Keep the government’s hands off my Medicare!

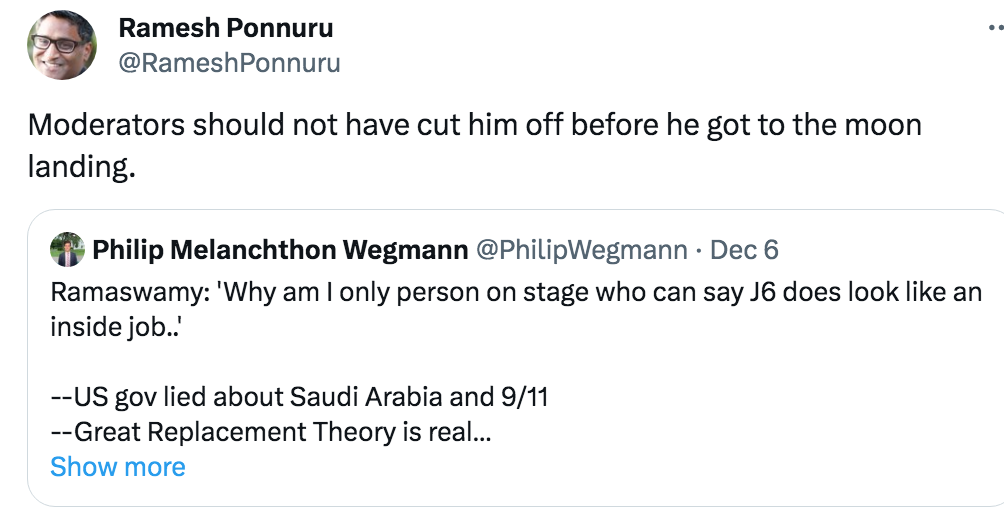

This tweet caught my eye:

I know what Ponnuru is getting at, but isn’t this a rather odd comment? Of course J6 was an inside job; the conspiracy went right to the very top of the US government. The president and his henchmen encouraged a violent mob to storm the capital with the goal of intimidating Congress into not certifying Biden’s victory.

I find it odd that when people talk about “the government”, they tend not to include the president. Consider:

During the Trump administration, campus leftists called for government laws against hate speech. And yet I doubt that those leftists actually wanted President Trump to regulate hate speech.

During the Trump administration, “the government” pressured Twitter to “combat misinformation” regarding Covid. Yet Trump was widely seen as being against cancel culture.

BTW, during the Trump administration, lots of Trump supporters liked his approach to lockdowns. But Trump supported the lockdowns back in the spring of 2020, and explicitly criticized the Swedes for avoiding lockdowns. It’s as if Trump’s supporters drew a distinction between Trump and “Trump”.

There is probably no politician in US history that spoke out more forcefully than Trump in favor of using “the government” to take political candidates off the ballot. Trump used this argument against Obama, Hillary, Ted Cruz, among others. And yet his supporters see him as a critic of “the government” meddling in elections. They were outraged by the Colorado and Maine rulings. (It’s the Dems who should be outraged, as the courts are handing Trump the presidency on a silver platter.)

There are some questions that are so absurd that no pollster would ever think of inquiring what the public believes. But they should! How about a poll on these questions:

1. Should the government be able to determine what’s taught in the public schools?

2. Should the government stop interfering with Medicare?

3. Should the government determine military policy on gays and transgender people?

You might be surprised to find out what “the public” actually believes.

PS. Recall this WaPo headline?

New study confirms that 80 percent of Americans support labeling of foods containing DNA

Don’t assume that any question is too stupid. Ask!!