A –> B –> C, Does A imply C?

I believe the answer is yes, due to “transitivity”. But what do MMTers believe?

Let’s say A is: Big open market operations occur when interest rates are positive.

And B is: Interest rates change by a large amount.

And C is: Has a significant impact on the economy.

The MMT textbook I’ve been reading suggests that A does not imply C:

Monetarists are hostile to the creation of base money to finance deficits because they claim it is inflationary due to the Quantity Theory of Money (QTM). MMT advocates would first highlight institutional practice, namely that net treasury spending initially causes an equal increase in base money.

Second, they would challenge the theory of inflation based on QTM, and argue that if a fiscal deficit gives rise to demand pull inflation, then the ex post composition of ΔB + ΔMb in Equation (21.1) is irrelevant. Overall spending in the economy is the driver of the inflation process, and not the ex post distribution of net financial assets created between bonds and base money.

When I first read this I thought:

1. This is a shocking claim.

2. This is clearly wrong.

So I set out to try to discover why they hold this highly controversial heterodox belief. Do MMTers believe that OMOs don’t have a big effect on interest rates, or do they believe that big changes in interest rates are irrelevant?

On page 364, the authors clearly indicate that they believe a big open market purchase could immediately drive interest rates sharply lower, perhaps to zero:

However, this mainstream argument [for a money multiplier] fails to recognise that the added reserves in excess of the banks’ desired reserves would immediately drive the interbank rate to zero or to a non-zero support rate

The term “non-zero support rate” presumably refers to IOER, but we can ignore that since I’m considering a big OMO in 1998, a time when IOER was zero. It is possible that a huge monetary injection could raise interest rates due to the Fisher and/or income effects, but we can rule that out as the authors are claiming “irrelevance”. A policy that has a big impact on inflation and/or real income is clearly not irrelevant. So they are obviously assuming the liquidity effect is the only relevant consideration after an OMO, in which case this MMT claim is certainly true. A big OMO would drive rates much lower, probably to zero.

OK, so MMTers correctly understand that big OMOs can have a major impact on interest rates. But perhaps interest rates don’t impact the economy?

On page 366, we find that big changes in interest rates do impact the economy:

While small changes in long-term interest rates (following corresponding changes in the target rate) may have little impact on spending, higher and higher long-term interest rates will eventually diminish domestic spending that is interest rate sensitive.

On page 369 they discuss the downside of a tight money policy:

Often too tight if it [i.e. monetary policy] is is geared to a low inflation rate (or target range), which can impose major economic and social costs of higher unemployment

(MMTers continually engage in the fallacy of reasoning from a price change, but I don’t want to be too hard on them on that point, as so do Keynesians, Austrians and NeoFisherians.)

The two key points are that OMOs can have a big impact on interest rates, and big changes in interest rates can have a “major” impact on the economy. A –> B and B –> C. But A does not imply C.

So I’m still confused.

In the comment section, people sometimes fall back on the claim that the Fed cannot arbitrarily adjust the monetary base because they target interest rates. They are mixing up several unrelated points:

- Money is endogenous when you peg interest rates at a constant level.

- A sudden change in the base could be disruptive for the banking system/economy.

Both claims are true, but have no bearing on the question of what would happen if you did a big OMO and didn’t care what happened to interest rates or the economy.

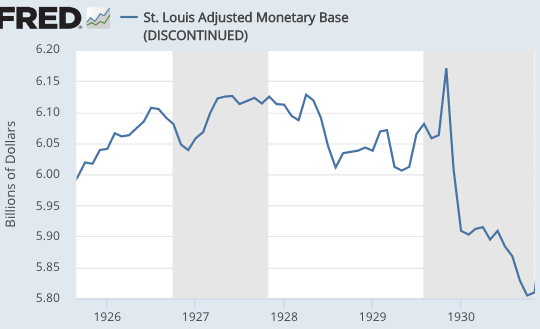

Yes, it would be very foolish to suddenly decrease the monetary base, as they did in 1929-30. That could drive the economy into a depression. But that doesn’t mean the Fed can’t reduce the monetary base. They have done so on several occasions. And it certainly doesn’t mean they cannot sharply increase the monetary base.

[The November 1929 spike is liquidity added right after the stock market crash.]

The textbook authors did not say that monetarists are wrong because the Fed has no technical ability to do discretionary open market purchases, they said that this action would be “irrelevant” if it were done. Monetarists know that money becomes endogenous if you peg interest rates, indeed that’s precisely why monetarists oppose interest rate pegs. So saying an interest rate peg makes money endogenous is not an effective critique of monetarism. Indeed monetarists either oppose interest rate targets entirely, or they favor adjusting the interest rate target frequently, as needed to keep the money supply on a non-inflationary path.

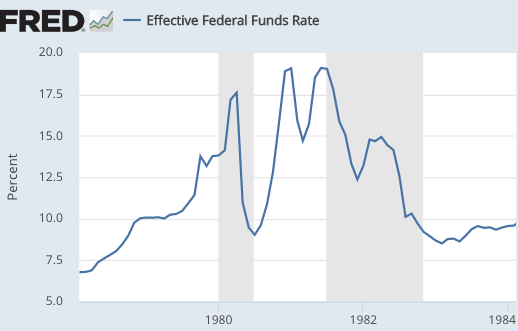

One commenter argued that the Fed continued to “set” interest rates even during the 1979-82 monetarist experiment. I’m OK with that as long as people understand that by “set” they mean this:

The Fed “set” the fed funds rate at 17.5% in April 1980, and then they “set” the fed funds rate at 11% in May 1980. A 650 basis point drop in one month. Is it just possible that the Fed had other objectives at the time, such as slowing money growth enough to reduce inflation?

And the textbook presentation of the monetarist experiment (p. 362) leaves much to be desired:

Many central banks, including those in the USA, UK, Canada, Germany and Australia, targeted a monetary aggregate that is a measure of the money supply in the late 1970s and early 1980s. They did so because through the Quantity Theory of Money (QTM), the growth rate of the money supply in the long run was alleged to determine the inflation rate. However, by the mid-1980s they had all discovered that they were unable to control the money supply, and abandoned this major plank of Monetarist thinking.

They didn’t “discover” they were unable to control the money supply, they came to believe that it was not a good idea. (Correctly, in my view.)

But that’s not my major complaint. Do you see the big problem in that paragraph? Students are informed that central banks such as the Fed adopted a monetarist policy in order to control inflation. But then students are not told the outcome of this policy experiment. Did the major central banks actually succeed in controlling inflation? Here’s the data they do not present:

Dec. 1978 – Dec. 1979: CPI rose 13.3%

Dec. 1979 – Dec. 1980: CPI rose 12.4%

Dec. 1980 – Dec. 1981: CPI rose 8.9%

Dec. 1981 – Dec. 1982: CPI rose 3.8%

And inflation has stayed fairly low ever since 1982. In other words, the monetarists were right that the Fed needed to abandon its previous interest rate smoothing policy and let rates rise as high as necessary to control the money supply growth rate. And the monetarists were wrong that a stable money supply target was a good idea (as they underestimated the volatility of velocity.) When inflation fell during the 1980s so did velocity, and the Fed rightly abandoned money supply targets and accommodated the increased demand for money

But students are not even told that the monetarist experiment succeeded in controlling inflation. Even if a textbook author (wrongly) believes it was just luck, and that the fall in inflation was unrelated to monetary policy, don’t you think that students would be interested in knowing how this famous anti-inflation experiment actually turned out?

Throughout the book you keep encountering sentences like:

The central bank would have no choice but to add reserves back into the banking system to keep the market (interbank) rate at its target level

Yes, but what if they were willing to let rates gyrate wildly, as in 1979-82? Are they still unable to inject or remove reserves on a discretionary basis? I cannot find an answer.

If you are willing to abandon interest rate pegging and let rates move around, then you can control the money supply. You should not have a strict money supply growth rule, but you should adjust the monetary base each day as necessary to keep market expectations of NGDP growth at 4%. And let interest rates be set by the market.

Tags:

27. November 2020 at 11:44

Nick Rowe often made analogies to cars and gears and strange jointed pendulums to explain what he was thinking. So I will try something similar even though it will not be as good as that.

So you start with a couple of hooks that can hold 25 lbs max. To one hook you attach a stretchy spring like you might find on an old lightweight screen door. The other hook you attach a spring like you would find on an overhead garage door. And then you hang an empty five gallon bucket on each spring. Then you start filling the buckets up with water and you notice that the one on the stretchy spring seems a lot more responsive to additional water and the bucket on the heavy duty spring really hasn’t moved much at all. But when you get to about four gallons of water, both buckets are on the ground. The bucket on the stretchy spring is still attached while it is on the ground, but the hook holding the heavy duty spring has broken.

MMT thinks monetary policy works like the bucket on the garage door spring. If you put enough water in it the bucket will fall to the ground. You might think monetary policy works more like the stretchy spring.

27. November 2020 at 12:10

Jerry, You said:

“MMT thinks monetary policy works like the bucket on the garage door spring.”

Very few things in the real world work that way, especially in economics. I used to have students tell me that people don’t respond to small price changes, but they do respond to big price changes. It turns out that’s false.

BTW, the markets understand this is false—look at how they react to unexpected changes in monetary policy.

27. November 2020 at 12:46

Maybe it is a bad analogy for economics. Sorry. But a lot of things in the real world actually do work that way. Relatively inflexible until they fail at a breaking point. It is why masonry buildings are so dangerous in earthquakes.

27. November 2020 at 14:00

To be pedantic, I don’t read “A -> B -> C” as “(A -> B) and (B -> C)”. I read it as an ambiguous statement that either means “If A then (B implies C)” or “If (A implies B) then C”.

27. November 2020 at 14:02

@Jerry Brown – it is always dangerous to draw comparisons of economics to Newtonian mechanics. The example you provided is can be well documented with a small amount of information. Contrast this to MMT where the results bear no resemblance to the information going in.

27. November 2020 at 14:11

In case you haven’t seen this, here’s Noah Smith on MMT, including noting you. https://noahpinion.substack.com/p/mmt-and-the-meme-ification-of-macro

27. November 2020 at 14:35

For sure it is dangerous to the ego Alan. But no actual people were in danger from my analogy I hope 🙂 I was trying to show how it is not unreasonable to think both that small adjustments in monetary policy may not work much in slowing an inflationary episode, and at the same time recognize that relatively drastic measures would work to crash the economy. Scott seemed incredulous that someone could think that.

I guess my analogy did not help explaining that.

27. November 2020 at 14:43

Jerry, I agree that lots of things work that way. At the individual level it’s true. A gradual rise in interest rates may not matter at all for a project, until big enough to kill it. But the place where interest rates kill off projects varies from case to case, so due to the law of large numbers these functions tend to be “smooth”.

Martin, OK. I don’t recall the symbols used in logic; I took that class 44 years ago.

Thanks foosion.

Jerry, You said:

“I was trying to show how it is not unreasonable to think both that small adjustments in monetary policy may not work much in slowing an inflationary episode, and at the same time recognize that relatively drastic measures would work to crash the economy.”

If MMTers believe that (I’m not 100% sure they do) then it would be interesting to learn WHY they believe that idea applies to monetary policy but not fiscal policy.

27. November 2020 at 17:00

I’m not 100% sure they believe that either- I am just doing my best to explain my understandings of MMT. But I believe they would mostly agree that if the central bank was to make borrowing extremely expensive then that would very much limit that part of aggregate demand that relied on financing and that would cause a big recession and that would have a disinflationary effect.

So, in my opinion of course, monetary policy works through making it easier or harder to borrow to spend. It doesn’t really have a direct effect on incomes of those who are trying to spend, whereas fiscal policy absolutely does have an immediate effect on incomes in the private sector. So that might explain the dichotomy you observe in ideas about fiscal and monetary policy.

And really, if you want a very simplistic explanation of MMT, you could consider it as ‘automatic stabilizers’ on steroids. And there really are very good arguments MMT makes to back up what it says. I don’t know why you have difficulty understanding their arguments. Even if you are sure they are wrong.

27. November 2020 at 19:44

Scott, your use of symbols was perfectly fine when targeted at a human reader. It’s mostly when dealing with eg computers in programming that you have to watch out more.

Eg in most programming languages something like a < b < c would mean something like c is bigger than the truth value of whether a is smaller than b. But that doesn't need to concern humans.

27. November 2020 at 19:49

Over at Econlog, where I am canceled, Scott Sumner has a post on the importance of expectations and monetary policy.

Perhaps expectations can play a role in asset prices, but I see a limited role in the real economy of goods and services.

I might expect a recession that lasts for years, but if there is a line outside my hot dog stand extends for 40 yards, I will raise my prices. Vice-versa too.

House prices are in oddity, in that in a convoluted claptrappy way, they feed into the Consumer Price Index as measured. There are some adjustments in core PCE, but I no longer remember what they are.

Add on, banks will lend on real estate, as long as prices are going up, which of course becomes a self-fulfilling prophecy….although you might see a Hyman Minsky moment or two.

This bank-lending on property amounts to the endogenous creation of money, and should not be overlooked in trying to determine what is good monetary policy. Property loans are a very large component of bank portfolios.

There is a side note, that nations that run chronic current-account trade surpluses see inflows of capital, and these inflows correspond to bulges in real-estate prices.

At times I wonder if the Expectations Fairy has a minus sign in front of it. After all, the most credentialed macroeconomists of the last two generations chronically projected higher rates of inflation and interest rates. Instead, the opposite happened.

Another consideration is that global central bankers themselves, who should be knowledgeable about the influence they can have on an economy, are almost in unison calling (stridently) for more fiscal stimulus.

Is Scott Sumner is correct, the world’s community of global central bankers are unable to determine the proper policies, even within their area of expertise.

And history shows us that the most prominent macroeconomists were chronically wrong, and for decades, on the direction of interest rates and inflation.

This is quite a predicament, no?

27. November 2020 at 20:02

> if a fiscal deficit gives rise to demand pull inflation, then the ex post composition of ΔB + ΔMb in Equation (21.1) is irrelevant.

I think you misunderstood the conditional statement.

Their claim is that inflation is controlled by spending, and interest rates have no independent effect on inflation. So while it may be true that interest rates change spending, they become irrelevant if you are looking at spending.

To risk a poor analogy: you can deposit an inheritance into your savings account, and your savings can earn interest. But interest is explicitly a function of the total amount in your savings account, not the amount of inheritance. The composition of sources (inheritance vs gifts, salary, etc) is irrelevant.

27. November 2020 at 23:55

In A->B->C there i a double coincidence of “May”. In Math -> implys a “must” not “may”. That double coincidence of “ma” should be considered and why it could coincide in the real world.

It happens because banks will not offer nothing close to the official interest rates with loans to the economy. But all your talk is as if Government’s interest rate is what economy can acces. That is your major assumption. In a large drop in interest rates it could take up to a year untill banks catch up and offer it +risk to the economy at large. SO, no increase in lending and no increase in spending and no increase in inflation.

On the other hand, a price of oil can jump and make fracking and shale oil profitable without any change in interes rates. That alone can increase lending and investment which can employ more people and increase income which in turn increase even more lending and with it spending.

We see that -> is not a “must” as monetarist see it but more as 50/50% “may”.

It seems that what you are saying is that OMO by itself if large enough can move an economy. We see that it potentialy could given enough time, say a year of time, or have no imact on GDP at all. It deppends what else is happening in the real economy. If banks quickly enough lower interest rates and loosen the loan terms due to OMO then it might increase the lendingd and with it the spending.

Spending is what drives economy, not OMO, if there is no more spending after OMO, then it will not affect economy. SO if banks do not lower lending interest rates after interbank rates drop to 0% why would it be any change in the economy. How would you explain that?

You assume that Official interest rates awailable to the government must be availale to the economy and that is where your assumption is wrong. If the official rate is not awailable to the economy then the change in interest rates will not affect the economy.

I wrote before how Spread between T-bills rates and Prime loans grew from 1% to 3% which showed why economy did not react to the low interst rates, Official rates and lending rates chasm grew larger so monetary policy became ineffective.

28. November 2020 at 08:39

–“It happens because banks will not offer nothing close to the official interest rates with loans to the economy. But all your talk is as if Government’s interest rate is what economy can acces. That is your major assumption.”–

Market interest rates generally do go down, as is evidenced by sub 3% 30yr mortgage rates in the United States in 2020, lower auto rates, etc.

But it is more than just market interest rates. An OM purchase converts a fixed income security into cash. Fixed income securities aren’t transactable, but cash is. That cash can be used to either spend or to purchase another security (which, in turn, brings the spend/invest decision to someone else). OM purchases also decrease the availability of investment options, supporting prices and leading to a positive wealth effect (or at least less of a negative one).

Inflation has been way too stable for too long for it to have been mere chance. The monetarists have things broadly correct. MMTers are right about one thing primarily: that regular default is a choice when your debt is denominated in fiat currency, and that gives a lot of leeway to countries which control their own fiat monetary systems.

28. November 2020 at 09:10

Jerry, I’m not sure if you realize it, but if you are correct then the authors are wrong in the passage I cited. OMOs are not “irrelevant” if much higher rates can slow the economy. Whether the effect is “direct” or “indirect” is irrelevant.

Thanks Matthias.

FSE, You said:

“So while it may be true that interest rates change spending, they become irrelevant if you are looking at spending.”

The MMTers often use language in a very strange way, but I’ve never seen them twist it to that extent!

Jure, When the government moves its target rate, short-term market interest rates tend to follow.

Justin, You said:

“MMTers are right about one thing primarily: that regular default is a choice when your debt is denominated in fiat currency”

I agree, but for 50 years we’ve been teaching students that Treasury debt is default risk free, so that’s not exactly a huge insight.

29. November 2020 at 01:39

“Jure, When the government moves its target rate, short-term market interest rates tend to follow.”

Yet, the market interest rates in the USA did not follow thae target rate for the last 12 years.

Why do you just provide the answers from your false models and check the real world what is happening.

It looks that you are aware that you are wrong yet your sallary deppends on it, that “tend” shows that you are aware of it.

29. November 2020 at 09:18

Jure, Actually they did. Compare T-bill yields with the IOER. They both rose during 2016-18 and fell in 2019.

Getting informed on the facts the the very first step to wisdom.