Is Christmas even merrier than in 1967?

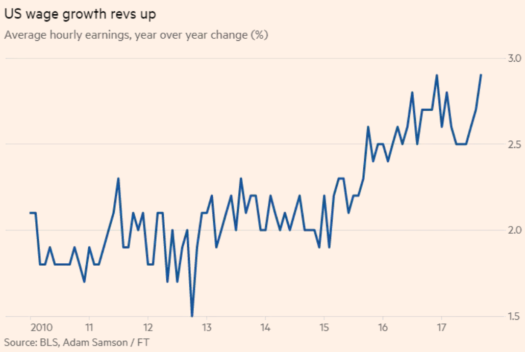

This graph in the FT caught my eye:

The graph shows two measures of the rate of increase in the “cost of living” in China. The blue line is the government CPI, while the red line shows the results of public opinion surveys.

The graph shows two measures of the rate of increase in the “cost of living” in China. The blue line is the government CPI, while the red line shows the results of public opinion surveys.

At first glance they look pretty similar, but check out the two scales. Chinese CPI inflation has been running at about 2% in recent years, while the public’s estimate of inflation is around 6%. The gap was even bigger in the (booming) early 2010s. So what’s going on here?

This is just one more illustration of my claim that inflation is a pretty meaningless concept. To economists, it’s the increase in the price of a bundle of goods, adjusted for quality changes. To the public, it’s the increase in the cost of “living the way we live now.”

Thus if a nice flat panel TV cost $600 today, and a nice black and white TV cost $300 back in 1967, then the public would say that the TV part of the cost of living has doubled, while economists would say that the price of TVs has plunged by something like 90%, because the quality improvements have been so massive.

[In 1967, I frequently had to shake the antenna on top of our TV set, to prevent constant flickering and “snow”. I didn’t even know that the Wizard of Oz was a color film until I saw it in the theatre at age 35.)

Alternatively, the public would say that Christmas today is about equally merry as in 1967, while economists would say that today’s Christmas is far merrier due to technological progress.

Here’s my take on the Chinese data. The top line is strongly correlated with growth in NGDP per capita, i.e. average income. If Chinese living standards are rising rapidly each year, then this factors into what people feel they need to earn to “keep up with the Zhangs”. They are interested in knowing how much it costs to have a middle class Chinese lifestyle. Indeed this concept may be even more important in “communist” China than in supposedly materialistic America.

On closer inspection, however, the rise in the perceived Chinese cost of living is a bit less that the rise in NGDP. And I think that’s due to lifecycle effects. Thus the older Chinese don’t need all the fancy new gadgets that millennials buy, and hence their cost of living rises a bit less rapidly than the overall rise in NGDP/person.

I’d expect that surveys of American perceptions of inflation would show something similar; a subjective inflation rate that is above the official CPI, but below the growth rate of NGDP/person. Does anyone know of such a survey?

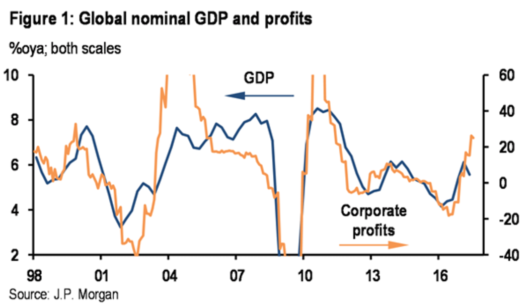

PS. The FT article says the Chinese economy is accelerating into 2018. It looks like those who predicted that the Chinese “bubble” would burst will be wrong for the 40th year in a row. Indeed 2018 looks like a relatively strong year for the entire global economy.

PPS. Check out the new Tianjin library:

Merry Christmas and a Happy New Year to all my readers.