Ryan Murphy on state and local stimulus

Ryan Murphy has a new piece at Mercatus that discusses the problem of estimating spending multipliers using regional data:

Even if the central bank is perfectly competent and offsets the effects of fiscal stimulus entirely (meaning the multiplier at the national level is zero), these statistical methods when applied to subnational data still calculate the fiscal multiplier to be greater than one. Under conventional assumptions and settings where central banks credibly target certain nominal variables, any multiplier greater than zero should instead be interpreted as one region taking aggregate demand and jobs from another. In other words, a multiplier of greater than zero in one area implies a multiplier less than zero in another.

Unfortunately, most researchers seem to be aware of this problem:

Research employing these methods is published in elite academic journals such as American Economic Review and American Economic Journal: Economic Policy. Very rarely does it seriously address the negative externality problem. If it does, it often implies that states engaging in fiscal stimulus will provide a positive spillover for neighboring states. When the problem is referenced, it is noted as a small caveat deep within the paper. For instance, one paper states in its abstract that $100,000 of public outlays corresponds to 3.8 job years (implying a multiplier greater than one). This article has been cited 133 times as of September 2016, according to Google Scholar. Within the paper, however, the authors write, “given that the results from this cross-state approach do not incorporate equilibrium effects, cross-state multipliers, or the response of the monetary authority, we interpret this multiplier as only suggestive of the national multiplier of policy interest.” This interpretation entirely undercuts their point.

Now that we have a new administration determined to pursue tax reform and infrastructure spending, it’s worth reviewing where monetary offset does and does not apply. Pundits often confuse the supply-side with the demand-side, when talking about the “growth” effects of “stimulus”. If the stimulus is demand-side, then monetary offset probably prevents any meaningful effects. But supply-side policies can still create growth, even with monetary offset.

Infrastructure spending is purely a demand-side policy as long as the infrastructure is still under construction. Thus one should not expect any immediate impact on growth from spending more on big projects such as highways, bridges and airports. Once an infrastructure project is complete, it may (and I emphasize ‘may’) boost aggregate supply, and hence real GDP growth. In my view, the supply-side effects of the sort of infrastructure package we are likely to see will be very small. That doesn’t mean it’s not worth doing, just don’t expect a dramatic boost to GDP growth.

As of now, the GOP is still claiming that it intends to pursue revenue neutral corporate tax reform. In that case, there would be no demand-side effects, so there would be nothing for monetary policy to offset. If the tax reform boosts the supply side of the economy, it may also boost real GDP growth. As with infrastructure, the long run effect may be greater than the immediate impact, as tax reform is likely to lead to more business investment. In my view tax reform could have a stronger supply side effect than infrastructure spending, albeit still fairly modest in absolute terms.

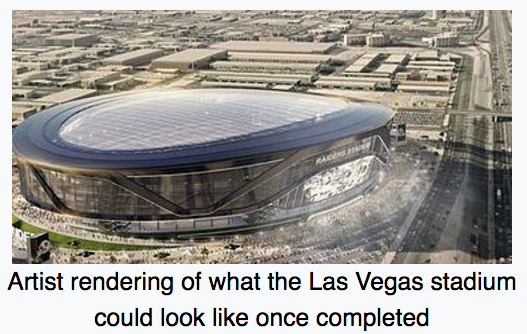

PS. I saw that the new Vegas football stadium was approved today. When these stadium projects are sold to the voters, there are promises of multiplier effects from the spending of tax dollars. Good luck.

According to Wikipedia, Vegas is just as sensitive to preserving its heritage as Boston:

The stadium as proposed is a domed stadium with a clear roof and silver and black exterior and large retractable curtain-like side windows facing the Las Vegas Strip. There is a large torch in one end that would house a flame in honor of the late Al Davis.[37] MANICA Architecture confirmed on March 28th, 2017 that a full nude strip club would be included into the stadium to honor the heritage of Las Vegas.

Does this project in some strange way remind you of a certain American politician?

Update: I guess that Wikipedia quote has been corrected. Shame on me for being so gullible.

Tags:

28. March 2017 at 14:41

It looks like tupperware.

28. March 2017 at 15:06

It looks like Trump’s hair: Strong at the edge, thin at the center.

28. March 2017 at 15:06

Or was it his policy?

28. March 2017 at 15:45

Worth noting—when Texas and North Dakota were going through their oil booms, they had inflation at national average.

Demand creates supply also.

28. March 2017 at 15:49

full nude strip club would be included into the stadium to honor the heritage of Las Vegas—

Maybe the half-time shows will be worth watching

28. March 2017 at 15:53

Unfortunately that particular statement has since been reverted from Wikipedia.

28. March 2017 at 16:17

Thanks BT, I corrected it.

28. March 2017 at 20:39

So much discussion about unemployment and monetary policy—is the real purpose of U.S. central banking and macroeconomic policy to engage in “wage suppression”?

Former Dallas Fed President Richard Fisher publicly fretted when wages in Texas rose faster than inflation.

We heard volumes in the financial media on “financial repression” when nominal interest rates reached lows after 2008. Savers are “entitled’ to positive returns, and fat ones, judging from the financial media.

But the idea of “Federal Reserve wage suppression” is relatively rare, at least by Google search.

29. March 2017 at 03:03

I’m confused about multipliers. If a multiplier of zero is perfect monetary offset (that makes sense to me), what does a multiplier of 0.5 mean? This is the sentence I find confusing (and why is the last word “one” and not zero?)

“For instance, one paper states in its abstract that $100,000 of public outlays corresponds to 3.8 job years (implying a multiplier greater than one).”

29. March 2017 at 03:24

OT On The China Collapse:

“China Stocks Have Best Start to Year Since 2006”

Bloomberg-12 hours ago

—30—

And that danged PBoC keeps buying bad loans off the books of China banks so the banks are solid as a rock.

It ain’t fair!

29. March 2017 at 06:37

Multipliers? Sticky prices? Money illusion? These are constructs invented in a simpler time. Multipliers are often used to illustrate the fractional reserve money system and Keynes’ theory too; pedagogically they have importance but not much in the real world. Sticky prices and money illusion is often used to illustrate David Hume et al’s quantity theory of money. But multipliers have been discredited, and nowadays with electronic money, discount prices and savvy consumers, not to mention the observation known for at least a generation that velocity is not constant, the QTM is also a relic of days gone by, a relic, like our gullible host. 😉

29. March 2017 at 09:13

bill,

Assuming offset does not exist for some reason, the case of a multiplier between 0 and 1 means that the increase in public spending causes the private to contract, but not as much as public output increased. I believe when this occurs, you would need to do a pretty convoluted cost-benefit analysis to determine whether the stimulus is “good.”

29. March 2017 at 09:50

Ryan – Thx! That was very helpful.

29. March 2017 at 11:11

On a gratuitously unrelated note:

“Kocherlakota on How to Reform the Federal Reserve System”

http://en.econreporter.com/en/2017/03/kocherlakota-reform-federal-reserve-system/

29. March 2017 at 13:08

Dr. Sumner,

One point that can’t be beaten enough is that infrastructure projects are only worth it when they’re individually worth it. If the new airport or freeway will increase utility more than it costs, then it’s worth it. If it doesn’t, then it’s not. If it’s not, somebody will try to pitch it as demand-side stimulus but in reality, we’d be better off just giving people the money and letting them put their efforts toward something with a positive ROI.

It boggles my mind that some people don’t understand this concept intrinsically. I swear I had an Econ prof say that paying people to dig ditches and fill them back up again was an acceptable form of Keynesian stimulus…

29. March 2017 at 19:22

Jim Glass:

Kocherlakota is okay, but it was Ronald Reagan who made the most sense when it comes to re-shaping the Fed.

http://www.nytimes.com/1982/09/18/us/reagan-suggests-tighter-control-of-central-bank.html

Reagan said put the Fed into the Treasury Department, where it would report to the T Secretary (and thus the President).

I admire The Great Communicator for wanting clarity in government, and also the willingness to shoulder the responsibilities of proper monetary policy, relieving Paul Volcker of the duty.

The present Fed governance situation is undemocratic, and makes Rube Goldberg looks straightforward. Who is Esther George again? And who appointed Richard Fisher to the board way back when?

Add on: Let us say for sake of argument that the Fed is way too tight through 2018, suffocating growth. Who will get blamed? Trump and the GOP, despite the fact it is a D-party FOMC at this point, plus the mysterious regional bank presidents.

Okay, ha-ha, just desserts for Trump and the tight-money crowd, but this is not democracy, accountability, transparency and clarity in action.

Trump should be calling the shots on Fed policy. Then we can vote him out of office if he screws up–screwd up as determined by the voting public, not orthodox macroeconomists armed to scrims of calculus and atavistic theories.

If you think independent central banks work, just look at Greece, Spain and Italy and the ECB. If you are a Greek voter and think the solution is to engage a pro-growth monetary policy and cheapen the drachma…how do you vote?

29. March 2017 at 20:30

@Randomize – boy, you’re old school alright. You do realize Sumner the monetarist believes in money illusion and sticky prices, the two tenants of Keynesianism? (that’s to say, the goodness of ditch digging and filling it up again)

@Ben Cole – seriously? Have you read anything about your hero Reagan? Going through the book “Triumph [not Trump!] of Politics” by Stockman, you’d quickly see that Reagan’s grasp on reality was situational, not theoretical or intellectual, and he was shielded by the trio of Deavers, Meese and Baker. Even when his instincts were sound, like to cut back on Social Security at the margins (e.g., raising the retirement age), the trio thwarted him. Reagan was a showman (and btw Fed. govt as percent of GDP went up higher in the 80s than the 70s, even as taxes were cut).

30. March 2017 at 03:45

Ray “El Greco” Lopez:

Not only that, Reagan was the greatest U.S. president trade protectionist (probably eclipsing Hoover), and his dudes mechanically devalued the US dollar at the 1985 Plaza Accord. Verily he ran big federal deficits and wanted easy money.

Carter did much more deregulating than Reagan.

But Reagan sure gave great speeches, was courtly, did not insult people, and did set a tone that government is not the answer.

Besides all that, the GOP needs a hero, and they have Nixon, Bush jr. the forgettable Bush sr. and Trump as recent US presidents. P.U.

GOP hagiographers have to work with Reagan; there is no one else.

30. March 2017 at 05:09

Thanks Jim.

Randomize, That’s right.