Ricardo Reis on debt sustainability

David Beckworth has an excellent podcast where he interviews Ricardo Reis. Here Reis discusses four options for paying for government debt (and by implication government spending):

What is Fiscal Sustainability and Why is it Important?

Reis: Look, there’s a simple flow constraint, which is, in order to pay for the current debt, and particularly the interest that’s due on it both principal and interest, you can only do one of four things. You can either issue more debt. You can either default on the debt and say, “Forget it, I’m not paying.” Or you can collect fiscal surpluses, more taxes than revenue, say, or finally, you can inflate away some of that debt that is have enough inflation so that even though you pay nominally in real terms you do less.

Notice that while only the third option mentions “tax”, all four of these involve taxes. Pilling up debt means higher future taxes. Default is like a tax on bondholders. Inflation is obviously a tax on moneyholders (and bondholders if the inflation unanticipated, or if nominal interest is taxed.)

Here’s a discussion of debt sustainability:

In the end, the debt has to be held by someone, and that person is either consuming, buying debt, or having income. That’s just a constraint. Well, at best, we can see the debt to GDP of the US going up to, I don’t know, 300% of GDP, which is the total assets in the US net are roughly 300% of GDP. Maybe that could increase but it can’t increase that much more. Well, with an R minus G of 2%, and with 300% debt, then you end up with a 6% persistent deficit that you potentially could run. . . .

Again, this is in the absolute limit, David. We all have no firms, no capital stock, all we do is put in the debt, and we have a 6%. Indeed, I actually argue that 5% is a better number. Well, what is the CBO projections before 2020 for the deficits in the US all the way to 2050, 5% already. So, all of whatever bubble R minus G, R minus N existed, we already spent it in the last 10 years. So there’s nothing new about this in R minus M that says, “Oh, now in 2021, I can completely reconfigure the government and exploit my R minus M revenues.”

I’ve made a similar argument. The fact that the interest rate on Treasury debt (R) is below the marginal product of capital (M) is certainly nice for the federal government. The recent decline in risk free interest rates is sort of analogous to a family that had a big debt it could not pay, and then found a box of exactly that much money hidden in the cellar of their house. The money would allow them to pay the existing debt, but is not a good argument for running up even further debts.

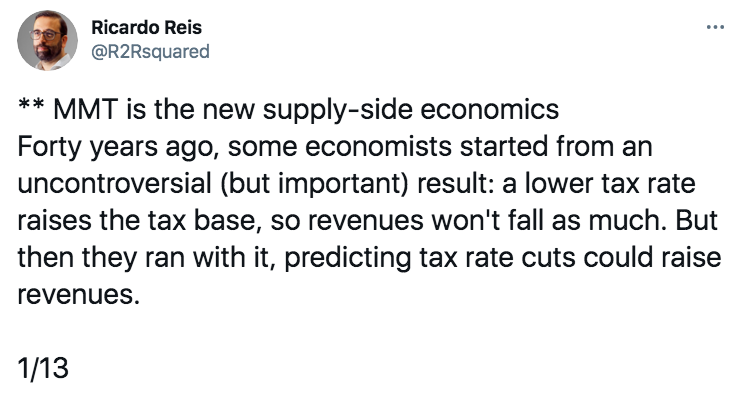

Speaking of Reis, I noticed this tweet:

While I understand the point he’s making in this thread (13 entries), I don’t agree. Supply-side economics is simply EC101. If you tax something, you reduce the quantity of the thing being taxed. Reis correctly points out that the term ‘supply-sider’ was applied to a group that made some wildly unrealistic predictions about tax cuts back in the 1980s, but the underlying model was completely uncontroversial among economists.

In contrast, the MMT textbook that I recently read (by Mitchell, Wray, and Watts) represents an almost complete rejection of mainstream macroeconomics. It’s not that they have a sound model that they take too far, they have a completely unconventional (and false in my view) model of the economy, and occasionally make a few predictions that happen to be accurate in a sort of “broken clock is right twice a day” sense.

My hunch is that if mainstream economists like Reis were to become fully immersed in MMT (something I strongly recommend they not waste time doing!!) they’d be horrified by what they saw. It’s wrong, but in a completely different way from how certain 1980s supply-siders (not all) were wrong.

Tags:

19. February 2021 at 13:50

Scott

How is default or inflation a tax on bondholders. Isn’t that fully factored into the price when bondholders purchase the bonds. The effective tax rate on bonds should be the same as that for any other asset.

You do believe in EMH don’t you?

19. February 2021 at 14:09

Scott says “Pilling up debt means higher future taxes.” Not necessarily: the UK debt fell from 250% of GDP in 1945 to about 50% in 1995 without any tax being involved. What happened was that inflation ate away at the real value of the debt, plus real GDP rose.

But even if there was no inflation and no rise in real GDP, it still would not be necessary to raise taxes if the private sector reamained willing to hold a record amount of debt at a near zero rate of interest.

And finally, if the private sector WAS NOT willing to hold quite so much debt at a zero rate, it would try to spend away the excess, probably causing excess inflation, which in turn would require a tax increase. But note that that taxation WOULD NOT mean a fall in living standards (as is normally the case with tax increases). Reason is that the sole purpose of that tax would be to keep demand down to the “inflation target hitting” level. Cutting inflation from an excessive level down to the 2% target probably invoves a RISE IN living standards, not a fall. To describe the latter as an “onerous tax” on the population would be very misleading.

19. February 2021 at 14:57

Prof. Sumner,

Have you ever written a post explaining exactly why Germany’s economy performed so well from 1933-1939? Was it because of fiscal stimulus? 🙂 🙂

Also, I look forward to hearing from you re: this new paper on cost-sharing for drugs within Medicare:

https://twitter.com/jonathanchait/status/1362895203867238402?s=21

19. February 2021 at 16:05

Just re-upping my comment on your Econlog fiscal sustainability post:

“My takeaway from the Reis discussion was that r<g, or – more precisely – r<m, is an anomaly, a 'bubble'. But we don't believe in bubbles, Scott. I think John Quiggin has long written about the 'equity premium puzzle' – why required rates of return on equity are much higher than on government debt, adjusting for risk.”

What if this is not a bubble? It would seem to mean we could create enormous value by the government owning everything. Are the objections to that ‘limited’ to incentive effects (which would be overwhelming in themselves) as opposed to it being inherently unsustainable?

19. February 2021 at 17:01

dtoh, I said unanticipated inflation. And obviously I meant unanticipated default, otherwise who’d buy the bonds?

For anticipated inflation, the only tax is the income tax on the inflation part of the interest rate.

Ralph, You said:

“Not necessarily: the UK debt fell from 250% of GDP in 1945 to about 50% in 1995 without any tax being involved. What happened was that inflation ate away at the real value of the debt, plus real GDP rose.”

Reread my post–I said inflation is a tax. And you don’t think other British taxes would have been lower without all that debt?

You said:

“Reason is that the sole purpose of that tax would be to keep demand down to the “inflation target hitting” level.”

Wait, are you saying that Congress targets inflation at 2%?

Travis, Monetary stimulus plus nominal wage controls.

Rajat, I agree that it’s not a bubble in the way that you and I use the term, and I agree that this implies the optimal public debt is well above zero. I don’t know how large. But I’ve always suspected that countries like Singapore and Norway were smart to create large sovereign wealth funds.

19. February 2021 at 17:27

Someone should tell the Japanese that having a central bank buy back half of national debt, now at 250% of GDP, won’t work.

It will lead to inflation, thus “robbing” bond holders.

I wonder why no one says bondholders “robbed” taxpayers, when US interest rates broadly declined for 40 years, from 1980 to 2020?

And if bondholders (generally, the wealthy) are roughly the same as income-tax payers (generally, the wealthy)…then higher inflation “robs” bondholders on behalf of income tax payers….Peter is robbing Peter! Horrors!

BTW, Bank Indonesia buys sovereigns directly from the government, through 2020 and into this year. Inflation has not picked up, and the rupiah has not done much.

But, more importantly, in theory Indonesia has higher inflation and a cheaper rupiah….

19. February 2021 at 18:32

I recall Paul Krugman agreeing with Piketty. That R>G. And now agreeing that we can run more deficits because R<G. Which I guess means that Piketty's case is no longer valid?

20. February 2021 at 00:29

So just about every year the government spends more money than it collects in taxes. This is entirely possible because the government ‘makes’ the money it spends at much less cost than the people who receive it value that money and are willing to provide services and real goods to the government in exchange for it. And save some of it. So long as that is true it is sustainable and all Reis’s 4 conditions that he imagines are pretty much irrelevant unless that changes. And so he should really provide plausible reasons that is going to change dramatically soon if he wants to make his case. And he doesn’t do any of that. So he is unconvincing to me.

20. February 2021 at 04:05

Scott, I agree that if inflation is counted as a tax, then the inflation in the UK (and other countries) between 1945 and 1995 counts as a tax.

Re your next point (does Congress target 2% inflation) my answer is that the government machine as a whole (i.e. Fed plus Congress) targets 2%. Also, Congress knows perfectly well that if it does too much fiscal stimulus, the Fed will simply counteract that with an interest rate hike, so Congress has a strong motive to keep fiscal stimulus within bounds.

20. February 2021 at 04:31

The fact that you and Reis and a lot of people are talking about it means that it’s not unanticipated. So I think describing it as a tax is not correct.

You also talk about the decline in risk free interest rates. Are you talking about nominal rates or real rates?

20. February 2021 at 06:00

It is a simple unadulterated fact that economists are plum dumb. . Economists think banks are intermediaries, loaning out the savings of the public.

Banks are “black holes”. Economists simply can’t reconcile the fact that it’s virtually impossible for the member DFIs to engage in any type of activity involving its own non-bank customers without, from a macro-accounting perspective, an alteration in the money stock (as bank-held savings remain un-affected, un-used).

An increase in bank CDs adds nothing to GDP.

20. February 2021 at 06:07

Inflation has been low because monetary savings (income not spent), is bottled up in the payment’s system. It’s further reduced by the FDIC raising deposit insurance from $40,000 to $250,000 PER ACCOUNT.

And the remuneration rate provides the payment’s system with a preferential interest rate differential in favor of the banks (as opposed to Reg. Q ceilings, between 1966 and 1986, which provided an interest rate differential in favor of the thrifts, in the thrifts borrowing short to lend longer savings/investment paradigm).

This destroys the velocity of circulation by inducing nonbank disintermediation. The short-end segment of the wholesale funding yield curve is inverted for 5 years out – the most contractionary FOMC policy since Oct. 2008.

Economists have lost all their marbles. Banks are “black holes”. They do not loan out the deposits that are capriciously impounded. I.e., deposits are the result of lending and not the other way around. All bank-held savings, $15 trillion, are lost to both consumption and investment, indeed to any type of payment or expenditure.

20. February 2021 at 06:08

Economists think banks are intermediaries, loaning out the savings of the public.

Banks are “black holes”. Economists simply can’t reconcile the fact that it’s virtually impossible for the member DFIs to engage in any type of activity involving its own non-bank customers without, from a macro-accounting perspective, an alteration in the money stock (as bank-held savings remain un-affected, un-used).

An increase in bank CDs adds nothing to GDP.

20. February 2021 at 06:25

The evidence of inflation, contrary to the conventional wisdom, cannot be conclusively deduced from the monthly changes in the various specialized price indices. The price indices are passive indicators: for the average change; of a group of prices. They do not reveal why prices rise or fall. I.e., inflation targeting depends on how inflation’s defined (which somehow neglects to encompass the vast proportion of all past and present bubbles).

Only price increases generated by demand, irrespective of changes in supply, provide evidence of inflation. There must be an increase in aggregate monetary purchasing power, AD, which can come about only as a consequence of an increase in the volume and/or transactions’ velocity of money.

The volume of domestic money flows must expand sufficiently to push prices up, irrespective of the volume of financial transactions consummated, the exchange value of the U.S. dollar (per the Nattering Naybob: “reflected in FX indices and currency pairs”), and the flow of goods and services into the market economy.

Money and money flows may be net robust, net neutral, or net harmful, depending upon the distributed lag effect of money flows, volume times transaction’s velocity.

That saturation point is determined by the rate of inflation, the monetary fulcrum, the lag’s pivot. This is perfectly clear. It is aptly demonstrated by the distributed lag effect of money flows being mathematical constants, for > 100 years.

20. February 2021 at 06:58

If growth is sufficient, you collect more taxes without raising tax rates.

If the market is willing, you can roll over debt forever. For example, the market might be willing if growth is sufficient.

Why would either of these be a problem?

20. February 2021 at 09:14

Maybe I am wrong about this, but isn’t an aging population correlated with falling velocity of money? Hence the possibility for the government to pay its debts by printing money without triggering inflation. Sure, ceteris paribus it raises inflation, but perhaps only by preventing disinflation.

20. February 2021 at 09:15

Jerry, I don’t think you understand what he’s saying there. It’s a tautology.

Ralph, I assure you that Congress pays zero attention to inflation when making fiscal decisions. To suggest otherwise is simply absurd. The Fed targets inflation.

dtoh, You said:

“The fact that you and Reis and a lot of people are talking about it means that it’s not unanticipated. So I think describing it as a tax is not correct.”

I have no idea what you mean by “it”. I’m not predicting high inflation right now. And no one pays attention to my views in any case. You don’t think the Great Inflation (1966-81) was largely unanticipated?

You said:

“Are you talking about nominal rates or real rates?”

Both, they both declined by quite a bit.

Spenser, You said:

“It is a simple unadulterated fact that economists are plum dumb. . Economists think banks are intermediaries”

LOL, where’d they get that weird idea?

foosion, A problem occurs if the debt is excessive.

20. February 2021 at 09:32

Lizard, Yes, but the effect is pretty small until you get to zero rates, and in that case monetizing the debt doesn’t really save you any interest costs.

20. February 2021 at 10:38

Scott, “A problem occurs if the debt is excessive.”

Of course, that’s tautological. But if the market is willing to roll it over and growth is sufficient for debt service without raising tax rates, just what is meant by “excessive”?

20. February 2021 at 10:53

Rather than debt or deficit “sustainability” we should be focusing on “optimality.” This, in turn, means to focus on the optimality of the individual taxing and spending decisions that sum to a deficit or debt over time. If we did this, I suspect we would settle on higher taxes and a deficit that is close to zero at full employment

20. February 2021 at 21:09

The best way to reduce government debt is to remove the federal income tax, cut off the supply of money, and force the federal government to pay down the debt with tariffs. This will also protect American workers.

It would also help if Biden stopped killing jobs in favor of special interest groups that support his campaign.

1. To appease the pharmaceutical companies that funded his campaign, he removed Trumps executive order that lowered prescription prices, forcing insulin prices from $60 to $360. For a man who claims to be “sympathetic” to the suffering, it sure appears that Trump is the more sympathetic of the two.

2. Biden’s executive order on fracking essentially bans it, destroying millions of well paying jobs and providing a boost to green energy companies who fund his campaign. Most studies show that fracking doesn’t harm water sources, so the democratic party is simply engaging in a calculated political move (i.e., destroying the companies that tend to support conservative candidates). It has nothing to do with “science”.

3. The tech companies have been targeting Ron Paul’s Facebook posts.

They have also been going after Robert F. Kennedy Jr for pointing out uncomfortable facts, such as Bill Gates killing thousands of children in the Philippines with his sponsored malaria drug. The administration remains silent, which makes them complicit.

4. Alex Jones and Roger Stone are once again being targeted by the corrupt political machine for reporting news on the day of the riots. Video footage proves that neither were in the building, or even near the building. Using the DOJ to bludgeon political opponents into submission, is a great way to destroy democratic ideals.

5. The democratic party claims to be the peace party, yet Raytheon received 300M in weapons grants, the US military is back in Syria, and Turkey is being threatened with Sanctions.

6. Just a few days ago, on National T.V., Biden chalked up the killing and castration of Uighurs, and the organ harvesting of the Fulon Gong as “cultural differences”. Why not just say “we are pathetic and scared of the CCP, so we will kneel to their demands”, because that is precisely what he indicated to the Asian world. Is America now a puppet? Seems likely!

Americans need to face the truth. The lefts policies are remarkably similar to Mao’s rise to power – that is, to make promises of a utopia you cannot achieve, brainwash the people into overthrowing an oppressive “hierarchy”, claim to the world that the utopia is on it’s way, watch people starve, and replace it with a dystopian one party system (CCP).

Romanticism is beautiful in moderation, but when you lean on that to create a philosophical ideal around a grand utopia, then you have reached a form of madness. And that is where we are! The idealists have run amok, and are tearing the world apart.

If you don’t speak out now, your country will soon be destroyed.

21. February 2021 at 05:42

Scott

“It” is paying off the debt with a tax.

How are you defining the real rate of interest?

21. February 2021 at 07:02

If banks are intermediaries between savers and borrowers, then how does the volume of money change with the saver-holder using his funds for the payment of a bank loan, interest on a bank loan for the payment of a banks service, or for the purchase from their banks of any type of commercial bank security obligation, e.g., bank stocks, debentures, etc?

Maybe you’ve never read “Modern Money Mechanics”?

Modern_Money_Mechanics.pdf (wikimedia.org)

The rhetorical question’s answer is found in double-entry book keeping on a national scale. But the economists of the late 1950’s already knew this.

“Double-entry bookkeeping is one of the most fundamental principles used in economic accounting and in financial accounting. In financial accounting, activities that affect the resources available to a business are recorded at least once as a source of financing (credit) and at least once as a use of financing (debit). Thus, double-entry bookkeeping provides a means to validate the accounting entries, because the sum of the entries on each side of an account must be equal.”

People have no historical economic perspective, viz., the transition from accounting ledgers to computers, from paper hand-held spreadsheets to the bits and bytes of software processing. Our economic problem is one of the non-neutrality of money velocity, money that capriciously serves as a “store-of-value”, and not as John Law’s “system” (volume that should be dictated by the needs of trade).

The FDIC’s $250,000 insurance limit on all deposit accounts surreptitiously destroys money velocity. Paradoxically, “Since the FDIC was established in 1933, no depositor has lost a penny of FDIC-insured funds.” And “The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.”

The macro-economic fallacy is that the insured member banks do not loan out savings deposits. This was proven every semester when Dr. Leland James Pritchard, a man 30 times smarter than Albert Einstein, handed out a paper to his Money and Banking students detailing double-entry bookkeeping on a national scale.

To wit: Like Dr. William Barnett said (a former NSA Rocket Scientist), “the Fed should establish a “Bureau of Financial Statistics”.

You can’t precisely duplicate this accounting today (after the DIDMCA of March 31st 1980).

1979: Double-entry Bookkeeping on a National Scale————————–Loans and investments 1229.8Cash and Due from Banks

169.5 Total Assets—Total Liabilities and Net Worth

1480.3 Demand Deposits

400.5 Time deposits

675.8 Borrowings

180.5 (principally e-$s since 1969)Currency outside the banks 106.1Reserve Bank Credit 128.3

MONETARY AND BANKING CHANGES End of 1939 to end of 1979 (figures in billions of dollars)

(1) Net effect on the volume of time and demand deposits and borrowing of all factors, except commercial bank credit (principally capital accounts) 13.5(2) Net expansion of commercial bank credit 1189.1(3) Net increased in time and demand deposits and borrowings 1202.6

Source: Computed from data reported in All-Bank Statistics, U.S. 1896-1955Federal Reserve; and the Federal Reserve Bulletin

The fact is that from a systems’ standpoint the banks pay for their earning assets with new money not existing deposits. This drastically changes everything in macro. For instance, the source of time deposits is demand deposits, i.e., the bank collectively pay for what they already own (very stupid and less profitable).

Bank deposit growth is almost exclusively tied to credit creation. There are many factors which can, and do, alter the volume of bank deposits, including changes in currency held by the nonbank public, in Reserve Bank credit, in bank capital accounts, etc.

Although these items are the largest in the aggregate, they nevertheless have been peripheral in altering the aggregate total of banks deposits.

Altogether, taking into account the principal factors affecting the lending capacity of the banking system, *outside factors* have made a negligible contribution to bank deposit growth.

That is to say, the capacity of the commercial banking system to lend, and the aggregate size of the system, given ample opportunities to make bankable loans and acquire eligible securities, are determined by monetary policy, not the savings practices of the public.

In other words, a growth in the lending capacity of the banking system is not derived from the savings of the public, nor indeed from the savings effected by the banks themselves. Rather is this great benefit derived from the expansion of Reserve bank credit. It is, like manna from heaven, showered on the banking system and is costless to the banking system. The commercial banks could continue to lend even if the nonbank public ceased to save altogether.

All monetary savings originate within the payment’s system. But a growth in time deposits depletes demand deposits by an identical amount. And savers never transfer their savings out of the payments system in the first place, unless they hoard currency or convert to other national currencies. The only way to activate monetary savings is for their owners to spend/invest either directly or indirectly. The banks can’t use savings in order to lend.

21. February 2021 at 07:14

Dr. Philip George’s corrected money supply confirms this idea. “The Riddle of Money Finally Solved”

http://www.philipji.com/

CMS vs. recessions.

21. February 2021 at 07:33

I don’t understand how professional economists will not analyze or seek to understand the various theories that exist—-such as Reis equating MMT to “supply side”. Latter was exaggerated, but at least it was directionally correct. MMT is, as I have stated before, economic nihilism.

Look how far we have devolved from Bastiat—maybe Keynes too. But not Samuelson—-he believed in the infinite Ponzi scheme——which to be fair—-has not yet been disproven. Scott states 300% as a kind of limit. Maybe. Japan is close to that.

Reis did not explicitly state decreasing spending (really, decreasing the increase in spending) as one way to to lower Debt/ GDP ——to me that has always been obviously preferable. Not merely because of “sustainability” but because of my assumption that the private sector is more efficient—-hence higher growth.

Finally, He does not discuss the definition of Debt. I think debt is outstanding securities and some percent of guarantees. Not “promises to,pay” (like SS) because those are not contractual. Does he say 300% of GDP equals 60% of net US assets? That is about right. The Fed Household balance sheet never subtracts debt owed by the government. I have never seen that described before. Of course, our debt is not 3x GDP—-but I like that he makes that point.

We have gone pretty far beyond where I thought debt was sustainable—-but maybe that’s false. Owing debt to “ourselves” is not even cold comfort. It creates an illusion——I do not think the economics profession has explained the nature of increasing debt——but if our economy has an ability to grow and be more efficient——it would not totally surprise me if Samuelson ends up being right.

21. February 2021 at 07:34

Not Scott, Reis has 300%bas a limit

21. February 2021 at 08:12

re: “MMT is, as I have stated before, economic nihilism”

On point. Money doesn’t make the world go around. Savings that is channeled into targeted real investment outlets does.

21. February 2021 at 08:16

See: Paul F. Smith “Optimum Rate on Time Deposits.” The Journal of Finance, December 1962, 622-633. His conclusion “Rates on time deposits currently being paid by banks are above the optimum rate and may be above the break-even rate”.

21. February 2021 at 08:17

Data compiled by Joseph Aschheim for member banks, by size of bank, and by ratio of time to total deposits, revealed that: as the ratio of time deposits to total deposits rises:

(1) the ratio of total expenses to total earnings is higher;

(2) the ratio of net profits to capital accounts is lower;

(3) the ratio of net profits to total assets is lower;

(4) the ratio of dividends to capital accounts is lower; and

(5) the ratio of capital accounts to total assets is lower.

All these relationships ad up to one conclusion: “the higher the ratio of time to total deposits, the less profitable are banks of a given size group”.

But exactly the opposite economic policy was pursued.

21. February 2021 at 08:20

See: “Should Commercial Banks Accept Savings Deposits?” Conference on Savings and Residential Financing 1961 Proceedings, United States Savings and loan league, Chicago, 1961, 42, 43

21. February 2021 at 09:36

foosion, I’m not sure what you are asking. The standard model is that debt should be managed in such a way as to minimize the long run deadweight cost of taxation. If you aren’t doing that, then the deficit is either too big or too small.

ankh, LOL, Trump’s idea to use “trade” to pay off the national debt.

dtoh, Ex ante. But both the ex ante and ex post real rates have plunged in recent decades. So my claim is true under either definition.

21. February 2021 at 11:54

Dear Professor Sumner,

The Job Guarantee is key to MMT and intends to replace interest rate targeting.

Most MMT people recommend Job Guarantee replace interest rate changes. What do I mean by this? Ban all bank lending except capital development lending (no mortgage lending) and for the small amount of bank lending left keep rates at zero. To counter deflationary effect of bank regulation implement Job Guarantee.

https://new-wayland.com/blog/how-the-jg-controls-inflation/

Guarantee every adult American a public sector job at minimum wage, it is a job like any other job can be fired (except for mothering.) Examples of JG Jobs: open source programming, social care, environmental work (e.g. stabilizing sand dunes), teacher assistants, musicians, community handyman, construction contacts on a shelf (e.g. side of a motorway), tour guides, gardening in old people’s homes and mothering.

Why do you recommend messing around with interest rates instead of strong auto stabilizers?

One MMT idea you should look at is permanent ZIRP. I find it is often overlooked by mainstream.

I have never received a decent reply about why the current system (interest rate targeting) is superior?

21. February 2021 at 13:32

Scott,

But as I’ve suggested before, if the inflation rate is miscalculated then you don’t know for sure that real rate have plunged.

I would suggest that as a thought experiment, you consider the possibility that real inflation is actually minus 5%. If you do, a lot of things that seem strange all of sudden start to make sense.

22. February 2021 at 03:04

The monetization of, and sterilization of, government securities must be done with the standard devices of legal reserves and reserve ratios.

Monetary policy should delimit all reserves to balances in their District Reserve bank (IBDDs, like the ECB), and have uniform reserve ratios, for all deposits, in all banks, irrespective of size (something Nobel Laureate Dr. Milton Friedman advocated, December 16, 1959).

22. February 2021 at 03:17

The NIRDs today aren’t 12% as they were in 1981.

22. February 2021 at 05:10

The increase in those who are viewing an inflation breakout just around the corner are increasing——-at least articles are increasing. WSJ was talking of M2 increasing by “32” percent. Wait till the Fed raises inflation for AIT purposes. We do not as a national policy have anything close to consensus. The Phillips Curve was the latest consensus, no matter how much it did not predict. Once whomever is running this country stops caring about Trump, they will start thinking about the new chair—-to be nominated 1 year from now.

We will see, and maybe Yellen “likes”, Powell——but I will be pleasantly surprised if he is rechosen.

22. February 2021 at 14:23

The discussion will center on productivity. The fiscal reality that Professor Reis highlights is being hand-waved away by those arguing that more debt is justified because it will lead to higher productivity. COVID stimulus, the Green New Deal, etc are being justified as ways to protect us from a fall off in productivity or to increase productivity. They either believe or want us to believe that choosing option 1, increasing debt, is actually a choice of option 3, fiscal surpluses. As others have pointed out in this thread, with the recent rise in M2 we have already made the choice of option 4, increasing inflation.

22. February 2021 at 14:48

Kester, You said:

“Why do you recommend messing around with interest rates”

I’ve opposed interest rate targeting my entire life. Find out what my views are before posting here. Otherwise you’ll just make a fool of yourself.

dtoh, You said:

“I would suggest that as a thought experiment, you consider the possibility that real inflation is actually minus 5%.”

If I ever started contemplating that theory then I should be put in a mental institution. It would imply that real incomes in the US have been rising at 8%/year, like in China.

22. February 2021 at 15:42

Scott,

“It would imply that real incomes in the US have been rising at 8%/year, like in China.”

Maybe they have been. If you started actually using a cell phone 🙂 you would see why this is not such a preposterous proposition.

And even at a more mundane level, you (and the official inflation numbers) are missing things like the improved printing and design on the outside of a can of beer and a million other things that missed by a simple count of quantity.

23. February 2021 at 01:00

Productivity:

“A barrel of conventional crude oil contains the equivalent of roughly 4.5 years of continuous human labour; or around 11 years at 35 hours per week, 48 weeks of the year. But the capitalist doesn’t pay for the value of the fuel, merely the cost of extracting it. For a mere £49 (at pre-pandemic prices) the capitalist purchases £330,000 worth of work (at the current UK median wage). It is the exploitation of fossil fuels rather than the exploitation of labour which generates the vast majority of the surplus value in an industrial economy. . . .

As Nicole Foss once put it – if conventional oil was like drinking draught beer from a glass, fracking was the equivalent of sucking the spilled dregs from the carpet.”

https://consciousnessofsheep.co.uk/2020/05/26/two-money-tricks/?fbclid=IwAR1rOz0jexO2dIIldSlseh-8-EqES4oYZcBTvHMtW-JyBgMHB6xgfOOsbBI

However.

‘We’ have ten years?

“ . . . our best estimate is that the net energy

33:33 per barrel available for the global

33:36 economy was about eight percent

33:38 and that in over the next few years it

33:42 will go down to zero percent

33:44 uh best estimate at the moment is that

33:46 actually the

33:47 per average barrel of sweet crude

33:51 uh we had the zero percent around 2022

33:56 but there are ways and means of

33:58 extending that so to be on the safe side

34:00 here on our diagram

34:02 we say that zero percent is definitely

34:05 around 2030 . . .

we

34:43 need net energy from oil and [if] it goes

34:46 down to zero

34:48 uh well we have collapsed not just

34:50 collapse of the oil industry

34:52 we have collapsed globally of the global

34:54 industrial civilization this is what we

34:56 are looking at at the moment . . . “

https://www.youtube.com/watch?v=BxinAu8ORxM&feature=emb_logo

23. February 2021 at 07:23

@ Michael Rulle

“The increase in those who are viewing an inflation breakout just around the corner are increasing”

They’re way behind. It’s now decreasing. But its increase is disguised: As Joe Carson states “The consumer price index (CPI) does not show in house price inflation because it uses a non-market rent index to capture the trends in housing inflation.”

23. February 2021 at 07:28

I should explain that the rate of increase is decreasing, second derivative.

23. February 2021 at 08:02

Readers should note that calculating inflation on a year-to-year basis minimizes, over time, the rate of inflation — since the rate is being calculated from higher and higher price levels. A $ today, using 1967 (a former base year), is equivalent to $7.83 of consumer purchasing power today.

In absolute terms, each year confronts all of us with a higher and higher level of prices with no end in sight.

23. February 2021 at 08:39

dtoh, Can’t tell if you are joking . . .

23. February 2021 at 15:44

Scott,

I don’t know if I am right or not, but I’m not joking.

1. Low inflation (deflation) would explain a lot.

2. Savings is basically an exchange of current consumption (utility) for more future consumption (utility.) It’s hard to think that basic human behavior has changed enough to shift the savings curve significantly enough to move real rates as much as current official numbers suggest (of course it might be a shift in the investment curve.)

3. I look at the stuff I consume on a day to day basis. The improvements (increases in utility) are fantastical.

4. Even for very mundane mature products, on the production side I see significant annual improvements in efficiency (lower unit costs of production), which are offset by product bells and whistles like higher quality printing on beer cans (which consumers will pay for and therefore presumably have utility), but which are never seen in inflation calculations.

24. February 2021 at 14:05

dtoh, I don’t see any evidence that people are getting happier. Do Millennials seem happier than Boomers at the same age? I agree that most stuff is better, but it adds very little to utility to have fancy labeling on a beer can. I get just as much utility from an old St. Pauli Girl picture.

I’m not saying there isn’t more desire to save, but I don’t see value is suggesting inflation might actually be minus 5%. It drains the term “inflation” of all meaning.

24. February 2021 at 19:36

Scott,

What does happiness have to do with utility?

Unfortunately (or fortunately), you’re not the utility dictator. The market determines utility, and if the market picks A over B, then by definition, A has more utility.

And… in many cases this can be quantified. But when the increased printing cost of beer labels is 4 cents and the cost of the producing the can goes down by 3 cents, this gets reported as 1% (assuming a $1 can) inflation.

I like the St. Pauli Girl label too, but that’s just because we’re cantankerous old farts.

25. February 2021 at 10:25

dtoh, You are using “utility” in a way that I don’t understand, and it’s totally unrelated you how economists use utility, or define inflation. The “market” certainly does not provide any evidence that inflation is negative 5%, at least as economist define utility.

You said:

“And… in many cases this can be quantified.”

How? The market doesn’t show maximum willingness to pay.

25. February 2021 at 15:06

Scott,

Savers make decisions to forego current for future consumption based on the relative utility of future consumption to the utility of current consumption… not the basis of relative prices adjusted for inflation as defined by economists. If inflation, as defined by economists, doesn’t accurately reflect relative utility, then for the purposes of understanding saving behavior it is a useless metric.

An efficient market guarantees willingness to pay.

Firms reporting to SEC must include data on the breakdown of price, mix and volume for changes in revenue. Most medium to large size private firms also maintain this data and it could be obtained through surveys. (Like I said though, this does not cover all cases.)

26. February 2021 at 09:20

dtoh, You said:

“Firms reporting to SEC must include data on the breakdown of price, mix and volume for changes in revenue”

Now you are contradicting yourself. If you use that technique you get 2% inflation, or more, not negative 5%. To get negative 5% you cannot rely of firm level price and quantity data.

And I still have no idea what you mean by “utility”. It doesn’t seem to be how economists use the term.

In 2017, I sold my house in Boston for 4 times what I paid for it. Had the “utility” derived from the house changed? Was that inflation, or quality improvement? Housing is a big part of the CPI.

26. February 2021 at 13:53

Scott,

No not at all. The BLS could use corporate data to statistically estimate the amount of product/service improvements not included in the current inflation calculation and use that the adjust inflation number downward.

Utility comes from consumption not from the sale of an asset. And if you’re talking about the utility of using the house, economic rent is a function of both the the price of the house and of interest rates.

27. February 2021 at 08:47

dtoh, You seem to mix up the utility of something from the price people pay for it. I don’t know what you mean by utility, or how you measure it.

And the BLS already adjusts for quality changes. If they did not do so, reported inflation would be higher.

27. February 2021 at 15:16

Scott,

I don’t know how to measure utility either, but relative price is a good proxy for relative utility.

“And the BLS already adjusts for quality changes. If they did not do so, reported inflation would be higher.

And if my hypothesis is correct (and again I’m not sure it is), if the BLS adjusted for quality changes more accurately, then reported inflation would be even lower.

27. February 2021 at 16:04

Scott,

Pretty interesting summary of the issue here….

https://www.schroders.com/el/sysglobalassets/digital/insights/pdfs/2016/ih5_is-inflation-overstated.pdf

28. February 2021 at 10:30

dtoh, Relative price changes tell us nothing about absolute price changes–which is what matters for inflation. And I still don’t understand your argument about utility.

28. February 2021 at 10:31

As for that paper, how can we accurately measure a variable that’s never been clearly defined?

28. February 2021 at 14:22

Scott,

I agree. I was talking about the price of one good or service relative to another good or service or the price of a single good or service over time.

I’m not sure what part of the argument you don’t understand. Do you disagree that savings is an exchange of current utility for future utility.

As for the paper, it appears that a hedonic index is an effort to measure relative utility of different goods by using regression analysis to compare different characteristics among a group of goods. Logically this seems sound to me, but maybe difficult in practice. Apparently BLS also uses this technique to some extent to calculate PPI and CPI.