Ueda hits the right notes

Some people have asked why I supported Japan’s decision to raise their inflation target from 0% to 2%. After all, money is roughly neutral in the long run and by 2013 Japan had mostly adjusted to their near zero inflation rate.

I made a couple of arguments. Central banks tend to use interest rates as a policy instrument, and this works better if nominal rates are not stuck at zero. In addition, Japan’s equilibrium real interest rate was so low that the Fisher effect is not fully operative. Raising inflation from 0% to 2% might only raise nominal interest rates from zero to 1%, or even less. This would help public finances. A 2% inflation rate would also lead to a smaller central bank balance sheet.

Bloomberg has an article where new BOJ Governor Kazuo Ueda makes some similar points:

“The most obvious benefit of a slightly positive inflation rate is larger room for monetary policy responses to an economic downturn,” Ueda said in a speech Monday at a conference hosted by the Keidanren, Japan’s biggest business lobby, in Tokyo. . . .

While Ueda refrained from dropping a clear hint on the timing of any potential policy change, he joins his deputy Ryozo Himino in highlighting some of the benefits that would come in a world without negative rates, including an improvement in net interest income.

I’m not certain which net interest income he’s referring to, but he clearly agrees that the Fisher effect is not fully operative.

I’ve also argued that it is wage inflation that matters, and without wage inflation any price inflation is transitory. In the US, the recent focus is on getting wage inflation down to a level consistent with 2% inflation. But as Ueda points out, Japan needs higher nominal wage growth to ensure that recent price inflation is sustainable:

The central bank kept the world’s last negative rate at a policy meeting last week. Ueda said Monday that a key point to watch is whether wages will continue to rise “markedly” in next year’s annual spring wage talks.

[Recall that I’m not a hawk or a dove. It depends on the situation. Lower wage growth in America, higher in Japan.]

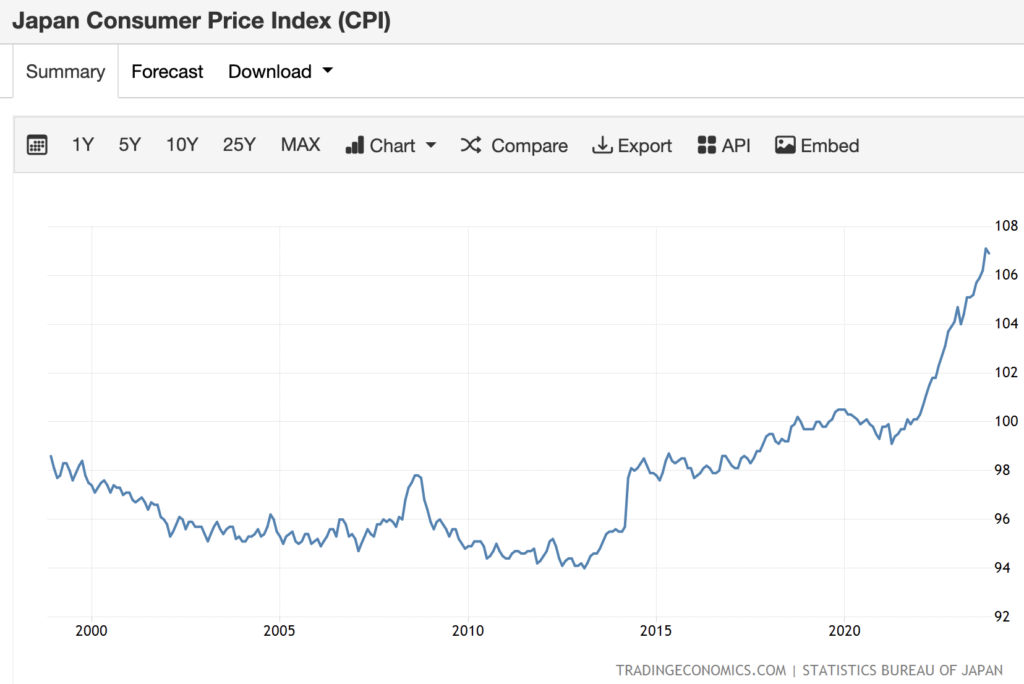

Prime Minister Abe switched to a positive inflation policy at the beginning of 2013. Since that time, inflation has averaged a little over 1%. That’s well below the BOJ’s 2% target, but far better than the deflation that existing prior to 2013. And despite the higher inflation, short-term interest rates remain at zero. For Japan’s fiscal authorities, this is like picking up 10,000 yen notes off the sidewalk.

I’m glad to see that Ueda is continuing Kuroda’s policies at the BOJ.

PS. Japan’s NGDP has also been increasing in recent years, a sign the higher inflation is not just reflecting high import prices due to a weaker yen.

Tags:

27. December 2023 at 05:27

“For Japan’s fiscal authorities, this is like picking up 10,000 yen notes off the sidewalk.”

Ok but, if they need money, they could also just levy a tax. They are the fiscal authority, right?

I don’t understand why there is so much fascination with accounting tricks like the one you mentioned. If the government is “getting a deal,” it is predicated on some misapprenhension of the state of affairs on the part of market agents. To the extent those agents are its own citizens, it’s not clear why a government should find such deals appealing. They are at best neutral.

27. December 2023 at 06:14

The demand for money is clearly different in Japan.

27. December 2023 at 06:14

Scott, somewhat unrelated, but speaking of Japan, did you see the movie “Monster”? Interested to hear your thoughts on it. I personally loved it.

27. December 2023 at 06:56

Jeff, They are correcting an inefficiency. The zero lower bound is analogous to a price control. It’s costly to pay interest on currency—cheaper to have the equilibrium rate on currency rise to zero.

sd0000, I look forward to seeing that film.

28. December 2023 at 13:25

Savings isn’t synonymous with the money supply. Banks don’t lend deposits. Deposits are the result of lending/investing. The Japanese save more and keep more of their savings impounded in their banks.

“Japanese households have 52% of their money in currency & deposits, vs 35% for people in the Eurozone and 14% for the US.”

The BOJ also has unlimited transaction deposit insurance.

28. December 2023 at 13:33

For the incredulous reader I make this assignment: Please explain how the volume of bank deposits could grow since 1939 from $48 billion, to $ 20,767.4 (NSA) billion, even while the banks were paying out to the non-bank public a net amount of (-)$2,240.3 billion (NSA) in currency?

It’s a delusion, banks don’t lend deposits. Deposits, inside money, are the result of lending/investing. Reserves, outside money, represent the monetization of sovereigns. The purchase of governments by the trading desk, increases supply, while decreasing demand.

The suppression of interest rates begets crime.

28. December 2023 at 16:21

Discuss the BoJ QE program.

29. December 2023 at 07:47

The BOJ’s income velocity is too low. If the BOJ wanted higher N-gDp, then it would target RPDs, reserves for private deposits. Yield curve control is a throwback to the stone age.

29. December 2023 at 15:58

SS: “Some people have asked why I supported Japan’s decision to raise their inflation target from 0% to 2%.” – given money is largely neutral and central banks respond to markets rather than the other way around, it’s laughable to read this sentence. It’s like saying: “Some people have asked why I supported gravity allowing water to flow downhill”. What? As if anybody cares…

Bonus trivia: long term, over generations, while money is neutral, even under a gold standard money supply seems to expand as the economy expands, since people like to see stable prices, the “unit of account” aspect of money.

30. December 2023 at 00:47

Allowing banks to borrow at 0% is theft.

What other industry is allowed to borrow capital at no interest, and lend that capital for a profit other than the banking cartel?

What is more anti-capitalist than that?

30. December 2023 at 08:56

Ray, You said:

“since people like to see stable prices”

Yes, the price level is determined by what people “like to see”. In 1923, Germans had a sudden preference for hyperinflation.

30. December 2023 at 20:11

Dear Prof. emeritus Sumner: if you’ve read my comments carefully over the years (as you should) you’d know I’m fully prepared to admit money is non-neutral during hyperinflation (shoe leather and menu costs and all that). Happy New Years!

31. December 2023 at 04:58

I thought that you didn’t believe in the ineffectiveness of policy at the ZLB. What am I missing?

31. December 2023 at 09:35

Ray, Sigh. You never get my jokes, do you?

Mira, Policy is still effective. But because central banks foolishly rely on interest rate targeting, it’s more clumsy at the zero lower bound.