The Great Stagnation continues

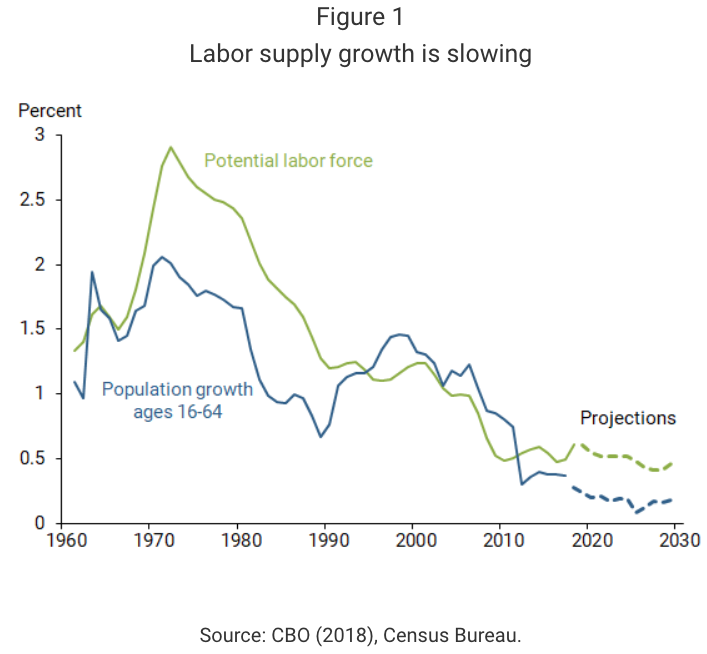

Five years ago, I suggested that the new normal was 3% NGDP growth, which included 1.2% RGDP growth and 1.8% rise in the GDP deflator. A few years later I realized my growth forecast was a bit too low, and raised it to 1.5%. Now the San Francisco Fed has come out with a new article suggesting that 1.6% growth is the new normal. This includes the CBO’s estimate of 0.5% growth in the labor force going forward and the 1.1% average rise in productivity since 2004.

In fact, RGDP growth has averaged 1.67% over the past 12 years. That’s during a period where the unemployment rate has actually fallen somewhat, so it’s not “cyclical”. And bond markets are signaling slow growth ahead.

My initial estimate of 1.2% was too low because I forgot to include rising employment levels among baby boomers who were over 65. The SF Fed piece has a nice graph, which shows that the growth rate of the labor force rises from 0.2% to 0.5%, once you include the old people who continue working:

Caroline Baum points out that there are two ways that growth could pick up:

And it appears that, short of some new, new thing that ushers in the next productivity wave or comprehensive immigration reform that encourages labor-force growth through initiatives such as a start-up visa, the new normal will be with us for a while longer.

Since we don’t know why productivity growth was so high during 1995-2004, I’m reluctant to say that it could not happen again. But I’m a market monetarist, so I’ll go with the bond market. The most likely outcome is that developed countries will continue on this slow growth track for quite some time.

And no, monetary policy cannot fix the problem, as we learned in the 1970s. We need supply-side policy reforms. A good place to start next Monday is replacing all taxes on capital income with consumption taxes on the rich plus a carbon tax. Then on Tuesday repeal all zoning and occupational licensing laws. On Wednesday we should triple the rate of immigration. On Thursday repeal all rent controls. On Friday replace minimum wages with low wage subsidies. Saturday we should slash public spending (and tax subsidies) on health and education to Singaporean levels. Then take a breather on Sunday.

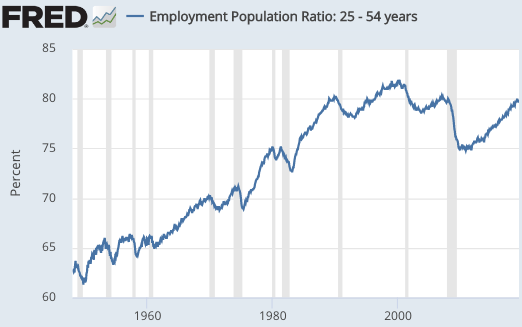

PS. The prime age employment ratio has risen from 75% during the recession, back up to the pre-recession level of 80%. I expect it to level off in the low 80s. We need more immigration or productivity for fast growth.

Tags:

1. July 2019 at 07:10

Growth may be more important for geopolitical reasons, but growth per capita is more meaningful to the local ciitzenry, and it’s not obvious that more immigration will move this needle.

I’m all for immigration, so long as it doesn’t disrupt social cohesion and create a backlash, like in the 1920s.

Foreign-born population is at record highs, annual legal immigration is at record highs, and social cohesion ain’t so hot right now. Pump the brakes on tripling of immigration please.

1. July 2019 at 08:41

Concur with Brian above; growth per capita is a better measurement for a successful regime and I imagine that there’s some sweet spot for new immigration that maximizes that measure.

Also, you lost me on slashing education spending. How on earth would that increase growth?

1. July 2019 at 09:07

And on the Sabbath, Scott Sumner rested; he saw that it was good. 🙂

1. July 2019 at 10:05

I think the US people needs at least 2days off per a week

1. July 2019 at 10:20

Wow, what a great take! We should totally triple immigration, hey whats that? It won’t grow GDP per capita, i.e. what actually matters? It also decreases wages? Oh, immigrants consistently vote for the left?

Lets turn the US into another Brazil by tripling immigration!

1. July 2019 at 13:24

Brian and Randomize, Surely total income also matters. If a tiny country like Norway has a higher per capita income than the US, i’d still view the US as being far more successful in improving human welfare. Don’t forget that current Americans were here due to immigration.

I see no major problem with social cohesion from immigrants, if anything the biggest splits are among native born Americans. Orange County where I live is full of immigrants, and it works very well. Heck, my wife is an immigrant.

David, Yes, I’m really tired now. 🙂

1. July 2019 at 14:11

Scott,

Your wife is a highly skilled immigrant who entered legally. Most people think that’s good. People are afraid of poorly qualified migrants who are trying to pass the southern border with kith and kin, no matter what. And if one doesn’t let them in immediately, they claim they are refugees in need of asylum.

Immigration is a hot topic. The US probably has the better immigration system. In Europe, at least 50% of the male “refugees” (in the best working age) live of welfare. I don’t think the numbers are that bed in the US, nevertheless Trump was elected. So there might be different opinions in considerable measure in the US as well.

On Monday I would recommend that asylum and refugee centers are now being build in the middle of the best residential areas of the rich and super rich, not only but also. That’s good for both sides. The elite gets to know the refugees and the refugees grow up in a good neighborhood.

And why does nobody ever want to reform the American legal system? Especially these ridiculous claims for damages. I recently read of a surgical nurse (in California?) who wasn’t treated nicely by a surgeon. The surgeon liked to scream, sometimes he also threw a scissor through the operating room. He didn’t hit anybody, but it he was a angry person. This went on for several years. Eventually, the surgical nurse has been awarded about 300 million dollars (?) by a jury because of “psychological damage”. And Americans are wondering why their healthcare system is so expensive.

1. July 2019 at 14:24

The solutions Scott purposes suggests that this is the diagnosis for the root causes of stagnant growth in the US. But is it? And will increased growth reduce inequality?

1. July 2019 at 15:48

I like the Scott Sumner economic policy proposals, but let’s add in national property taxes and sales taxes, and reduce income-payroll taxes particularly on the lower half of the spectrum.

The great productivity gains of 1995 to 2004 coincided with a long and economic expansion. This makes sense, no? People invest in plant and equipment when there is a prospect for lots of sales.

Higher real wages will create a larger labor force. Remember supply and demand. Higher demand will result in higher supply.

The lessons of the 1970s? One might say central banks learned to suffocate economies thereafter.

The best policy goal for the United States is that of tight labor markets now, tomorrow and forever. A nation with “labor shortages” is a happy country.

By the way, if you want to get depressed, read the latest BIS report issued on June 30. They say monetary policy can do nothing to stimulate global growth, and we need to have tighter monetary policirs globally.

1. July 2019 at 17:02

Scott,

right on – and it’s sad that this even needs to be said.

On Singapore though, let me tell you right now we’re in a phase of increasing education subsidies – mostly in the adult education (continuous learning) sector.

Christian List,

“In Europe, at least 50% of the male “refugees” (in the best working age) live of welfare. […]

On Monday I would recommend that asylum and refugee centers are now being build in the middle of the best residential areas of the rich and super rich, not only but also. That’s good for both sides. The elite gets to know the refugees and the refugees grow up in a good neighborhood. ”

You’re in luck – my mom has been renting out apartments to Syrians for years, in her posh, upper middle class neighborhood. That’s maybe the only benefit of rent control, you get the same rent from anyone, so the social strata are mixing indeed. Everybody’s well behaved, the males would like to work, though it’s hard to find jobs with limited language skills when you’re in your 50s. They’re electrical engineers and such, but diplomas often aren’t recognized. The women are home makers and the kids fare best, because they pick up German very well. Mind you, the adults miss Syria and would like to go back. The kids, not at all. That’s in Austria, where the now defunct right wing government proposed to bunch the refugees up in “concentrated” camps instead. Presumably to help integration or what, I don’t know, you got to ask them.

Speaking of Austria, I can’t remember any time since the 80s when construction work was NOT done by immigrants. Etc. Entire economic sectors wouldn’t even exist w/o immigrants. A bit like the fruit industry in Florida or California.

1. July 2019 at 17:19

Tuesday afternoon is never ending…

1. July 2019 at 17:55

Scott,

Your list of supply-side reforms is worthy, but am I correct in thinking there’s no low hanging fruit here? Even in the ideal Sumner world, it wouldn’t be expected to boost real growth that much.

I’m not yet convinced this is entirely secular, as I’ve pointed out, but it doesn’t look like I’ll get a good test of my hypothesis. Inflation targeting makes it very difficult, and the trade wars don’t help.

Adoption of a 5% NGDP level target would be a safe way to test it.

1. July 2019 at 19:05

“Since we don’t know why productivity growth was so high during 1995-2004…”

You mean the period where there was basically no opposition to neoliberalism due to capitulation on the Left (Clinton, Blair)? Such a mystery…

Seriously, which of Scott’s supply side reforms could not have realistically been adopted in the 1990s? (Keep in mind, Clinton was ready to privatize Social Security were it not for the Monica Lewinsky scandal.) Eliminating capital income taxes? Plausible, although raising consumption taxes on the rich would depend on form of implementation. Carbon taxes, probably not, although those don’t seem related to growth anyways. Reducing zoning and occupational licensing would have been plausible. Increasing immigration? Without a doubt. Repealing rent control and minimum wages? Not a hypothetical: we actually repealed rent control in the 90s in places like Boston, and the liberal NYT was declaring that the optimal minimum wage was zero! Low-wage subsidies? The EITC was expanded in 1986,1990,1993,2001. Slashing public spending? Probably not.

Tyler Cowen used the phrase “The Great Forgetting” recently. That’s the best description yet of our current decade.

1. July 2019 at 19:10

“…monetary policy cannot fix the problem, as we learned in the 1970s. We need supply-side policy reforms.”

If that’s true, then what’s with all the talk about money being tight right now?

“Saturday we should slash public spending (and tax subsidies) on health and education to Singaporean levels.”

How could we ever do that effectively without implementing all the various reforms Singapore has used to control health and education costs?

1. July 2019 at 20:57

My recipe for long term growth (in addition to Scott’s list);

1. Radically simplify the tax code, get rid of all exemptions, include charitable donations.

2. Get rid of financial engineering – Tax company interest payments and dividends at source at 20%. No further tax on receiver. Tax capital gains at exactly the same rate. Same flat tax on salaries. Zero corporate tax. “Other income” at 20% tax as well.

3. Kill Moral Hazard – Eliminate federal deposit insurance, Ban guaranteed return accounts including all checking accounts, any deposit or checking account must be based on equity not debt structure unless invested in Fed. Allow checking at Fed for individuals. i.e. narrow banking.

4. Create special investment zones in North East US – removal all planning and permitting in these areas. Make them large areas. No construction codes but buildings must have liability insurance from A rated insurer. Government can build infrastructure before building starts including subway lines, sewage etc. This is much cheaper than doing after everything is built.

2. July 2019 at 02:54

One of the biggest supply-side constraints is housing. housing policies in high-income states like California are horrible and a drag on growth. Some economists like Moretti have estimated that a with an elastic housing supply in high-income states, US GDP could increase by some 5% to 10% in the very long-run, so maybe 0.2 to 0.4% of additional growth per year over a time period of 2 decades? A lot of this would come from workers moving to high-productivity regions.

Obviously, the housing policies that are required to achieve this outcome are politically infeasible…

So there is always that.

2. July 2019 at 03:08

Scott,

You’re ignoring the impact of tax rate changes on capital formation, increased productivity and growth. This is especially pronounced when you have asymmetrical returns on capital.

2. July 2019 at 03:39

Scott wrote: “Surely total income also matters. If a tiny country like Norway has a higher per capita income than the US, i’d still view the US as being far more successful in improving human welfare.”

A switcheroo was just made here. At first Scott is saying how to increase U.S. growth with more immigration or higher productivity then he says the U.S. growth through immigration would increase world welfare.

Obviously, if the median immigrant enters America at the same wage he or she was earning in her home country, that would increase U.S. growth but wouldn’t change any increase in human welfare.

The growth of a country is of little importance – growth per capita is what matters by far the most.

2. July 2019 at 03:50

The last line should be: “Growth per capita is what matters by far the most.”

2. July 2019 at 05:28

Every hour spent complying with a regulation lowers productivity. That hour increases the denominator of the productivity calculation without increasing the numerator.

2. July 2019 at 05:35

Todd Kreider,

“Obviously, if the median immigrant enters America at the same wage he or she was earning in her home country, that would increase U.S. growth but wouldn’t change any increase in human welfare.”

But obviously, the immigrant will earn a far higher wage in the US due to the higher productivity of the US economy as a whole – all at the exact same skill level s/he had when entering the US. There is a whole World Bank report on this, called “Where is the Wealth of Nations”, detailing in what proportion the productivity of a country is due to capital, machinery, natural resources, education etc. – and in what proportion the societal system as a residue contributes. Conclusion, “society” far, far outweighs all other factors. People earn a lot in the US not because they’re so smart or well educated or because of machines or abundant capital – all these help and are abundant too in the US – but mainly, because the US (and a bunch of other countries) work well _as a system_. This includes trust, rule of law, contracts being respected and enforced etc. And this is why there is immigration to these countries, and the US – you can make a lot more money at the exact same skill level, because you now live in a better society.

Conversely, the exact same American being put in the social and political condition of your average “bad country” dictatorship, let’s say Venezuela …. what do you think are your chances there? Without your passport protecting you?

2. July 2019 at 09:47

Christian, You said:

“Your wife is a highly skilled immigrant who entered legally. Most people think that’s good.”

(Not the alt-right Trump supporters.)

So triple high-skilled immigration. I never suggested tripling illegal immigration.

I do agree about our legal system.

BC, Good points.

Paul, Then do the reforms. But at a minimum stop the huge subsidies, even if costs don’t fall all the way to Singapore levels.

Chris, More good ideas.

Todd, That’s a silly argument. No serious economists doubts that immigration to the US boosts per capita world GDP. And there was no “switcheroo”, I was responding to a separate point made by a commenter. My post was on how to boost total US GDP.

2. July 2019 at 12:04

Migration should boost US GDP per capita, too, due to agglomeration effects, no?

In any case, just auction off the immigration and work visas to the highest bidders, and use the proceeds to lower taxes. That should be politically popular.

2. July 2019 at 16:08

“Todd, That’s a silly argument. No serious economists doubts that immigration to the US boosts per capita world GDP.”

Scott, think this through.

As for your first point, it doesn’t matter if the U.S. allows in immigrants with respect to increasing GDP unless the GDP per capita increases. It might, but it would depend on who immigrated. (I’m pro immigration but that shouldn’t be relevant.)

2. July 2019 at 16:37

Scott, forcing people to pay out-of-pocket by removing subsidies is not going to reduce costs for college or healthcare. It’s a fun theory, especially for free-market economists, but it just isn’t true.

2. July 2019 at 20:46

Paul,

if you remove subsidies, you reduce quantity demanded because the price increases for the end user. Subsidies artificially inflate demand. You save both on subsidy cost (which needs to be raised by taxes at the other end) and contribute to a more efficient use of resources.

3. July 2019 at 09:25

Todd, I think you are confusing total and per capita GDP. When people migrate here their incomes usually rise sharply.

Paul. Don’t be silly. Recently, an older lady of modest income that I know went to the doctor with a mild cold. The doc says: “Just to be safe, let’s keep you overnight and do some tests.” The bill was $8000, entirely paid by Medicare. There’s no way she does those tests for just a mild cold if paying out of pocket. I have many similar examples from my own life, and lots more from people I know. Who should I believe, you or my own life experience?

If you make things free, then people buy more.

3. July 2019 at 09:29

Sumner, I think Paul was referring to price when he said costs, not total spending which is what you seem to be referring to. There is no guarantee that prices would fall if people were forced to spend less on healthcare or education.

3. July 2019 at 10:44

“Saturday we should slash public spending (and tax subsidies) on health…”.

Stylised fact or factoid, I don’t know which, oft cited in Europe: the US spends more on health with worse results, and Europe spends less for better.

Are you saying that the relative performance is down to US public spending?

5. July 2019 at 12:03

I know I’m late to this thread, but I agree real GDP per capita is a better measure to try to maximize than real GDP. Even better is real GDP per hour worked.

We should be trying to replace as much labor with capital and automation as possible, and getting as much capital into the working poor and middle class as possible.

So I endorse your first week, except possibly Wednesday (though I’m not necessarily opposed to more immigration). But after the day of rest, here’s my suggestions for week two:

Monday: Require 401k contributions, 15% with a dollar for dollar match, for a total of 30%.

Tuesday: Pigouvian tax on consumer credit of 10%, including credit cards and car loans over 3 years.

Wednesday: Reduce mortgage interest deduction to 15 year loans on purchase, or refinancing providing no cash out or extending the term.

Thursday: Pay profits from the Fed to each adult citizen into their Roth IRA. Do the same with all oil royalties.

Friday: Begin raising the reserve ratio gradually from 10% to 100% over the next 5 years. Increased profits go into the citizens dividend.

Saturday and Sunday: Rest.

7. July 2019 at 02:54

“Todd, I think you are confusing total and per capita GDP. When people migrate here their incomes usually rise sharply.”

I’m not confusing total and GDP per capita. They must make above the U.S. median wage to increase U.S. GDP per capita and while some do that, others obviously do not.

The move to America would not necessarily increase world GDP per capita either as you stated. If an economist moves from one university to another in the U.S., is he or she automatically increasing the GDP per capita? Usually not.