March of 2025

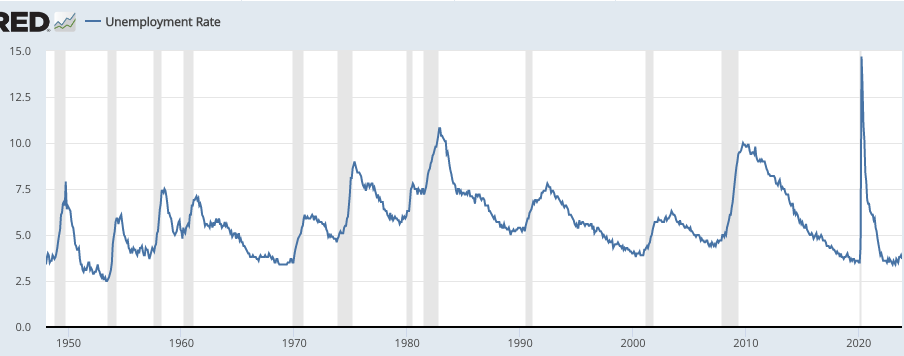

Mark your calendars. Unemployment fell to 3.6% in March 2022. Now it’s 3.7%. If it’s still relatively low in March 2025, and if inflation has fallen close to the Fed’s 2% target, then the US will have achieved its first ever soft landing. Three years of cyclically low unemployment without triggering high inflation is something that has frequently occurred in other countries (say the UK in the early 2000s), but never in the US. No one knows why.

America’s been around for a quarter of a millennium, which is a long time. The early years are not well documented, but I’m pretty sure that we’ve never had a soft landing since at least the Civil War. And yet it seems like Wall Street prognosticators are increasingly of the view that the US will soon achieve a soft landing, our first ever.

(One caveat is that the late 1940s are kind of an odd period, as the US had a technical recession after WWII, and yet the unemployment rate stayed pretty low. On the other hand, we had a significant inflation problem.)

I recently saw an interview with Claudia Sahm, where she suggested that’s it’s quite possible that the Sahm’s Rule will be violated during this cycle, which again would be unprecedented. I see these two potential outcomes as being related. Thus, suppose that unemployment rose just enough to trigger a Sahm’s Rule recession warning, with NGDP slowing just enough to bring down inflation, but not enough to trigger an actual recession.

In the US, unemployment rises by at least 2% in actual recessions. What if it merely rises to 4.2% by March 2025? That’s not a recession, but it would trigger a Sahm’s Rule warning.

How does one achieve a soft landing? Simple—just reduce NGDP growth to about 4%/year—forever. Will we do so? I have no idea. I fear that bringing inflation down will be more painful than many people now assume. I hope I’m wrong. (It’s the final percentage point that’s the toughest.)

PS. You may wonder why periods like the 1960s and 1990s were not soft landings. In the 1960s, inflation didn’t stay low once the labor market recovered. In the 1990s, the labor market didn’t fully recover until very late in the decade. March 2025 is now only 15 months away. It could be President Trump’s first great 2nd term success!!! (BTW, of the last eleven recessions, ten began under Republican presidents and one began under a Democratic president.)

PPS. Do you recall the many failed recession calls for 2023, such as Bloomberg’s famous “100% odds” forecast? Where did these failed forecasts come from? Probably at least in part from the fact that the US has never achieved a soft landing. If there was any question as to whether economists can predict the business cycle, then 2023 should have removed all doubt. Economists are utterly incapable of predicting the business cycle. Our track record is beyond abysmal. Please stop—don’t even try. Just set monetary policy so that markets expect 4% NGDP growth, level targeting.

PPPS. Back in August I started a post as follows:

I believe that the next 12 weeks will be critical for the Fed’s anti-inflation program. During that period, we’ll get three more jobs reports and the 3rd quarter NGDP report. Hopefully, we’ll see a bit further progress on wage inflation, which is the only sort of inflation that actually matters for macroeconomic stability. And I hope that NGDP growth continues its recent downward trend (to 4.7% in Q2).

But that’s not what I expect to happen. I expect that NGDP will accelerate in Q3, perhaps to 7% or 8%. That would be bad! And I expect 12-month nominal wage growth (average hourly earnings) to accelerate above the current 4.4% figure. I hope I’m wrong, but I fear that the Fed still hasn’t actually achieved a contractionary monetary policy stance.

The outcome surprised me. I was right about NGDP growth being too high in Q3 (albeit the slower NGDI data suggests it might be overstated), but wrong about nominal wage growth, which slowed to 4.0%. So I’m sort of neutral right now, waiting for further data to confirm where we are. Overall, the chances of a soft landing seem to be a bit better than I expected.

Tags:

10. December 2023 at 23:56

NGDI seems understated to a degree, but closer to reality than NGDP. The fact that inflation breakevens are falling below the Fed’s target in core PCE terms, while the S&P 500 is roughly on its pre-pandemic trend as commodity prices fall, suggest continued healing of the supply side.

I think many have underestimated and continue to underestimate the role of supply-side factors in the high inflation. I don’t deny the Fed overshot on stimulus, but that hasn’t been a problem for quite a while now.

The question I’m asking lately is how much more healing will occur? the employment level is still below the pre-pandemic trend, as is RGDP and RGDI. That makes me think that only a productivity boom could get us back to the previous trend of real growth, and by definition, that will not be sustained. That said, perhaps we will see a permanent productivity growth increase, which is plausible given a certain level of development of AI technology.

11. December 2023 at 02:05

OT but interesting.

China has moved into deflation.

Sumner is a Sinophile and a monetary policy wonk.

What gives with the PBoC? They have an inflation target of “about” 3%, which is a good target, I think.

The PBoC (or Beijing)is worried about too much debt. It may be macroeconomists need to consider how to stimulate growth without building up debt bombs.

11. December 2023 at 05:19

Two comments:

1) you note that nominal wage growth is down to +4%yoy, which I assume is referring to average hourly earnings. I believe that is a bad metric, because it is skewed by composition effects. E.g. if the labor market is adding more jobs in lower-wage sectors, AHE will decline due to the makeup of employment, not because wage growth is actually slowing. The Atlanta Fed’s wage tracker accounts for this, and shows wage inflation still running above +5%yoy.

2) you had a recent post (I forget if here or on the other blog) about the problem with the asymmetry in the Fed’s new average inflation target. But isn’t it possible that the “level target” benefits are working properly, when brining inflation down rather than up? I.e. if markets, like forecasters, anticipated a “hard landing” as NGDP slows, they likely also accounted for subsequent monetary easing to make up for any shortfalls in inflation. As predicted, this made the initial slowdown less severe; there is no hard landing. I view this is a huge win for the “level targeting” crowd. Now we just need to make the target symmetrical.

11. December 2023 at 07:15

I don’t understand why Nov 1996 to Nov 1999 doesn’t count as a soft landing, per this definition of soft landing: “Three years of cyclically low unemployment without triggering high inflation”?

PCE yoy: Nov 1996 2.44% , Nov 1999 1.92% and lower in the interim.

Unemployment rate: Nov 1996 5.4%, Nov 1999 4.1%, declining throughout.

Yes, these dates are cherry picked. But they are cherry picked to meet your definition. With a broader definition of soft landing, like “unemployment fell over an extended period without triggering inflation”, the entire period from mid-1992 to mid-1999 is a soft landing.

11. December 2023 at 09:08

I suspect that some of the issues around nominal wage growth stem from the lag of wage changes (just as with Dr. Sumner’s econlog post from January respective of housing costs, average versus new contracts https://www.econlib.org/good-news-on-inflation-2/ ).

11. December 2023 at 09:45

Michael, RGDP has risen slightly above trend over the past 4 years—(2% vs. the Fed’s estimate of a 1.8% trend.)

stoneybatter, You may be right on wages, I’d like to see a bit more evidence before making up my mind.

Yes, it “worked” in the sense of avoiding a prolonged recession, but it would have also worked if it were symmetrical.

Todd, To me, a soft landing occurs when the economy stabilizes for three years after unemployment is fully recovered. As long as it’s falling, we are still in the recovery stage. I’d like to see a fully recovered economy continue to grow, like the UK 2000-2007.

Brent, Yes, that’s always an issue with wage data.

11. December 2023 at 10:38

Scott,

RGDP is still below the pre-pandemic trend level.

11. December 2023 at 11:00

Michael, You probably have the wrong trend line—it’s a common mistake. Trend RGDP growth is below 2%

11. December 2023 at 16:51

Scott,

Yes, I recently made a mistake with a different trend line calculation, due to an error in my Python code, but I’ve checked my calculations in this case and they are correct.

Also, the Treasury Department concurs:

https://home.treasury.gov/news/featured-stories/the-us-economy-in-global-context

“But given its quicker return to trend growth, the United States is the closest, real output is only 1.4% lower than if pre-pandemic trends persisted.”

11. December 2023 at 16:55

Michael, They use 2015-19 as the pre-Covid trend. That’s nonsense, as that was a period of recovery. All the estimates I’ve seen are that trend RGDP growth is below 2%. The Fed says about 1.75% or 1.8%. We are above that trend line.

11. December 2023 at 19:57

Scott,

What baseline are you using for your trend line calculation?

Using the same 5-year basline to calculate the trend line for the employment level, there is also a negative gap.

https://exactmacro.substack.com/p/stock-and-gdp-outlook-for-week-ending-e6c

11. December 2023 at 20:58

Michael, I feel like I’ve answered this question 100 times. You must pick similar points in the business cycle. Try 2007 to 2019 for instance. But whatever you do, don’t pick 2015-19, which is completely worthless as a trend estimate. It’s an expansion. Please don’t cite misleading data.

11. December 2023 at 20:58

BTW, my car gets great mph when I’m coasting down a steep mountain road.

11. December 2023 at 21:44

Scott,

I’m not trying to frustrate you or mislead. I chose the 5-year baseline, because it’s not much different than choosing the 10-year baseline in this case, and because it represents a period of long, stable growth, under a new monetary policy regime.

My impression is that, including an entire economic cycle is one criteria for choosing a baseline, but is only one of many, and is not necessarily the most important one. Your reply seems to suggest that there’s no good argument to be made for not including the Great Recession.

But, even if I agree that the Great Recession should be included, why should we start the baseline at 2007?

11. December 2023 at 22:27

Also, when I compare the employment level versus trend using your preferred baseline, I get an above-trend result from roughly 2016 through 2019. That seems to suggest that this is not the appropriate baseline for the trend line calculation.

The RGDP and employment level data are more consistent versus trend using the 5 or 10-year pre-pandemic baselines.

12. December 2023 at 03:54

Even if price inflation is falling, wouldn’t you expect wage inflation to still remain elevated for a brief time?

Wages are sticky, so they adjust slower than other prices. If money is still neutral in the long run, wouldn’t you expect wage inflation to “catch up” with price inflation?

12. December 2023 at 04:57

You can learn a lot about a generation, especially the Avante Garde, by how they dress themselves and express themselves. Take this post for example:

“Simple-Just (arrogant, teenage exclamation)

“Please-Stop” (teenage exclamation, mostly feminine)

“Flat-Out” (bizarre term, overused by talking heads)

“Full-Stop” (Another odd term used by talking heads)

“Don’t even try” (teenage exclamation, exhibiting tougness)

“utterly incapable” (arrogant, desire to show one’s superiority)

12. December 2023 at 09:31

Michael, This is very simple. You cannot use an expansionary period with falling unemployment for trend, unless you think the expansion and the falling unemployment rate will continue for ever. So when will the unemployment rate become negative, in your view?

tpeach, Yes, but the question is whether it can be reduced without a recession. That’s unclear. Wages are not just rising because of a lag, they are rising because monetary policy remains expansionary. NGDP rose by more than 6% over the past year.

12. December 2023 at 12:30

SA quarterly rate-of-change in N-gDp

2020-10-01 7.1

2021-01-01 10.9

2021-04-01 12.8

2021-07-01 9.5

2021-10-01 14.6

2022-01-01 6.2

2022-04-01 8.5

2022-07-01 7.2

2022-10-01 6.5

2023-01-01 6.3

2023-04-01 3.8

2023-07-01 8.9

Too high for too long. That’s a trend. And the trend is due to the change in the composition of the money stock, more transaction accounts relative to gated deposits. The recent spike is due to the draining of the O/N RRP facility.

It’s incredulous that people think banks lend deposits. Where do the academics think the superstructure of money comes from?

It’s no double entendre. Economists universally posit that banks lend money.

No, every time a DFI makes a loan to, or buys securities from, the non-bank public, it creates new money – demand deposits, somewhere in the payment’s system. I.e., bank deposits are the result of lending and not the other way around. The DFIs could continue to lend even if the non-bank public ceased to save altogether.

12. December 2023 at 12:59

Link Dr. Richard Werner:

https://www.educatedinlaw.org/2017/03/banks-dont-take-deposits-banks-dont-lend-money/

Link Dr. Philip George:

http://www.philipji.com/riddle-of-money/

American Yale Professor Irving Fisher’s equation of exchange is a truism:

“In my opinion, the branch of economics which treats of these five regulators of purchasing power ought to be recognized and ultimately will be recognized as an EXACT SCIENCE, capable of precise formulation, demonstration, and statistical verification.”

The FED’s mandate should drop its mandates of moderate long-term interest rates, maximum employment, and stable prices and replace them all with a N-gDp target.

12. December 2023 at 15:36

1996 was a soft landing in the US.

12. December 2023 at 15:38

Doug, No, unemployment was still falling during 1996-98.

12. December 2023 at 17:29

Scott,

I take your point. Thank you for correcting me. I hadn’t thought deeply enough about it, though it is a simple point, as you say.

12. December 2023 at 17:54

The Fed raised interest rates by 3% in a 6-month period. They were able to slow the economy enough to keep inflation from ever raising its head. The Fed started cutting a year later. It was the most beautiful work the Fed has ever done.

It was such a soft landing, that it seems that you didn’t even feel it!

I am not sure how you can say “the labor market hadn’t recovered” when the unemployment rate was at a 20-year low. Yes, unemployment continued to drop another percentage point in the 3 years that followed. And at the time, everyone thought it was entirely unbelievable that unemployment could be as low as it was.

13. December 2023 at 06:30

The Producer Price Index for final demand was unchanged in November, seasonally adjusted, the

U.S. Bureau of Labor Statistics reported today. Final demand prices decreased 0.4 percent in

October and rose 0.4 percent in September. (See table A.) On an unadjusted basis, the index for

final demand increased 0.9 percent for the 12 months ended in November.

—30—

I think it is time to step on the gas.

13. December 2023 at 07:42

re: “I think it is time to step on the gas.”

Rent prices are inelastic.

“A bill introduced in the House and Senate would prevent hedge funds from owning single-family houses in the United States.”

But “mom and pop” housing is predominant.

13. December 2023 at 09:03

Doug, Of course each person can define terms as they wish, but my interest is in how central banks can (or cannot) sustain a recovery after unemployment has reached the cyclical low. The UK did that in 2000-07, we have never done it.

13. December 2023 at 13:33

“I fear that bringing inflation down will be more painful than many people now assume.”

Or, maybe the Fed has no intention of actively bringing inflation down any lower. Based on the immediate market reactions (Gold/Silver spiking upwards; US Dollar falling against major currencies) to the Fed’s decision today, I’m not sure the Fed can credibly claim to still be fighting inflation.

It sure looks like easy(er) monetary policy is on the way. I hope all those people that think lagging effects and fixing supply-side issues will take care of the inflation problem by themselves are right. If they are not, it’s going to be tough for the Fed to handle round 2 of the inflation fight.

13. December 2023 at 15:53

“Rent prices are in elastic”–SS

Probably a lot of truth in that and the silliness about who owns the property is the usual politicized response to a serious problem.

About the only practical solution I can think of is federal bounty payments to cities that unzone property in high density zip codes. In other words, give cities financial inducements to unzone property.

Perhaps the cities could use the money to bribe property owners to accept unzoning.

14. December 2023 at 21:07

The headline of your next article should be “2% inflation floor”. I’m excited to read your next posts. What the fed signaled this past week is that 2% inflation targeting over the next 5 years is completely gone. I thought the fed had been late and a little slow, but have been mostly supportive of their actions the last 6 months. They continued to stay hawkish and even raised a couple times when many wanted them to cut.

It seems like they completely capitulated. Even crazier that they had decent framework with FAIT.

15. December 2023 at 09:41

“It seems like they completely capitulated. Even crazier that they had decent framework with FAIT.”

I’m agnostic on the first point, but completely agree with the second.

15. December 2023 at 16:44

Hi Scott,

I’d love for you to do an in depth analysis of civic virtue, utilitarianism, and economics in the case of Israel vs the Arab states.

I see Israel 🇮🇱 as a higher trust, more liberal and utilitarian society, than say the Palestinians.

Yasser Arafat died a billionaire. The heads of Hamas are billionaires because they robbed Gaza of its humanitarian aid blind.

Mahmoud Abbas, the current head of Fatah, is a multi millionaire with a Swiss bank account.

Whatever else you could say about the founders of Israel, (they engaged in ethnic cleansing, they didn’t like Arabs) Ben Gurion didn’t have a Swiss bank account. He lived and died on the land.,

In a kibbutz.

Speaking of kibbutzes, Israel may be the ONLY society in the world where anarcho communism, or voluntary communism, WORKED.

Israel was built by the labor movement.

So, an in depth analysis of Israel?

Please 🙏??? 🙂🫡

Thanks.

PS.

One of the reasons why Israel doesn’t want to give Palestinians a state is because the PA is unspeakably corrupt, and Israel withdrew its settlements from Gaza in 2005, handed the keys to Abbas, and Hamas launched a coup and took over.

So it’s more than simple greed for land on the part of the settlers. Israel doesn’t want a failed state on its border.

15. December 2023 at 18:20

Edward:

I am aghast that the UN collaborated with Hamas before Oct. 7…but simply speechless that the UN continues to collaborate with Hamas after Oct. 7. What does it take for the UN to say, “This is a government with which we cannot collaborate.”

BTW, since this is an econ blog, Israel real per capita GDP has risen sharply in the last 20 years. In a region defined by failed states.

Israel also has universal conscription, with no social distinctions.

I wonder if nations such as the US will devolve, while nations such as Israel or China, which have pride in culture and a sense of national unity, will prevail—for reasons orthodox economists speak of very little.

BTW, I hold the CCP in very low regard. But the Han Chinese are very strong, and have huge numbers.

16. December 2023 at 06:00

We had the only safe landing after an interest rate inversion in 1966.

Back then, the banks were driven out of the savings business. The 1966 Interest Rate Adjustment Act forced time deposits from 105 percent of demand deposits in July, to 98 percent by the end of the year. This increased the supply of loan funds in the nonbanks, but not the supply of money. And the means-of-payment money was held constant for 20 months.

Likewise, today, Powell has held the means-of-payment money supply constant for 20 months, and retail money market fund inflows have increased the supply of loan funds, but not the supply of money (a velocity relationship).

https://fred.stlouisfed.org/series/WRMFNS

Conterminously, the ratio of gated deposits to transaction deposits has dropped by 16 percent, from .77 to .65, since May 2020 (which activates monetary savings).

The prospect of a safe landing is in sight.

16. December 2023 at 06:24

The FED’s technical staff doesn’t know a debit from a credit, a bank from a nonbank, money from liquid assets.

This is the source of the pervasive error that characterizes the Keynesian economics, the Gurley-Shaw thesis, the elimination of Reg Q ceilings, the DIDMCA of March 31st, 1980, the Garn-St. Germain Depository Institutions Act of 1982, the Financial Services Regulatory Relief Act of 2006, the Emergency Economic Stabilization Act of 2008, sec. 128. “acceleration of the effective date for payment of interest on reserves”, etc.

In almost every instance in which Keynes wrote the term “bank” in his General Theory, it is necessary to substitute the term non-bank in order to make Keynes’ statement correct.

16. December 2023 at 09:49

Edward, I did a post over at Econlog, but honestly the Arab-Israeli dispute bores me to tears. There is no other story that has been more over reported in the media.

In that post, I suggested reading Matt Yglesias’s various posts if you want my view on the mess–he basically takes a utilitarian approach.

16. December 2023 at 14:00

This is “means-of-payment” money:

03/1/2022 ,,,,, 4812.8

04/1/2022 ,,,,, 4881.2

05/1/2022 ,,,,, 4933.6

06/1/2022 ,,,,, 4943.4

07/1/2022 ,,,,, 4955.9

08/1/2022 ,,,,, 5172.2

09/1/2022 ,,,,, 5100

10/1/2022 ,,,,, 5074.7

11/1/2022 ,,,,, 5075.4

12/1/2022 ,,,,, 5123

01/1/2023 ,,,,, 5049.9

02/1/2023 ,,,,, 5034.6

03/1/2023 ,,,,, 5078.2

04/1/2023 ,,,,, 4986.6

05/1/2023 ,,,,, 4973.9

06/1/2023 ,,,,, 4965.9

07/1/2023 ,,,,, 4939.9

08/1/2023 ,,,,, 4897.4

09/1/2023 ,,,,, 4886.7

10/1/2023 ,,,,, 4927.1

Greenspan discontinued the longest running time series that the FED had in September 1996, the G.6 Debit and Deposit Turnover release:

https://fraser.stlouisfed.org/files/docs/releases/g6comm/g6_19961023.pdf

Note the difference between the turnover ratios for bank deposits on this release. Demand deposits turnover was at a radically faster rate than other deposits. Ergo, demand deposits are our means-of-payment money supply.

16. December 2023 at 14:08

Atlanta’s gDpnow’s latest estimate: 2.6 percent — December 14, 2023

Sticky Price Consumer Price Index less Food and Energy (CORESTICKM158SFRBATL)

Observation:

Nov 2023: 3.57037

I.e., N-gDp is still too high.

18. December 2023 at 17:05

“(BTW, of the last eleven recessions, ten began under Republican presidents and one began under a Democratic president.)”

More than a little misleading, I think. Take the 2001 recession. It started a few weeks after Geo. W. Bush was inaugurated, but it’s hardly possible that Bush could have instituted any policies that would have induced it.

18. December 2023 at 17:49

Patrick, You said:

“More than a little misleading, I think.”

Not at all misleading. I never even suggested any political causality for any of the recessions, and do you actually believe that I’m so stupid as to believe such a silly theory?

It’s the general public that believes this utter nonsense.

19. December 2023 at 03:13

Annual inflation in the Eurozone was confirmed at 2.4% in November, down from 2.9% in October, according to Eurostat’s final report published on Tuesday. Month on month, the Consumer Price Index (CPI) declined 0.6%. The core CPI was down to 3.6% compared to 4.2% in October.

—30—

Are central banks again fighting the last war?

7. February 2024 at 17:07

Good luck 🙂

29. February 2024 at 07:37

Good luck 🙂