The very real problem of wage inequality

A commenter pointed me to Krugman’s recent post on inequality, expecting me to respond that income inequality is meaningless. Well income inequality is meaningless, but Krugman’s post was on wage inequality, which is a real and growing problem. It’s not one of the top ten problems facing the country, but probably makes the top 20. (I’ll do a post on what I think are the big issues, in a few days.)

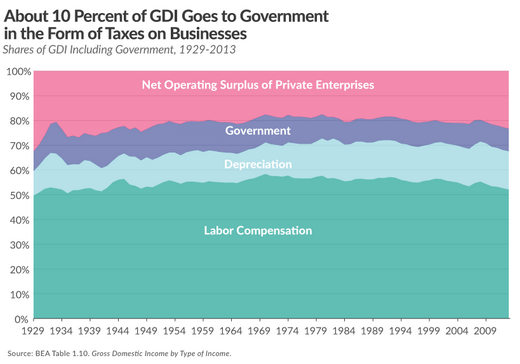

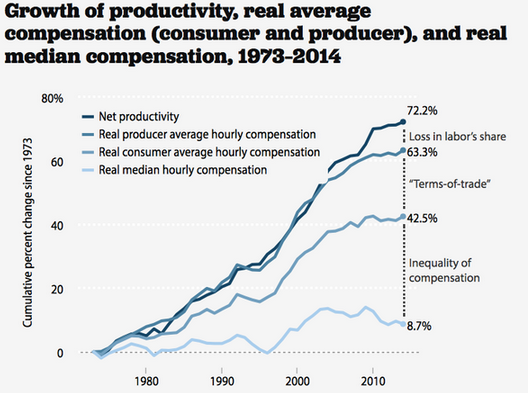

Krugman presents this graph:

I have read some of the excellent work by Matt Rognlie and Kevin Erdmann, which looks at these issues in more detail. They found that some of the fall in wage share was going to implicit rents on owner-occupied homes.

I have read some of the excellent work by Matt Rognlie and Kevin Erdmann, which looks at these issues in more detail. They found that some of the fall in wage share was going to implicit rents on owner-occupied homes.

I decided to take a fresh look at the data for my own benefit, and compared current (GDI) income (2015:2) with income from 50 years ago (1965:2). The earlier period was the Golden Age of American labor.

And here’s what I found:

Type of (Gross) income Share in 1965 Share in 2015

Wages and benefits 54.6% 53.0%

Indirect taxes – subsidies 7.8% 6.6%

Net Operating Surplus 25.7% 24.9%

Depreciation 11.9% 15.6%

It seems silly to focus on gross domestic income, which includes depreciation and indirect taxes. If we subtract them out we get the more conventional measure of national income, the way most people envision the concept. And using that measure the labor’s share has been amazingly stable, rising from 68.0% in 1965 to 68.1% in 2015. Capital’s share fell from 32.0% to 31.9%. No change in 50 years! Is that too good to be true? Yes, for instance in 1990 labor’s share was 72.4%, so it’s just a coincidence. But it does suggest that labor’s share in the very long run is pretty stable.

So why the perception that workers are not doing well? Krugman points out (correctly in my view) that it’s an inequality story. Blue collar workers at GM and Ford are not doing as well as in 1965 (especially younger workers). Workers like Goldman Sachs executives, Tom Cruise and LeBron James are doing much better than in 1965. So the problem is not that “workers” are getting screwed by companies, but that worker income is itself becoming more unequal. That seems like a problem to me, but then I’m a utilitarian who doesn’t think Tom Cruise deserves a high wage income just because he was lucky enough to be born with a lot of charisma and ambition.

Let’s revisit the Jeb Bush tax plan. The structure of the plan is great; it does lots of wonderful things. It’s not my dream consumption tax, but it’s vastly better than the current system. But the left hates it. I believe the plan is so good that Bush should meet the objections of the left (not now of course, but in the very unlikely event he gets elected.) The obvious compromise is to keep the structure of the tax system as he proposes, but adjust the tax rates upward enough to make it both revenue neutral and progressivity neutral.

I normally ignore progressivity discussion in the media. Not because I don’t care about tax progressivity, but rather because no one knows how to measure tax incidence. Thus even though corporate taxes are not actually paid by corporations, it probably makes sense (politically) to set the new corporate tax rate at a revenue neutral level. Or perhaps revenue neutral given whatever growth boost the CBO estimates. And the top rate on personal income needs to be higher than 28%

Unfortunately, with taxes there will never be an end of history. The fights between the GOP and Dems will continue. But both sides should be willing to fight with a clean tax regime, not a monstrosity. You can still nudge the rates up or down, as the elections change who’s in power, but you’ll do so with a much simpler regime.

I’m enough of a supply-sider to understand why the right prefers low MTRs on the rich. But given the very real increase in wage inequality, and given that never in history has it been easier to make a billion dollars by age 30, I really think you need a tin ear to propose a massive tax reform that simultaneously lowers taxes on the group that has done so well in recent decades.

PS. Earlier I said I favor a zero top income tax rate. I still favor that. But that’s only if we have a fairly progressive consumption tax. This post assumes that’s too big a reach, and that this proposal is the best we can do.

PPS. Although I said Tom Cruise does not deserve a high income, I nonetheless want him to be very rich (for utilitarian reasons.) That’s because an economy that allows Cruise to be very rich will generate more good films for me to watch. So yes, he should be very rich, just slightly less very rich than he actually is. Let’s face it, if you get to have young women fawning all over you because you have the guts to do dangerous stunt work in James Bond type films, when you are in your fifties, you are pretty much the luckiest man who ever lived, even if you make the LA minimum wage.

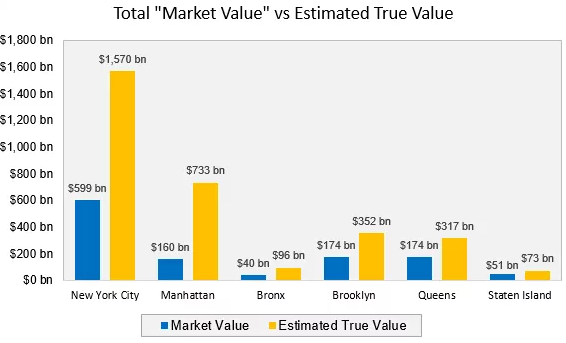

Update: Kevin Dick sent me to this very nice graph: