G. William Powell?

G. William Miller was appointed Fed chair in March 1978, at a time when 12-month CPI inflation was running at 6.4%. He was “promoted” to Treasury Secretary (basically fired) in August 1979, at a time when inflation was 11.8%. He was such a incompetent Fed chair that the rest of the FOMC actually voted to raise rates in 1979 over his opposition.

Of course Powell is nowhere near that ineffective. At least not yet. TIPS spreads are still below 3%.

But the signs are worrisome. The Fed continues to set its target rate at zero and engage in QE even as PCE inflation is running at roughly 6% and NGDP growth is over 11% because . . . well no one seems to have any idea why they are doing this. Do you?

And that’s not even the Fed’s biggest mistake. The Fed’s biggest error is a failure to credibly communicate a commitment to its new average inflation targeting regime. Indeed, last month Powell seemed to repudiate the whole idea behind AIT, which is that a period of above target inflation should be followed by a period of below target inflation. In my view, we are teetering on the edge of a cliff, where the Fed will rapidly lose credibility if it does not make a dramatic shift in policy toward tighter money.

What should the Fed do? By far the most effective step would be a renewed commitment to insure that PCE inflation averages 2% over time. I suggest they make that commitment more specific by indicating an intention for PCE inflation to average 2% during the 2020s. Of course that sort of specificity should have been there from the beginning—if it had been then we probably wouldn’t be in this mess.

As to policy instrument settings, that completely depends on the economy. Because the Fed is so far behind the curve, they’ll have to raise rates by far more than if they had acted a few months sooner. My fear is that the Fed will try to do something “dramatic”, and they’ll actually do far too little. And then (just as in the 1970s) people will say, “See, monetary policy cannot control inflation”. At least until Volcker was appointed.

PS. In 2020, a big theme in this blog’s comment section was that AIT had failed because TIPS spreads were too low. In 2021, a big theme was that we didn’t need experts like Bernanke and Yellen because Powell was doing so much better. Beware of hasty judgments, including this post.

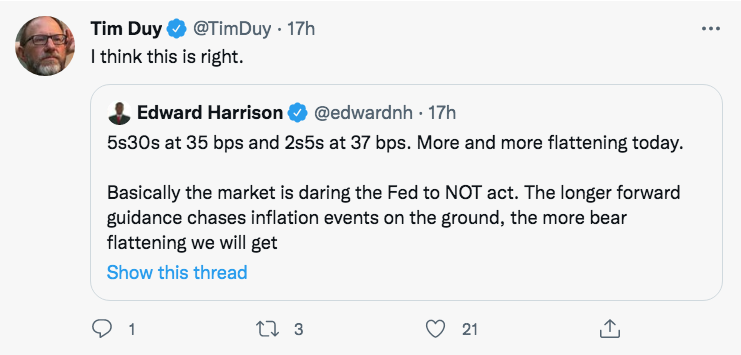

PPS. Tim Duy has been ahead of most people in spotting the Fed’s loss of credibility:

Yup, the biggest risk of recession now comes from a dovish policy. I’ve made this point before, but after the 2010s people seem to have forgotten the lessons of the 1970s.

Why does the Fed ALWAYS have to be behind the curve? Why can’t they let the market set the policy instruments at a level expected to produce success?

Tags:

11. February 2022 at 07:57

When you say TIPS, could you be more specific?

You put a lot of weight on indications of inflation for the next five years.

But what about the five years after that, as indicated by the 5-Year, 5-Year Forward Inflation Expectation Rate?

https://fred.stlouisfed.org/series/T5YIFR

That data certainly doesn’t look alarming. Why not focus more on that data rather than inflation for 2022-2026?

11. February 2022 at 08:00

Also, Prof. Sumner,

Could you please take the time to write a critique of this excellent recent post by Ryan Avent?

https://ryanavent.substack.com/p/the-big-picture-on-inflation

11. February 2022 at 08:09

There is no such thing as ‘general price rise.’ In reality people have apples and offer them for sale. People have oranges and offer them for sale.

Then something happens that makes people go off oranges and suddenly the price of apples shoots up.

But inflation is still declared – even though all that has happened is oranges have gone out of fashion and the apple producers haven’t caught up yet.

There is no general price rise – as the decomposition figures show. Categories are all over the place.

There is no such thing as a “neutral rate of interest”. It’s complete woo. Up there with homeopathy, crystal healing and alchemy.

Under their “expectations theory”, where everybody has the capacity to discount their future income flows to the present, if there was such a thing they would automatically know what it was.

It’s all self referential BS. Modern Ether Theory.

Mainstream isn’t doing science or academia. They are doing politics.

It’s way past time we drop the “Queensbury Rules” and did the same. These people are religious quacks and should be called out as such. There is nothing to be gained by fighting on their turf.

11. February 2022 at 08:12

The ‘general price level’ is just a collection of relative price changes. In other words ‘the general price level’ doesn’t really exist. It’s another of those aggregate figures that hides more than it reveals – as we can see when we drop down into the details.

There isn’t enough gas. The price is going up until the indifference level is met. Somebody has to have less gas than they want.

11. February 2022 at 08:31

Scott,

Any idea when the *2023* NGDP forecasts will be published on hypermind?

11. February 2022 at 08:57

Stating an intention to average 2% PCE for the decade seems right to me.

I will be curious to see what happens politically if/when the Fed starts to realize losses on sales from its balance sheet, or is paying out more in IOR than it’s earning on its holdings.

11. February 2022 at 09:13

Surprised at how hawkish you’ve become over 3% expected inflation. With the release of the December 2021 PCE, we see that the Fed has at long last achieved its target of 2% PCE growth, with the 7 year average PCE increase hitting 2.06%. Yay?

Why is AIT only such a good and urgent idea after the inflation?

11. February 2022 at 09:18

“Why does the Fed ALWAYS have to be behind the curve?”

Monetary policy responds to the economy with long and variable lags.

This may be a shortfall related to your comment at Econlib to consensus making policy. In general in the Federal gov’t there always seems to be a reality lag between circumstances and action.

Consider ARP being touted in October 2020 as needing to be $1.9T. Once that number became fixed in the mind, the fact that Congress passed a $900B support package in December 2020 didn’t seem to work its way up fast enough for someone to say maybe we should shave $900B off of our $1.9T plan.

11. February 2022 at 09:25

Were you asleep under a rock for most of 2020? You think Powell’s reputation is at risk of being like Miller after the Powell Fed orchestrated a rescue from the absolute collapse of every financial market at the onset of the pandemic?

Inflation above target is a major concern but my god, get some perspective!

11. February 2022 at 09:59

Travis, I’m much more concerned with the next five years because that’s what is most reflective of current policy. What did Keynes say about the sea being calm after the storm?

Kester, You said:

“The ‘general price level’ is just a collection of relative price changes.”

Thanks, I always wondered what caused the Zimbabwe hyperinflation.

Jim, I don’t know.

Brian, Most people (including me) assumed the Fed had no intention of looking back seven years. And indeed it would have made no sense to do so. In any case, whatever the Fed is trying to do they should stick with it. Obviously they are not committing to ANY sort of AIT.

R, Powell did an excellent job in 2020. That doesn’t make him immune from criticism today. And did you forget to read this part:

“Of course Powell is nowhere near that ineffective.”

11. February 2022 at 10:03

“Thanks, I always wondered what caused the Zimbabwe hyperinflation.”

They gave away land to those who couldn’t farm.

Detailed MMT analysis of Zimbabwe:

http://bilbo.economicoutlook.net/blog/?p=3773

“Whites who constituted 1 per cent of the population owned 70 per cent or more of the productive land. After the civil war of the 1970s and the recognition of independence in 1980s, Mugabe’s government more or less oversaw relatively improved growth with stable enough inflation outcomes.

In this World Bank Report 1995 you see the data shows that the economic performance was variable but reasonable. The economy underwent a severe drought in 1992-93 which pushed the inflation rate up but it soon came back to usual levels.

The following graph is of GDP growth since independence in 1980 to 2007 (data from IMF). The performance up until about 2000 provided no sign of the disaster that has followed. GDP growth looked to be like many other nations – variable and usually positive except for the harsh drought in 1992-93.”

“The problems came after 2000 when Mugabe introduced land reforms to speed up the process of equality. It is a vexed issue really – the reaction to the stark inequality was understandable but not very sensible in terms of maintaining an economy that could continue to grow and produce at reasonably high levels of output and employment.

The revolutionary fighters that gained Zimbabwe’s freedom from the colonial masters were allowed to just take over productive, white-owned commercial farms which had hitherto fed the population and was the largest employer. So the land reforms were in my view not well implemented but correctly motivated.

Like the allies after Versailles, you sometimes do not get what you wish for. The whites in Zimbabwe had always been reluctant to share with the majority blacks and ultimately reaped the nasty harvest they sowed.

From an economic perspective though the farm take over and collapse of food production was catastrophic.

Unemployment rose to 80 per cent or more and many of those employed scratch around for a part-time living.

So the land reforms represented the first big contraction in potential output. A rapid demand contraction was required but impossible to implement politically given that 45 per cent of the food output capacity was destroyed.”

11. February 2022 at 10:03

Powell is much worse than Miller. Powell’s another economist that thinks banks are intermediaries. Powell destroyed econometrics by turning savings accounts into transaction accounts.

If you dissect M2, you find that savings accounts to transaction accounts turn over 1 time to 99 times. OCDs turn over 5 to 95 times. I.e., all the monetary punch comes from DDs. The rate-of-change in DDs, the proxy for inflation, peaks in January – as my modeling predicted (published in February). I.e., M2 is meaningless. But money still matters.

If you want to stop inflation in its tracks, you raise reservable liabilities, not interest rates. But Powell eliminated reserve requirements.

11. February 2022 at 10:19

@Alex S. re: “Monetary policy responds to the economy with long and variable lags”

That’s another myth. If you use the wrong metrics, you get variability.

11. February 2022 at 10:37

Prof. Sumner,

What a surprise. I had no idea you’re a big believer in “long and variable lags”! That’s the root of our disagreement.

I believe there are not “long and variable lags.”

If the 5-Year, 5-Year Forward Inflation Expectation Rate soars out of control, the Fed has the nearly-instant ability to turn on a dime and bring it down with forward guidance.

I believe in the Fed. I believe it has that power.

Unlike you (apparently), I am not a believer in “long and variable lags.”

🙂

11. February 2022 at 10:41

Assuming that NGDP of 4% is optimal monetary policy, shouldn’t the Fed abandon AIT if it leads to below 4% NGDP growth? Explicitly saying that inflation will average 2% in the 2020’s seems like it will be inconsistent with 4% annualized NGDP growth throughout the decade. Why shouldn’t they just say that the pandemic is unique and that 2022 to 2032 will average 2% inflation? So long as they act quickly and decisively to bring inflation down now, they should be credible for the rest of the decade, and having already let inflation run high, I doubt many would bet against the Fed being able to reinflate the economy if inflation drops below 2%.

11. February 2022 at 12:22

“Why does the Fed ALWAYS have to be behind the curve?”

The Soviet Union asked the same question when they tried to centralize the production of beef. You will always be behind, because your philosophical conception of economics is wrong, and your instruments are reactionary. The so-called “policy” that you use to stablize actually creates a negative externality in the marketplace 10x worse than the previous externality. Your decades of permitting banks riskless investment at zero percent interest has not “saved the economy”. It has simply created another massive bubble that will be worse than the previous one.

It’s not a matter of IF anymore, it is only a matter of WHEN. Your generation destroyed the greatest nation for good the world has every known, and sadly only chaos will emerge.

The thugs that burn buildings will be in power in ten years and the glorious federalist papers and their theoretical conception will be replaced with some racist, CRT, marxist, totalitarian dystopia.

You watch!

11. February 2022 at 12:25

Prof. Sumner,

Ryan Avent just published a new post:

https://ryanavent.substack.com/p/a-tight-squeeze

11. February 2022 at 12:47

RUSSIAN BOOGEYMAN IS COMING!

run for your life BOOMTARD.

IMMINNENT. IMMINENT. RED ARMY IS IMMINENT.

THREE WEEKS AGO IMMINENT. STILL WAITING. IMMINENT.

IMMINENT. MEDIA SAYS IMMINENT. RUN OR DIE, ITS IMMINENT.

IMMINENT. boomber crazies say imminent.

stil waiting….

still…

omg….

bye…

11. February 2022 at 12:49

Scott, what asset prices are you looking at to make you conclude the Fed is wildly behind the curve?

11. February 2022 at 12:52

Kester, A supply shock eh? A billion percent inflation. Thanks for clearing that up.

Travis, Not sure what point you are making. If the economy performs exactly as the TIPS spreads predict, that would be bad. Do you disagree?

Lizard, If they want NGDP to average 4% for the 2020s, I’d be fine with that too. Just pick a target and stick with it. They are too expansionary for any plausible target.

11. February 2022 at 12:52

“Things could go crazy quickly,” Biden warned.

“crazy quickly”

“like crazy quickly”

“not quickly”

“not quick”

“like crazy quick”.

SOUNDS LIKE A GENIUS.

WHERE DO I SUBMIT A BALLOT.

WHAT A SMART GUY.

GOOD CHOICE.

WE SHOULD BELIEVE EVERYTHING HE SAYS. DON’T ASK HIM ANY HARD QUESTIONS.

11. February 2022 at 14:04

It’s bizarre that people can close an entire street in Seattle, kill a person (literally), write graffiti on the walls, call for Gatordade and food to be delivered at taxpayer expense, blast music 24/7, burn buildings, and the mainstream media calls it “peaceful”.

But truckers and farmers are called “white supremacists” for shutting down streets, honking horns, and waving flags in support of freedom outlined in the Canadian charter, which is their version of the bill of rights.

The puppets and their media narrative is out of control!

11. February 2022 at 14:11

ladies gentlemen we have a breaking story of….IMMINENT DANGER……

RED ARMY. BIG BAD BOOGEYMAN. BAD RUSSIAN BEAR. HELLO GUYS, I’M A BRAINWASHED 1960’S MORON.

RUN RUN RUN RUN RUN.

hey, sumtard does your bunker have toilet paper? Don’t forget the essentials. It would be a shame if your ass got a bit chappy after pooping diarrhea for the next 30 years of radioactive emissions by that big bad russian boogeyman

IT’S IMMINENT!

STILL WAITING FOR THIS IMMINENT ATTACK

zzzzzzzzzzzzzzz

11. February 2022 at 14:35

lol. There is a movie called “blast in the past”, I think it’s late 90’s. 98 or 99.

It’s a pretty good comedy about the boomers and their Russiaphobia.

Sadly, instead of seeing modern Russia as moderate, they still see the radicals of the 60’s. I mean, we still have boomers who think Russia is a communist country.

I think we need to clean house in Washington. Too many of the old guard remain. People like Pelosi and Schumer are not good for the country. And the new radicals like Cortez are the disgusting spawn of many of their bad and bigoted policies.

It would be good to see some young blood. And there is no doubt that the entrenched politicians today see Russia as a scapegoat for all their self created problems. When you have problems at home it’s so easy to blame some fictious oppressor.

It would also be nice to see the end of the federal reserve, although I doubt it will happen. Ron Paul and the Austrian School have always been correct about the Fed.

11. February 2022 at 14:52

I’m sorry but shouldn’t the yield curve steepen on too dovish Fed as 30’s sell off on fear fed isn’t fighting inflation and carry in the front end provided a reward.

The flattenning curve to me indicates concerns Fed will hike too much. 30’s don’t indicate much long term fear of lack of Fed credibility but in fact the reverse that the fed will keep inflation in check.

11. February 2022 at 14:57

@Spencer Bradley Hall: I think you misread me. I wrote:

“Monetary policy responds to the economy with long and variable lags.”

And NOT that the economy responds to monetary policy with long and variable lags. I have come to disagree with the latter sentiment long ago thanks to Scott’s research.

11. February 2022 at 16:20

Powell has betrayed monetarism. If Powell wanted inflation to subside he’d do something about it. Watch what he does. Powell still believes in long-term FAIT (an historically failed policy).

If Biden wanted oil to come down, he’d approve of the keystone pipeline. Biden is just going to line the Russian plutocrats pockets while picking ours.

11. February 2022 at 17:00

Sumner’s democrat party is now just as bigoted as the Jim Crow democrats.

https://twitter.com/robkhenderson/status/1492209700997406724?cxt=HHwWiIC95aS0srUpAAAA

Apparently, if you are Asian you are now “unlikeable”, and not worthy of admittance. Perfect grades are not enough. You have to believe what they tell you to believe, and be “widely recognized”, “kind”, and “likeable” (all subjective terms).

Kindness is not always a virtue. Has anyone on the left ever read the book “beware of pity”. I’m guessing not, since the left tends to pretend they are intellectual. Staring at the cover doesn’t make you smart.

11. February 2022 at 22:08

During this entire episode, 5 year inflation expectations haven’t even reached 3% in PCE terms, according to market forecasts, as you point out. You’ve also pointed out many, many times how the monetary policy should not be tightened in response to temporary supply shocks. This is not the 1970s and it isn’t going to be, unless MMT sorts take over the FOMC one day.

I think you care way too much about Fed adherence to an explicitly defined FAIT, as you conceive it. You agree that the Fed could just target NGDP at near 4% and that we’d be better off anyway. Few would be the wiser. That’s what we really should hope they’ll do, as opposed to the half-assed level targeting approach that FAIT represents.

All this fuss over less than a 1% average inflation difference over 10 years? Who cares? The Fed can stop the yield curve from continuing to flatten by simply ceasing to tighten policy.

For monetary policy to be much closer to optimal, a rule-based system run by software should be employed. Level target NGDP using the subsidized futures market. An FOMC that changes in its membership cannot credibly make the slighter adjustments to policy in outer years to avoid the need to slam on the breaks.

11. February 2022 at 22:22

Soeren, One indication is 5-year TIPS spreads. Another is the Fed’s own forecast, which is inconsistent with their announced policy goals.

Michael, You said:

“You agree that the Fed could just target NGDP at near 4% and that we’d be better off anyway. Few would be the wiser. That’s what we really should hope they’ll do, as opposed to the half-assed level targeting approach that FAIT represents.”

If 4% NGDP is their target, why do they seem to be aiming for much higher NGDP growth? Policy is currently way too expansionary for 4% NGDP.

“The Fed can stop the yield curve from continuing to flatten by simply ceasing to tighten policy.”

Yes, at the cost of much higher inflation. BTW, they have not tightened at all.

12. February 2022 at 02:28

Scott,

Yes, you would prefer an NGDPLT at around 4%. I prefer 5%. The vagueness of the FAIT is the beauty of it for me, as the Fed has long expressed skepticism about the PR aspects of trying to sell NGDPLT.

I was surprised when you initially claimed the Fed hadn’t tightened policy since January 3rd. I’m even more surprised to see you double down.

If you believe the stock market, NGDP growth expectations are down. According to the bond market, inflation expectations are down. The yield curve has been flattening. Interest rates are rising across the entire term structure(except for today, perhaps the beginning of a clearer indication the Fed has tightened too much). Add to that, the Fed Futures market has indicated that the expected date of the first rate hike has moved up, and the number of expected number of rate increases this year has increased. Oh, and then the Fed has definitely been issuing more hawkish forward guidance, which has driven this tightening cycle.

As I read it, the market is clearly saying policy is getting tighter. I believe the market. The fact that you even mention what’s going on with QE, to me, means you’re off track, from a market monetarist perspective. QE only matters in the total context of the Fed’s expected reaction function.

12. February 2022 at 03:25

Before reading the comments here, I wouldn’t have expected people to challenge the notion that 6% inflation is far higher than a 2% target, nor that 11% NGDP growth is far higher than a 4-5% target, nor that 5-yr TIPS breakeven inflation of 3% is far higher than a 2% target, nor that 5-yr expected inflation of 3% following a year of 6% inflation (22.9% over 6 yrs) is far above a 2% average inflation target (12.6% over 6 yrs). Before reading Conor Sen’s linked column, I wouldn’t have expected someone to claim that stable prices are destabilizing.

Last decade, when we had low inflation, some ultra-hawks liked to claim that inflation was mismeasured and that “true” inflation was much higher. Now, ultra-doves don’t bother questioning the inflation measures but claim that (a) neither 6 nor 3 are higher than 2, (b) 22.9 is not much higher than 12.6, (c) 11 is not higher than 4-5, and (d) stability is destabilizing. I’m not sure which is worse. The latter is not even denying facts (inflation and NGDP measures). It goes beyond that to denying meaning itself, e.g., a 2% inflation target means 6% followed by many years of intentional 3%.

12. February 2022 at 07:14

BC,

Most of the current inflation is due to supply shocks, not monetary policy. Even at its worst, the 5 year inflation breakeven never reached 3% in core PCE terms, and it has fallen considerably since January 3rd. You need to focus in core PCE, not core CPI, because core PCE is what the Fed uses within its targeting framework.

Scott is correct to say that monetary policy has been too loose if you take a 2% mean core PCE inflation limit over, say 10 years, as the Fed’s target objective. But the Fed has never

claimed to have that objective. They claim to have a “flexible” average inflation target at 2%, with the explicit additional full employment mandate.

I think it’s a mistake anyway to judge the success or failure, or indeed, tightness or looseness of monetary policy based on whether a central bank is adhering to a flawed targeting regime.

So, I think Scott is wrong in multiple ways.

12. February 2022 at 07:27

For others who may disagree with me here, Scott has, in part, become a person of the “concrete steppes”, as Nick Rowe has put it. It’s disappointing to see him mention the continuance of QE and the current level of the Fed Funds rate, when market expectations are what a market monetarist should focus on. And anyway, markets very strongly believe that QE is ending soon and that the Fed Funds rate is going to rise rapidly this year.

I think Scott is still more market monetarist than most economists. I’ll put him at roughly a 7 on a scale from 1-to-10, whereas I put myself well above 9, and closer to 10 than 9.

He certainly does not favor a neutral monetary policy, as he genuinely believes he does, but instead is somewhat mildly hawkish, and he’s had a hawkish stance since at least 2016.

12. February 2022 at 08:29

I feel like I’m always critizing this guy, but he really is a moron.

The reason you are ALWAYS behind the curve is because you have no friggen clue what you are doing.

You said one year ago, and I quote, “The inflation is transitory”. Now, after the game has been played and you realize that non economists were correct in predicting out of control inflation (not a hard prediction after printing more money), you and the other monday morning quarterbacks blame the Fed for making all the wrong mistakes. In other words, the problem is not that we printed a ton of friggen money. The problem is that YOU are not in power. If only you were chairman; if only you could plan the supply we’d all be better off.

The arrogance is truly incredible. This is the same arrogance we see with the Marxists at Universities. They think Stalin and Mao failed, but just let us try. We know better.

With the way he talks, you’d think he’s never been wrong.

Except, oh yeah, we have all of your poor predictions on this blog. All of which are in writing.

Instead of blaming everyone else. Why don’t you blame your profession for being a quack science. Seriously, no investor needs you. We just need you to get out of the way. And take your regulations with you.

Free us from your chains!

12. February 2022 at 09:11

re: “The reason you are ALWAYS behind the curve is because you have no friggen clue what you are doing.”

That’s exactly right:

Powell “And there is a measurement problem. “We think inflation will move up in the near term [because of] the base effect. Twelve-month measures of inflation are likely to move well above 2 percent over the next few months as the very low inflation readings recorded in March and April of last year drop out of the calculation. These base effects will contribute about one percentage point to headline inflation and about 7/10 of a percentage point to core inflation in April and May. They’ll disappear over the following months. And they’ll be transitory. They carry no implication for the rate of inflation in later periods.” – Powell’s April 28 Press Conference

And that was after the 3rd stimulus check was sent in March.

12. February 2022 at 10:19

The payment’s system should be nationalized. Selgins’ wrong. Selgin is one dimensionally confused.

https://www.cato.org/blog/defense-bank-deposits-open-letter-professor-omarova

Wells Fargo is one of the worst managed banks in the world.

https://www.businessinsider.com/banks-are-vying-for-deposits-and-the-fight-marks-a-shifting-industry-2018-4

We live in a predatory society. If you give a bank an edge, it will capitalize on its economies of scale.

No, banks don’t loan out deposits. Almost any transaction with nonbank customers alters the volume of money.

12. February 2022 at 12:26

5 year breakevens have dropped 35 bps from 3.17% to 2.82% in the last 90ish days. That’s tightening. Another 50 to 75 bps to go.

12. February 2022 at 13:52

Part of the problem is that the Fed is behind the curve due to fact that the Chairman had to wait until December to be re-appointed vs the end of the summer because he wasn’t the first choice. I think some of same bloggers and economists who were cheerleading the Fed all along need to have some self-reflection and admit we were wrong in the transitory nature as well as the base effects.

The question is will the market monetarists blame the Fed or the GOP politicians for the next recession.

12. February 2022 at 14:26

Finally! There is a person on the left with guts.

Maher stands up for the working class yesterday in his tirade against Nazi Trudeau.

https://www.newswars.com/maher-trudeaus-rhetoric-sounds-like-hitler-and-hes-talking-about-unacceptable-views/

Does Sumner have the courage to speak out? Nope, he is lady with balls.

12. February 2022 at 14:54

Michael, You said:

“For others who may disagree with me here, Scott has, in part, become a person of the “concrete steppes”, as Nick Rowe has put it. It’s disappointing to see him mention the continuance of QE and the current level of the Fed Funds rate, when market expectations are what a market monetarist should focus on.”

Where did I say QE or interest rates are an indicator of the stance of monetary policy? Please quote the specific sentence.

You remind me of those post-Keynesians in the late 1930s who insisted that Keynes didn’t understand his own model.

And again, monetary policy has not been getting tighter, the TIPS spreads have been pretty stable for a year, if anything trending slightly upward. But it’s even worse than the TIPS spreads suggest, as we’ve had a lot of actual inflation over the past year. That means the market prediction of the average inflation rate during the 2020s has been rising significantly.

You like FAIT because it doesn’t mean anything specific? Then we disagree.

Unlike many others, I’m not a perma-hawk or a perma-dove. I favor a stable monetary policy.

A. Smith, You said:

“Part of the problem is that the Fed is behind the curve due to fact that the Chairman had to wait until December to be re-appointed vs the end of the summer because he wasn’t the first choice.”

I made that point too. But I’m beginning to fear the problem is deeper. Powell simply doesn’t seem to have much commitment to AIT.

And I can’t speak for other market monetarists, but here’s what I said last July:

https://www.themoneyillusion.com/who-wants-a-recession-in-2024/

12. February 2022 at 14:58

Hey, Sumtard did you see the australian protest today?

Your little WEF thugs are losing the information war.

Didn’t think that would happen did you fucktard.

Game. Set. Match. pretty soon.

You are the FRINGE MINORITY, with UNACCEPTABLE VIEWS.

Punk Nazi boy.

12. February 2022 at 15:22

Chairman Jerome Powell: “there was a time when monetary policy aggregates were important determinants of inflation and that has not been the case for a long time”

12. February 2022 at 16:10

“As announced on December 17, 2020, the Board’s Statistical Release H.6, “Money Stock Measures,” will recognize savings deposits as a type of transaction account, starting with the publication today. This recognition reflects the Board’s action on April 24, 2020, to remove the regulatory distinction between transaction accounts and savings deposits by deleting the six-per-month transfer limit on savings deposits in Regulation D”

See: New Measures Used to Gauge Money supply WSJ 6/28/83.

See: Fed Points

https://www.newyorkfed.org/aboutthefed/fedpoint/fed49.html

“Following the introduction of NOW accounts nationally in 1981, however, the relationship between M1 growth and measures of economic activity, such as Gross Domestic Product, broke down.”

WSJ 6/28/1983: “The experimental measures are designed to resolve some of the confusion by isolating money intended for spending, from the money held as savings. The distinction is important because only money that is spent-so-called “true money” – influences prices and inflation”

Powell’s propagandizing has rendered the use of money as a monetary metric problematic.

12. February 2022 at 16:40

Scott,

You replied:

“Where did I say QE or interest rates are an indicator of the stance of monetary policy? Please quote the specific sentence.”

Here is relevant the quote from your post above:

“Of course Powell is nowhere near that ineffective. At least not yet.

TIPS spreads are still below 3%.

But the signs are worrisome. The Fed continues to set its target rate at zero and engage in QE even as PCE inflation is running at roughly 6% and NGDP growth is over 11% because . . . well no one seems to have any idea why they are doing this. Do you?”

You state that TIPS spreads are still below 3%, but then go on to say you’re worried about the concrete steppes.

The current inflation rate doesn’t matter for monetary policy, as we’re still in the midst of the largest general supply shock since at least WWII, and inflation expectations aren’t very high.

You also replied:

“And again, monetary policy has not been getting tighter, the TIPS spreads have been pretty stable for a year, if anything trending slightly upward. But it’s even worse than the TIPS spreads suggest, as we’ve had a lot of actual inflation over the past year. That means the market prediction of the average inflation rate during the 2020s has been rising significantly.”

The inflation breakevens have all been falling since January 3rd, when Fed forward guidance began to become more hawkish, as nominal and real yields have been rising. Same for the simple TIPS spread, like the 5 year, for example:

https://fred.stlouisfed.org/graph/?g=M2RZ

Which TIPS spreads are you referring to?

You also replied:

“You like FAIT because it doesn’t mean anything specific? Then we disagree.

Unlike many others, I’m not a perma-hawk or a perma-dove. I favor a stable monetary policy.”

I do prefer a more vague policy that allows for something closer to NGDPLT, yes. And yes, a vague policy does cause confusion early on, as markets adapt, but markets do adapt and will end up predicting the Fed’s behavior better than the Fed itself. I would prefer a clear policy rule too, but not a necessarily a clearer, inferior policy rule.

And I agree that you’re not a perma-hawk. As I stated, I think you’ve been hawkish since 2016. I know you don’t agree.

12. February 2022 at 17:00

My take is that Powell is actually dishonest.

13. February 2022 at 01:39

The tsunami of sweeping hasty policy changes implemented without evocation as an excuse for the Covid-19 pandemic would necessarily be reversed if Powell was honest. The payment’s system excuse for further deregulation was dishonest, i.e., completely unnecessary.

If the commercial bankers are given the sovereign right to create legal tender, then the DFIs must be severely circumscribed in the management of both their assets and their liabilities – or made quasi-gov’t institutions.

13. February 2022 at 04:13

In a supply-shock driven inflationary rise, you’d expect to see RGDP growth fall as a share of NGDP growth. This happened after the 1973, 1979, 1990, and 2008 oil shocks. In contrast, during periods of great supply-side strength, the share rose, as in 1961-1965 and 1996-2000. Of course, you have to pay attention to the trend: the share was low in general during the 1970s due to rapid NGDP growth.

By that measure, I see no evidence that supply-side issues are a large factor in the US’s current inflation:

https://fred.stlouisfed.org/graph/?g=M398

The average RGDP growth for the US in 2020 and 2021 was about 1%. Even if you think that the trend is 2% and it was 1% lower due to supply-side problems, the US would still be facing above-target inflation right now, extremely low ex-post real interest rates, NGDP growth far above a non-inflationary level, and inflation expectations gradually becoming unanchored.

Also, given the Fed’s huge interventions into the bond market and the international demand for liquid dollar-denominated assets in a crisis, how seriously can we take the TIPS spread as a measure of inflation right now? Survey data paints a different picture:

https://fred.stlouisfed.org/graph/?g=M39y

13. February 2022 at 09:24

William Peden,

Yes, there’s no evidence at all for shortages in the economy right now. No labor shortages, no empty store shelves, no auto production shutdowns due to parts shortages, no delays in deliveries of furniture or home appliances…

And when considering current RGDP growth versue NGDP growth, we should never consider how deep a hole we fell into in 2020 and the current remaining supply and demand imbalances…

And yes, TIPS markets do get badly distorted during extreme shocks, as we saw in the Great Financial Crisis and early in the pandemic as markets were crashing, but they tend to stabilize quickly once the Fed provides sufficient liquidity to the market, which is otherwise constrained in crises due to market design flaws.

The reaction of the stock market is 100% consistent with that of the bond market, by the way. The S&P 500 discount rate versus price tells the story.

And that Michigan survey only looks one year down the road, so it’s completely irrelevant.

13. February 2022 at 09:43

Michael,

“but then go on to say you’re worried about the concrete steppes.”

In other words, you admit that you cannot find any place where I say interest rates or QE measure the stance of monetary policy, just that I don’t like where they are currently set. And TIPS are just one indicator, not the only one.

13. February 2022 at 10:25

Scott,

You replied:

“In other words, you admit that you cannot find any place where I say interest rates or QE measure the stance of monetary policy, just that I don’t like where they are currently set. And TIPS are just one indicator, not the only one.”

How am I supposed to interpret that quote from you? You made an explicit statement about one measure of inflation expectations that never rose above 3%, and is lower now, and then you express concern about current QE and the current discount rate.

I can’t claim to know what you intended to convey, but I don’t think my interpretation is unreasonable at all.

So, what other indicators of inflation expectations are you looking at? The Treasury and stock markets don’t share your concerns, so what am I missing?

13. February 2022 at 10:26

Fed Funds rate, not discount rate, above.

13. February 2022 at 11:57

Michael,

I don’t deny that there are supply-side issues in the US. I deny that these are a large factor in the current inflation.

I took into account the 2020 hole, by averaging 2020 and 2021 RGDP growth: 1%. Suppose that the US’s capacity for non-inflationary growth is 2% per year. Then, about 1% of the US’s inflation over 2% can be explained by supply-side factors. That’s 1% out of about 5.5%. Not a large factor.

The Michigan survey indicates that inflation expectations are *starting* to be unanchored. Of course, the Fed can wait until inflation expectations *become* unanchored, but that is setting the US economy up for a potentially nasty recession in the future, as in the early 1980s.

13. February 2022 at 14:45

Asset price dominance. I know you don’t like that answer, but it’s true.

13. February 2022 at 14:50

– When I look at the 3 month T-bill rate then I think the FED is going toraise rates this month.

14. February 2022 at 06:13

Powell has transitioned the U.S. banking system into a new regime, he has now joined Canada, the United Kingdom, Australia, New Zealand, Hong Kong and Sweden as a Central bank conducting monetary policy with just interest rates and not legal reserves. But interest is the price of credit, the price of money is the reciprocal of the price level.

The money stock can never be managed by any attempt to control the cost of credit. The creation and destruction of money is not self-regulatory, it is self-reinforcing, The only tool, credit control device, at the disposal of the monetary authority in a free capitalistic system through which the volume of money can be properly controlled is legal reserves.

14. February 2022 at 07:40

Michael, I don’t think you understand what average inflation targeting means. It means inflation should average 2%. Until you understand that you’ll be hopelessly confused about my views on policy. Less than 3% is still too high.

Again, I never said interest rates show the stance of monetary policy. I never even hinted that was true.

14. February 2022 at 09:04

Scott,

You replied:

“Michael, I don’t think you understand what average inflation targeting means.”

Okay, so now you want to be insulting. Of course I understand what average inflation targeting means. The Fed didn’t commit to targeting 2% mean inflation over 10 years. That’s something you keep bringing up, but the Fed never mentioned it.

You’re ignoring the “flexible” part of FAIT, and the fact that the Fed didn’t specify a time frame over which inflation should average 2%, in addition to the fact that the Fed publicly acknowledges it also has a full employment mandate, in addition to price stability. Stop obsessing over a 2% average inflation target over 10 years.

I get that you don’t like the vagueness of the commitment, but it is what it is. You’re simultaneously judging the Fed on a commitment it hasn’t made, while often failing to judge it against what you consider the optimal criteria, which would involve NGDPLT.

If the “concrete steppes” don’t matter, why bring them up at all when discussing the stance of monetary policy, particarly when markets clearly expect QE to end soon and for the Fed Funds rate to rise several times this year? You’ve stated more than once on this blog that monetary policy is 99% about expectations, and given that you’re a market monetarist, market expectations should be the focus, right?

There seems to be an implicit assumption in what you write that, because you do clearly acknowledge at times that “concrete steppes” are a distraction, that you must necessarily always be consistent in your views, or at least that such should be assumed. But, of course, the human brain doesn’t work that way. Generalization failures are a real thing. I do think you fail to generalize across contexts when your hawkishness comes out. You’re not immune to cognitive lapses and biases, just because you’re very meta-aware and work hard to try to avoid succumbing to them.

Or, it may just be that you’re not communicating as clearly as you think.

The fact is, you typically do a much better job of avoid such mistakes than I do, but in this case, I think you’re way off.

And you still haven’t revealed any data to support your claim that monetary policy hasn’t tightened since January 3rd. Sure, there are some other factors bringing down real growth expectations right now, such as those related to Omicron and the situation in Ukraine. But, since January 3rd, I think there’s signicant evidence that monetary policy has tightened, given it was the beginning of more hawkish guidance by the Fed, rising interest rates, falling stock prices, a falling yield curve, etc.

14. February 2022 at 09:54

Here ya go:

https://fred.stlouisfed.org/graph/fredgraph.png?g=M5eI

The 30 year breakeven is now a bit below 2% in core PCE terms. Do you feel better now?

Now, I can go around claiming that the Fed is successfully targeting 2% mean inflation over somewhere just beyond 30 years.

See how ridiculous it is to try to judge the Fed by its expilicit commitment? It’s too vague, even without the “flexible” part, and the full employment mandate.

Judge it compared to what you consider optimal, or near optimal policy, which is NGDPLT. Everything else is a distraction and leads to nonsense.

16. February 2022 at 08:30

Michael, You said:

“The 30 year breakeven is now a bit below 2% in core PCE terms. Do you feel better now?”

When you keep repeating these misleading points, I wonder if you are even reading my responses. What has PCE inflation been over the past year?

Under inflation targeting that doesn’t matter, under AIT past inflation is supposed to matter. But now Powell tells us it doesn’t? How is it AIT if past inflation doesn’t matter? How is it AIT if the Fed says it will NEVER, ever aim for below 2% inflation?

16. February 2022 at 12:14

Scott,

3 points:

1. The Fed doesn’t have an AIT commitment. It has FAIT + full employment.

2. The Fed doesn’t have an AIT commitment. It has FAIT + full employment.

3. Before thinking about AIT, consider points 1 and 2.

17. February 2022 at 14:24

Michael, I’ve already responded to that point.

17. February 2022 at 19:35

I’ll end by saying that I think monetary policy should definitely move in the direction you think is optimal, but I think your commentary judging the stance of monetary policy using criteria other than stable NGDP growth is problematic. To me anyway, your messaging is not always clear, and I don’t buy the theory behind it, either economically, or in terms of effectiveness of communication.

I wish you’d focus on judging policy against an NGDPLT. If you want 4%, fine, as it doesn’t matter much in the long run. That is highly defensible theoretically, and a simpler message.

It seems to me that fine economists, of which you are one, often make their greatest mistakes when pushing what they know to be suboptimal policies, based on their reading of the political or general PR tea leaves. Many examples from Keynes come to mind, including his push for protectionism during the Great Depression.

I just don’t think analysis from an AIT framework makes much sense, particularly when it’s actually FAIT with a full employment mandate, with no specified time frame for average inflation.

And ultimately, why would an NGDPLT guy want to entertain the notion that inflation should be lower over some arbitrary time period because it’s above an arbitrary average today? It should be about price and RGDP flexibility, in the context of stable NGDP growth. AIT is better than IT, in that it allows for some catch up after a downturn, but still has the same drawbacks, albeit, in milder terms.