A very depressing interview

David Beckworth has an excellent interview with The President and VP of the Minneapolis Fed. I did a post on the portion of the podcast that interviewed Neel Kashkari, over at Econlog. Here I’ll address the part where David interviewed VP Ron Feldman, mostly on banking regulation. I’ve always thought that eliminating moral hazard is the only way out of this mess. Feldman says that’s politically impossible:

I think you just need to look at what happened with Fannie Mae and Freddie Mac. This was in a prior regime. People used to talk about what’s called subordinated debt, but it’s the same idea, that they would be forced to issue debt that would be very junior, so it would get converted, and there would be no problem.

Now, flash forward. You’re in a crisis, and what people are worried about is, am I going to lose my money? You’re in the middle of a crisis, and you’re telling me that the solution to making people feel comfortable, not freaking everybody out, is that you’re going to impose more losses on more people. It just seems implausible.

The only active creditor in the US where we have a record that we do impose losses on them is equity holders. We do treat equity holders differently from fixed income holders, depositors, or bond holders. I think CoCos and bail-in debt, it’s very elegant. If it worked, I think that would be great. But we have a record of it here.

I should just add, in Italy and other places, they’re using the same idea. Last year, they were confronted with this issue: what are they going to do about the bail-in debt of the Italian banks that are in trouble? They said, “We want a special exception. We’re going to need to protect those folks.”

I think that’s the history. We talked about, is the five-year delay credible? The thing that’s not credible is that in a crisis, a government is going to want to impose more losses on debt holders.

Just to be clear, I don’t think it would be a problem doing this in a technical sense. Crisis or no crisis, there’s no reason why bonds can’t be converted to equity when a bank gets into trouble. But I suspect he is right about the politics, at least in highly corrupt countries like Italy and the US. (Perhaps it would work in the Nordic countries, or Canada.)

I find this to be profoundly depressing, and pushes me toward reluctantly supporting tighter bank regulation, especially higher capital requirements. The Minneapolis Fed has developed a plan that calls for a 23.5% capital requirement for large banks:

We would require banks to fund themselves with equity that would be equal to 23.5 percent of their risk-weighted assets. Risk-weighted assets means there’s a bigger weight that’s put on something, an asset that’s risky, and a lower weight that’s put on something that’s safe, like a Treasury bill.

I actually think the main problem is reckless smaller banks. That’s where our tax dollars go. I’m much less worried about the bigger banks, where moral hazard is less of a problem. Unfortunately, it seems like higher capital requirements are just as politically infeasible as reducing moral hazard through convertible bonds:

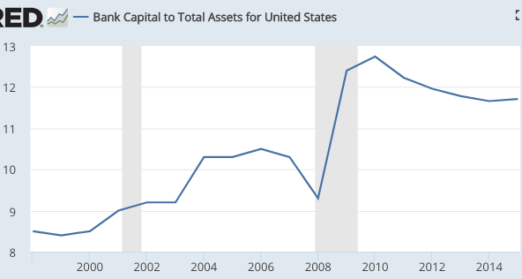

The capital ratio rose from 10.5% before the crisis to 12.7% after, but has since slipped back below 12%. A 23.5% ratio sounds great, but only if applied to all banks, not just large banks. Unfortunately there’s probably almost zero political support for doing some something like this.

The capital ratio rose from 10.5% before the crisis to 12.7% after, but has since slipped back below 12%. A 23.5% ratio sounds great, but only if applied to all banks, not just large banks. Unfortunately there’s probably almost zero political support for doing some something like this.

As with healthcare reform, as with zoning reform, as with FAA privatization, as with a hundred other issues, there’s simply no interest in banking reform. In either party.

Tags:

12. February 2018 at 14:49

OT: I have become a bit more optimistic on zoning reform, at least out here in California. Bay Area just permitted more housing units in 2017 than in any year on record (records only go back to 1990). SB827 has been introduced in the legislature and would be revolutionary. (https://sf.curbed.com/2018/1/4/16850000/transportation-near-housing-bonus-wiener-ting) It’s doubtful it will pass and will certainly be watered down but it’s exciting that it’s being proposed and backed by powerful figures in CA politics.

But yea…on all other things…hopeless.

12. February 2018 at 16:00

Liberal, The problem with that bill, as I read it, is that it mandates low income housing. That drives up the cost of housing, and actually hurts low income people.

12. February 2018 at 16:21

[…] réponses à cette entrée à travers le Flux RSS flux. Vous pouvez laisser une réponse ou Rétrolien depuis votre […]

12. February 2018 at 16:37

Scott,

You said, “I find this to be profoundly depressing, and pushes me toward reluctantly supporting tighter bank regulation, especially higher capital requirements.”

So you finally agree with me. I’ve been saying this (and you’ve been disagreeing) since practically the first day I started commenting. Specifically,

– Politically, you will never get rid of TBTF

– Therefore you need to make regulate (and guarantee) the big institutions (smaller institutions can participate voluntarily).

– The way to regulate is by setting equity/asset ratios by asset class and giving the Fed the leeway to set and change these whenever and however they see fit. (This is basically a better way to do do capital requirements.)

– Any remuneration to bank employees over a cap has to be subordinated unsecured debt that vests five years after retirement.

– If the Fed has to bail out a bank, equity owners and highly compensated employees lose every nickel. Everybody else stays whole.

12. February 2018 at 17:21

China has a 17% reserve (capital ratio) ratio. So I guess higher reserve ratios can work.

The power of the banking lobby is certainly in full view—after all the blah-blah, US banks added 3% to capital ratios? That’s it? The Fed and bank regulators work for the banks? I am shocked, shocked!

Moral hazard: In China, the People’s Bank has periodically purchased large amounts of bad loans from the banking system, essentially by printing money (I think). This does allow the banking system to keep working, no collapses, no bank runs etc. and capital continues to enter the economy without friction. Not such a bad result.

I do not know (despite efforts to find out) what happens to bank managers in China of a bank that gets necessary capital infusions. Perhaps bank managers suffer enough that no bank manager wants his bank to lose money. (But then, what really happens to bad bank managers in the US?)

China is far below its inflation targets, so evidently a central bank buying up bad loans periodically does not result in inflation.

In the US I would prefer to see fat layers of convertible bonds and then bonds between a bank and a federal bailout. Let convertible bond holders form committees and devise covenants or workout schemes to protect their interests.

But as with the federal deficit—the question is not whether it is good or bad. The question is what policies do we try given the political realities.

The US will borrow $10 trillion in the next 10 years.

Federal bailouts of banks happen rarely, and money-wise are small potatoes. Maybe not a concern. The federal government got all its money back from 2008 bailouts.

Sometimes ugly works well enough.

12. February 2018 at 17:56

I think I found a similar measure with a longer history.

https://fred.stlouisfed.org/graph/?g=inaS

It doesn’t seem to me like capital levels or the trend in capital levels are the problem here.

12. February 2018 at 19:59

I think we need to rethink banking in general.

Banks are essentially government agencies. If Uncle Sam guarantees depositor A’s loan to bank C (mostly through explicit promises like FDIC), what is actually happening is that A is lending to Uncle Sam and Uncle Sam is lending to bank C.

The government should have charged more for insurance (interest) during the 2000’s as Banks took on more risk. Instead, they outsourced credit analysis to the rating agencies allowing Banks to fool the FDIC into charging less for guarantees. As Banks moved to maximize spread, the FDIC was essentially subsidizing risk.

I doubt tighter regulations would help. Banking is already the second most regulated industry, behind healthcare. Bankers are adept at innovating their way around barriers, and even if their were air tight rules, the rules are meaningless unless their are regulators to enforce them.

Instead, I think an alternate, competing form of banking should be introduced that doesn’t carry with it the chance of catastrophic meltdown. Ala Cochrane:

https://johnhcochrane.blogspot.com/2014/06/the-economist-on-narrow-banks.html?m=1

The presence of a more secure bank that can take over some responsibilities of the crisis prone Banks will allow feds to have the breathing room to let some institutions fail, hopefully ending TBTF.

12. February 2018 at 20:33

As someone who’s never worked in the financial sector (or in the US), I struggle to differentiate between the notion of TBTF and the notion of bank bond-holders being somehow different to other debt-holders. According to my elementary understanding, in a solvency crisis, bond-holders would still rank above equity. And I think during the financial crisis, John Hussman wrote posts along the lines that if bank bond-holders were exposed to losses, actual bank depositors would be left whole. So what’s the problem – just get on with it.

Surely the whole point of having corporate bonds is that they offer higher returns for higher risks than Treasuries – the risk of losing your money. Feldman seems to be saying that anyone who holds a bond in a US corporate (or is it just a bank) effectively holds a US govt Treasury?

12. February 2018 at 21:10

dtoh, I still think it’s a bad idea to guarantee banks debtors. I oppose it. I’ve always favored higher capital requirements if nothing else could be done.

And small banks are the main problem, not big banks.

Kevin, Well they certainly seemed to be a problem at some banks, at least in 2009-12! I’m not sure how you could draw any conclusions about capital adequacy from that graph.

Kevin A, We don’t need to rethink banking, we know exactly what is wrong (and you are right that its essentially a socialist institution, where I lend to Uncle Sam, and they lend to the bank.) The problem is political. We know how to fix it, but Congress and the banks and the property developers like it as it is.

Rajat, Excellent comment. The system seems insane, but isn’t that what also happens in Ireland, Italy, and lots of other places. But yes, when you think about it it makes no sense.

12. February 2018 at 21:30

For Scott, a cure to depressing interviews.

The photos are superb….

https://www.curbed.com/2018/2/9/16995558/frank-lloyd-wright-photograhy-andrew-pielage

12. February 2018 at 22:36

Et tu, Scott? You used to understand the concept of CoCos as canaries in the coal mine;

http://econlog.econlib.org/archives/2015/11/could_gramm_lea.html

———-Quoting Calomiris and Herring——–

Start with a requirement that a megabank maintain a 10% book equity-to-asset requirement–but add to it the requirement that 10% of its assets be issued in CoCos that convert from debt into equity if the market value of equity relative to assets falls below a critical ratio, say 10%, on average for a period of 120 days. If conversion does occur, the CoCos exchange at a premium of, say, 5%. CoCo holders end up with more shares than the face value of their debt holdings.

By using the market value of a bank’s equity as a conversion trigger, bank managers have an incentive to maintain sufficient true economic capital. Conversion means a significant amount of stock is issued, diluting the value of the equity held by the rest of the owners. To avoid this outcome, bank managers would choose to issue new stock (fewer shares than would be issued than under conversion) to offset declines in their market valuation. Managers would make that choice because dilutive conversion is more costly to existing stockholders; both the holders of newly converted shares and pre-existing shareholders would likely agree to sack management incompetent enough to allow such a conversion to happen.

———–endquote——–

The whole idea is to prevent crises in the first place. Using natural incentives, rather than ‘good regulation.’ All the MinnFed VP is saying is that he likes his idea better. That’s just handwaving, and David Beckworth should have challenged him on it.

This seems like an appropriate time to re-re-re-recommend the excellent, ‘Fragile By Design’ (Calomiris and Haber). It’s a lot more valuable than what Kashkari–who is not an economist, btw–and this other guy are peddling.

12. February 2018 at 22:41

Here’s the Amazon link the the Calomiris/Haber book (a mere $10, for the Kindle version, which you can begin reading immediately);

https://www.amazon.com/Fragile-Design-Political-Princeton-Economic-ebook/dp/B00GMSUUVS/ref=tmm_kin_swatch_0?_encoding=UTF8&qid=1518503925&sr=1-1

12. February 2018 at 23:05

If you don’t want to shell out $10 for the best book ever written on banking, Charlie Calomiris dealt with these issues in a book review of ‘The Bankers’ New Clothes’ back in 2013;

https://voxeu.org/article/25-bank-equity-requirement

————-quote————

Admati and Hellwig’s discussion of bank funding costs and capital structure recognizes only two benefits of debt finance: the tax deductibility of interest, and the safety-net distortions stemming from government guarantees that effectively reduce banks’ costs of subordinated debt as well as deposits. They argue that eliminating these advantages of debt finance is desirable. That claim neglects substantial empirical evidence consistent with other influences, such as signalling models. But even if tax favoured treatment of debt and safety net subsidies were the only factors favouring debt finance, and even if one could argue from a social cost-benefit analysis that it would be desirable to eliminate both safety-net subsidies and the tax deductibility of interest, it does not follow that doing so is costless.

An important implication of the various models of optimal capital structure is that forcing banks to raise their equity-to-asset ratio requirement generally will reduce banks’ willingness to lend. A large number of studies have shown that, when banks need to raise their equity-to-asset ratios, they often choose to do so by cutting back on new loans, which avoids the need to raise new equity and the high costs associated with it. For example, one recent study of the loan supply response to increases in required equity ratios in the UK reports that a one percentage-point increase in required equity ratios reduces the supply of lending to domestic nonfinancial firms by about 7% (implying an elasticity of loan supply of roughly negative 0.7).

The reduction in loan supply that comes from raising equity ratios is not just a one-time cost. A higher required equity ratio will mean that, as the banking system grows, a larger percentage of bank equity will have to be raised externally rather than through the retention of earnings. Because it is costly to raise outside equity (in large part because of the signalling and agency costs mentioned earlier), banks will face permanently higher funding costs, which in turn will permanently reduce the supply of lending relative to a world with lower equity ratio requirements.

———–endquote———-

12. February 2018 at 23:21

I’ve always gotten the impression that higher capital requirements were understood as alternative to more regulation, not something one does in conjunction with it, like having both a carbon ta *and* onerous emission regulations. The kind of combination only people who just plain hate the industry they’re targeting generally endorse.

It seems bizarre that one would favor more regulation because one accepts that the appropriate deregulation that would solve the problem is politically unfeasible, since regulation has already proven to be phenomenally unsuccessful in solving problems in the financial sector. Regulatory capture and discretionary (arbitrary) enforcement of rules are endemic, and it seems whenever the enforcement of a regulation might be politically inconvenient, it will just be ignored/adjusted anyway, like the SEC did in 2004 by loosening several big banks’ capital requirements (if I recall correctly) in part due to political pressure to keep housing from getting too unaffordable.

12. February 2018 at 23:27

Great post. Agree 100%.

12. February 2018 at 23:30

Patrick, why wouldn’t retaining earnings increase equity?

And also, is there some central bank offset to be expected, if the banking sector as a whole loans out less?

13. February 2018 at 00:38

There’s much to be said for vastly higher capital ratios, i.e. 100% capital ratios, as advocated by Milton Friedman and two or three other Nobel laureate economists (“100% reserves” as Friedman called it). Under that system, bank loans can only be funded via equity. As to deposits, i.e. money which depositors want to be totally safe, that’s deposited with the state (i.e. the central bank or put into short term government debt.

The money market mutual fund industry has recently had to switch to that system.

The basic flaw in the existing system is that where capital ratios are under 100%, private banks can in effect print money, which amounts to a subsidy of private banks (as if they aren’t in receipt of enough subsidies already). Under 100% reserves, a private bank can only obtain money to lend out by borrowing it or earning it. In contrast, under the existing system, when someone applies for an $X loan, a private bank can simply credit $X to the person’s account: $X produced from thin air. For more on that, see:

https://seekingalpha.com/article/4127496-bank-subsidy-one-mentions

13. February 2018 at 02:01

A 100% reserve requirement on banks is to ban banks. They can’t lend money in that system since it would lower their reserves. They would just put the money in a safe box and charge a fee. The economy needs banks as a middle man between savers and borrowers. We would be back to the Middle Ages.

Also banks don’t create money out of thin air (at least base money). The new deposit created is just a promise of the bank to the borrower. 5 minutes after receiving the loan, the borrower will transfer it to a person in another bank which will require the lender bank reserves to the amount of the loan, not a promise. Thus, the lender bank needs new reserves, which can get borrowing money, attracting deposits, etc.

So as you see, although banks make loans first, they then need to acquire new reserves. The only way to avoid this is in a monopoly or if the central bank wants it by issuing new reserves.

What they can create out of thin air is debt. If you want to call this debt money that’s ok, but it’s not the same money as the base money (high powered money) and they are still limited by reserve, capital and liquidity requirements.

13. February 2018 at 04:15

<>

Scott, can you explain?

13. February 2018 at 04:15

Sorry, this is what I wanted you to explain: “Liberal, The problem with that bill, as I read it, is that it mandates low income housing. That drives up the cost of housing, and actually hurts low income people.”

13. February 2018 at 07:45

Original CC,

It’s well known to economists that the legal obligation to provide something to other people, usually has unintended consequences that swamp the promised benefits. Short of an offshoot of ‘tax incidence’, as low-income housing mandates can be considered a ‘tax’ on developers.

Such as rent control;

http://conference.nber.org/confer//2017/PEf17/Diamond_McQuade_Qian.pdf

‘In this paper, we exploit quasi-experimental variation in the assignment of rent control in San Francisco to study its impacts on tenants, landlords, and the rental market as a whole. Leveraging new micro data which tracks an individual’s migration over time, we find that rent control increased the probability a renter stayed at their address by close to 20 percent. At the same time, we find that landlords whose properties were exogenously covered by rent control reduced their supply of available rental housing by 15%, by either converting to condos/TICs, selling to owner occupied, or redeveloping

buildings. This led to a city-wide rent increase of 7% and caused $5 billion of welfare losses to all renters. We develop a dynamic, structural model of neighborhood choice to evaluate the welfare impacts of our reduced form effects. We find that rent control

offered large benefits to impacted tenants during the 1995-2012 period, averaging between $2300 and $6600 per person each year, with aggregate benefits totaling over $390 million annually.’

Take note of the numbers; $390 million in benefits to people, many of whom aren’t poor, but $5 BILLION in losses to many who ARE POOR.

13. February 2018 at 07:51

Ralph, and Matthias;

First Friedman abandoned 100% reserve banking, when he gave it some thought. Second retained earnings certainly can increase bank equity, but at what cost?

The criticism that Calomiris levels at the Admati and Helwig, is also applicable to the MinnFed scheme. You’ve got to think about costs, as well as benefits. As the late Sonny Bono put it; ‘There people out there who will game any system.’

13. February 2018 at 08:36

Inklet,

Re your point that 100% reserves is a ban on banks, you are quite right in the sense that 100% R destroys banks as we currently understand them. Some advocates of 100% R are perfectly open about this. E.g. see this Bloomberg article by Matthew Klein entitled “The best way to save banking is to kill it”.

http://www.bloomberg.com/news/2013-03-27/the-best-way-to-save-banking-is-to-kill-it.html

Re your claim that under 100% R banks (or at least the new entities that take the place of banks) cannot lend – yes they can: it’s just that loans must be funded via equity rather than via deposits, as is made clear in the literature on 100% R.

Re your claim that private banks do not create base money, no one ever said they did. However it is widely accepted that private banks do create their own form of money which is a close substitute for base money: you use debit or credit cards to pay for stuff rather than Fed issued Dollar bills don’t you? And for more confirmation that private/commercial banks create money, see the opening sentences of this Bank of England article:

http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdf

13. February 2018 at 09:08

Patrick Sullivan,

Where did Friedman abandon 100% reserves? He first advocated it, far as I know, in a 1948 American Economic Review paper of his entitled “A Monetary and Fiscal Framework for Economic Stability”. See item No.1 under the heading “The Proposal”.

https://miltonfriedman.hoover.org/friedman_images/Collections/2016c21/AEA-AER_06_01_1948.pdf

He was still advocating it nearly 20 years later in his book “A Program for Monetary Stability” – mainly in Ch3, under the heading “Transistion to 100% Reserves”.

Re your claim that 100% R increases banks’ costs, that’s debatable. If the Modigliani Miller theory is right, then there is no effect on costs at all. MM does have its critics, but I’ve looked at the criticisms and they seem pretty feeble to me. See section 1.4g here:

https://www.yumpu.com/en/document/view/57025889/fulresbk179senttocrspto

Also, even if 100% R does increase banks’ costs, that is not necessarily of much relevance, because under the existing system, commercial banks can create money out of thin air, whereas other businesses and corporations can only obtain money by borrowing it or earning it. I.e. under the existing system, commercial banks are not on a level playing field with respect to other corporations. In contrast, under 100% R, commercial banks can only obtain money by borrowing it or earning it.

13. February 2018 at 10:36

Ralph,

“However it is widely accepted that private banks do create their own form of money which is a close substitute for base money: you use debit or credit cards to pay for stuff rather than Fed issued Dollar bills don’t you?”

Although I don’t directly use Fed issued Dollar bills, if I buy a water bottle at the supermarket, my bank will transfer reserves to the supermarket bank account in another bank. So even if I don’t use base money, my bank uses it for me.

I’ve read that article and it contradicts itself since it makes clear that banks need to acquire new reserves after making new loans. This “new money” that you say banks can make can’t be used for anything since it’s just debt, a promise from the bank that he will give you that money. Every loan made, every new deposit created by the bank is apparently new money UNTIL it’s used. At that moment other banks won’t accept the bank IOU and ask for real reserves (or cash if the borrower wants physical), which can only be created by the central bank.

A similar case: I a person deposits his money at a bank and later the bank lends that money, it will appear that new money has been created, since the depositor and the borrower both see positive numbers in their accounts. However this is false, since the money the depositor thinks he has its not there and can’t be used nor withdrawn.

13. February 2018 at 13:34

Inklet,

Of course Banks with a 100% reserve requirement can lend money! They just do so out of equity.

Ralph, your not a modern monetary theory person, are you?

13. February 2018 at 13:35

Oh you are, checked the link. (I’m not)

13. February 2018 at 14:13

Edward Harrison tries to explain why U.K. government bond yields are so low:

“over time, movement in long-term yields largely reflect the bond market’s collective view of the path of central bank policy on short-term rates. When yields move up and stay elevated, that is a sign that the market expects future policy rates to climb.

This is what happened in the US before the equity market correction; markets started pricing in a greater likelihood of 3 or even 4 rate hikes in 2018 and yields climbed. But that’s not what happened in the UK, where real interest rates stay deeply negative. And so, the dichotomy is instructive.

What the experience in the UK is telling us is that, despite the rise in inflation, markets in the UK expect the UK policy rate to remain low due to the uncertainty surrounding the UK’s exit from the European Union.“

https://pro.creditwritedowns.com/2018/02/uk-long-term-rates-low.html

At first, I was skeptical of Harrison’s story but then I looked up inflation-linked swap spreads for the U.K.:

https://www.bankofengland.co.uk/statistics/yield-curves

If I’m interpreting the data right, while five-year inflation expectations are 3.09%, five-year U.K. government bonds only yield 1.76%. Wow, that’s a big discrepancy! Hugely negative real rates. Quite a puzzle in my mind.

13. February 2018 at 17:10

Ralph, Patrick and Matthias:

I have a copy of Friedman’s 1992 edition of “A Program for Monetary Stability”, where he reiterates his support for 100% reserves in the preface.

“One major reform that I recommended in the third lecture to achieve that objective was 100% reserve banking, a proposal that had been made by a group of economists at the University of Chicago during the 1930s and that was strongly supported by the greatest of American economists, Irving Fisher.” … “Unfortunately, the proposal was completely neglected for decades.” – Milton Friedman, May 4, 1992

It’s possible he changed his mind during the last 14 years of his life (I have yet to see a source), but he certainly “gave it some thought” during the 50 years that he believed in it.

13. February 2018 at 17:26

OT, but in the ballpark:

OT but interesting:

Okay we know that cash in circulation is increasing so rapidly that the Fed will only be able to sell off a couple trillion of the $4-odd trillion in bonds they bought during QE.

See Bernanke from Jan 2017.

“However, today currency in circulation has grown to $1.5 trillion. Because of rising nominal GDP, low interest rates, increased foreign demand for dollars and other factors, Fed staff estimates that, the amount of currency in circulation will grow to $2.5 trillion or more over the next decade.[7] In short, growth in the public’s demand for currency alone implies that the Fed will need a much larger balance sheet (in nominal terms) than it did before the crisis.”

So…the Fed buys $4-odd trillion in bonds during QE, but can only sell half back. Is one way to look at this, that the Fed bought $4-odd trillion in bonds, and the public converted $2 trillion of that into paper cash?

Seems to be that, net-net, the Fed bought $4-odd trillion in bonds, and $2 trillion will be monetized, literally, into paper cash by 2025.

What does this mean for monetary policy?

14. February 2018 at 02:27

Negation of Ideology,

Bit pedantic this – you have been warned…:-)

Yes: I’ve got a copy of what you call the 1992 edition of Friedman’s book. However, all versions of that book published after 1960 were actually REPRINTS rather than NEW EDITIONS. So it’s just possible he changed his mind after 1960 and that change is not reflected in post 1960 reprints.

On the other hand, seems to me it’s unlikely he’d have let those reprints go ahead if there had been a basic change in his thinking without some sort of note in the introduction to say so.

14. February 2018 at 05:23

Ralph –

Yes, they were reprints, but my copy (and I assume yours) has a new preface from Friedman, dated 1992, which I quoted from. I think the preface makes it pretty clear that he still supports 100% reserves.

14. February 2018 at 08:26

Ben, Nice!

Patrick, You said:

“All the MinnFed VP is saying is that he likes his idea better.”

Actually that’s not at all what he’s saying. He’s saying that CoCos won’t work because of the time inconsistency problem. Obviously if they would work they’d be better than his idea, even he’d agree on that point.

Thanks Noah.

Mark, You said:

“I’ve always gotten the impression that higher capital requirements were understood as alternative to more regulation”

I agree.

Original CC, I have a recent post advocating the building of “unaffordable” housing. I’d recommend taking a look. The basic idea is that it’s all about quantity. The more housing we build, the more affordable housing there will be. It makes almost no difference what type of housing is built, you just want to build as much as possible. Low income mandates discourage new construction. Low income people don’t live in new housing, they live in old houses vacated by people moving into new houses.

TravisV, Dornbusch overshooting.

Ben, I’m skeptical of those currency estimates. Rising interest rates will discourage cash holding. (On the other hand, that may be correct if we go back to zero rates.)

14. February 2018 at 13:10

The solution to TBTF banks is knowing that NGDP will stay on its course. The 2008 bailouts because, under an “orthodox” regime, NGDP really did depend on the bailouts. By bailouts, I include discount window, PDCF and money market fund facilities.

Scott has mentioned a variant of free banking with 1/NGDP shares instead of gold. I have tried to envision various ways to “end the Fed,” with monetary base automatically adjusting to NGDP expectations. But I haven’t seen concrete implementations except for the Mercatus NGDP future proposal. That proposal still depended on OMO’s and I would want a system without OMO’s. The only UNBOUNDED solutions I see are:

1. Unbounded negative IOR with restrictions on cash.

2. Unbounded helicopter money, with reductions in taxes (payroll then income withholding).

14. February 2018 at 13:28

Benjamin,

Currency in circulation went from $800 billion to $1.5 trillion after 2008. Unlike Fed reserves, currency did not see a huge 100x jump in 2008. I believe most of the currency is overseas, but I am not certain about that.

If the Fed had a single-minded goal to reduce the balance sheet to, say, $500 billion, it could probably do so. At some low price, the Fed could sell its bonds. Bank accounts would increase interest rates until the accounts attracted currency. Then the currency is used to buy bonds from the Fed.

But the Fed’s single-minded goal is its inflation target. IOR is an orthogonal variable the Fed could change while also meeting its inflation target. Ending IOR would almost certainly require a large reduction in the balance sheet.

On the other hand, currency in circulation is not orthogonal. Foreign holdings, number of dollarized countries, etc. are things out of the Fed’s control. If the Fed seeks to reduce currency in circulation, it will eventually undershoot its inflation target.

14. February 2018 at 22:39

‘“All the MinnFed VP is saying is that he likes his idea better.”

‘Actually that’s not at all what he’s saying. He’s saying that CoCos won’t work because of the time inconsistency problem.’

No, he’s just shoveling the manure. He’s wrong. CoCos are working in Europe right now (As I pointed out to you in 2016.);

https://www.bloomberg.com/quicktake/contingent-convertible-bonds

‘Banco Popular, Spain’s sixth-biggest bank, was swallowed by rival Banco Santander SA to prevent its collapse under a mountain of bad property loans. The muted reaction in the debt market was considered a win for the wonks, since the Cocos were written off without rattling trading. In early 2016, the Coco market briefly seized up on concern Europe’s biggest issuers might have trouble making interest payments. Prices rebounded after regulators clarified the rules. The most popular form of CoCos are used to raise what’s known as additional tier 1 capital, a lender’s first line of defense against financial shocks after equity. Spain’s Banco Bilbao Vizcaya Argentaria SA brought the first such bonds to the market in April 2013, and a flood of $140 billion was sold by the middle of 2017.’

I don’t know anything about the VP, but Kashkari is no scholar. How he got the MinnFed gig is beyond me. I follow these developments, remember.

14. February 2018 at 23:01

‘I have a copy of Friedman’s 1992 edition of “A Program for Monetary Stability”, where he reiterates his support for 100% reserves in the preface.’

That’s a quarter century ago. I don’t know that formally published his revised opinion, but I remember him explaining in an interview (probably in the early Oughts) that he’d realized than banning bank lending of deposits would only kick the can down the road. I.e., some other entrepreneurial mechanism would take its place.

I don’t have time to search out all his interviews right now, but he did allude to it in his 2006 interview with Russ Roberts. It’s about 23 minutes in here;

http://www.econlib.org/library/Columns/y2006/Friedmantranscript.html

———–quote———-

Milton Friedman: But that’s why what you want—if possible—is a mechanical system. If there was any virtue to the gold standard, it was that virtue. Maybe you could create the same thing now. My favorite proposal really is a little bit more sophisticated—or less sophisticated if you want to look at it that way—than a straight increase in the quantity of money. I would—if I had my choice—freeze the amount of high-powered money. Not increase it.

Russ Roberts: High-powered money being bills and cash.

Milton Friedman: High-powered money is the currency plus bank reserves.

Russ Roberts: Okay.

Milton Friedman: I would freeze that and hold it constant and have it as sort of a natural constant like gravity or something. Now, you would think that that’s a bad idea because there would be no provision for expansion; however, high-powered money is a small fraction of total money and the ratio of total money to high-powered money has been going up over time. So the economy would create more money and on average, you would have a pretty stable money growth and a pretty stable monetary system.

————endquote———

Note well that; ‘So the economy would create more money and on average, you would have a pretty stable money growth and a pretty stable monetary system.’

15. February 2018 at 20:54

Compared to his predecessors, Jerome Powell is loosening up communications lines, seeking broader views

“Powell, who was sworn in as chairman on Feb. 5, is by many accounts a voracious reader of economic research. At the same time he lacks the academic grounding of Ph.D economists who have recently led the Fed, such as Ben Bernanke and Janet Yellen. Perhaps in recognition of that potential weakness, he’s keen to engage staff on topics that grab his attention.

Spur-of-the-moment exchanges between the chair and junior staffers would have been largely unthinkable at the Fed a generation ago. Even in recent years, a request for information would often result in a carefully vetted formal presentation that might take weeks to prepare and an hour to deliver.

Powell, who spent a dozen years in banking and private equity, has no patience for that, the two current insiders said. Nor does he want staff to over-invest their time in a complex production when all he needs is a substantive and frank discussion with just the right expert — but right now.”

https://www.bloomberg.com/news/articles/2018-02-15/powell-seeks-to-bury-era-of-fed-barons-in-tapping-wider-staff

Good thing? Bad thing?

16. February 2018 at 08:40

Getting back the scholarly shortcomings of Neel Kashkari, here’s his argument as to why CoCo’s won’t work;

https://www.minneapolisfed.org/news-and-events/messages/wsj-op-ed-new-bailouts-prove-too-big-to-fail-is-alive-and-well

‘On June 1, the Italian government and European Union agreed to bail out Banca Monte dei Paschi di Siena with a €6.6 billion infusion, while protecting some bondholders who should have taken losses. Then on June 24, Italy decided to use public funds to protect bondholders of two more banks, Banca Popolare di Vicenza and Veneto Banca, with up to €17 billion of capital and guarantees. The one recent case in which taxpayers were spared was in Spain, when Banco Popular failed on June 6.’

The astute reader may have noticed that Kashkari just produced an example of when CoCos DID WORK. The same one I pointed out up above. Continuing;

‘The largest of these four banks was less than one-tenth the size of $2.5 trillion JPMorgan. Think about that: If bail-in debt couldn’t protect taxpayers from a midsize bank failure when the global economy is stable, what are the odds it will work if a Wall Street giant runs into trouble when the economy looks shaky? Or how about when several giants are in trouble at the same time, as in 2008? Don’t hold your breath.’

What I won’t be holding my breath for is a logical argument from the current President of the MinnFed. All he’s produced is an argument that Italian banking regulators are…weak, corrupt…? And one sterling example of how CoCos will prevent crises in the first place!

16. February 2018 at 08:55

Also, John Taylor seems to be as big a fan of Kashkari as I am;

https://www.wsj.com/articles/the-case-for-a-rules-based-fed-1482276881

————quote———–

Yet in a recent Journal op-ed, Neel Kashkari, president of the Minneapolis Fed and the newest member of the Federal Open Market Committee, joined the debate by arguing against rules-based reform. Those in favor of reform, he said, want the Fed to “mechanically follow a simple rule” and “effectively turn monetary policy over to a computer.”

This is a false characterization of the reforms that I and many others support. In those reforms the Fed would choose and report on its strategy, which would neither be mechanical nor run by a computer.

….Mr. Kashkari, by contrast, argues that a rules-based approach would shackle Fed policy makers, forcing them to “stick to” a rigid rule “regardless of economic conditions.” That too is false. ….And he wrongly claims that rules cannot take account of changes in productivity growth.

….

Mr. Kashkari ignores the hundreds of research papers that have been written on the effectiveness and robustness of such a rule and refers only to one study by “my staff at the Minneapolis Fed,” ….

Mr. Kashkari finishes off with a non sequitur….

——–endquote———

That’s Kashkari’s specialty, that last line.

16. February 2018 at 09:15

Here’s another piece that’s at odds with Kashkari’s claims (albeit a bit of self-congratulation);

https://www.msci.com/www/blog-posts/don-t-let-coco-bond-risk-sneak/0736821130

————quote———

Standard fixed-income models tend to ignore the conversion feature of CoCo bonds and thus can paint a misleading picture of risk. In our analysis, we studied the risk of Banco Popular-issued CoCo bonds failing using MSCI’s Contingent Convertible model. Our post-event measure of this ex-ante risk is 95% Value at Risk for a one-day horizon, as a percentage of market value.

MSCI’S MODEL DETECTED RISING RISK OF BANCO POPULAR’S COCO BOND

[Color graph excluded]

The CoCo model and the MSCI Generic Bond model provided very different indications of forecasted risk. …the CoCo model successfully forecast rising expectations of conversion, resulting in declining valuations and growing risk to the investor. The standard bond model’s risk forecast failed to pick up the growing expectation of a tail event, providing a misleading insight.

Using our risk model, we can readily see … a steep increase in the risk of Banco Popular CoCo bonds failing relative to the average risk forecast across the universe and to the average forecast of the top 10 riskiest bonds. While the risk of Banco Popular CoCo bond was always higher than the average of the entire universe, in February and March it was lower than the top 10 average. In April and May, however, the risk of the Banco Popular CoCo bond escalated, and by June was going through the roof, far surpassing the rest of the universe.

———Endquote——–

The gist of this piece is that, as analysts become more familiar with CoCos, they’ll get the hang of valuing them properly. The conclusion;

‘CoCos have become very popular financing tools since the financial crisis. Issuance has continued, mostly in APAC recently, with $675 billion in CoCo bonds outstanding worldwide (see exhibit below). For the foreseeable future, they are here to stay, offering higher yields in a low-yield environment. But their complex and somewhat opaque features make investing in them challenging, especially when an issuer faces a sharp reversal in fortune. A dedicated model offers a new tool to evaluate the potential risks from this market.’

Again, you wouldn’t know any of this from reading the interview with the two Minnfed guys.

17. February 2018 at 07:24

Patrick Sullivan,

Friedman’s claim that banning money creation by commercial banks would “only kick the can down the road. I.e., some other entrepreneurial mechanism would take its place” is a common criticism of full reserve banking. I’m not impressed by it.

Obviously “other entrepreneurs” WOULD TRY to create/print money, but strikes me that as long as the larger banks (both regular banks and shadow banks) are prevented from doing that, that cracks the problem. Reason stems from the basic definition of money which is normally something like “anything widely accepted in payment for goods and services or in settlement of debts”.

The liabilities of large well known banks, credit card operators, etc are “widely accepted”, but who’s going to accept the liabilities of some small unheard of bank? Only a few people in the world’s financial centers with specialist knowledge is the answer to that. Ergo the liabilities of small banks etc will never become a very effective form of money.

17. February 2018 at 15:33

Ralph, could you explain why you were impressed with Friedman’s advocacy of 100% reserve banking, but not with his change of mind?

Btw, our current system of fractional reserve banking started out with small banks issuing notes. What we see today is merely the evolution of that. No reason it couldn’t happen again. In fact, it might be happening with Bitcoin and other ‘non-money moneys.’

17. February 2018 at 15:58

Patrick, I hope you are right, but the Italian case is worrisome, as every day the US is becoming more like Italy.