Confusing “history” with numbers

It turns out “Canucks Anonymous” is Adam P. Here he discusses the 1974 recession:

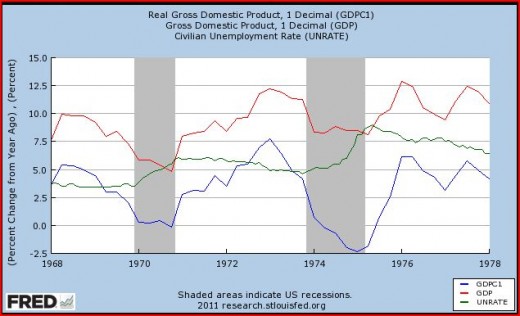

Below is a time series plot of real GDP growth, nominal GDP growth and the unemployment rate during the 1970s. On the eve of the supply shock NGDP growth is running about 10%, real GDP growth is running around 5% and unemployment is about 5%. Now, 10% NGDP growth is a higher level than you’d typically choose to target but the important thing to notice is that in the preceding 4 years or so the unemployment rate is extremely stable right around 5%, inflation is also very stable as both real GDP growth and NGDP growth are accelerating virtually in parallel. It certainly looks like an economy in equilibrium.

Now, when the shock hits real GDP growth of course plummets as is required for the episode to warrant the name “supply shock”, but look at NGDP growth, it is remarkably stable! This is exactly the response of monetary policy and NGDP growth that the market monetarists want, this is supposed to prevent unemployment from rising but if fails miserably! Unemployment rises sharply and remains elevated for several years.

Furthermore, as we all know there was subsequently an acceleration in inflation that got somewhat out of hand, you might even say an inflation overshoot perhaps?

This is an amazingly pure test case, NGDP did exactly as the market monetarists would want and the whole thing is a total failure. Monetary policy does not appeared to have fixed the situation.

I was somewhat in a state of shock after reading the preceding. It would be difficult to find a worse test of market monetarism in all of American history. Remember, we favor a stable 5% NGDP growth rate. Let’s examine all the flaws in Adam’s analysis:

1. NGDP growth rises sharply in the early 1970s, from barely over 5% to a peak of 12.5% in 1973. Then it falls to about 8% in the recession. Also recall that market monetarism is a natural rate model. That means even if NGDP growth had remained at 12.5% in 1974, and even if there had been no oil shock, we still would have expected a recession. The preceding demand-side growth certainly pushed unemployment below the natural rate, and hence a relapse was inevitable in 1974.

2. Now add on the fact that NGDP growth slowed by 450 basis points in 1974. If the decline had started from a 5% baseline, that would be like a decline to 0.5%.

3. Now add on the fact that there was a severe real shock to the economy, in the form of a dramatic reduction in OPEC oil production. Also recall that our economy was much more oil intensive back then. The easiest way to consider this case is to assume the AD curve is a hyperbola. Then if aggregate supply shifts left, we’ll have a recession, even with NGDP targeting.

4. Even worse, the data from this period was completely distorted by price controls. Economy-wide price controls were installed in 1971, and gradually phased out in 1973 and 1974. So the inflation and NGDP data for 1974 was biased upward by the removal of price controls. Money may well have been even tighter than it looked.

5. It’s also widely acknowledged that the natural rate of unemployment rose sharply during the 1970s—market monetarist policies have no control over that variable.

But even if you ignore price controls, and ignore the oil shock, and ignore the rise in the natural rate of unemployment, the recession of 1974 is roughly what a market monetarist would expect if the Fed revved up NGDP to get Nixon re-elected, and then slammed on the brakes in 1974.

To add insult to injury, Adam suggests that market monetarism is somehow to blame for the inflation overshoot of the late 1970s. Recall that NGDP grew at an 11% rate from 1972 to 1981. We recommend a 5% rate. Those extra six percentage points pushed inflation from 2% to 8%. There’s no mystery here, inflation rose because the Fed was ignoring the advice of market monetarists, and regular monetarists as well.

An amazing pure test case? I don’t think so. But if it was, market monetarism passed with flying colors. In my view it would be much more interesting to look at a period where NGDP growth was highly stable. Marcus Nunes had some great posts showing that when NGDP growth got more stable, so did RGDP growth.

Adam continues:

To conclude lets take a look at another historical episode. The following plot shows NGDP growth, real GDP growth, inflation and unemployment from 1957 to 1967 in the US. Inflation is extremely stable while real output growth varies a lot and thus NGDP growth is very volatile as well (both inflation and NGDP are included because the inflation series is ex food and energy).

Why would someone choose 1957-67? That’s the tail end of the Eisenhower/Kennedy low inflation period, and the first three years of the easy money policy that led to the Great Inflation? In addition, when NGDP growth slowed sharply (1957 and 1960) so did RGDP. So what’s that supposed to show?

Then one final shot at yours truly:

Unemployment stays stable around 5% the whole time. So, which outcome do you prefer?

Actually no. Unemployment rises to about 7% in the two recessions (when NGDP growth slowed sharply) and fell below the natural rate in 1966, as NGDP growth was excessively fast.

Scott Sumner says “I make no apologies for ignoring these little toy models, and having my policy analysis incorporate a complex mixture of politics, macroeconomic history, well-established basic economic principles, and logic.”

I pointed out here that “well-established basic economic principles” shouldn’t really be on that list, can we strike “macroeconomic history” as well.

If you are going to trash me for not knowing any “macroeconomic history” (history I lived through) you might want to read up and find out what actually happened to the US economy during the period you are discussing. History is more than numbers.

I don’t want to be too negative here. Adam did provide a useful public service. He showed that when NGDP growth slows sharply we usually get recessions.