Recessions are not forecastable

I’m seeing too many people assuming that a recession will occur within the next year or so. That’s certainly possible, but let’s not lose sight of the fact that recessions are not forecastable.

This looks like a trend, doesn’t it?

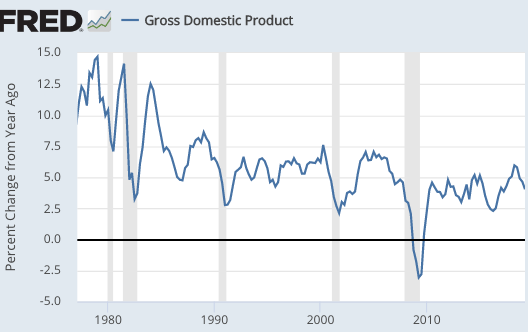

I’ve argued that long term interest rates reflect NGDP growth. That’s presumably still true, but the linkage seems to be weakening in recent years. NGDP growth since the mid-1990s has not slowed anywhere near as much as the decline in 30 year bond yields:

I’ve argued that long term interest rates reflect NGDP growth. That’s presumably still true, but the linkage seems to be weakening in recent years. NGDP growth since the mid-1990s has not slowed anywhere near as much as the decline in 30 year bond yields:

For most of the 1990s, 30-year bond yields were in the 6% to 8% range, despite NGDP growth running only about 6%. Now the yields have fallen to 2%, despite NGDP growth of roughly 4%.

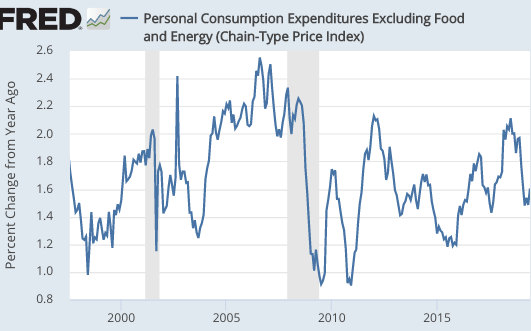

The inflation trends are even more startling. Core PCE inflation hasn’t slowed at all in the past 20 years (which surprised me), and thus real interest rates have fallen especially sharply. Here’s 12-month core PCE inflation:

The 5-year TIPS spread is running about 1.35%, which implies about 1.1% PCE inflation (as PCE inflation is at least 0.25% below the CPI inflation used to adjust TIPS.) That just seems weird. Obviously the TIPS spread is not measuring inflation expectations, as it seems very unlikely that PCE inflation will average only 1.1% over the next 5 years. (I’d guess about 1.8%.) I’m told by people who work on Wall Street that investors simply don’t like TIPS. Thus I believe that real interest rates on conventional bonds have probably fallen by even more than the decline in 30-year yield TIPS yields

The interest rate situation is certainly weird, but that doesn’t tell us much about whether they’ll be a recession. In a month or so there’ll be a new NGDP prediction market, which will add a useful forecasting tool.

PS. I used core PCE inflation, as most economists believe that core inflation is a better predictor of future headline inflation than is headline inflation itself.

Tags:

16. August 2019 at 12:12

“I’m told by people who work on Wall Street that investors simply don’t like TIPS.”

Dangerously close to the idea that investors don’t like arbitrage.

The yield curve ain’t even that funky. Spot and forward curves still slope up after the first couple years. It’s just a technical problem at the short end.

And credit spreads are about where they were in May 2017. If spreads start rising (like in 2007), that’s an issue.

As a taxpayer, I’m wondering if my government shouldn’t refinance debt for longer term. Borrowing at 2% over 30 years seems like a better idea than borrowing at 2% overnight.

Cut short yields, fix the yield curve, increase inflation. Pretty obvious to me.

16. August 2019 at 13:56

This new NGDP market releasing in one month…will it be with hypermind?

Have you seen the most recent estimates from NGDP advisors showing 2% or less NGDP growth over next year?

http://ngdp-advisers.com/ngdp-forecast-client/

16. August 2019 at 15:41

Jim, Yes, Hypermind. And yes, I saw that forecast. I’d expect somewhat higher growth, but I’ll defer to the market, once it’s up and running.

16. August 2019 at 16:22

Professor,

I would argue the Fed has actually lost credibility it will ever hit its inflation target. Similar to what happened during the late 60s when the Fed lost credibility it would ever follow through and actually cause a recession in order to lower inflation and control inflation expectations. Eventually they did cause a recession, taimada inflation, then Greenspan implemented some form of forward guidance late in his tenure. All of this served the Fed to gain credibility it would do everything it takes to control inflation, which it did. Now the Fed has the oposite problem, it cannot seem to persuade market participate it will do whatever it takes to achieve their 2% target, which has lead to the continual downtrend in long term interest rates. For this to revert we would need a really aggressive Fed which not only properly communicates their intent, but actually shows the markets it is willing to go through with what they say, like Volcker did.

Not sure this will happen, but either way its a really interesting time for monetary policy. It seams to be on the front page of all financial/market/econ publication I read.

Whatever happens please do keep enlightening us.

16. August 2019 at 19:19

Haha. Everyone knows that US economists cannot predict anything. You cannot even do basic math, that is why you owe so much money. We own most of your businesses and property already and soon we will own them all. Everyone is changing to our model, because its better, US will change as well after government completely collapse economy. If you need help from real economists, let me know 😀

16. August 2019 at 19:19

Suppose we assume 40 years of tight money by major global central banks?

That would explain the 40 years of declining 30-year treasury yields as well as a glut of capital, that is people are being paid too much on their savings and deposits, interest rates have been kept artificially high by chronic central-bank tightness. This also explains falling inflation and near deflation in Japan and Europe and much lower inflation in the US.

16. August 2019 at 21:32

I’m continually surprised by how few economists understand *why* an inverted yield curve predicts recessions. It’s not just a variable with some latent correlation. It’s a cause. The federal funds rate, and/or IOER, is significantly higher than it would be if it were set by market forces. This pulls too much of the available capital to the short end, where it is either soaked up by the Fed and destroyed (to maintain the federal funds rate at 2.10%), or stored on ice by banks as part of their excess reserves (because they’d rather receive 2.10% on their riskless capital than something lower in the treasury bond market).

An inverted yield curve sucks capital out of the market that would otherwise be circulating, being invested and spent. If this condition persists for long enough, it slows down and then reverses the economy.

The same type of reasoning informs why a large spread between the federal funds rate and long-term treasury bonds pushes banks to create new money — borrowing federal funds at a low rate and investing their riskless capital in long-term treasury bonds — moving new capital out into the market.

This is how your NGDP is either braked or accelerated. By regulating the supply of cash — more cash leading to more spending aka NGDP, less cash leading to less spending.

The spread between fed funds and longer-term bonds is like the floodgates allowing more cash into the system, or less, or like adding to the height of the levee, drying up the flow of cash into the system.

Sometimes I think all the members of the Fed understand exactly how this works, but they obfuscate to avoid taking blame for the speed of the economy. Other times I think they have no idea what they are doing. But they’re probably just a mixed bag, like any arbitrary group of humans assigned to a team project.

16. August 2019 at 22:51

Implicit in that NGDP Advisors forecast is that NGDP growth will continue to fall at the rate it has since around this time last year.

https://fred.stlouisfed.org/graph/?g=msHD

If you think it more likely than not that Trump won’t get a trade deal, then this is perhaps not a bad forecast.

17. August 2019 at 01:37

My hypothesis is that we would have seen this drop in real interest rates earlier but for the unexpected high inflation in the 1970’s. Our current inflation rate expectations includes expected inflation plus a risk of unexpected high inflation, this risk is falling over time as CB’s understanding of causes of inflation improve. This actually explains TIPs prices by the way, when you buy tips you get protection from unexpected high inflation.

17. August 2019 at 04:28

Is your (dumb) statement that “recessions are not forecastable” even falsifiable? If so, how?

17. August 2019 at 05:07

“I’m seeing too many people assuming that a recession will occur within the next year or so.”

Are you really so dense that you actually cannot see the source of this is FAKE NEWS (OPERATION MOCKINGBIRD) to attack Trump re: 2020 election?

17. August 2019 at 06:37

lu xian, You said:

“We own most of your businesses and property already”

Wow! The Lu Xian family must be pretty rich.

Mai, You said:

“I’m continually surprised by how few economists understand *why* an inverted yield curve predicts recessions”

I would hope that most economists understand that if the Fed sets the policy rate too high it can cause a recession. But these days, who knows?

You said:

“The federal funds rate, and/or IOER, is significantly higher than it would be if it were set by market forces.”

Yield curves can and did invert before the Fed was created, indeed even more often.

So that can’t be the whole story.

And an inverted yield curve does not always imply that money is too tight.

ChrisA, Yes, but it doesn’t explain why inflation spreads are so low in absolute terms. It just explains why they have been falling even faster than the decline in expected inflation.

Harding, Yes, if any sort of consensus measure, say the Philadelphia survey of economists, were able to forecast recession more often than by chance, that would falsify my claim.

17. August 2019 at 08:11

Scott,

I’ll take some issue with the statement that recessions are not forecasteable. I would amend it to say they’re not absolutely forecasteable. Clearly there seem to be predictors, though none perfect. It’s always a matter of estimated probability.

I realize this is just semantic and you understand all this better than I do.

What I don’t understand is why a global savings glut causing increased capital inflows into the US or Sweden, for example, shouldn’t increase real GDP potential, ceteris paribus, and hence justify a temporary increase in inflation to spur real growth. Is it because you think real factors like demographics are more than offsetting the effects of cheaper capital?

17. August 2019 at 08:13

I don’t know why my autocorrect snuck an “e” into forecastable twice.

17. August 2019 at 08:55

Scott,

And to be clear, I’m talking about inflows from strong growth countries like China over the years, not safe haven flows from the EU.

17. August 2019 at 10:27

Mike, We tried spurring growth with monetary policy during the 1960s. It did not end well. We need a stable monetary framework.

17. August 2019 at 12:33

This is another, sinister, usurping purpose of fake news.

https://twitter.com/ChuckRossDC/status/1162803771702988801

FEC chair launches an investigation BASED ON A NEWS CLIP ON THE INTERNET.

Criminals are being exposed there is declassification tidal wave.

Antifa ‘riot’ in Portland is a manufactured D narrative to distract from proof they are criminals.

17. August 2019 at 12:35

ANTIFA ARE ATTACKING AMERICAN FLAG WAVING PATRIOTS.

THEY DON’T WANT US TO DO WHAT THE YELLOW JACKETS ARE DOING.

FOLLOW THIS ON ONE OF ANTIFA’S VICTIM’S TWITTER

https://twitter.com/MrAndyNgo/status/1162817089058459649

17. August 2019 at 12:44

Here’s a book that says major recessions are predictable:

A Brief History of Doom: Two Hundred Years of Financial Crises by Richard Vague.

He argues that too much private debt is the common cause.

His book was published a few months ago and has been, as far as I can tell, pretty much ignored.

Which, of course, does not surprise me very much.

17. August 2019 at 12:50

http://magaimg.net/img/8r5z.png

Take a good hard look at this picture.

Look at a who these ‘anti-fascists’ are using for human shields.

NOTICE AT LEAST EVERY PERSON IN THIS PICTURE.

This is what the Demokkkrats think of their own followers, this blog author included.

Feeling sick yet?

THIS IS HOW STUPID THEY BELIEVE YOU ARE.

17. August 2019 at 14:20

In 2016, Trump voters were Deplorable

In 2017, Trump voters were Russians

In 2018, Trump voters were Nazis

In 2019, Trump voters are wittingly or unwittingly, white supremacists.

The people calling you these things would like you to vote for them.

17. August 2019 at 15:33

Scott,

Yes, but this isn’t the 70s, and I bought the NGDP level-targeting idea back in ’09 when I first read the blog. You’ve occasionally talked about adjusting NGDP targets in response to apparent changes in RGDP potential. That’s all I’m advocating.

Hit a wall in terms of real growth due to overshooting,and growth snaps back down to potential, and the NGDP target can be adjusted downward, or we can just accept a permanently higher inflation rate, if it isn’t too much higher. Obviously, money’s neutral in the long-run.

Granted, macro data and interpretations thereof don’t allow for any process so clean currently, but you’re pushing some excellent ideas to help clean it up.

What about my central question though? Shouldn’t inflows from strong growth countries like China and Vietnam boost real GDP potential, ceteris paribus?

And it amazes me, anyway, that many economists seem to underestimate the seeds being planted now, and the harvesting that’s slowly beginning, with respect to this new era of automation and what will increasingly be automated automation. We will increasingly have more cognitive processing/capita which could increase the rate of innovation over time, allowing developed economies to have ever accelerating real growth rates. Can you think of a reason this won’t happen?

17. August 2019 at 16:10

Larry, There’s a reason that people who claim to be able to predict recessions get ignored.

Mike, You said:

“You’ve occasionally talked about adjusting NGDP targets in response to apparent changes in RGDP potential. That’s all I’m advocating.”

I’ve said that can be done, not that it’s desirable. It’s possible that RGDP growth will speed up, but I’d prefer that NGDP growth be kept stable.

17. August 2019 at 20:00

Scott,

I find it interesting that credit spreads have widened since the 2001 recession.

https://fred.stlouisfed.org/graph/?g=oEHV

This is a period in which I claim money’s been too tight for the duration. Spreads narrowed some after Trump was elected, as real growth started to pick up, but still remained relatively wide. This is consistent, though not uniquely consistent with my claim that nominal rates have been above the neutral rate for about a generation. The question is, what else could have caused this over such a long period of time?

You’ve correctly pointed out that productivity started to fall in 2004, and inflation actually rose initially with this real GDP decline. But then, that was also when an extended oil and wider commodity shock began, having ended with the deepening of the Great Recession in late ’08. Even absent these shocks, I don’t think there was a long enough period of time between the start of the productivity slowdown in ’04 and the NGDP slowdown in 2006 that began with tighter money, to claim there was a significant trend.

And if the neutral rate should equal expected NGDP growth at monetary equilibrium, the gap between the current working age population ratio pre-2001 recession high and the current figure is what one would expect, given the gap between NGDP growth and nominal rates.

It’s striking when looking at the graph of NGDP versus the 1 year Treasury rates, for example. Look at the long period from the Volker triumph over inflation through the Great moderation. The spreads between NGDP growth and one year Treasury rates were tight.

https://fred.stlouisfed.org/graph/?g=oEHX

The point is, if you had more confidence in estimating RGDP potential, would you more likely to support adjusting an NGDP growth target?

Perhaps I’m just dumb and/or ignorant, but if the principle that the neutral rate equals NGDP growth expectations at monetary equlibrium holds, wouldn’t it be a useful fact?

18. August 2019 at 07:08

And the very bright market monetarist Julius Probst offered Sweden as a counter-example to my proposed principle on Twitter. I must have seen bad data or initially misinterpreted what I saw. Sweden, with a recent NGDP trend of just under 5% now has negative 10 year rates. For my principle to hold, optimal NGDP growth would need to be around 10%. Not impossible, especially given the relatively muted growth snapback a few years ago after their slowdown, but challenging to say the least. Sure, credibility may be somewhat lacking, but still.

18. August 2019 at 07:23

That said, from a trend perspective, temporary 10% NGDP growth doesn’t seem so ridiculous.

18. August 2019 at 08:49

Just a video captured of Prince Andrew inside a mansion of pedophile Jeffrey Epstein.

https://twitter.com/QBlueSkyQ/status/1162856431235862529

Who said ‘tin foil hat’ again?

SHEEP

18. August 2019 at 08:53

“The Failing New York Times, in one of the most devastating portrayals of bad journalism in history, got caught by a leaker that they are shifting from their Phony Russian Collusion Narrative (the Mueller Report & his testimony were a total disaster), to a Racism Witch Hunt…..

…..”Journalism” has reached a new low in the history of our Country. It is nothing more than an evil propaganda machine for the Democrat Party. The reporting is so false, biased and evil that it has now become a very sick joke…But the public is aware! #CROOKEDJOURNALISM”

http://magaimg.net/img/8reg.png

And you dumb sheep just keep believing the lies.

18. August 2019 at 18:09

https://i.imgur.com/mxwZTwe.jpg

19. August 2019 at 06:34

I’ll be the first to admit that my NGDP forecast system is not perfect. It would be much better to have a market. What can I do but report what the model ensemble says?

Really what I’m doing with my forecast engine is not much different from what you’re doing with the plots in this post. Using data to figure out what the expected path of NGDP is. You’re saying NGDP will be high enough to avoid recession, I guess you’re saying we’ll have another 2015. I’m saying NGDP will be so low that the NBER will probably call it a “Recession”.

By building the case that NGDP growth will be high enough to avoid recession, you’re implicitly saying it should be possible, given sufficiently weak data, to forecast really low NGDP growth. What’s a synonym for really low NGDP growth?

19. August 2019 at 09:58

You said: “Larry, There’s a reason that people who claim to be able to predict recessions get ignored.” But you did not say what that reason was.

Well, here’s an article pointing out the biases of the economic world:

https://www.nakedcapitalism.com/2019/08/ideology-is-dead-long-live-ideology.html

Perhaps you think there are no biases in the economic world. And maybe you are correct. But probably not. I’ve been reading economic thinkers for a long, long, time and I don’t know of any other academic discipline as divided by politics as the economic discipline.

So when a relatively simple explanation for severe recessions comes along that the economic profession has not thought of, of course you will dismiss it out of hand.

19. August 2019 at 10:21

larry,

Simple question: if you can predict recessions, why aren’t you rich already? Why aren’t the authors of these books already very rich? With your incredible knowledge, don’t read and write books, get rich!

On another note:

This video of Prince Andrew is new to me. It should be really hard to explain for the royal family. What’s Andrew’s explanation? What reasonable explanation could there be? It’s shocking.

19. August 2019 at 10:48

Christian,

The author of this book is already very rich. So I guess his theory works.

I am waiting to hear from an economic expert perspective why his theory is wrong and/or ignored.

Name calling is not an answer.

19. August 2019 at 11:09

Mike, I just don’t see any need to estimate trend RGDP growth. The point is to stabilize NGDP.

There’s no reason to assume that nominal rates should equal expected NGDP growth. I recently did a post on Sweden at Econlog.

Larry, If a commenter tells me about a formal for turning lead into gold, I can’t rule it out because I have not studied the formula. But I’m not likely to allocate time to this theory because life is short and previous attempts were all bogus. If others look at it and say there’s really something there, I’ll take a look.

Justin, I’d look at a wide variety of indicators. BTW, I’m certainly not saying there’ll be no recession, I’m saying the risk is less that 50% over the next year or two. Stocks are near record highs. But the risk is much higher than a year ago.

19. August 2019 at 12:42

“If others look at it and say there’s really something there, I’ll take a look”

And this ladies and gentlemen is precisely why ‘the efficient markets hypothesis’ is untenable as a theory.

If everyone acted in accordance with what it claims people are already doing, NOBODY would or could do anything. Everyone would be waiting for everyone else, which means everyone would wait and wait and wait…until they’re dead (true description of ALL ‘general equilibrium’ models that lame brained self-congratulating economists needed to cook up to justify their salaries)

Market participants DO NOT and CANNOT ‘wait’ before pricing anything.

Information does not spread to everyone equally. It is decentralized.

EMH also an excuse losers make to justify their own impoverishment.

19. August 2019 at 15:40

Six times China Joe Biden describes ‘life events’ that never happened.

https://www.washingtonexaminer.com/news/six-times-biden-described-major-events-in-his-life-that-never-happened

19. August 2019 at 16:32

OT: I understand that not everybody likes President Donald Trump. I even gather that Scott Sumner regards Trump with somewhat lukewarm enthusiasm.

But this is a great idea:

White House officials eyeing payroll tax cut in effort to reverse weakening economy–WaPo

I wonder why it is of all the characters on the DC political stage, it is only Donald Trump who talks openly about getting out of Afghanistan, Iraq and Syria and a payroll tax cut. Trump even takes the Federal Reserve to task, which I also agree with.

My hero, the vulgarian reality-TV show host.

19. August 2019 at 17:53

POTUS tweet:

https://twitter.com/realDonaldTrump/status/1163603361423351808

This shit’s hilarious

19. August 2019 at 17:56

Scott,

Yes, I read your piece mentioning Sweden on Econlog. I have a couple of problems with it, hopefully without being silly.

First, it would be nice to see credit spreads for Sweden, that is between private and public bonds. I haven’t been able to find the data, but would be nice to find some evidence that credit is actually loose.

Second, the current unemployment rate in Sweden is not low, if you compare it to the 1990 low of about 1.5%.

https://fred.stlouisfed.org/series/LRHUTTTTSEM156S

And the most recent figure was 7.1%.

Yes, 1990 was almost 30 years ago, so it’s quite possible there’s more structural unemployment now. I nothing about their labor market over this period, or any period for that matter.

Empirically, I still don’t have enough data to make one believe nominal rates should equal NGDP growth at monetary equilibrium, but there is at least some data consistent with the idea. It wouldn’t be enough to convince me on its own, and I’m not in fact convinced. I just find the idea tempting.

A priori, the idea makes sense to me, simply because it seems markets would elminate opportunity costs by equilibrating nominal rates and NGDP growth expectations at monetary equilibrium. It seems the potential risks and rewards, with random information updates, would be equal and opposite. I need to find a way to explore the idea more theoretically, at least, if not come up with more clever ways to try to test the idea against sparse data.

19. August 2019 at 20:31

S#!thole corrupt state

https://twitter.com/JudicialWatch/status/1163631739475918848

20. August 2019 at 08:34

And there it is.

Demokkkrats soliciting FORIEGN INTERFERENCR (read between the lines you dummies) in the 2020 election, BECAUSE AMERICAN CITIZENS ARE NOT VOTING FOR THESE PSYCHOPATHS.

https://www.bloomberg.com/news/articles/2019-08-20/dnc-chief-plans-to-raise-money-from-americans-in-mexico-city?srnd=markets-vp

20. August 2019 at 16:33

Ben, A payroll tax cut is an idiotic idea.

Mike, I’m pretty sure that private lending rates are also low. Mortgage rates in Denmark are minus 0.5%. I’d guess Sweden is also pretty low.

20. August 2019 at 17:53

Scott,

Yes, but just as low rates are not necessarily indicative of easy money, they are also not necessarily indicative of easy credit. And I’m wondering about spreads because they are a much better indicator of private credit markets than government bond yields. My guess is that credit is not as easy for those with lower credit scores as they were when unemployment was lower.

20. August 2019 at 21:20

From the perspective of the value of the currency versus output, that is, the internal value of the currency, it gets dearer as money gets tight. So, in that sense, the interest rates don’t really change in response to monetary policy, at least in the short-run.

21. August 2019 at 03:35

BTW, OT but yuuuuge:

The world’s largest asset manager, BlackRock ($6.84 trillion AUM) just called for money-financed fiscal programs, or MMT, or something really similar.

https://www.blackrockblog.com/2019/08/20/how-central-banks-might-deal-with-the-next-downturn/

So, the world’s largest bond manager, PIMCO; the world’s largest asset manager BlackRock; and the world’s largest hedge fund manager, Ray Dalio, have all called for money-financed fiscal programs, or MMT, or something really close to those concepts.

We may be on the cusp of a new monetary-policy era. This time Wall Street seems to want it.

It seems like only yesterday it was a badge of honor in financial circles to talk about the need for monetary discipline, and the righteous war on inflation. Now it is only retrograde types like Ester George, Cleveland Fed President, who talk about tight money.

Where is Richard Fisher?

21. August 2019 at 05:33

Scott,

By the way, the topic of low interest rates world-wide is addressed in interesting ways in Beckworth’s latest podcast, if you haven’t heard it yet. Demand for safe assets has continued to rise while the creation of safe assets has slowed, the latter due to fiscal consolidation.

I think though that money in many developed economies is tighter than most think, even among those who think it’s tight, and rising unemployment is one of the strongest pieces of evidence for that perspective, such as in countries like Sweden.

21. August 2019 at 14:38

Forget a payroll tax cut, have the Treasury mint coins with massive face values; use them to buy up securities. Run a parallel monetary policy next to the Fed. What could go wrong?