Let’s hope my life finally hit rock bottom in 2017. (At age 62, fat chance!) I’m looking forward to wrapping up my two book projects by mid-2018, and then starting to actually live again. Reading books, buying CDs, figuring out how to watch films on the internet. (BTW, is Netflix as awful as it looks, or am I missing something? Their selection of good films seems virtually nil. Where are the good films on the internet?)

Ross Douthat is a brilliant essayist who has a blind spot when it comes to sex. His newest piece is titled:

Let’s Ban Porn

I’m trying to visualize how this would be implemented. Perhaps Jeff Sessions will sit in a room all day, screening X-rated art films from France, Italy and Japan, trying to determine whether they are pornographic. (I say yes, but in a good way.) What would Jeffrey make of In the Realm of the Senses? There’s an amusing Atom Egoyan film that gets at the internal contradictions of censorship. If watching porn really does turn us into bad people, as Douthat seems to think, then under his proposed regime the actual censorship decisions will be made by moral degenerates.

Despite the fact that the proposal is silly on many levels, it would not surprise me at all if Douthat wins in the long run. The US is going downhill in so many different ways—why should this be any different? [I’m striking a blow against the New Puritanism by topping my list with a film I was not allowed to see. I liked the previews, and was really looking forward to it.]

In fairness to Douthat, I do see one silver lining in his proposal. There was a time, way back in the 1960s, when lots of Americans did go to see foreign films. Especially foreign art films. That brief golden age occurred at the point in time when we’d liberalized enough to allow in “erotic” Swedish and France films, but not so much as to allow “porn” (Which I define as erotic art films for the working class. Yes, there’s a lot of class snobbery in the new puritanism.) Once Americans were given access to their own home grown porn in the 1970s, they stopped going to see films by Godard, Bergman and Antonioni. Wouldn’t it be funny if Douthat got his way, and Americans were once again forced to watch long boring art films, just to catch a glimpse of skin!

2017 Films

I Love You, Daddy. (US) 4.0 I’m hoping this will be what Woody Allen films should be, but aren’t. Something a bit more Kubrick-like.

Stalker (Russia, 1979) 4.0 Not just my favorite Tarkovsky, my all-time favorite European film. Geoff Dyer said it best:

it’s not enough to say that Stalker is a great film – it is the reason cinema was invented.

Twin Peaks Part II (US) 3.9 Not as good as part one, but then that was the best TV show of all time. Reminds me of “In the Mood For Love” in the way the director used the posture of actresses in a very evocative way. Check out the scene where Lynch and the two FBI women are out on the porch having a cigarette. Nothing is said for about 2 minutes, and it plays no role in the plot. But it’s stupendous filmmaking—an example of what makes cinema magical. And let’s not even talk about Naomi Watts, who is brilliant throughout the series.

I searched online and found someone else who liked the scene on the porch as much as I did:

http://ew.com/recap/twin-peaks-season-3-episode-9/3/

The series is also a critique of the anti-cigarette hysteria on the rise in America.

Thelma (Norway) 3.7 A very enjoyable Norwegian film, very skillfully directed. Doesn’t break any new ground, but I was engrossed throughout the entire 2 hours.

After the Storm (Japan) 3.7 Another gem from Kore-eda, my favorite living Japanese director. This one is probably worth seeing twice, as there’s a lot going on right below the surface.

Sweet Bean (Japan, 2015) 3.6 Directed by Naomi Kawase, another great Japanese director that I had somehow overlooked. Reminds me a little bit of the style of Kore-eda. A beautiful understated film; the polar opposite of what gets produced in Hollywood these days. Now I need to find her earlier films.

Star Wars: The Last Jedi (US) 3.6 The best Star Wars film since the first two. They finally found a director who is more than just a corporate clone. It still fell short of what it might have been—Mark Hamill is not a good actor and the depictions of alien planets continue to be quite unimaginative.

Intimacies (Japan, 2012) 3.6 A nearly 4½ hour film by the director of Happy Hour. The first half shows people putting together a theatrical production and is pretty slow going. After intermission we see the play itself, which becomes increasingly engrossing. I have no interest in theatre, but I enjoy seeing filmed plays. This is a director to watch.

Full Metal Jacket (US, 1989) 3.6 This uneven Kubrick film is saved by the intense final battle.

The Square (Swedish) 3.6 A film that is full of ideas, and lots of sharp observation, although it doesn’t have the sustained artistic vision of something by Lars von Trier, Kubrick, Haneke, etc. It’s a tweener, but a pretty engrossing 2 ½ hours. In its defense, the satire of the art world and liberalism more broadly is not always as obvious as it might seem. Strongly recommended for people who (unlike me) like their cinema mixed with social commentary.

Brimstone and Glory (Mexican) 3.6 Documentary about a small town in Mexico that puts on a stupendous fireworks festival each year. Imagine the running of the bulls in Spain, except at night with dazzling fireworks. Soon after the film was completed, many people in this town died in a fireworks accident.

Vanishing Time: A Boy Who Returned (Korea) 3.5 A charming Korean crowd pleaser, which I found myself enjoying more than I expected. The director (Tae-hwa Eom) is someone to watch.

Columbus (US) 3.5 I’m tempted to say that this film is not for people who have short attention spans. But then maybe it’s not about attention spans at all, but rather a question of interest—more specifically it’s for people with an interest in architecture. (The character I stole this line from was the most interesting person in the film, but he only had a small role.)

Blade Runner 2049 (US) 3.5 This is an outstanding film in many ways, especially the visual effects. So why do I rate it slightly below the original? I’m not quite sure. Maybe it’s just a question of originality—the first one had a fresh (and sublime) vision, and this one just recycled that vision. Originality seems especially important in sci-fi. Or perhaps it tried to do too much. The last half hour dragged on, and seemed somewhat pointless.

Lolita (US, 1962) 3.5 This uneven Kubrick film is saved by Peter Seller’s inspired performance. (A warm-up for Strangelove.) It’s probably unfair to compare the film to the book. Kubrick and Nabokov are very different artists, and hence the film should not be anything like the book. And it isn’t.

David Lynch: The Art Life (US) 3.5 A very interesting documentary about David Lynch. He did not direct the film, but there are moments when it feels like he did. Lots of glimpses of his graphic art.

Blade of the Immortal (Japan) 3.4 The 100th film by Takashi Miike. I’ve only seen two, which leaves 98 to go. Not my favorite genre (lots of blood) but it’s nice to see a real craftsman at work.

Youth (China) 3.3 The sort of film Spielberg would make if he had been born in China. Tries to do too much, but it’s fairly engrossing. If I were Chinese I’d rate this lower–too emotionally manipulative.

March of Fools (Korea, 1975) 3.2 Interesting coming of age film from a director I had not seen before.

La La Land (US) 3.0 With all the talent in Hollywood, do they really have to rely on so many clichés? Her dream is living in Paris? Even Chinese directors use Prague.

Your Name (Japan) 3.0 This animated feature was a smash hit in Japan. It’s good, but I found it to be somewhat derivative.

The Swindlers (Korea) 2.9 This entertaining film is full of twists and double crosses, but in the end it didn’t make much sense (at least to me.)

Woman of Fire (Korea, 1971) 2.8 At times it’s one of those campy “so bad it’s good” films, at other times it’s somewhat engrossing. And sometimes it’s just bad. Might be of some interest to Tarantino fans.

Baby Driver (US) 2.8 Mildly entertaining, but also rather silly. I would have given it 3.0 rating if the film had ended with Dave Edmunds’ 1970s pop classic “Deborah” playing over the credits. (The two stars kept trying to think of a great pop song with “Deborah” in the title.)

Dreams That Money Can Buy (US, 1947) 2.5 Not very good, but interesting in what it tells us about progress in the cinema. While certain types of films (comedy, drama, noir, etc.) have made almost no progress since the 1940s, visionary film-making improved dramatically between 1947 and 1968, when 2001: A Space Odyssey came out (not to mention Tarkovsky). Here’s what Wikipedia says:

Dreams That Money Can Buy is a 1947 experimental feature color film written, produced, and directed by surrealist artist and dada film-theorist Hans Richter.

The film was produced by Kenneth Macpherson and Peggy Guggenheim.

Collaborators included Max Ernst, Marcel Duchamp, Man Ray, Alexander Calder, Darius Milhaud and Fernand Léger. The film won the Award for the Best Original Contribution to the Progress of Cinematography at the 1947 Venice Film Festival.

Saint Terrorist (Japan, 1980) 2.2 Nihilistic punk filmmaking from Japan. Not my cup of tea.

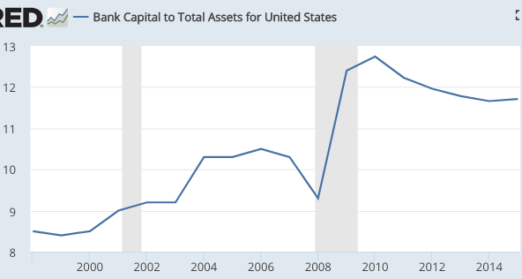

The capital ratio rose from 10.5% before the crisis to 12.7% after, but has since slipped back below 12%. A 23.5% ratio sounds great, but only if applied to all banks, not just large banks. Unfortunately there’s probably almost zero political support for doing some something like this.

The capital ratio rose from 10.5% before the crisis to 12.7% after, but has since slipped back below 12%. A 23.5% ratio sounds great, but only if applied to all banks, not just large banks. Unfortunately there’s probably almost zero political support for doing some something like this.