actual unemployment rate (in Japan) is higher than measured unemployment.”

Could you give us a link? I haven’t actually read anyone argue this, and I’m curious to hear what they say. Is it an institutional thing? Just bad metrics?

Cheers.

15. March 2013 at 07:33

The problem is if governments pursue austerity, there is no solution but falling wages. It would be less true for countries sparking AD with either fiscal or monetary policy.

But in Europe the tight money along with austerity leaves falling wages as the only viable option. Too bad labor market regulations don’t allow that.

15. March 2013 at 07:43

In a country like Japan, does it matter much whether you’re looking at the average real wage or median real wage?

15. March 2013 at 08:49

“Falling wages are a problem, a sign of a labor market that is out of equilibrium. Falling wages are a solution, they help restore equilibrium in the labor market.”

I think we should keep the GI solution in mind when we think the above.

http://www.themoneyillusion.com/?p=19982

Since we can always have full employment because sticky wages are not a problem, the question I have Scott – and please I really don’t know the answer here…

Let’s say, we have the plan running, everyone is getting their $240, all 30M are choosing the job bid they are happiest with.

So you are Fed head, you are running 4.5% NGDPLT, you have FULL EMPLOYMENT.

And in the past you never reason from price change.

IF the price on jobs taken were to actually fall, and let’s say that the price on job offers is also falling, and you are the economist running the platform AND you are the Fed…

Would it be better to temporarily increase the GI, that’d be helicopter drop with permanent injection to end users, or would you use normal Fed operations?

Let’s get past the “do nothing” thing, meaning NGDP is faltering BUT the loss is almost ENTIRELY at low end in the GI market, do you use treasuries to fix NGDP or do you use GI?

15. March 2013 at 09:27

There’s no paradox. Those two statements have been stripped away from their respective typical contexts, and presented as universally true statements, thus leading to the seeming paradox.

Falling wages are a problem, a sign of a labor market that is out of equilibrium…when there is full employment.

Falling wages are a solution, they help restore equilibrium in the labor market…when there is less than full employment.

15. March 2013 at 09:29

I realize the context of employment was addressed, I was just wanting to point out the lack of paradox.

15. March 2013 at 09:45

Scott I know it’s a little off topic but what do you make of Stephen Williamson’s post praising Jeffrey Sachs?

“I especially like this one:

“The US economic emergency in late 2008 and early 2009 wasn’t really an aggregate demand crisis but a financial crisis.”

“That should be pretty obvious, but many people don’t seem to get it.”

“Predictably, the usual cast of characters is calling Sachs an idiot. Someone should take him out to lunch and give him a pat on the back.”

15. March 2013 at 09:46

http://newmonetarism.blogspot.com/2013/03/jeffrey-sachs-and-keynesian-economics.html?showComment=1363367894997#c6988772549801641057

15. March 2013 at 10:36

Ben, I don’t recall now. Perhaps some commenters can chime in, I recall seeing them make this argument as well.

Ashok, Exactly.

Travis, Maybe a little, but I’d guess both would show a fairly similar pattern.

Morgan, But even with your plan, employment would fluctuate somewhat if NGDP is highly unstable. Unemployed high paid workers would often prefer to search, rather than take the first low skilled job they can find.

Geoff, I suppose all paradoxes vanish under close inspection.

Mike, Interesting quote. Suppose you are on the way to the hospital with a case of pneumonia, and are stabbed along the way. Then you don’t have a “stab wound crisis,” because your real problem is pneumonia!!

I can’t undertand that argument, unless they believe in a version of macro where a big fall in NGDP doesn’t cause any problem for the labor market, because wages are flexible.

15. March 2013 at 11:27

Dr. Sumner:

“I can’t undertand that argument, unless they believe in a version of macro where a big fall in NGDP doesn’t cause any problem for the labor market, because wages are flexible.”

Is there any “room” for wages to be more flexible, by economists meticulously analyzing the many separate governmental forces that make wages inflexible, and to relentlessly advocate for a removal of those forces?

15. March 2013 at 12:39

“Geoff, I suppose all paradoxes vanish under close inspection.”

That is absolutely untrue. Some paradoxes are actually logical paradoxes in the sense that two contradictory statements follow logically from your premises. But, I agree with the spirit of the quote.

With regard to the “The US economic emergency in late 2008 and early 2009 wasn’t really an aggregate demand crisis but a financial crisis.” quote, is it possible that we are not realizing the importance of the word ’emergency’. In your example with pneumonia and a stab wound, I would say that the emergency is the stab wound. Sure, it wouldn’t have happened without the pneumonia, and the pneumonia is still an important issue that requires attention. Yet, the EMERGENCY, that makes you fear for your life in the short-term is the stab wound. Massive unemployment on the scale of what the US experienced in 2009 is scary, but the financial crisis made people fear for the survival of the capitalist system. Stock prices would not have collapsed without the drop in NGDP, but certainly part of the drop was due to fears surrounding the financial crisis and bank failures.

15. March 2013 at 13:29

I don’t see the paradox. The two statements are logically consistant.

15. March 2013 at 18:05

Here’s a question:

What would be the downsides of pursuing an NGDP permanent trend growth line of 8% rather than 4.5%?

I can only think of one: if an economy is at full employment, inflation is a tax on capital. Are there any other downsides?

15. March 2013 at 18:50

Morgan, the GI plan is like paying for infrastructure, just like someone has to scrape the bird crap off bridges in good times and bad, likewise you’ll need the GI plan to keep the low end of the labor pool from dumpster diving regardless of economic cycle.

I think Lorie Tarshing had the right idea. Adjust employer payroll taxes to unstick wages (it’d help if full 15.3% FICA was put employer side). Full employment, employers pays baseline FICA but at say, 10% unemployment, they’d pay 0% FICA (or 0.3%, to keep them in the habit of regular payments)– essentially cutting wage by 15% without reducing workers’ take-home pay.

If FICA rate was adjusted by monthly unemployment (or every quarter, to keep payroll companies from revolting), real wages could be marked down by as much as 15% a hell of lot faster than it took Japan to make the same adjustment (and then as economy cycles back to full employment, FICA wages costs would move back towards full freight).

15. March 2013 at 22:55

The chart shows about a 15 percent reduction in real wages from the peak in Japan. The peak looks to be 1997-8.

I wonder about those who say there is such a thing as “good deflation.”

If there is a general deflation, good or otherwise, the incentive to buy (or lend) on real estate disappears, just about. Indeed, in Japan real estate is off 80 percent from the 1992 era peak. Of course, this becomes self re-enforcing. No one will lend on real estate, ergo no one will buy.

For most people, then, in even a good deflation government bonds become the default investment of choice, or simply cash. Cash is nice to have in deflations. Stocks are very iffy.

One might even speculate that the deflation of the last 20 years in Japan is “good,” or about equal to improvements in productivity.

And the result is a disaster.

I think Sumner is right, you have to target NGDP growth and in it a salubrious portion of inflation. My guess is that 3 percent is a nice number, although the record in China suggests that maybe 4 percent is better.

16. March 2013 at 05:56

@Benjamin Cole,

That is a very interesting argument! I wonder what David Beckworth would say……

16. March 2013 at 06:00

Dr. sumner: do you think monetary stimulus may lead to an expansionary AS shock if workers do not have bargaining power? I tried to figure this but am not sure so far: central bank lowers interest rate -> AD shifts right -> output increases and price level goes up -> real wages are expected to fall. Then workers with bargaining power will raise nominal wages, so real wages do not actually fall and AS stays the same; if workers have no bargaining power, and fail to raise nominal wages, then real wages will really fall and AS shifts right. Do you think it makes sense?

16. March 2013 at 06:08

Geoff, No, advocating wage flexibility doesn’t make wages less sticky. Indeed wages are still sticky even if you implement flexible wage market policies.

J, Maybe so, I was thinking about economic paradoxes.

If your interpretation of Sachs is correct then he expressed himself very poorly. I’d add that he doesn’t seem to agree with Krugman on the need for demand stimulus–so I think there is a disagreement there.

Travis, You’ve identified the main one, and even that could be eliminated via tax reform. There are other lesser problems like menu costs, calculation costs, confusion over relative prices, etc.

Chun, I don’t think a fall in real wages increases AS, I think it increases quantity supplied of labor. Nominal wages affect AS.

23. March 2013 at 09:15

“Geoff, No, advocating wage flexibility doesn’t make wages less sticky. Indeed wages are still sticky even if you implement flexible wage market policies.”

Sticky from what standard? Instantaneous price adjustments? Well then, all prices are sticky, because nothing changes over zero time elapses.

Wages fell in 1921 more than they did in 2008 because policies make wages less flexible.

Also, wages are made more sticky because wage earners expect price inflation on the basis of monetary inflation, even when such inflation doesn’t take place.

29. March 2013 at 02:25

beowulf, that idea might actually be stronger policy than one would assume at first glance. While the effect of reducing labor costs is the driving force, it’s worth considering that such quarterly FICA adjustments directly affect business cash flow, not just the bottom line.

Since payroll is such a huge drain on cash, that sort of fiscal policy immediately ensures employers have significantly more liquid assets exactly when they might need it most. That’s apt to affect the decisions of marginal firms much more than, say, a tax credit that they might be able to get next year for the same amount.

8. June 2013 at 06:35

You should see the real wage per hour. Japanese real wages PER HOUR have NOT fallen since the 1990. In 2002-2006, the hours of labor increased because the real wage per hour have fallen.