Has fiscal policy been unsustainable for decades?

After the previous post, Carl made the following comment:

I have a hard time believing it’s because “fiscal policy is unsustainable”. It’s been unsustainable for decades.

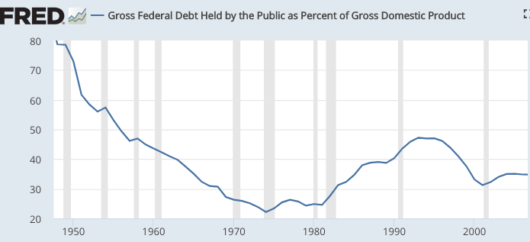

Here’s the data for 1947-2007:

So no, fiscal policy has not been unsustainable for decades. The debt ratio fell from 80% of GDP in 1947 to 35% of GDP in 2007. That’s not to say that there were no long term fiscal challenges in 2007—the looming retirement of baby boomers was an issue that needed to be addressed.

So no, fiscal policy has not been unsustainable for decades. The debt ratio fell from 80% of GDP in 1947 to 35% of GDP in 2007. That’s not to say that there were no long term fiscal challenges in 2007—the looming retirement of baby boomers was an issue that needed to be addressed.

However it is not true that a longer life expectancy creates major problems for fiscal policy. Living longer need not cause health care costs to rise dramatically, if people are also healthier. To some extent the costs simply occur later in life. The much bigger problem is that we now spend far more on the same health problems that we spent less on in the past. Singapore does not.

And greater longevity need not increase the pension burden, as long as the retirement age reflects improvements in health. Longer life spans may create a problem if we don’t handle them in a sensible way, but that’s up to us. Thus we could set the Social Security retirement age equal to the average life expectancy in America, minus 12 years.

Today, the debt burden is nearly back up to 80% of GDP, and likely headed much higher. The problem today is that fiscal policy is currently unsustainable—we are running massive and growing deficits late in an expansion. It was certainly not unsustainable when we were rapidly reducing the ratio of debt to GDP under Bill Clinton.

PS. My previous post title should not be taken as a prediction of recession. I do not expect another recession in the near future. I would emphasize that the level of stock prices is still pretty high, even after the recent drop.

Tags:

9. February 2018 at 13:53

As noted to you for YEARS, Bill Clinton didn’t want to balance the budget, after CHANGE, INVEST was second most use word of his campaign.

Then one meeting with Greenspan: choose between higher rates / Econ crashes OR forget about your investments.

Bill puts Greenspan on dias for first SOTU and his first policy change is Don’;t Ask, Don’t Tell – only free thing he had for left.

—

Obama was determined to not be Clinton. And the money flowed to non-Trump voters.

This elects Trump.

—

When GOP holds it is different.

Because Fed fundamentally sees tax cuts as different than govt spending.

‘I didn’t come her to balace the budget” – Reagan

—

Dems need to run a Bill Clinton, someone smart enough to bend when Fed Chair gives them the deal.

9. February 2018 at 14:16

Scott,

Debt/GDP is not really the relevant number. Interest cost/GDP is what you need to be looking at. If your prediction that trend RGDP growth has dropped then so has the Wicksellian rate and therefore a much higher debt/gdp ratio is sustainable because interest/GDP has dropped. If on the other hand, you’re wrong about growth, i.e. we’re not near the end of the recovery, then tax revenues will rise substantially and debt to GDP will drop.

Either way I think you may be be wrong about the sustainability of current fiscal policy.

9. February 2018 at 16:33

There is no US fiscal policy. So expect permanent deficits.

Sustainable? Dtoh makes some interesting points.

But the real quizzical is QE.

The Bank of Japan appears able to buy back the bulk of national debt with only positive consequences.

So maybe there is an option to becoming Argentina. Become Japan.

9. February 2018 at 16:44

Add on re Dtoh: in the next recession I expect interest rates for government borrowing to go to zero. So maybe Dtoh is right.

I still prefer balanced federal budgets. But monetary policy must be made in the real world.

9. February 2018 at 17:08

dtoh, The debt ratio will keep rising even if interest costs stay low. If rates rise to historical norms then we are even more trouble.

Rates and growth are correlated, but not perfectly. Right now rates are low relative to growth.

If the debt ratio keeps rising, it’s unsustainable at ANY interest rate.

9. February 2018 at 18:50

Unsustainable for decades.

That’s kinda an oxymoron, isn’t it?

9. February 2018 at 19:16

“If the debt ratio keeps rising, it’s unsustainable at ANY interest rate.”–Scott Sumner

Scott: What if debt is regularly monetized through QE? Is that an escape hatch? It is not what I prefer, but we must ponder policies in the real world.

Who owns Japan’s national debt? Has it been effectively monetized? Adair Turner says it has.

Also, what if rates hit zero? Then a nation could issue perma-bonds, paying zero, and re-fi existing debt. There would be a huge national debt with zero interest costs. (Or a nominal rate, such as 0.10%, which is what JGBs pay now).

As I said, hey, I prefer a balanced national budget (and one that takes a much smaller percentage of the nation’s GDP).

But what I want and what will see are two different things.

We will see huge USA national debts. It is inevitable

So, what is good monetary policy given the inevitable?

Can a little financial jujitsu work?

Japan says yes, so far.

9. February 2018 at 21:51

So wait, we ran surpluses under Clinton and the economy slowed. We have been running sizeable deficits since 2008 and the economy has chugged along. Japan is growing despite a much larger “debt”. If the fed is all powerful, then what do we have to worry about? They can hand wave real GDP higher than the real interest rate on the debt, and we carry on.

Maybe we just stop issuing debt, and hand control of the rate structure to the fed?

Treasuries are just a liquidity management tool. It is money in the form of a time deposit.

If the the Fed wants to, it could simply peg the entire set of Treasury rates along the yield curve at a target ceiling.

If GDP slows enough, then that is bad – debt or no debt.

Worry more if there is a massive build up in private debt issued by banks.

9. February 2018 at 22:47

I was thinking about the fiscal gap. And our long term liabilities are primarily in the form of entitlement spending on the elderly, an expense without great expected ROI.

As you point out, long term liabilities could be managed by making changes to Social Security rules and making improvements to how we manage medical expenses. But even during the 90s when budget deficits were brought down, there wasn’t any headway made on entitlement reform. And, in recent elections, no major presidential candidate even dared to to mention the term entitlement reform.

10. February 2018 at 05:39

“fiscal policy has not been unsustainable for decades”

Those who are wont to minimize the ill effects of the federal deficit are prone to compare the size of the deficit with nominal GDP, as if the volume of nominal GDP were independent of the size of the deficit.

Unprecedented large deficits “absorb” a disproportionately large share of nominal GDP.

Present deficits are unprecedented no matter how measured, and the past gives us no reliable guide to the future effects of deficit financing, beneficial or otherwise.

But to appraise the effect of the federal budget deficit on interest rates, it is necessary to compare the deficit, not to the debt to GDP ratio (a contrived figure), but to the volume of current savings, domestic and foreign, made available to the credit markets (including “concealed greenbacking” – debt monetization).

10. February 2018 at 05:57

Carl, isn`t all entitlement money spent back into the economy. Medicare supports doctor, nurse salaries etc… We can cut health worker`s salaries in half and save a ton on medical spending – maintain current payroll rates, cut reimbursments and bingo problem solved. But, what happens to the economy in that scenario?

Entitlements are dependent on real resources – workers producing goods in excess of what they consume. Otherwise, retirees would need to go back to work to make their own stuff. By 2050 there will be approximately 2.9 workers per retiree, 2 robots (slight exaggeration here), an autonomous car, all sorts of other automation, and then there is immigration. So the Fed should allow adequate NGDP growth to support wage and production growth. Entitlement debt could be a problem, if real resources become in short supply in the future triggering inflation, but i am just not seeing that.

10. February 2018 at 07:37

Matt, You said:

“So wait, we ran surpluses under Clinton and the economy slowed. We have been running sizeable deficits since 2008 and the economy has chugged along.”

Yup, the economy “chugged along” much better in 2009 than during the Clinton years.

Everyone, Did some of you commenters study macro in Zimbabwe?

10. February 2018 at 08:06

Scott the deficit just before 2008 was about 1% of GDP, and was declining for years 2004-2007 U. S. Deficit Reduced 61% Private debt was about 200% of GDP.

10. February 2018 at 08:15

Is Japan closer to Zimbabwe than us?

We compare Japan or the US to a country that is dysfunctional on just about every level?

Can debt become a problem? Yes. Are we near a problem. I don’t think we are, nor is Japan.

10. February 2018 at 10:02

Scott: I thought the entire point of your blog was that central bankers could restore their credibility by copying Zimbabwe!

10. February 2018 at 10:43

Scott,

By repealing IPAB, which is essentially a cap on Medicare spending, the Republicans have massively increased the size of government. In the long run, that will probably be more important for sustainability than any of the tax changes or immediate spending items.

10. February 2018 at 13:53

IIRC, the UK after WWI also got debt/GDP above 300%, similar to Japan today.

I never really have found a good answer to “how much debt is too much?” A run on fiat currency debt is really a run on the currency. A truly dedicated central bank will sell all of its assets and raise IOR until inflation is brought under control. To make interest payments and outlays, the government has to sell bonds as the central bank also sells their bonds and increases its interest rate.

The market, if it doesn’t believe in the country’s willingness to hold down inflation, will at least temporarily test the will of the government. Higher real interest rates will ultimately force more revenues or lower expenditures. Without changing the primary deficit, higher interest costs are rolled over into yet more debt, creating a death spiral.

To look at probability of death spiral, you can look at mix of debt by maturity. Of the $14tr US debt, $8tr matures within four years. So an interest rate of 5% is $400bn. and 10% is $800bn. Total revenues are $3.3tr and interest costs are currently $200bn. The 5% and 10% scenarios are 3% and 8% real rates. Such high real rates should kill the death spiral, again reducing interest costs. (I couldn’t easily find Japanese maturity data)

I guess fiat currency debt is too high when it becomes politically infeasible to counteract a run on debt/currency and the higher real interest rates. That’s extremely hard to game out. In any case, why risk such a run? Any deficit spending has monetary offset. Even if the debt is never paid down, interest expenses will continue on forever. No government spending is ever free.

10. February 2018 at 13:53

Matthew. Please proofread your comments before entering them in my blog.

John, Yes, that’s what you thought.

10. February 2018 at 14:08

Matthew McOsker:

I assume a fiscal multiplier of less than one and am convinced that subsidizing health care spending on the elderly has led to outsized spending on the elderly and will continue to do so.

Even some Progressives are starting to worry that spending so much money on entitlements is crowding out other more urgent needs

10. February 2018 at 19:57

I am so sorry. Reading it again, my comment appears grammatically correct. I made the sentence structure too convoluted though and I am really sorry.

11. February 2018 at 07:07

Maybe U.S. fiscal *policy* hasn’t been unsustainable for decades but I think what we might call the fiscal *policy regime* has been. To my mind, the CBO’s “alternative fiscal scenario” is a reasonable cut at the fiscal policy regime.

For decades the CBO has issuing such warnings as “Policymakers will still need to make tough decisions about paring entitlement benefits and other spending or increasing taxes to avoid unsustainable growth in the federal deficit and debt in the next 40 years or so.” (quote from page xv of the Summary from the CBO’s 1997 outlook https://www.cbo.gov/sites/default/files/cbofiles/attachments/Eb01-97.pdf )

On an actuarial basis the U.S. fiscal policy regime has been unsustainable for decades.

11. February 2018 at 12:23

Total public debt is already well over 100% of GDP

https://fred.stlouisfed.org/graph/?g=ilhS

The rise in the ratio since 2009 or rather its inability to fall back since 2010 is the lack of a nominal recovery. The US is still in a depression.

http://ngdp-advisers.com/2017/07/24/monetary-story-great-recession-ongoing-long-depression/

11. February 2018 at 12:34

Carl, thanks for your reply I better understand what angle you’re coming from.

Scott, I apologize as I was entering many comments via mobile phone, which is really not conducive to commenting. You know, I enjoy your blog, and am always trying to better understand market monetarism. Now that I’m at a desktop, I will try to post something more coherent.

The fiscal position in and of itself can be quite meaningless – a surplus does not equal boom times nor do deficits equal positive fiscal stimulus. It seems to me that NGDP is incredibly important when it comes to the fiscal position.

Following the Clinton Surplus, if the Fed had better targeted NGDP (was money too tight at that time?), would we have had a the recession that followed. Slowing or falling NGDP can lead to deficits. Now politics will always be present when it comes to the fiscal position, and there were the Bush tax cuts that followed.

During Bush II the deficits declined from 2004 to 2007, and if NGDP had continued to grow the fiscal position may have moved to surplus. But, as you have argued, money was too tight and we had the GFC, which led to a deterioration of the fiscal position. Add to that the political reaction of tax cuts, and a spending package. During the Obama years, deficits sharnk as a % of GDP up to about 2016, and started getting larger as a % of GDP since.

Now comes Trump and the current fed actions.

Trump gets his tax cuts, and recently congress introduced some new spending. The fiscal position will change as a result.

Now add the current Fed actions – Increasing rates. Note: I am not saying this is necessarily making money tight. The Fed appears to be trying to combat potential higher inflation, and “normalize”. I see two negatives here. They are increasing the fiscal position (larger deficits) with higher rates, and potentially causing inflation via currency adjustments. Our rates are higher than many other economic zones, so via covered rate parity we have a declining dollar. We will see if there is a positive effect on exports in time. So IMO, this make the case more than ever that the Fed target NGDP. Their current targets of inflation and employment may lead to making money tight at exactly the wrong time.

So fiscal sustainability is dependent on the Fed and politics.

As for Zimbabwe – I will just stay away from that for now. 🙂