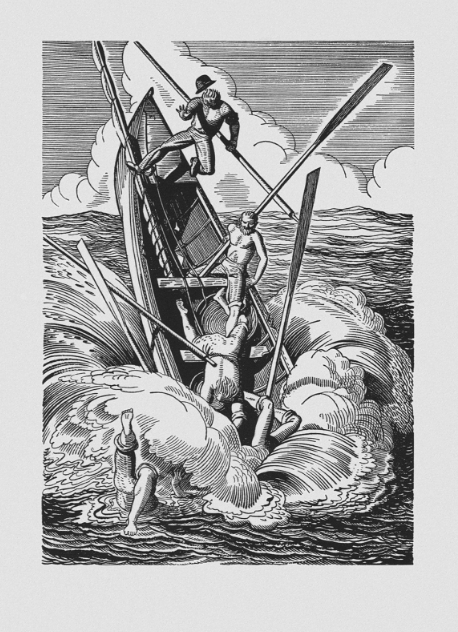

Central bankers and the Great White Whale

Here’s the Financial Times:

Global economy: Why central bankers blinked

It’s been 18 years since I read Moby Dick, but I vaguely recall that Captain Ahab made the mistake of anthropomorphizing the white whale. Ahab had a sort of steely-eyed gaze—and didn’t blink when seeking revenge.

Central bankers need to work hard to avoid anthropomorphizing the market. Better to view market forecasts as a sort of natural force, like wind and waves. If market forecasts change (as they did late last year), then by all means “blink”.

It’s nothing personal.

Tags:

9. February 2019 at 21:02

Indeed.

But no government agency wants to suddenly reverse course. It is unseemly.

Pull out suddenly from Afghanistan and admit it was a bad idea?

Indeed, the Fed does not want to even aggressively move to a desired goal—see 2008-2018. If you want insulation, ossification, self-reverence, and no accountability then create an independent government agency.

In some ways, the above reality suggests an “automatic Fed” might be better.

Seems to me there should be automatic widening holidays on Social Security taxes as economic output slows, offset by money-financed contributions to the Social Security Trust Fund.

Or, you could wait for the Fed to see something is wrong, and then timidly and sanctimoniously start up the Rube Goldberg-monetary policy machine to address the situation.

Except Rube Goldberg contraptions usually made sense. That is, the ball would roll down the tube, the see-saw lever would raise, and the spring would spring, etc.

In contrast, the Fed operates a Rube Goldberg machine with levers made of sponge, deadened springs, and rolling-ball tubes that undulate enough to create deadspots.

Egads, would an sane person design a monetary system like we have from scratch?

9. February 2019 at 23:22

Ben, Changing interest rate targets is not “reversing course”. It’s steering. It would be like saying “no bus driver likes to turn the steering wheel.” Really?

10. February 2019 at 05:53

Scott Sumner: what would Ralph Kramden say?

Anyways, I like the idea of widening Social Security tax holidays, any time unemployment gets above 3.5%.

Offset the revenue loss with money-financed fiscal contributions to the Social Security system.

Goodbye, Rube Goldberg-Fed contraption, about which the most brilliant scholars debate the fine points but never in agreement, and often diametrical opposition.

10. February 2019 at 07:52

http://ngdp-advisers.com/2019/02/08/trade-deficits-monetary-policy-and-blowing-asset-bubbles/

Very thought-provoking.

10. February 2019 at 08:39

http://web.mit.edu/krugman/www/deflator.html

In short, if you really believe that deflation is now a global threat, you should also believe that only policies that lie outside the realm of what is conventionally regarded as responsible will contain that threat. And because unconventional thinking is not what one expects (or, in normal times, wants) from finance ministers and central bankers, there is now a real risk that deflation will indeed become a global scourge.

Any one read this, I know its Krugman, but its a short read….

10. February 2019 at 10:04

Mike, Yes, his earlier stuff on deflation was very good.

10. February 2019 at 20:13

Mike–

Perhaps global deflation is a risk, but I think more we see very slow-growth, lowflation. Hopefully the People’s Bank of China and the Bank of Japan can act act engines of global growth.

For now, thankfully, unemployment is finally receding in the US, and there might even be some minor wage gains.

But in the next recession we go right back to borderline deflation, declining real wages and limited job opportunities and a feeble Fed.

Whatever you think about monetary policy, if you fight inflation long and hard enough, you can put Bernie Sanders in the White House. Maybe his First Lady will be OAC.

11. February 2019 at 06:57

The overall point is well-taken, but I am not sure that Ahab’s mistake was anthropomorphizing Moby Dick; I found Moby’s actions to be malicious, tactical, and vengeful in the climactic chapters. I would say that Ahab failed to comprehend the extent of Moby Dick’s power and did not heed the warnings of Starbuck.

11. February 2019 at 07:53

I like derek’s take on Ahab. Given the description in the novel of the practice of whaling, I think you could say this more generally about the entire business. Whatever the whale equivalent for anthropomorphize is – any whale who starts doing this with the whaling crew should be strictly avoided. Even if the whole ship is not in danger, the individual whaling boats certainly have no chance whatsoever.

11. February 2019 at 09:39

Inflation is falling again in the US, Treasury yields flatline out to 7 years, and the 30-year Treasury is back under 3% today.

Surely, the bus driver tentatively turns the wheel to “no more FFR increases, continue shrinking long-end of Fed portfolio, start chipping away at IOER.”

11. February 2019 at 10:24

Derek, You may be right. It’s been a long time since I read the novel.

Brian, I agree we don’t need more rate increases right now.

11. February 2019 at 13:47

I think Powell has all but said that they won’t raise rates again unless they have room to do so without inverting the curve. So right now the FFR is 2.25-2.5%, and the 10 year Treasury is at 2.66%.

If the 10 year got up to 2.9-3.0% then there would be room for another 0.25% hike, and probably reason to as well. If it doesn’t get there, the Fed stays put.