Nick Rowe on money illusion

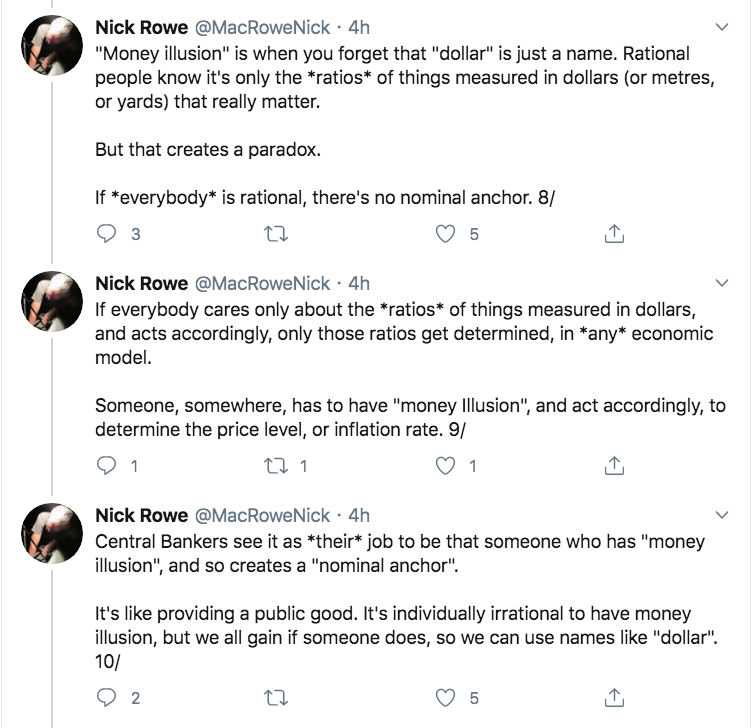

Craig Fratrik sent me a Nick Rowe twitter thread discussing the way that central banks create a nominal anchor. I think I agree with the substance of the thread, but I’m not certain. My hesitation has to do with what seems like an unconventional use of terms like “rational” and “money illusion”. I hope commenters will tell me whether I actually disagree with Nick, or if we just define terms differently. Here’s a portion of the thread:

I’d like to present two imaginary conversations. Both occur in a country where inflation has been running at 10%/years for several decades:

First conversation:

Jack: I’m bummed out.

Jill: Why is that?

Jack: My boss just gave me a lousy 6% pay raise for next year.

Jill: Yikes, that’s not very much given the 10% inflation rate.

Second conversation:

Jack: I’m on cloud nine today.

Jill: Why is that?

Jack: My boss just gave me a 6% pay raise for next year!

Jill: Umm, you do know that the inflation rate is 10%?

In both conversations, Jack is describing his situation using an unstable measuring stick—money. His account of his pay raise is in money terms, and by itself doesn’t accurately convey his actual economic situation. On the other hand, in the first conversation Jack seems well aware of the 10% inflation rate, and understands that his real wage is declining. In the second he does not. In my view, the second conversation exhibits irrational behavior and money illusion, while the first conversation does not.

As I read Nicks twitter thread (especially #9), it almost seems like he’s saying that merely setting monetary measures of value is ipso facto evidence or irrationality, or money illusion?

Do I have a substantive difference with Nick, or is this just semantics?

My view is that the “public good” aspect of money is so strong that even a highly flawed numeraire is far superior to no numeraire at all. I believe that it’s more rational to talk about a 6% raise in a world of 10% inflation than to talk about one’s pay raise without any reference to a numeraire. I don’t want someone telling me that last year they got paid 30 shares of Google stock per month and this year their pay was changed to 40 ounces of gold per month. I want all my information in dollars. The math is easier and I’ll sort out the real implications myself.

Tags:

23. May 2020 at 17:12

Scott,

Third conversation (after many years of high persistent inflation)..

Jack: I just got a raise from 0.0000000000001 of the current money supply to 0.000000000000106 of the current money supply.

Jill: Wow that’s great.

People are rational, they generalize and take shortcuts based on known and/or expected actions/behavior/circumstances. They don’t waste time internalizing temporary or insignificant changes in circumstances. Once it’s worthwhile to adjust, people adjust. I guarantee you there is no money illusion in Zimbabwe.

23. May 2020 at 17:26

Yes there seem to be one fundamental difference at least. You seem to emphasize the conventional view that money illusion is basically confusing the nominal value of money with its real value.

I don’t quite understand Nick, but he seems to say something along the lines of that whoever doesn’t believe at all times that money is worthless (since there is no intrinsic value) is already subject to money illusion.

I mean, he is right, money has no intrinsic value, but that is not the definition of money illusion. He should come up with a different, new technical term for it, otherwise it only leads to confusion.

23. May 2020 at 21:48

My gut feeling is that Trump will make Ivanka his running mate as his surprise move later this year to boost support. If he wins he will resign at some point, make her president, then take on whatever legal troubles he has and she will pardon him, if need be.

23. May 2020 at 22:04

Thanks for stopping by, Liz

23. May 2020 at 22:37

I don’t have anything of substance, but Archie Bunker and Meathead had a similar exchange in an episode of All In the Family. Archie was Jack in the 2nd conversation.

24. May 2020 at 01:09

Rwperu34: also, in the movie Goldfinger, the arch-villain was going to irradiate Ft. Knox gold, making it worthless, and thus increasing the value of the arch-villain’s cache of gold.

24. May 2020 at 02:02

I’m not sure why he refers to money illusion as a public good. He also seems to be of the view that the central bank creates money illusion, but I’m not sure how that would be possible. If no one else but the central bank had money illusion, it wouldn’t seem to matter what the central bank did, because everyone else would adjust.

I get your two examples, but isn’t the core issue more one of incomplete information than of rationality? Obviously if there was an instantaneously updated inflation number, it would be irrational not to use them. But there aren’t, and we mostly notice inflation through our own normal consumption, which takes time. And that seems to match the fact that wage demands relatively easily adjust to whatever stable trend inflation is.

Also, counter the example of pricing things in Google stock or ounces of gold, isn’t that just substituting one type of money for another? Isn’t the real problem that the ratio I care about is the ratio of whatever I’m getting paid in to my own personal consumption basket, and everyone’s consumption basket is different?

24. May 2020 at 05:37

Even if I only care about ratios I still have dollars — everyone has dollars. So we rationally care about any ratios involving dollars too. We measure inflation by seeing if the ratio of dollars to a basket of products is moving in a particular direction. I see no paradox.

What am I missing here?

24. May 2020 at 07:11

I think Mr. Rowe disregards nominal “stickiness”. His “acting rationally” means that everyone can adjust their behavior instantaneously based on fully available and internalized information about economic/monetary situation.

24. May 2020 at 07:59

I’m not sure what he’s trying to say. I thought it was supposed to be the opposite: if no one was subject to the money illusion, money would be neutral; of course that may not be true, e.g. Christopher Sims’s idea of ‘rational inattention’ leading to price stickiness, and maybe Rowe is saying that rational behavior leads to price stickiness, and monetary policy comes from a standpoint of ‘corrective money illusion.’ I don’t know.

24. May 2020 at 08:57

Dan, To talk about one’s pay in terms of “consumption baskets” would be even more confusing. How would one even calculate such a thing? Without money it would be exceedingly difficult. “I’m paid X amount of good A, plus Y amount of good B, plus Z amount of good C, etc. etc.?

D.O. I wondered about that as well. That’s the interpretation that seems most logical, but it seems to me to be an odd criterion for “rationality”, and an even odder one for lack of money illusion. So I’m not sure. That’s why I wonder if this is about semantics.

Mark, But he doesn’t say you need money illusion just for non-neutrality, isn’t he saying you need it for the central bank to be able to determine inflation?

24. May 2020 at 10:29

Elizabeth,

That’s some heavy duty conjecture.

24. May 2020 at 11:57

Rationality and asymmetric information can coexist?

24. May 2020 at 15:49

Randomize, Yes.

24. May 2020 at 17:45

Hi Scott:

Thanks for posting on this.

Yes, I didn’t explain that bit as clearly as I should have. David Andolfatto questioned me on it too.

Let me try to explain it more clearly:

Suppose someone had a money demand function like Md=$100. They want to hold a fixed $100 (on average), regardless of the price level (or their nominal income).

That person has money illusion.

If instead it’s Md=Py, it’s not got money illusion. That second equation is homogenous in nominal variables; the first equation isn’t.

Now suppose one central bank has a money supply function Ms=100. It holds M fixed.

And a second central bank has Ms=PY. It adjusts money supply in proportion to nominal income.

The first money supply function has “money illusion”, in the same sense that the first money demand function has “money illusion”. But holding Ms fixed creates a nominal anchor.

The second money supply function does not have “money illusion”. It’s homogeneous in nominal variables. But there’s no nominal anchor. If P rises 10%, the central bank raises M 10%, so the price level can drift up (or down). It’s indeterminate (in the long run).

Is that clearer? (I’m planning to do a blog post on this one day.)

25. May 2020 at 00:29

@Nick Rowe – yes, it’s now clear…as mud. So under your definition, a fixed money supply, i.e. a gold standard, is subject to money illusion, while a variable money supply is not? That turns the definition of ‘money illusion’ on it’s head. In fact, what dtoh said upstream is right: money illusion only occurs during hyperinflation, and then only for a brief period while people figure it out. I posit, like Nobelist Fisher Black, there’s little or no money illusion short term. The only illusion is from economists who confuse the fact nominal wages go up during fiat money creation and mistakenly think this is money illusion or sticky wages. If the price of coffee doubles in a half hour in Zimbabwe, that’s neither money illusion nor sticky prices, it’s simply rational behavior from Zimbabweans who know their money is becoming worthless.

Don’t fret though, since you use quantity theory of money symbols and are a fellow economist, Scott’s got your back. He’ll dump on me not you.

25. May 2020 at 04:38

I am a bit confused as well. If no-one had money illusion, then I can’t see any benefit in having a nominal anchor – or even ‘money’. We would all live happily in a barter economy with no unemployment and no business cycles (except for real shocks). But if we have money to reduce transaction costs and if enough people have money illusion, we get business cycles when the equilibrium value of money changes rapidly. Keeping that equilibrium value stable – a stable nominal anchor – helps avoid business cycles. Also, if we have business cycles, it makes sense to have equity and debt to accommodate different people’s risk preferences. Because equity is positively correlated to the cycle, some people prefer to either hold or take on debt (which is not). And because of debt, many people care about the MOA and want it to be stable.

25. May 2020 at 05:46

Well, we do not have to worry about money illusion much for a while, if the Cleveland Fed is right.

“As an aside, the Cleveland Fed’s expected inflation term structure is shown in chart 2. It depicts expected inflation rates by year out to 30 years on the curve by using a model based upon Treasury yields, inflation data, inflation swaps and survey-based measures of inflation expectations. It’s a superior hybrid approach over excessively relying upon just one subset of measures. The result is that markets expect to be beneath 1% inflation out to six years on the curve and below 2% out to 30 years on the curve. Obviously the results are to be interpreted with caution and may be overly reactionary, but for comparison purposes the curve from one year ago is also shown.”

from Scotiabank.

It is remarkable. Uncle Sam is running record deficits and the Fed is pretty heavy into QE and their full range of programs is large if indecipherable.

1% inflation for the next six years?

The Swiss National Bank is back to QE to try and tamp down the value of the Swiss franc. Switzerland is has dodged in and out of deflation since the Great Recession and now has built up a a balance sheet topping $00 billion in a nation of 8.57 million.

Food for thought. Abba Lerner was right all along?

25. May 2020 at 06:04

Not sure why Nick has to create a paradox from purchasing power as a series of ratios —for example—-(2012 Audi A4 or 16000lbs of bananas? Or perhaps I should lock in 12 years of Netflix for my 5 grandchildren. Of course, that is just today’s ratio—-will inflation alter the ratios?.)

But we have a method for measuring for that. What is the paradox? People think first of money, second in what it can buy, and third, the value of saving and investing it. We are also always somewhat betting on our “ratio holdings” (televisions and apparel have much better ratios today than health care than they did 20-30 years ago. Perhaps preventative procedures should be considered In our ratio choices.

In the world of macro measurement, we functionally assume an inflation regression but implicitly assume a normal distribution of individual residuals around the mean as different people may have preferences for higher and lower “relative ratio” assumptions.

But a rational person will still always prefer a “rise in income” relative to their perception of inflation as well as wanting to earn more than the regression line of inflation—-why should other people’s crummy ratio choices make my income lower?.

Nick almost seems to be saying that an infinite set of barter quotations, might be more “real” and for those capable—— maybe even practical—-And perhaps that is true—-in a world where ratio thinking is “natural” and easy. Perhaps with new iPhone apps we can always optimize everything we do——and have our daily optimized choices. Does he believe we can live in a barter unit world without money illusion ? How do those units get allocated?

He recognizes the it is easier to use money as an approximation—(“money illusion”) for the whole. Money illusion is helpful because 1) it is practical; 2) it is not a bad approximation—even as people are quite aware of their own ratio/barter preferences, and 3) someone has to calculate it—hence the Fed

But if it were not the Fed, it would be someone else.

He brings up an interesting thought—-not sure it impacts how one should conduct policy.

25. May 2020 at 09:35

Nick, Yes, then I think it’s a question of semantics. The central bank holding M fixed does not have money illusion as I would define the term. That action, considered in isolation, doesn’t tell me whether they are under some sort of “illusion”, or whether they created that nominal anchor for perfectly rational reasons, knowing exactly what they were doing.

Having said that, I’m reassured that we don’t have a substantive difference, AFAIK. I look forward to your blog post.

Rajat, You said:

“If no-one had money illusion, then I can’t see any benefit in having a nominal anchor – or even ‘money’. We would all live happily in a barter economy with no unemployment and no business cycles (except for real shocks).”

I disagree. Money reduces computations costs, even among people like me who do not have money illusion. I’d hate a system of barter.

25. May 2020 at 13:09

Ssumner: ” Money reduces computations costs, even among people like me who do not have money illusion” – and why don’t you have money illusion? You think you’re better than the rest of us?

25. May 2020 at 23:35

The question you should all be asking yourself is why Scott Sumner deletes comments on Econlib and his own blog. The reason is because he does what so many are doing today – and that is to try and stop dissenting voices from sharing their opinions. If everyone says the same thing, the power of group think becomes increasingly stronger. This makes it difficult for people to see a different side of the story. Those in power can use their power to silence those voices. Debate and persuasion are no longer needed. The voice of the public is reduced to one. One way. One voice. One path. Does it sound familiar? Indeed it is. Just take a look at the CCP.

26. May 2020 at 08:49

On topic. Ripped from today’s headlines: NY Times 5/24/20– There Are No Sticky Wages (TANSW) – “Pay Cuts Become a Tool for Some Companies to Avoid Layoffs “Shared sacrifice” in the white-collar ranks aims to avoid the cost of staffing up again. It was late and Martin A. Kits van Heyningen feared he was letting the team down at the company he co-founded, KVH Industries. Rather than lay off workers in response to the coronavirus pandemic, he had decided to cut salaries, and when he emailed a video explaining his decision at 3 a.m. last month, he was prepared for a barrage of complaints. Instead, he woke to an outpouring of support from employees that left him elated.”

26. May 2020 at 08:58

Ray, You said:

“You think you’re better than the rest of us?”

No. But I do believe that I am better than many people at not having money illusion.

Gerald, You said:

“is why Scott Sumner deletes comments on Econlib”

I wouldn’t even know how to delete a comment at Econlib. And I’ve never deleted a single comment at Moneyillusion for any reason other than obscenities. Not one in 11 years.

26. May 2020 at 14:16

@ssumner – how can you not have money illusion when real rates, not to mention the Wicksellian natural rate, is unobservable? Inflation is not homogenous; it varies depending on what class you’re in, what basket of goods you buy, and arguably it’s hard to track real prices, hence we just follow nominal prices by and large and thus all suffer from money illusion. I never thought I’d type that, but there it is.

@Gerald- it’s true, Sumner does not censor people, though he almost banned me a few months ago but I apologized for misreading him. What happens with this WordPress site is sometimes your comments get blocked by mistake, especially if you’re using a VPN proxy server it seems (has happened to me).

26. May 2020 at 14:41

Rajat,

Isn’t money one of the best inventions mankind has ever made? Without some form of money, how would one efficiently trade or build capital? Just to name two examples.

And why should money illusion be an advantage of money, isn’t it rather a drawback? A drawback we have to live with.

26. May 2020 at 19:54

I’m lost and I’ve read this stuff for near a decade now.

I thought money gained real value thru taxation.

27. May 2020 at 14:07

Ray, Don’t waste your time with people like Gerald. They have an agenda and they’ve already made up their mind.