Was NeoFisherism vindicated?

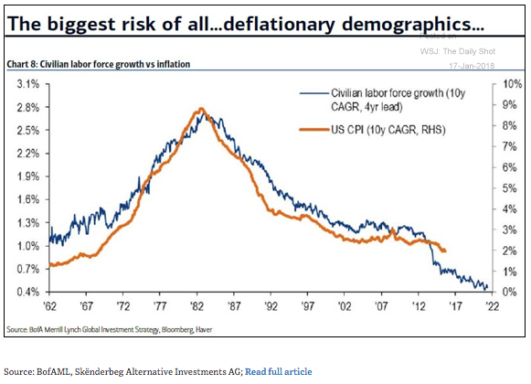

Rajat directed me to a new post by Stephen Williamson, which suggests that recent events provide support for the NeoFisherian view. The Fed has been gradually raising their interest rate target since late 2015, and inflation has gradually risen from near zero up to roughly 2%. In addition, nominal interest rates are positively correlated with inflation rates at the international level.

Here are three ways of interpreting that evidence:

1. Higher interest rates cause higher inflation. (NeoFisherism)

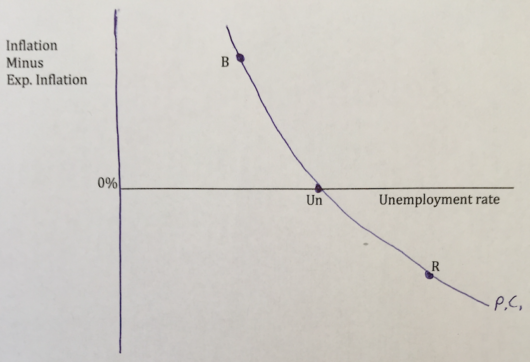

2. Low unemployment led the Fed to fear inflation (Phillips Curve), and they tightened monetary policy to prevent inflation from overshooting. (Keynesian)

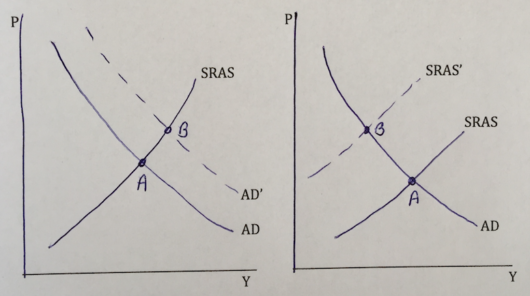

3. The Fed did not tighten at all. Contra NeoFisherism, raising the interest rate target is usually contractionary, ceteris paribus. But the Fed often raises rates during periods when the natural rate is rising, and in most cases they raise rates more slowly that the natural rate is rising. This means that while it is true that raising rates is usually contractionary, ceteris paribus, in the majority of cases a period of rising interest rates is also a period of increasingly expansionary monetary policy. I would argue that 2017 was no different. So I also reject the Keynesian view.

I prefer the second and third explanation to the first because the NeoFisherian view is inconsistent with the response of asset prices to unexpected changes in the central bank’s nominal interest rate target. And I prefer the third explanation to the second because the Phillips Curve is not a reliable way of forecasting inflation, and changes in the nominal interest rate are not a reliable indicator of changes in the stance of monetary policy.

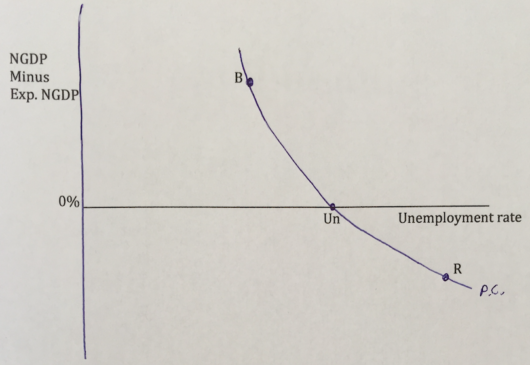

Off topic, I just returned from a monetary conference at the Hoover Institution, which was attended by no fewer than 4 Fed presidents. I was delighted to see both John Williams (who was recently appointed to the New York Fed), and Robert Kaplan (Dallas Fed) mention both price level and NGDP level targeting as promising options to think about. While neither endorsed these policy options, I had the impression that if the Fed were not already committed to inflation targeting, these two Fed presidents would probably be favorably inclined to one of these two approaches. Kaplan seemed especially interested in NGDP targeting. However, I don’t expect the Fed to change its policy target as long as things are going well. Instead, I’d expect some consideration of level targeting the next time we go into a recession, and hit the zero bound.