The incredible shrinking yen

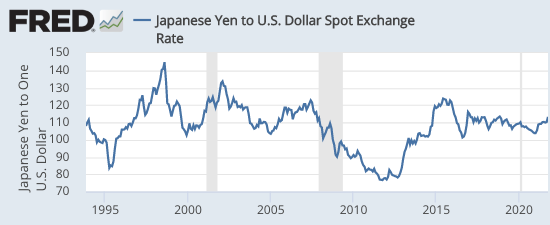

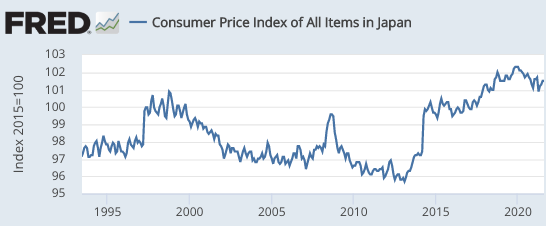

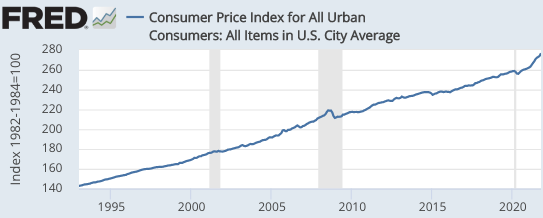

Over the past 28 years, the dollar/yen exchange rate has behaved very oddly. During this period, Japan’s CPI has risen by 4%. Not 4%/year, rather 4% in total. And even that merely reflects a set of sales tax increases. Meanwhile, the dollar has appreciated by about 6% against the yen (in nominal terms). If we combined those two facts, and apply the theory of purchasing power parity (PPP), then you might have expected the US price level to have fallen by about 2%. Instead, it rose by 90%.

This means that the US real exchange rate appreciated by roughly 92% against the yen. That’s a lot!

Each year, I expect PPP to finally kick in. But over the past 12 months, the US CPI rose by 6.2%, while the Japanese CPI fell slightly. So did the dollar depreciate? No, it’s up almost 8% against the yen, for a real appreciation of nearly 14%. (Japan is becoming a real travel bargain.)

So why don’t I give up on my belief in PPP? Why do I still believe that the optimal forecast of the real exchange rate for the dollar against the yen in the year 2049 (28 years from today) is roughly the same as the real exchange rate today? The answer is simple. The logic behind PPP is so powerful that almost any anomaly is easier to explain as being due to a one-time adjustment in Japan’s real exchange rate, rather than PPP being wrong. Ceteris paribus, I still expect US/Japan inflation differentials to show up in future movements in the nominal exchange rate.

Here’s another example. Over the past 28 years, the NASDAQ stock index has massively outperformed British and French stock indices. And yet, if asked to predict which index will do the best over the next 28 years, I’d predict they do about the same. And the reason is simple. The logic behind the Efficient Markets Hypothesis is incredibly powerful. Rather than reject the EMH, it’s easier to explain this huge NASDAQ outperformance as a one-time unanticipated adjustment in response to US tech firms doing better than they were expected to do back in 1993.

People often respond to these explanations with, “Oh come on, for 28 years?”

Apparently so.

Tags:

12. November 2021 at 10:55

Of course the only time I visited Japan was late 2010 with a low-80s exchange rate. My girlfriend at the time was studying abroad there so I went for a week. Whenever looking at prices she’d mentally think “100 yen equals 1 dollar” and I had to keep reminding her things were way more expensive than she thought.

12. November 2021 at 11:07

Economists don’t know a debit from a credit. The deceleration in velocity was predicted in May 1980 by Dr. Leland James Pritchard, Ph.D., Economics Chicago 1933, M.S. Statistics, Syracuse

“The Depository Institutions Monetary Control Act will have a pronounced effect in reducing money velocity”.

Thus, the stage was set for secular stagnation, the decline in velocity. “Among the purposes of the act were ‘to provide for the gradual elimination of all limitations on the rates of interest which are payable on deposits and accounts, and to authorize interest-bearing transaction accounts.’ ”

Japan’s experience reflects a decline in velocity. ““JAPAN’S EXPERIENCE OF TRANSITIONING FROM BLANKET GUARANTEE TO LIMITED COVERAGE”

https://www.dic.go.jp/content/000010398.pdf

The Japanese save a greater proportion of their income and keep a larger proportion in their payment’s system. “Japanese households have 52% of their money in currency & deposits, vs 35% for people in the Eurozone and 14% for the US.”

Banks do not lend deposits. Deposits are the result of lending.

12. November 2021 at 12:15

Garrett, I also used the 100 to 1 in 2018, but now that’s an overestimate of the cost! Japan has gone from being quite expensive to quite cheap.

12. November 2021 at 12:21

Scott, I am not sure I follow the logic here, which I’m sure is sound but I don’t understand very well.

If Japan’s Yen is undervalued, wouldn’t you make a killing purchasing items from Japan at a virtually discounted rate, and that profit margin would incentivize people to purchase items from Japan until the Yen rose to the appropriate level? The same is true for China and many other countries. Even if PPP calculations are in things that cannot be traded, they do impact the inputs of what can be traded, so Japan’s nice infrastructure should make their exports more competitive, and that should cause the Yen to appreciate until it reaches the correct position. This doesn’t mean that the Yen won’t appreciate, but that the current standings seem relatively accurate.

12. November 2021 at 14:19

Anon, Yes, I’m not saying the yen is undervalued, just that its real exchange rate has plummeted by an extraordinary amount. There are reasons why this occurred (competition from China, Korea, etc.)

12. November 2021 at 15:14

Scott,

I think the explanation is in part a) to the extent that the real exchange rate is driven by trade in goods and services, it is only (or mostly) driven by tradeable goods and services, b) not all goods and services in the CPI are tradeable and c) with a multi party system, the subset of tradeable goods between any pair of countries may be substantially different than the subset between another pair of countries.

So basically a lot of the cheap stuff in Japan can’t be exported and at the same time Japan has banned tourism, so nobody can come to Japan to buy the cheap stuff either.

Also I believe that while forward rates are driven in part by PPP, current rates are just of function of the forward rate and the interest rate differential. (Most people look at it the other way around, but I think that’s wrong.)

12. November 2021 at 23:18

“If Japan’s Yen is undervalued, wouldn’t you make a killing purchasing items from Japan at a virtually discounted rate, and that profit margin would incentivize people to purchase items from Japan until the Yen rose to the appropriate level? The same is true for China and many other countries.”

Not when China uses Uighur labor to produce items cheaper – and not when economists call for fewer tariffs to protect workers.

There is no such thing as equilibrium in the real world. Such a utopia only exists in the fictitious, abstract world of economic textbooks. Nowhere in this world is trade free, but even if it was it wouldn’t be a “good thing”. Ricardo’s version of free trade – which is what every economist worships on Sunday – would lead to homogenization, centralization, destruction of national sovereignty, etc, etc. Because in the real world people want this thing called POWER, which follows their SELF INTEREST. Remember Smith! And if I can produce coal cheaper than you, I’m going to FUCK YOU UP! Not only am I going to destroy your industry (if you don’t protect it), but once I’ve monopolized industry I will set the prices higher than you can afford. I will make you beg for coal, until you genuflect to my every demand. This is the way the world REALLY WORKS.

This is why your country is “third world”. It has “third world” minds.

Japan, like most of the west, is losing big time.

13. November 2021 at 00:51

Federal Judge destroys Sumner’s tyrannical mandates in just 22 pages.

https://www.ca5.uscourts.gov/opinions/pub/21/21-60845-CV0.pdf

This work of genius shows a clear difference between the two professions, i.e., law requires hard facts and real evidence while economists rely on abstraction and subjectivity.

The difference in education and ability is palpable.

13. November 2021 at 02:43

The title should be “incredibly shrinking intelligence”

Sumner’s left wing paper WAPO, just retracted their Pulitzer prize winning piece that smeared Trump. Turns out the steel dossier, which we all expected was Clinton Rubbish, turned out to be exactly what we thought.

More indictments of Sumner’s left wing cabal are probably coming. Remember when Sumner kept quoting that piece in 2017? He wrote numerous blog posts – all libel btw – that smeared Trump for his so called “Russian Connections”.

He is wrong again. And the reason he’s wrong: he doesn’t have any original ideas. He doesn’t do any research. He just regurgitates what he hears on CNN, or reads in NYT and WAPO.

Very definition of “brainwashed”.

While he’s soaking up the propaganda, the administration’s DOJ is raiding journalist homes, trying to recover a diary that alleges to reveal Biden’s daughters thoughts on his “touchy, feely”, behavior.

Possible pedophile, like his son?

Or maybe the diary reveals the buyer of Hunters art masterpiece?

I never new armature artists and crackheads could sell paintings for more than a Picasso. Perhaps I’m in the wrong profession?

Must be more “hard right” conspiracy, eh Sumner?

13. November 2021 at 06:06

Scott: “Garrett, I also used the 100 to 1 in 2018, but now that’s an overestimate of the cost! Japan has gone from being quite expensive to quite cheap.”

There hasn’t been much change.

The exchange rate has averaged 110 yen per dollar this year and the past month has been at 114. In 2018, the rate was about 109 for the year but at 107 for a few weeks from mid-February to mid-April.

13. November 2021 at 09:45

The national debt is the counterparty of the national financial assets. They are equal.

In MMT we call it the ‘net financial assets of the private sector’. It’s a stock. You can tell this by the denomination. It’s in dollars, pounds, yen, etc.

It’s nothing to do with money in circulation. That is a flow characteristic and depends on how much of the nation’s financial assets are changing hands at the moment. The denomination of that is different: dollars/month, pounds/week, yen/annum.

The difference is the same as the difference between miles and miles per hour.

The much beloved-by-monetarists ‘M’ series calculations try to take the entire national debt and work out what ‘money in circulation’ there is from that using various series. They are all wrong because they try to predict a flow level from the level of a stock.

The whole point of excluding ‘public deposits’ from the totals was because that doesn’t have to circulate. But apparently everything else does because ‘interest rates’.

Yet in reality it doesn’t. There is no difference between a bill in the mint and one in a wallet. Both of them just haven’t been spent yet.

They are trying to predict a flow level from a stock amount based upon a belief, and that is supposed to show something in the real economy. The evidence from reality is that it shows nothing. It’s a complete waste of time that has distracted people for 50 years.

What they assume is that nobody holds money for its own sake. They only hold it because they are induced to do so by an interest rate. And that isn’t how people work.

People hold money for status and insurance purposes, and the lack of spending that money represents is largely why there is unemployment.

The calculations of the amount of national debt, currency quantities, bank deposits and the rest largely miss the point. It’s the flow that matters, not the stock.

13. November 2021 at 10:56

Todd, Not sure your point . . .

Kester, When you attach a comment that has no bearing on the post I’ve written you don’t help your cause.

13. November 2021 at 11:49

I’ve worked at a hedge fund for about twenty years now. We used to hire economists, but then we recognized an interesting pattern. The investment proposals sent to us by economists underperformed investment proposals sent to us by consultants who had previous business experience and/or owned a business.

Our theory on this matter is quite simple. The businessman is better able to see the red tape and the overarching policy on the ground in a far superior way to the economist who very often, but not always, integrated theory into their investment decisions.

If things continue on their current path, then the Yen will continue to devalue and lose purchasing power. Southeast and East Asia will continue to rise. The same will happen to the dollar. The youth will continue to struggle to find employment, most will be purged from the unemployment roles after six months – you can find them sitting on the side walks of ultra liberal cities like SFO and LA – such people will make life unsafe for the productive and Americans will have less purchasing then Sumner did in the 1970’s.

In other words, his babyboomer generation lived beyond their means, saddled you with tremendous debt, and sacrificed your future so they could live in oversized suburban homes.

We can continue the story.

The young gentlemen in 2030 will most likely spend most of his paycheck on subsistence. He won’t be able to save. He won’t be able to start a business. Indeed, it is already happening. (less than 70% of Americans have 1000 in their bank accounts). That is lower than the average Thai, and far lower than the average Chinese!

He will notice that his bosses are mostly Chinese and South East Asian. He will realize that they bring a different culture, and he will realize that their culture clashes with his own. Social cohesion will collapse, individualism will erode, the population will become more militant as they seek to protect their tradition and culture. The politicians, recognizing the degradation and demise, and inevitable collapse of the republic, will become more corrupt as they pursue self interest over virtue – hastening the decline.

The legal system will become two tiered, one rule for the poor another for the rich.

The story continues, but I think you know where Sumner’s economic policy proposals lead: bankruptcy, war, or both.

And if the IMF attempts to “fix” the currency, by artificially buying and selling, that will only delay the inevitable. You can only subsidize bad policy for so long.

In this case, the end result will be even more horrific.

14. November 2021 at 12:41

This post, and especially the comments, make me want to re-watch Rising Sun. God, I miss Sean Connery.

By the way Scott, the town of Newton continues to descend further into madness. You got out just in time.

16. November 2021 at 01:23

Are the top two graphs supposed to look a little bit correlated? Because it looks like the Yen was at its strongest when the Japanese CPI was at its lowest, and the Yen depreciated when inflation increased slightly in Japan.