Basil Halperin on sticky wage models

Some of the earliest New Keynesian models featured wage stickiness. By the 1980s, NKs switched to price stickiness, which remains the standard assumption even today. Basil Halperin has an excellent essay that explains why wage stickiness is a more useful assumption for macro models. This portion of his essay caught my eye:

1. Identification: the source of the shock matters!

Recessions caused by tight monetary policy should cause real wages to increase and be too high, leading to involuntary unemployment. Recessions caused by real supply-side shocks should cause real wages to fall and nonemployment to rise.

If the economy experiences a mix of both, then on average the correlation of real wages and recessions could be anything.

Maybe in 1973 there’s an oil shock, which is a real supply-side shock: real wages fall and nonemployment rises (as in the data). Maybe in 2008 monetary policy is too tight: real wages spike and unemployment rises (as in the data). Averaging over the two, the relationship between real wages and unemployment is maybe approximately zero.

This view was around as early as Sumner and Silver (1989) JPE, where they take a proto-“sign restrictions” approach with US data and find procyclical real wages during the real shocks of the 1970s and countercyclical real wages during other recessions.

But: while Sumner-Silver was published in the JPE and racked up some citations, it seems clear that, for too long a time, this view did not penetrate enough skulls. Macroeconomists, I think it’s fair to say, were too careless for too long regarding the challenge of identification.

My sense is that this view is taken seriously now: e.g. in my second-year grad macro course, this was one of the main explanations given. At the risk of overclaiming, I would say that for anyone who has been trained post-credibility revolution, this view is simply obviously correct.

The paper I did with Steve Silver is my first published use of “never reason from a price change” (NRFPC). My subsequent research also relied heavily on that maxim. I’m not sure why it didn’t “penetrate enough skulls”, but perhaps it had something to do with the fact that we both taught at Bentley College. In any case, I’m glad to hear that it has now penetrated more skulls. This blog has been bashing people over the head with NRFPC for 12 years.

As Pissarides (2009) ECMA pointed out, it doesn’t really matter if the wages of incumbent employed workers are sticky. What matters is that the wages of new hires are sticky.

Why is this? Suppose that the wages of everyone working at your firm are completely fixed, but that when you hire new people, their wages can be whatever you and they want. Then there’s simply no reason for involuntary unemployment: unemployed workers will always be able to be hired by you at a sufficiently low real wage (or to drop out of the labor force voluntarily and efficiently). If new hire wages were sticky on the other hand, that’s when the unemployed can’t find such a job. . . .

And the best evidence from Hazell and Taska does argue for sticky wages for new hires from 2010-2016 – in particular, sticky downwards.

It’s hard to image a world where existing workers have sticky wages and new hires do not. In that case, a company could announce that it was firing 100% of its workforce at 5pm on Friday and hiring back 100% of its workforce the following Monday morning at 10% lower wages. Surely wage stickiness must be more deeply embedded in labor markets than suggested by the new hire/existing worker distinction. Something more is involved.

Halperin summarizes a great deal of empirical and theoretical evidence and reaches this conclusion:

[I]f you think of involuntary unemployment as being at the heart of recessions, you should start from a sticky wage framework, not a sticky price framework.

And here’s the policy implication:

More importantly, this should affect your view on normative policy recommendations:

1. Sticky prices – when modeled via Calvo – prescribe inflation targeting: in the simplest setup, stabilize aggregate inflation so that the stickiness of prices need never affect anything. (This provides an intellectual foundation for the policy of inflation targeting used by most developed central banks today.)

2. Sticky wages on the other hand prescribe stabilizing nominal wages: in the simplest setup, stabilize an index of aggregate nominal wages, so that the stickiness of wages need never affect anything.

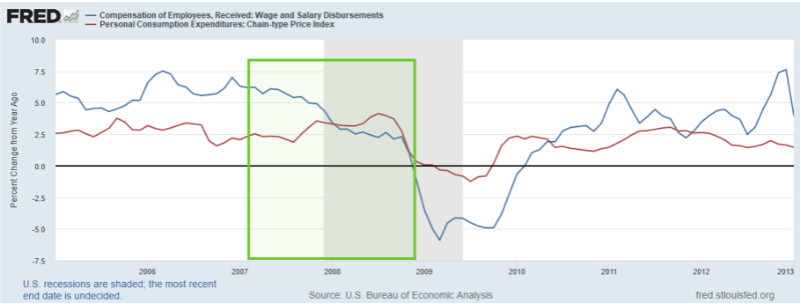

Halperin illustrates the advantage of nominal wage targets with this graph:

The aggregate nominal wage series (blue line) correctly signals a mild recession in early 2008 and a major recession in late 2008. The price series (red line) does not suggest any sort of problem in the first half of 2008.

PS. I hope David Beckworth is correct:

PPS. I interpret the market reaction to the Fed’s recent announcement as reflecting a growing realization that the Fed is serious about 2% AIT. They removed some tail risk of high inflation, and thus TIPS spreads fell about 10 basis points. Otherwise policy did not change, and hence there wasn’t much reaction in the stock market. So far, so good.

Tags:

18. June 2021 at 09:57

The stock market had a gigantic move. You are just looking at indexes. Which its opex week which tends to prevent large moves and is a technical consideration.

Underneath the surface you see gigantic moves in banks stocks, materials, etc.

Also giant moves in 5/30 spreads.

18. June 2021 at 10:12

Sean, Not sure what you are talking about. What measures the stock market better than an index? Bank stocks will react to changes in interest rates.

18. June 2021 at 11:53

Great post.

18. June 2021 at 13:18

Re: PPS

I have this tendency to equate the market with those who comment on the market—–certainly the latter don’t seem to ever even realize AIT exists. One of those commenters is Bullard, who knows AIT exists but clearly hates it. He definitely was pushing his anti-Powell view hard and the stock market reacted—-1.5% seems a lot these days —at least he has no vote—-

18. June 2021 at 13:31

It’s a different market microstructure now.

First the use of options is much larger right now and this week was one of the big 4 quarterly expirations. This leaves dealers with a lot of positions they need to hedge and manage this week. And hedges to roll off which dominates flow this week. For this week that tended to reduce vol.

I’d assume you get a better read next week on how the indexes view the move.

Also I looked about yields back in 2010. It’s amazing how high yields were back then. And how that may have hindered the Feds ability to stimulate a faster recovery. You start seeing 4.5% 30 years and I would have seen that as indicating a fed that did a lot and an economy that should have been in a robust recovery. Stocks didn’t boom like today. Today we have stocks looking like a robust recovery and 30 years at 2% which feels like indicating a weak recovery.

18. June 2021 at 15:18

Michael, You said:

“One of those commenters is Bullard, who knows AIT exists but clearly hates it.”

That’s not at all clear.

Sean, That makes no sense to me, but OK.

18. June 2021 at 15:58

Sticky wages cause sticky core Inflation, so of course the focus should be on wages. Inflation can only run as far as nominal wage growth allows.

How could this have ever been unclear?

18. June 2021 at 16:03

Scott,

I think the view expressed in this post about the recent Fed action is consistent with your prior views. You’re fine with 4% mean long run NGDP growth, because you believe it’s the best that can be. But, the same perspective that gives me the 4% implicit market forecast also indicates real growth could be up to 1% higher.

19. June 2021 at 06:50

RE:Bullard

I thought his statement was an aggressive rebuke of Powell——-which makes the market confused. I guess it shows one can have similar views in theory (e.g., AIT might possibly be an approximation of NGDP) but different views on what needs to be done. The fact that he made that comment (who knows, maybe he was assigned to task of having an aggressively different view) has given ammo to the theory the Fed is playing it too “loose”—-and that others may be thinking the same.

19. June 2021 at 07:46

Michael Rulle. I don’t see how it’s a rebuke to Powell. He just has a slightly different opinion on when rates will increase.

19. June 2021 at 09:38

Okay —- slight disagreement. We can define slight as one year. But The decision to raise rates is not a passive decision based on clear issues. If they have the same difference of opinion next year that would not be slight next year—-or whomever will be Fed Chair. Market did not like it. I did not either.

19. June 2021 at 13:37

Money is neutral. Employment does not matter to a modern economy. Prices/wages are not really sticky. Solve for the equilibrium. See my comment at MarginalRevolution on this paper. Or you can believe in a “confidence fairy” like our host (metaphysics).

19. June 2021 at 13:58

I’ve been hitting refresh on my web browser to see if you’ve posted on what your take was on the market reaction to the Wed Fed event.

Going into the Wed Fed event, it was billed as possibly the most the consequential meeting since the 2013 Taper Tantrum. And for the same reasons. Watchers had it pegged as probably a binary event: either the Fed continues to ignore building inflation pressures or they’ll move sentiment too much and cause a tantrum.

Watching Powell’s comments realtime, I was thinking that they threaded the needle perfectly: acknowleging risks to inflation, but citing the example of broken lumber market momentum as evidence of their “this inflation is transitory”, and moved their tightening timeline ever-so incrementally forward.

Eyeballing it, the asset market with the most outsized reaction was gold, downward. Implying to me that much of the shift in perceptions was intermediate-term sustainably higher real rates on the dollar. (How much was global real vs how much was US dollar specific, not sure I can “do the math” on that).

I saw Goldman Sachs commodity guy Jeff Currie a week or two ago on TV saying that while much news-punditry talk was long the inflation trade, he’d never seen markets “so long on conviction yet short on positioning” (traders weren’t actually really overly long commodities).

The standard implication was that there’s a lot of room for traders to get long commodities. However, I wondered if the opposite might be true, which is another old adage: “pay attention to what they do, not what they say.”

I’ve wondered all year if “secretly” the market was itching to get short the inflation trade. That idea is looking slightly more plausible for the intermediate term.

19. June 2021 at 14:08

Ricardo, I didn’t see this meeting as being all that important. Meetings are important when policy is far off track.

19. June 2021 at 14:53

OK, Scott, point taken. Useful information. I do take interest in your statement. Certaintly, before the Wed Fed event, the balance of opinion evident in popular financial media was skewed to the “OMG, Fed is totally behind the inflation curve.”

Even after the Wed Fed event, there probably still persists some balance of opinion (my opinion) from sane pundits the possibility that Fed remains “late.”

19. June 2021 at 15:10

On a totally blog post related event… in a recent staff meeting when someone started in with some mention of “inflation”, I totally launched into an erudition of how the raison d’etre of monetary policy was b/c ‘sticky wages”. They were gobsmacked at the obvious simplicitity at which that idea would explain things. Oh. This was a staff meeting of (non-economist) IT professionals. But, hey, they “started it”. 🙂

19. June 2021 at 15:35

You may not have known this, but the proto-typical embedded intellectual upper-class of a long-standing IT culture at some organizations has a bit of Austrian “Mises-Hayek-AynRand” tilt.

19. June 2021 at 16:12

Someone left a great comment that I will paraphrase here: A box of cornflakes doesn’t object if you lower its price.

19. June 2021 at 16:16

Also, why are new wage hires sticky?

19. June 2021 at 17:16

@Lizard Man: Much of time, I perceive when Sumner is facetious in his written blog. Possibly, he’s doing that this time? … Think of yourself as a manager in the real world: firing everybody Friday at 5pm and attempting to re-hire over the weekend. Would you expect that come Monday, you could completely start with new hires which are untrained and ignorant of built-up institutional knowledge would be capable of the same intermediate-term productivity ?

19. June 2021 at 17:33

Ricardo, Yes, it’s possible that they are a bit behind the curve. On the wage question, I meant the firm rehired exactly the same workers at 10% lower wages. And yes, I realize it’s a crazy idea, but so is the notion that wages are sticky for existing workers but not new hires.

As far as Austrian macro, how’d that do during the 2010s?

Lizard, See my reply to Ricardo.

21. June 2021 at 07:26

Excellent post.