FT bond market bleg

Since my previous post was a bit of a fiasco (I seem to have mixed up Canada and the UK on the mortgage interest deduction), let me set this up as a question, so I don’t have two stupid posts in a row. Here’s today FT:

Republicans’ proposal to slash corporate tax rate to 20 per cent helped spur a rally in Treasuries last week. The expectation was that lower corporate taxes would jolt economic growth and prompt policymakers to step up the pace of their monetary tightening.

But the Senate’s proposal to delay a headline corporate tax cut until 2019 appeared to be driving a reversal in the rally on Friday.

I’m doubly confused. First of all, when something like economic growth (or inflation) causes interest rates to change, it’s not because it causes policymakers to adjust monetary policy. Economic growth, inflation, and other macro variables have a direct impact on interest rates. They would cause a change in interest rates even if the Fed did not exist, and indeed did cause changes in interest rates before the Fed was created (in 1913.)

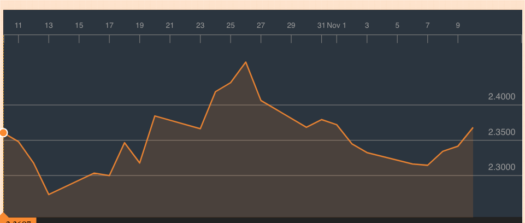

But that’s not my main source of confusion. Reading this piece I couldn’t tell whether the FT was talking about bond prices or bond yields. I had to check the bond yield graph to figure out that it had to be bond prices, as yields fell last week and rose today:

So bond prices rose last week and fell today, as yields and prices move in the opposite direction. Just as they said. But then I don’t get the FT claim that Treasuries (prices) rallied last week on expectations of faster economic growth. Am I having my second brain freeze in a row? Am I just as mixed up as my undergraduate students occasionally were at Bentley?

So bond prices rose last week and fell today, as yields and prices move in the opposite direction. Just as they said. But then I don’t get the FT claim that Treasuries (prices) rallied last week on expectations of faster economic growth. Am I having my second brain freeze in a row? Am I just as mixed up as my undergraduate students occasionally were at Bentley?

PS. Check out this trailer, especially the final line. Where can I see this film? I’m getting bored with Woody Allen films, and would like to see one produced by someone else.

Tags:

10. November 2017 at 10:40

Scott, I think the FT means lower rates. They are arguing that tighter policy means higher ST rates but flattening — so lower ten-year rates. This is admittedly the opposite of assumptions usually made in the media, which tend to be a kind of partial equilibrium idea that the fed moves all rates around in the same direction as FFR. Yes if they are merely projecting monetary offset then rates should not necessarily decline under their theory, but the explanations are always too provincial.

Obviously the right answer combines a full equilibrium inclusive of monetary offset/passivity with whatever quirks in the market make term premia dance their jig along the edges of the nominal expectations equilibrium. If you have them he benefit of the doubt you could argue they thought corporate tax relief would not be an effective stimulus yet would wrongly induce tightening, which would then lower rates.

10. November 2017 at 10:46

dlr, If true, that’s perhaps the worst article I’ve read in years. Faster economic growth does not lead to lower interest rates. If (as you suggest) they mean that the government might wrongly assume there is faster growth, respond with tight money, and this will reduce long term rates via the Fisher effect, then THEY DAMN WELL BETTER SAY SO. Not one person in a million would draw that conclusion from reading the article.

10. November 2017 at 12:02

For November (through the 9th), the yields on short-term Treasuries (1 month to 2 years) increased, but yields at the longer-end (7-30yr) declined. So it’s really a big yield curve flattening. But while the yield curve flattened, it’s not a bear flattening, strictly speaking, because the longer-term yields declined instead of rose. At the short-end, we have the upcoming Dec. rate hike that sent yields higher. It’s less clear why the long-end is so weak. There were some Treasury auctions last week that seem to have garnered decent enough interest. While I would like to use some kind of explanation like the stock market decline earlier in the week, it’s not sufficient because the bulk of the decline in yields came before earlier in the month. During this period, payroll data was better-than-expected and equity markets were rallying so you would expect higher yields. The Republican tax plan was really the main event in the U.S. that could be the driver. So they are probably right to focus on that.

Their argument is that the tax plan is probably a positive for aggregate demand. However, the Fed will likely offset the impact by raising rates. This explains the short-term yields increasing (by more than you would expect from just the upcoming Dec. hike), but it doesn’t explain the long-term ones declining.

So this requires a little more searching. I downloaded the 5, 7, 10, 30 yield TIPS yields and got the implied inflation from that. These are basically unchanged in November. So the market has essentially left its inflation forecasts unchanged. What we really see is a decline in the real interest rates, particularly 10 and 30 year real rates.

I’m not sure I have a good explanation for it, but falling long-term real rates is what someone would need to explain.

10. November 2017 at 13:01

“Bond market rally” means higher prices and lower yields. Although, I have seen the press gets this backwards.

However, the rationalization that lower tax rates > Stronger growth > Tigher money > Lower 10 year rates is a strained piece of logic.

10. November 2017 at 13:57

John, There’s still the puzzle of why higher economic growth would lead to lower long term real interest rates.

But I’m really interesting in knowing whether the FT piece is a typo, or if they have some argument I missed.

10. November 2017 at 13:58

Doug, I agree. No article should imply that without clearly explaining the logic. Readers aren’t going to assume that’s what he meant.

10. November 2017 at 14:51

“China” – that’s really smart.

C.K. is a genius but unfortunately this movie might not get a release ever because a) C.K. took his Louis out way too often at inappropriate times and because b) the world seems to become more prudish and hypocritical every day.

10. November 2017 at 19:27

I got bored with Woody Allen movies 30 minutes into the first one I ever saw. Maybe because I got over my Freud phase and realized he was mostly nonsense when I was 16, and the “wow look how neurotic I am” trope just couldn’t do anything for me.

I myself am looking forward to the Disaster Artist. James Franco seems to been forgiven for his escapades, so maybe Louis C.K. will recover eventually.

10. November 2017 at 19:30

I think FT got it backwards, and posited that higher rates was a bond rally. It is the opposite of a bond rally.

This happens on deadline sometimes. “The Japanese yen rallied, and traded up from 114 to 113 to the US dollar”—it just sounds backwards, even though that is a correct sentence. “Bonds rallied, and now offer less yield.” Tricky.

Yes, the financial media should be better. But try writing on a hourly, or even less, deadline sometime.

Why didn’t the New England Patriots score that touchdown when they had a chance? On TV, I could see they had a receiver wide open.

10. November 2017 at 23:41

Scott, you are not confused. The writer for the FT is confused.

11. November 2017 at 04:42

@Benjamin Cole That’s why when I always talk about currencies, I always say appreciated or depreciated, i.e. “The Japanese yen appreciated against the dollar with USDJPY falling from 114 to 113.” I also prefer to refer to it like a Bloomberg ticker, rather than as USD/JPY because I think that confuses some people too (b/c it should be read 1 USD = 113 JPY, instead of 113 USD to 1 JPY, as in unit conversions from physics or something).

11. November 2017 at 04:59

John Hall–

Valiant efforts on your behalf.

It is a sticky bit of work no matter how you tackle it.

11. November 2017 at 13:19

When I think I’m confused or busy, I clean up my desk first

11. November 2017 at 15:53

I think that FT got it doubly wrong.

1- Their “… spur a rally in Treasuries last week.” really meant “sent Treasury yields higher”, and

2- A recurring and persistent issue in financial media is their attribution of an expected Fed monetary response as being causal rather than reactionary. Or, maybe its just thier poor articulation.

Since you brought up film in the P.S:

1- Whomever made “I Love You, Daddy” now has an ego-saving excuse for losing money on it.

2- Off-topic: If your enjoyment of a film is proportional to how many artsy, stylish photos might be extracted from each frame, then you might like this four-minute country music “film”:

Midland Drinkin’ Problem

https://www.youtube.com/watch?v=g7f6HiQ2LuU

11. November 2017 at 18:00

dtoh, Glad to know I’m not going crazy.