The policy that must not be mentioned

I have always been deeply skeptical of “imbalances” arguments. Free Exchange recently linked to this discussion of the euro crisis by Guntram Wolff:

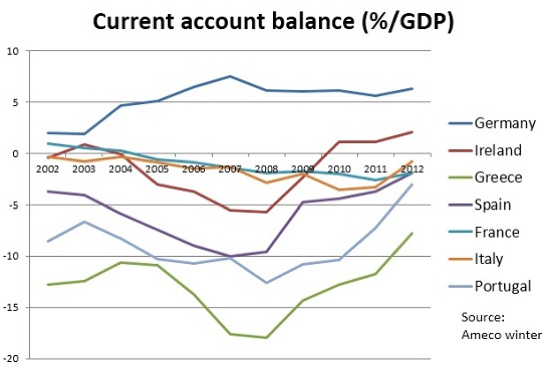

In the sixth year of the crisis of the euro area, it is time to review whether adjustment to external imbalances in the euro area is working. Current accounts have dramatically adjusted in a number of countries of the euro area as the graph below shows. The one country showing virtually no adjustment is Germany and I will revert below to it. Is the dramatic adjustment in current account deficits a sign of success of the export sector or merely a reflection of a dramatic collapse in domestic demand due to the private sector deleveraging and the start of fiscal consolidation?

The question should be:

“Is the dramatic adjustment in current account deficits a sign of success of the export sector or merely a reflection of a dramatic collapse in domestic demand due to tight money depressing eurozone NGDP?”

And the answer is pretty obvious.

Unfortunately I’m not fluent in “European,” but my eurozone commenters tell me that on the continent there is virtually no discussion of the role of monetary policy in the crisis. I’m not saying that people should necessarily agree with my views, but wouldn’t you think that a historic collapse in NGDP growth would at least trigger a discussion of whether tight money might be to blame?

Tags:

13. March 2013 at 20:13

Do you (or other posters) have any data on the current account balance of Europe as a whole?

I’m wondering if the whole continent is grinding toward a large current account surplus as they all try to become German mercantilists with hugely suppressed domestic demand.

The reason I ask is that all the lines on your graph appear to be pointing up. And if that’s true, then isn’t Europe the one engaged in currency wars, trade wars, monetary wars, export wars or whatever you want to call it?

14. March 2013 at 01:00

Steve, net position of all the deficits/suficits of in-eurozone balances is always 0. If you are thinking about Eurozone-world relationship, i think there is a small eurozone surplus most of the time. Most of the trading still happens inside of EZ, but as I wrote, the inward balance for the area will be 0. if periphery countries increase exports to, lets say, china (or other parts of the world, not EZ) then maybe I can see your point. But, in face of restrictive ECB policy, those countries would have to experience a supply-side wonder, in a very short period of time, which is impossible, even if they were doing best policies. Mr. Sumners interpretation is very correct: falling demand and falling imports, so you see an illusion of increase of exports, but actually they have a huge fall in imports and ngdp

Mr. Sumner, you are right, as long as that HICP is, for whatever reason, around 2%, ECB, or anyone else will not see a reason to change anything. Maybe Hollande or other socialists, but they have a different idea what should be done than you do

14. March 2013 at 03:25

[…] See full story on themoneyillusion.com […]

14. March 2013 at 04:05

I’ll add a coda to the “there is no discussion of monetary policy in Europe” (I think I might be one of the commentators you had in mind).

Because I live between 3 countries, I regularly read the Portuguese, French, German, and Luxembourgish press. By this I mean the serious press as far as is possible, not the tabloids. There may be wonderful discussions of monetary policy in Finnish that I am missing, but I think I’m covering a big part of the eurozone space.

Even outside of monetary policy, only the Luxembourgish press does a good job discussing EU politics/policy decisions. All of the other fail to give it the importance it should have, treating it almost as a foreign policy issue. Which is odd, given that 50% of legislation is now decided “federally” and so is monetary policy and, increasingly, fiscal policy.

Imagine if the US press reported whatever the POTUS said on page 15 and only mentioned Congress a couple of times a week, similarly far from the front page. Instead, front page political news would be state legislators, and governors. There would be diatribes on the opinion pages blaming the governor for some policy on which he had no choice because it was Congress-mandated.

It’s, in part, because monetary policy is outside the game of national politics that it does not get covered.

Politics is not about policy.

I just checked the Le Monde webpage. There is a front-(web)page item about the EU budget (the EU budget is very important, once a few-years discussion, so it does not really disprove my thesis). Curiously, I don’t know which of the section on the top of the page it is under: it’s not “Politics”, not “Economy”, not “Society” (which are all France-only issues), but it’s not “International” either. Checking the print covers for the past week shows a single item on EU politics (referring to a Hungary-EU fight), with less emphasis than another discussion of the politics of austerity in the US or Chavez’s death. Rest is all either inner French politics or the War in Mali.

14. March 2013 at 04:12

Once “converted” to Market Monetarism, it becomes frustrating to read any number of of news articles or analyses about economics and Europe—or China for that matter.

Does not the aggressive monetary policy of China People’s Bank play a role in that nation’s terrific growth? No one ever says so.

The Hong Kong Monetary Authority said that mainland China’s bank has a “revealed preference” for growth. Publicly, China central bank say they target 4 percent inflation, as a ceiling.

I am still not yet convinced that 2 percent is a magic number for inflation targeting. It has assumed divine status, just as others genuflect to zero inflation (set aside how you even measure that).

Maybe 4 percent inflation is better than 2 percent for long-term growth. Or 3 percent. All these rates would have been considered low 20 years ago. Now 4 percent in considered way too high, worth enduring perma-recession to avoid.

I don’t get it.

Give me 4 percent inflation and 4 percent real growth forever.

14. March 2013 at 05:03

The European Commission defends itself:

http://blogs.wsj.com/brussels/2013/03/13/eu-fires-back-in-austerity-debate/

14. March 2013 at 05:28

Here’s a good way to visualize what EU politics is like: imagine that Obamacare has passed with virtually no public discussion whatsoever in 2009/2010. And, now, there would be major per-state discussions on the governor’s attempt to overhaul the insurance market as they set up the Obamacare exchanges with major political battles over the details.

14. March 2013 at 07:36

Globaly, the net current account must be zero. For every exporter, there is an importer. But, it isn’t. OECD says that net exports exceed net imports.

Where are the excess exports going? Are we exporting to the moon?

14. March 2013 at 07:42

Ships sinking?

14. March 2013 at 12:29

Steve,

You wrote:

“Do you (or other posters) have any data on the current account balance of Europe as a whole?”

I interpret this to mean the *eurozone* as a whole. Information on the eurozone sectoral accounts can be found here:

http://epp.eurostat.ec.europa.eu/portal/page/portal/sector_accounts/detailed_charts/contributions_of_each_sector

Click on the item marked “Charts” on the right hand side to open the Excel file. In Table S1-8 you’ll find an item labeled “total euro area.” That is the current account balance for the eurozone as a whole. The eurozone was in deficit through 2001 and in surplus in 2002 through 2007 with the exception of three quarters in 2006. It remained in deficit through 2011 and has run a surplus since. It has swung from a record deficit of (-1.6%) of GDP in 2008Q4 to a record surplus of 1.0% of GDP in 2012Q3.

14. March 2013 at 12:45

I do not always agree with your views that monetary policy can solve all problems at the zero bound. But I am absolutely sure that the Euro crisis is first and foremost a monetary crisis. Oh please, oh please, we need a monetary pendant to Krugman to bash our madcap central bank. You would fit the bill perfectly.

14. March 2013 at 12:57

Everyone, Thanks for the info–short of time . . .

14. March 2013 at 12:59

Scott,

You wrote:

“Unfortunately I’m not fluent in “European,” but my eurozone commenters tell me that on the continent there is virtually no discussion of the role of monetary policy in the crisis.”

I’ve been having a running dialogue with commenters from the Netherlands and Germany. I was flat out told that northern European macroeconomics is very different from the rest of the planet’s, and that they don’t teach anything about aggregate demand there.

Then I asked one of them what principles of macroeconomics textbook was most commonly used where they lived, and they said Mankiw (southern Germany). I had them read the section on the AD-AS model and the factors affecting AD (e.g. monetary policy). They were shocked to discover that what the economists on TV are saying is totally contradicted by the elementary textbooks.

I’m beginning to wonder if there has been some atrophy in the knowledge of monetary policy in the eurozone due to the foundation of the European monetary system. For example, the Dutch guilder was effectively pegged to the mark from 1983 until the creation of the euro. Thus it’s been at least 30 years since the Netherlands has had an independent monetary policy.

It’s almost as though they are living in a Dark Age of monetary economics and have to rediscover everything they once knew.

14. March 2013 at 13:10

Steve,

You wrote:

“And if that’s true, then isn’t Europe the one engaged in currency wars, trade wars, monetary wars, export wars or whatever you want to call it?”

You might find this interesting:

Ryan Avent:

“…The balance of payments approach provides a framework for thinking about so-called “currency wars”. As Mr Pettis says:

“There are broadly speaking two kinds of countries right now. Countries loudly engaged in currency war, and countries quietly engaged in currency war.”

In the first category, you might put China and Japan, and possibly even America, where the Federal Reserve has endeavoured to support its domestic economy while remaining agnostic about the dollar, leading to a weaker currency than in a but-for world. In the latter category, you might put the euro zone, which is fighting just as hard albeit by complaining about others’ stimulative activities and relentlessly crushing internal demand. If we define “currency war” as the extent to which an economy is interested in growing its external surplus, the euro zone may be the most belligerent economy of all…”

http://www.economist.com/blogs/freeexchange/2013/03/global-imbalances

15. March 2013 at 00:27

One of the traditional methods of inter-region economic adjustment within a monetary union is inflation. Inflation drives up both wages and consumption in rich regions, driving investment towards poorer, lower-wage (in real terms) parts of the union.

Unfortunately, the built-in moral hazard of a monetary union means that without an incentive for component governments to act responsibly, inflation can spiral out of control (or you might get a bubble in the external exchange rate; the problem is overvaluation of the real exchange rate more than inflation per se). This is why successful monetary unions need fiscal limits at the regional level.

Even if the Eurozone had real, enforced fiscal limits, I’m not sure it would work. The Germans aren’t terribly keen about giving up their trade surplus, whether via appreciation of the euro or inflation within Germany.

15. March 2013 at 06:35

Mark, Thanks. That’s quite interesting. The Dutch haven’t had much control over AD for many decades, so it might make sense for their policymakers to focus on AS. But northern Europeans do have great influence on ECB policy–which obviously matters a lot.

Joe, I also have doubts about the euro, but think more than 50% of the current problem is simply low NGDP growth, which the ECB could have prevented.

15. March 2013 at 07:44

Mark, I’ve even had people tell me that it’s not that they learn macroeconomics differently, it is that the economy behaves differently. Thus, it may be perfectly true that in the anglo-saxon world, whatever I am saying applies. It just does not apply in Europe. The culture is different, thus we need different economic theories.