Is inflation actually normalizing?

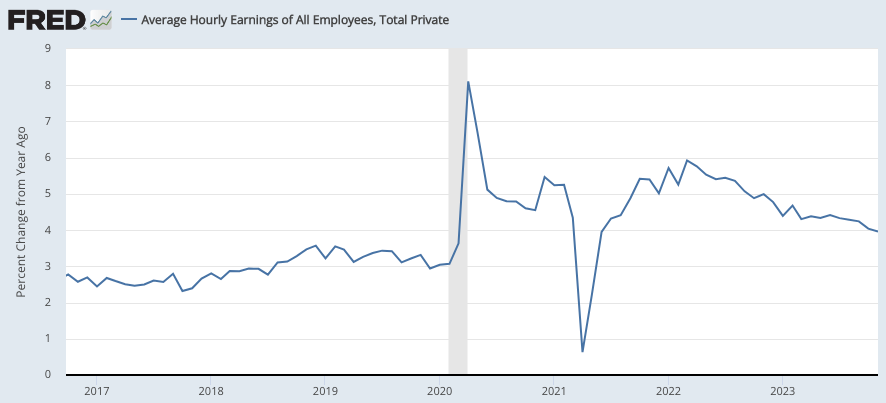

I’m agnostic on this question. But I do have strong views on a related issue—wage inflation is the only inflation that matters. The Fed needs to get wage inflation down close to 3%. Are they doing so? I’m not sure. The FRED data site says average hourly earnings are up 4% over the past 12 months, and are rising at an annual rate of only 3.4% over the past three months. That’s almost consistent with 2% trend inflation.

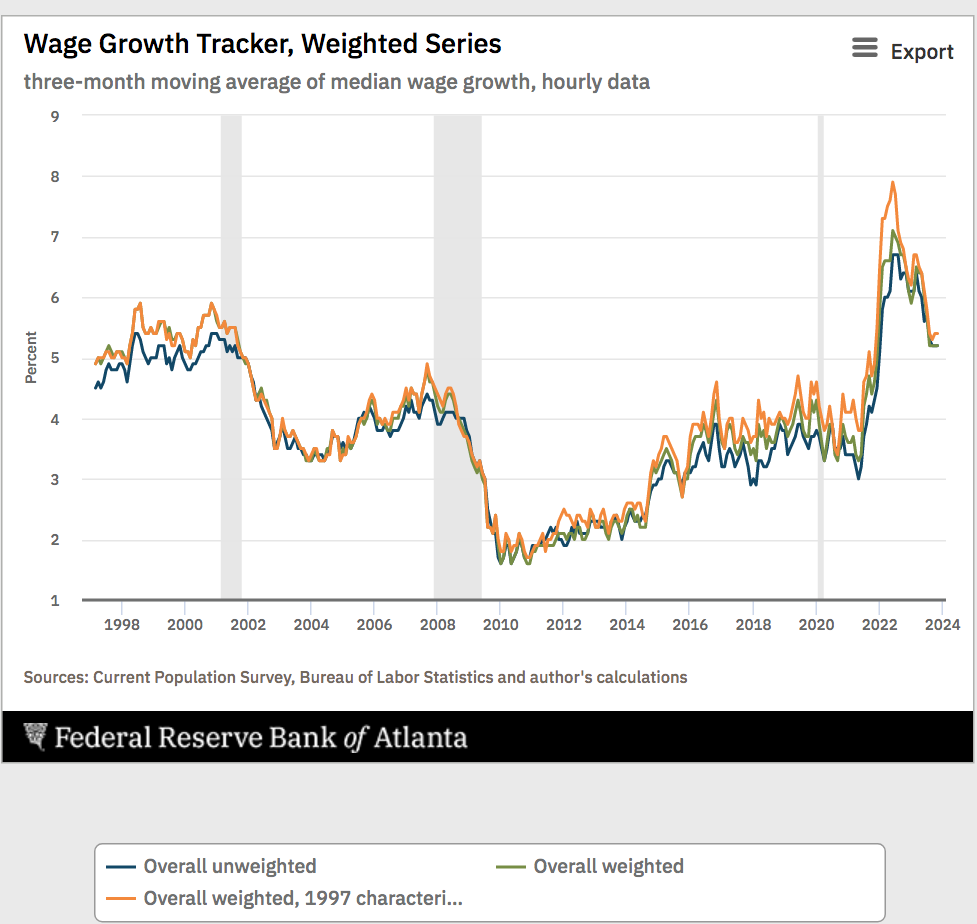

But the Atlanta Fed wage tracker says hourly earnings are up between 5.2% and 5.4% over the past three months, depending on whether you use a weighted or unweighted series. So which is correct?

I don’t know which series is more accurate. But I can say that if the FRED series is correct then the Fed has probably won its battle, and if the Atlanta Fed series is correct then we are in for a tumultuous 2024. What do you think?

PS. Yes, wages are a lagging indicator. But the early indications are that NGDP growth will remain strong in Q4.

Tags:

19. December 2023 at 10:39

I’ll go with the forward market indicators. Even if we’re still running hot, markets don’t expect it to continue for long.

19. December 2023 at 10:46

Philly Fed SPF has 3.8% nominal GDP growth forecasted for next year (cumulative by quarter, not the annual average version).

19. December 2023 at 12:50

I would strongly suggest trusting the FRBATL measure with two caveats. It is showing the change from 12-months ago. It would be more ideal to have a m/m annualized rate of change but I don’t think that’s possible from the data source used in constructing the WGT. The other issue is that WGT is coming from household survey data which has a smaller and less reliable sampling size; conversely, the establishment data which is used to construct AHE is a far larger sample and tends to be less noisy (note this issue is generally brought up when one is receiving conflicting signals from the unemployment rate and payroll job gains).

Definitely be wary of AHE. It should ***never*** be referred to as wages, since it is total payrolls paid divided by total hours worked. Thus, if you get more job growth in low-wage sectors (such as Leisure and Hospitality) it will make it look like the average “wage” is falling.

19. December 2023 at 12:54

Alex, Thanks. That’s a very misleading way they labeled the graph. They should have said it was the 12 month change, not the 3 month moving average.

19. December 2023 at 15:22

The unit labor costs are behaving very well.

If the price of avoiding a recession is moderate inflation, so be it.

19. December 2023 at 15:45

Anecdotally, the job market is still tight.

Everyone I talked to is short staffed, trying to hire and raising wages

20. December 2023 at 07:43

Scott,

I saw a headline that said the futures markets anticipates 6 rate cuts in 2024. What are your thoughts on that? I’ve never heard of 6 rate changes in a year in either direction before.

20. December 2023 at 08:55

Bobster, Yesterday, I went to a “fast food” restaurant. I just wanted a quick bite. The line was so long I gave up. It seems like the labor shortage will never end.

Dr. Richard, That’s usually a prediction of recession, but right now the markets seem to anticipate a soft landing. It will be an interesting year.

20. December 2023 at 13:31

if wage inflation is the only cause of inflation, then why havent we been in a depression for the last 20-30 years? wages have not been inflating but deflating, and wages havent really grown much till the last 3 or so years.

20. December 2023 at 13:32

Any good reference material on why wage inflation is the only inflation that matters?

20. December 2023 at 13:38

dw, I didn’t say that wage inflation causes price inflation, I said it’s the only inflation that is important. It doesn’t cause price inflation—both are caused by monetary policy, supply issues, etc.

And nominal wages have grown a lot over the past 30 years. Perhaps you are confusing nominal and real wages.

Scott, I’ve done a number of posts on this over the years. Basically the idea is that stable nominal wage growth leads to a more stable macroeconomy. That is not true of stable price inflation. If you want an academic paper, Mankiw and Reis did a good one. There are many others, but I’m bad at recalling names.

20. December 2023 at 18:15

“Everyone I talked to is short staffed, trying to hire and raising wages”

This is only true in certain industries, like farming, changing breakpads and waiting tables, because people would rather accept government handouts then do backbreaking work. Additionally, nobody wants to be a waiter today, because you might have to serve some militant activist who calls you a racist and spits in your face, simply because you forgot to bring them a fork.

The reality is that most companies are laying off employees and/or are simply trying to rehire employees that they lost after the tyrannical lockdown. There is no real growth. Most are trying to get leaner, some even preparing for a potential civil war in the first or second quarter of 2025, as it becomes increasingly unlikely that the left or the right will accept the outcome.

21. December 2023 at 04:40

re: “wage inflation is the only inflation that matters”

Then you’d target GDI

https://fred.stlouisfed.org/series/GDI

21. December 2023 at 06:10

Inflation normalizing? The surge in home prices will obviously result in higher rents – higher inflation – in other words stagflation in due course.

21. December 2023 at 06:32

Scott,

If we are experiencing higher productivity in the post COVID economy, wouldn’t wage growth and low inflation be expected? I know you think it unlikely, but it sure looks like productivity is going up to me.

21. December 2023 at 08:00

Holiday spending is trending upwards, and it’s coinciding with more deals from retailers which means that bargain hunters might continue dropping cash through January and February. Commercial real estate is supposed to be interesting next year–I almost feel sorry for anybody who holds a mortgage for class B office buildings in any American city.

All of this probably means more sideways movement on wages.

Another piece of good news is that China probably won’t invade Taiwan until 2027 so we can enjoy some geo-political stability for most of Trump’s second term.

21. December 2023 at 08:11

Core inflation is @ 4.0%. GDPnow is @ 2.7%. So, N-gDp is too high.

And short-term money flows have bottomed out. The trajectory is higher in the first half of 2024.

21. December 2023 at 09:57

TF, It’s also possible that productivity is overstated due to the recent fall in the quality of services.

In any case, even if productivity growth rose modestly (a few tenths of a percent), it wouldn’t be enough to have much impact on inflation.

David, Ukraine may be giving China second thoughts.

22. December 2023 at 06:53

Looking at the PCE report this morning, I see that total PCE for the last 5 months rose 0.8% in total (about 2% annualized), and core PCE rose 0.7% over the 5 months. Both 5 year and 10 year breakevens suggest approx 2% PCE inflation going forward. While I wish the Fed would be using NGDPLT, I imagine that the Fed feels good looking at that PCE data. Where is the disconnect?

23. December 2023 at 04:06

Scott, wages have been lagging prices, which are now at 2%. And we have a RGDP boom that pumped faked you in Q3 into thinking inflation is reaccelerating. Higher than usual nominal wage growth is consistent with at target inflation and a productivity increase.

23. December 2023 at 08:10

Kiubo, You said:

“And we have a RGDP boom that pumped faked you in Q3 into thinking inflation is reaccelerating.”

I see you are a first time commenter. You should probably know that I don’t like commenters who misrepresent what I said. Go back and reread the post. Heck, just reread the very first sentence of the post.